In this issue

- WSB stocks flounder as cryptos surge

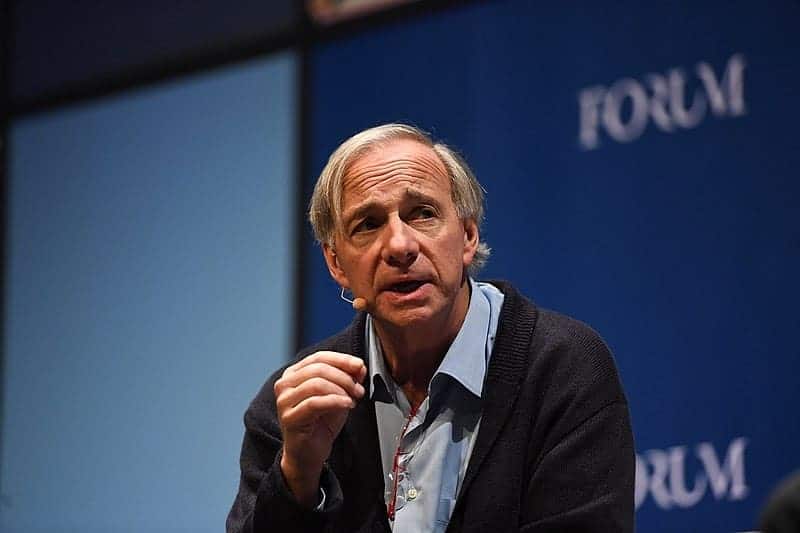

- Bridgewater’s Ray Dalio weighs pros and cons of crypto

- Elon Musk waves #bitcoin flag

- Will India replace crypto with CBDC?

- S. Korea looks to DeFi

- Bitmain’s amicable divorce

From the Editor’s Desk

Dear Reader,

It is another week of extremes, and the juxtaposition is downright poetic.

On one hand, we have the meltdown (or melt-up, depending on the day and your perspective) that is GameStop. The tsunami that swept onto Wall Street’s shores, exacting vengeance of the sea and the earth that rumbled beneath it. It was a long time coming. Whomever to blame: the Redditors, Robinhood, the hedge fund billionaires… this market-changing, game-stopping event held true to the very name of the company that triggered it all.

On the other hand, an eloquent, stream of consciousness-like missive from Ray Dalio, one of the original Wall Street titans. Dalio founded Bridgewater Associates in 1975 and built it into one of America’s premier asset management firms with US$102 billion in assets currently under management. That’s a lot of liquidity. In his LinkedIn message, Dalio openly contemplates the value of bitcoin and other cryptocurrencies, seeing enough of a trend that he and his associates are actively looking into the asset. Dalio states he would invest, despite all the risks, perceived or otherwise.

What one realizes quickly is that both are saying the same thing. The giant horde of retail investors pouring into the market to prop up a stock that to Wall Street makes little sense in the long run, to the institutional investors like Dalio who are increasingly seeing the run-up interest in bitcoin and other cryptocurrencies and getting into the market. It boils down to this: The rules are changing. Those who have traditionally been in control of the levers of finance are increasingly becoming aware (in the case of GameStop, in a brusque awakening) of the consequences of their own previous actions in a system that was in equal parts designed for stability but also designed for control by a few. Now, technology has empowered retail investors (a.k.a. the “little people”) who are openly questioning the way things have been done and are pushing back.

Question is: what happens when control shifts?

If the price of shares represent the anticipated future value of that share as a portion of the company, was GME’s extraordinary 1,500% price rise a reasoned belief in GameStop’s business strategy or likely growth? It was not. Only the speculative moves of a group of inspired investors who are now plummeting back to earth. Until they move on to something else. The “game” has given all parties access to participate whether one likes it or not.

Until the next time,

Angie Lau,

Founder and Editor-in-Chief

Forkast.News

1. GameStop is flopping as Ethereum and other cryptos rise

By the numbers: WallStreetBets — over 5,000% increase in Google search volume.

Robinhood faces scrutiny for its ties to electronic trading giant Citadel, founded by billionaire hedge fund mogul Kenneth Griffin. GameStop (GME) stocks had been on the decline well before the Covid-19 outbreak, falling from US$11 a share on March 15, 2019 on the New York Stock Exchange (NYSE) to US$4 per share on March 16, 2020.

- Some hedge funds, such as Melvin Capital, had shorted GME stocks, betting that GameStop would have its “Blockbuster moment” and go bust — which would result in a financial windfall for the short-sellers. But a series of events — including a Reddit user who rallied the subreddit community r/WallStreetBets (WSB) against the Wall Street short-sellers — made GME prices surge to as high as US$483.

- As a result of GME’s price surge, the Wall Street short-sellers lost massive amounts of money. Melvin Capital received a $2.75 billion bailout from Citadel and Point72 Asset Management, while retail trading platforms such as Robinhood — which serves a clientele of retail investors — suddenly halted the trading of GameStop (GME) stock and caused a drop in GME prices.

- According to an earlier SEC filing, Citadel is a big revenue generator for Robinhood. In just the first quarter of 2020, Robinhood received almost US$100 million from payment for order flow (PFOF) fees from institutions like Citadel, Wolverine Securities, and Virtu Americas.

- Citadel has since denied pressuring Robinhood to block retail trading of shorted stocks like GME on its platform.

- GME shares are currently trading at US$90 as of publishing time. Robinhood has since resumed limited trading of GME.

- As the GME drama unfolded, a spoof of WSB, SatoshiStreetBets coordinated a massive copycat rally for Dogecoin, the alt-coin that had started off as a joke. Retail investors pumped DOGE prices up by 1,000% before prices normalized.

- The storm unleashed by GME and Dogecoin also appeared to sweep other cryptos to rise, including Ripple’s XRP and now, bitcoin and ethereum — which hit a new all-time high of over US$1,567 today.

Forkast.Insights | What does it mean?

The GameStop storm may have taken Wall Street by surprise, but the Reddit collective of WallStreetBets is something we’ve seen before — in crypto.

The community, a group of like-minded cypherpunk-bending individuals, discover a kinship and shared passion in cryptocurrency in subreddit groups and Telegram chats and come together to invest. These investment pools were behind the 2017 ICO craze that raised millions upon millions of dollars for crypto projects and tokens that later went bust and continue to be the subject of SEC investigations and prosecutions to this day.

We are now seeing a migration of trading patterns, honed in crypto, now going mass and head-to-head against Wall Street. Even crypto derivatives exchange FTX is jumping on the retail investor bandwagon and listed a WallStreetBets (WSB) index quarterly futures index, which includes GameStop, Nokia, BlackBerry, AMC and now silver.

For crypto retail investors, if GME’s spectacular rise and fall serves as a cautionary tale, it will be all about timing. How to get into a market at the right time and cash in before the rest of the market realizes that a company’s long-term value does depend on business fundamentals.

How does one catch a falling knife? It was a rhetorical question in 2017 as the vast majority of ICO investors learned was impossible. The ICO boom-to-bust was a painful lesson for many. The question this time is, who are the ones being taught the lesson now?

2. Ray Dalio compares bitcoin to BlackBerrys

By the numbers: Ray Dalio — over 5,000% increase in Google search volume.

What does Ray Dalio — the billionaire founder of the world’s largest hedge fund Bridgewater Associates and the best-performing hedge fund manager of all time — really think of bitcoin? In a research note written by Dalio, he states up front that he is not an expert on bitcoin, but goes on to praise the cryptocurrency’s longevity so far and as a store of wealth. However, Dalio also points out what he sees as bitcoin’s risks and highly uncertain future.

- “Since the way Bitcoin works is fixed, it won’t be able to evolve and I presume that a better alternative will be invented and pass it by. I see that as a risk,” Dalio wrote. “For those reasons the ‘limited supply’ argument isn’t as true as it might appear — e.g., if Blackberries were in limited supply they still wouldn’t be worth much because they were replaced by competitors that were more advanced.”

- “To me Bitcoin looks like a long-duration option on a highly unknown future that I could put an amount of money in that I wouldn’t mind losing about 80% of,” Dalio continued. “That is what Bitcoin looks like to this non-expert. I am eager to be corrected and learn more. On the other hand, believe me when I tell you that I and my colleagues at Bridgewater are intently focusing on alternative storehold of wealth assets.”

Forkast.Insights | What does it mean?

Despite the speculative nature of cryptocurrency (which we’ve seen in the volatile spectrum of the price of bitcoin in January alone), Ray Dalio sees potential. Well, welcome to the growing club, Mr. Dalio. You’re right to explore why this alternative asset should be something your team is considering. First reason — and likely the one that triggered the move to investigate crypto as an alternative asset: investor interest is warming up, and that means people have cash they want to put into this space. More liquidity and greater demand means the value of the existing supply will rise.

Dalio wrote that, “Since the way Bitcoin works is fixed, it won’t be able to evolve and I presume that a better alternative will be invented and pass it by. I see that as a risk.” He’s right and he’s not right. Bitcoin is not the best blockchain protocol out there. It was the first. And since 2008, the thousands of blockchain protocols that followed all aimed to improve on the original. Ethereum, which features smart contract functionality and has its own cryptocurrency that drives transactions, is a good example. There are also other protocols trying to improve on Bitcoin and Ethereum, too many to name (but all you have to do is to check out the latest Coinbase or Binance or insert your exchange of choice list of tokens). Bitcoin has birthed an entire industry, and it is being fuelled by both demand from investors who are hedging devaluing fiat into an alternative system of cryptocurrency assets and actual use cases for those same cryptocurrencies in blockchain transactions across a multitude of industries.

More astutely, Dalio does point to the one thing that has driven the cause since 2008. “Rather than it being far-fetched,” he writes, “that the government would invade the privacy and/or prevent the use of Bitcoin (and its competitors) it seems to me that the more successful it is the more likely these possibilities would be.” This explains every doubtful word ever expressed by governments, institutions, officials. The biggest risk will come in Bitcoin’s success. The risk comes when the masses decide to decouple from the traditional financial system to create one that is further from the reach of institutionalized or centralized control. This is the biggest danger of all… albeit with an antidote. That antidote is folks like Ray Dalio, and the institutional money that are interested in hedging the very system they can’t 100% champion anymore.

3. Elon Musk steps out in #bitcoin fancy dress

By the numbers: Elon Musk — over 5,000% increase in Google search volume.

In an interview conducted by the CEO of Clubhouse, the invite-only social media app for sharing audio clips, Elon Musk verbally confirmed his support for bitcoin, asserting his belief that the cryptocurrency is on the verge of mass adoption. Musk added that he should have bought bitcoin eight years ago.

- Musk also kickstarted a Twitter frenzy by changing his account bio to just “#bitcoin” — which pushed bitcoin prices up 16% in a matter of minutes, from US$32,232 to US$37,420, eventually reaching a high of US$38,400, according to CoinMarketCap data.

- Musk joined Twitter CEO Jack Dorsey, whose own Twitter bio box had already been changed to #bitcoin. But it was Musk’s #bitcoin bio update that moved markets. Bitcoin is currently trading at US$35,884 as of publishing time.

- Following Musk’s tweet, almost US$350 million worth of bitcoin shorts were liquidated, while US$120 million in long positions were also liquidated, according to Decrypt.

Forkast.Insights | What does it mean?

If you can’t beat ’em, join ’em. As the saying goes, so too the retail interest in crypto. Some of the frustration felt by the little guy being frozen out of trades by Robinhood stoppages and the like are now finding a home in cryptocurrencies. And now they’re being joined by Elon Musk, whose every move on Twitter is now also moving crypto markets.

Musk, the founder of Tesla and SpaceX, has become a figure of intense focus and fascination for the cryptocurrency crowd, including other CEOs. In a recent Forkast.News exclusive, Changpeng Zhao (better known as “CZ”), the CEO of Binance, sat down with our editor-in-chief Angie Lau and predicted that Musk would put some corporate treasury dollars at Tesla to work in bitcoin. MicroStrategy CEO Michael Saylor has also publicly offered to share his crypto playbook with Musk.

When Musk added #bitcoin to his Twitter profile, the price of bitcoin jumped 20%. But the real metric to watch is Bitcoin’s network activity. According to Glassnode, the number of those addresses sending or receiving bitcoin rose above 22.3 million for the first time last month — the highest to date in bitcoin history.

Those addresses belong to people who are now engaged and actively trading in bitcoin. And if bitcoin is the gateway crypto to this whole new world of alternative assets, this too explains the corresponding rise in alt-coins and DeFi activity. The real money has already arrived, and now is being joined by their friends. Elon Musk is simply one of many who continue to come into this space.

4. India wants to replace cryptos with CBDC

By the numbers: Crypto Ban India — 3,400% increase in Google search volume.

The parliament of India is taking a page out of China’s digital currency playbook by proposing a ban on private cryptocurrencies while planning to launch its own central bank digital currency (CBDC). A new bill titled “The Cryptocurrency and Regulation of Official Digital Currency Bill, 2021” is among the 20 new bills in the nation’s current budget session now pending before the Parliament. In an earlier interview with Forkast.News, Unocoin CEO Sathvik Vishwanath explained why the industry could expect crypto-ban threats in upcoming parliamentary sessions.

- India’s Parliament is not the only group to throw shade at digital currencies. Bank of International Settlements (BIS) general manager Augustín Carstens warns that bitcoin is becoming increasingly “vulnerable to majority attacks” (51% attacks) as it closes into its 21 million supply cap, and may “break down altogether.” Carsten also noted that private stablecoins such as Facebook’s Diem (formerly known as Libra) “cannot serve as the basis for a sound monetary system,” and need to be “heavily regulated.”

- In Europe, governing council member of the European Central Bank Gabriel Makhlouf told Bloomberg that bitcoin investors need to be prepared to “lose all their money.”

Forkast.Insights | What does it mean?

Stability is one of the roles of government. It is also integral to keeping and maintaining power. Without stability, governments lose the confidence of its people, and that’s when we see transitions of power — democratic or otherwise.

India is no stranger to this mistress we call power. Those in power are keen to maintain control amidst the Covid-19 pandemic and one of the deepest economic slumps in history. India’s deficit is rising, while the economy is stagnating. More disturbingly, poverty is rising alongside stock prices and profits. And now cryptocurrency is in India’s crosshairs again.

When Narendra Modi came to power in 2014, it was on the heels of reform — on calls that the system no longer worked for the people and that change must come. Shortly after becoming prime minister, Modi challenged banks to provide bank accounts for every one of its citizens. Digital finance transformed India’s landscape and local markets. You could pay in real time with a simple QR code. It stoked a familiarity with digital payments, and today we’ve seen Indian adoption in cryptocurrency climb since the Covid-19 lockdown. However, we’re also starting to see banks starting to push back against having to do all those small transactions for free — cue bitcoin and cryptocurrency and their eight decimal places for all those micropayments.

But instead of allowing power in the hands of many (as in those citizens who want to hold and transact in cryptocurrency), the Indian government wants to take back control. So in one fell swoop, India is now championing its own Reserve Bank of India-backed digital rupees and pushing a bill that would make cryptocurrency illegal while preserving and promoting blockchain technology.

In this way, we are watching in real time what Ray Dalio warned, that the real threat to bitcoin and other cryptocurrencies lies in its own success and the governments that will aim to wrestle power back — and the stakes are high. India, if its government so chooses, would be removing the crypto participation (liquidity) of its 1.3 billion citizens from the global market. But that could also accelerate the exodus of the nation’s talented engineers, developers and entrepreneurs who want to work in crypto to seek out more hospitable shores. India’s economic future depends on innovation. It was what Modi once understood when he came into power, but perhaps that understanding has faded in the case of bitcoin.

5. South Korea explores DeFi’s potential

By the numbers: DeFi — 550% increase in Google search volume.

The South Korean Ministry of Science and ICT, which supports research and sets policy for the nation’s information and communication technology, has released a world-first government-led research paper on DeFi. The 245-page report titled, “Blockchain-based Innovative Financial Ecosystem Research Report” published in collaboration with the Korea Internet & Security Agency says that although Korea’s consumer demand for decentralized finance is currently not that high, DeFi has the potential to replace a large chunk of Korea’s traditional finance.

- While the report states that it does not represent the government’s official stance on DeFi, it set out a goal for Seoul: “To become the leading country in all indicators of the entire decentralized finance industry by 2027.”

- The report also states that media reports, blogs, and YouTube videos are confusing Korean investors into concentrating on the “dangers” of digital currencies, rather than the government’s positive position towards blockchain technology. However, in the current movements of the global market, it is difficult to determine whether cryptocurrency is truly dangerous or not. The ministry recommends raising awareness and providing more information so that Koreans can make their own informed judgments.

Forkast.Insights | What does it mean?

Talk about a stark contrast.

While other nations discuss banning cryptocurrencies, Korea openly discusses embracing DeFi. Instead of joining the increasing cacophony of worried governments and regulators elsewhere, the South Korean Ministry of Science and ICT says the best move for the country might be to become a leader in the whole decentralized finance industry by 2027.

This is the same country that took Japan’s playbook of consumer electronics, automobiles and music entertainment, and owned it via K-Pop, Samsung and Hyundai. No doubt Korea’s forward-thinking on DeFi just won over a legion of new stans. If Korea can provide the regulatory environment that allows DeFi to thrive, and bring order to the Wild West nature of this space, it will be the newest play in an economic playbook where only one thing matters: to survive and thrive.

6. China: War of the Bitmain Roses ends in civil divorce

The year-long civil war within Bitmain, the world’s biggest cryptocurrency mining machines manufacturer, has come to an end as its founders formally agree to go their separate ways. Co-founder Jihan Wu has officially exited Bitmain — this time, without much ado.

- “The disagreement between Micree and myself, the two co-founders of Bitmain, has been finally settled in an amicable and, more importantly, a constructive manner,” said Jihan Wu in a letter on Twitter. “I have resigned from the CEO and Chairman of Bitmain as of today.” Wu added he would become the CEO of BitDeer, a computing power-sharing platform, which has been spun off from Bitmain.

- To retain control of Bitmain, its other co-founder, Ketuan Zhan, also known as Micree Zhan purchased almost half of the company’s shares for US$600 million dollars. The shares were owned by Bitsource, the entity representing a group of founding shareholders that includes Wu.

- Wu said: “ through the above-mentioned arrangement, Bitmain’s business model will be highly streamlined, which will make it much easier to go for an IPO.”

Forkast.Insights | What does it mean?

Why fight when there is enough to go around?

Bitmain’s peaceful end to what had been dramatic rows (that included a street fight and epic property battles) coincides with the company’s future interests. As China’s leading crypto mining chip company — the seller of the picks and axes, so to speak, used in the crypto gold rush — Bitmain’s fortunes are rising along with the growing popularity of bitcoin and other alt-coins in the crypto universe.

As a result, there is now a renewed rush to buy Bitmain’s wares, most importantly its ASIC (application-specific integrated circuit) chips needed for mining bitcoins. Bitmain recently doubled the price of some of its merchandise, but the latest models still sold out. The prospects of an IPO will make friends of even former enemies.