This week has been one where big changes came fast and furious on the opposite sides of the central bank digital currency world.

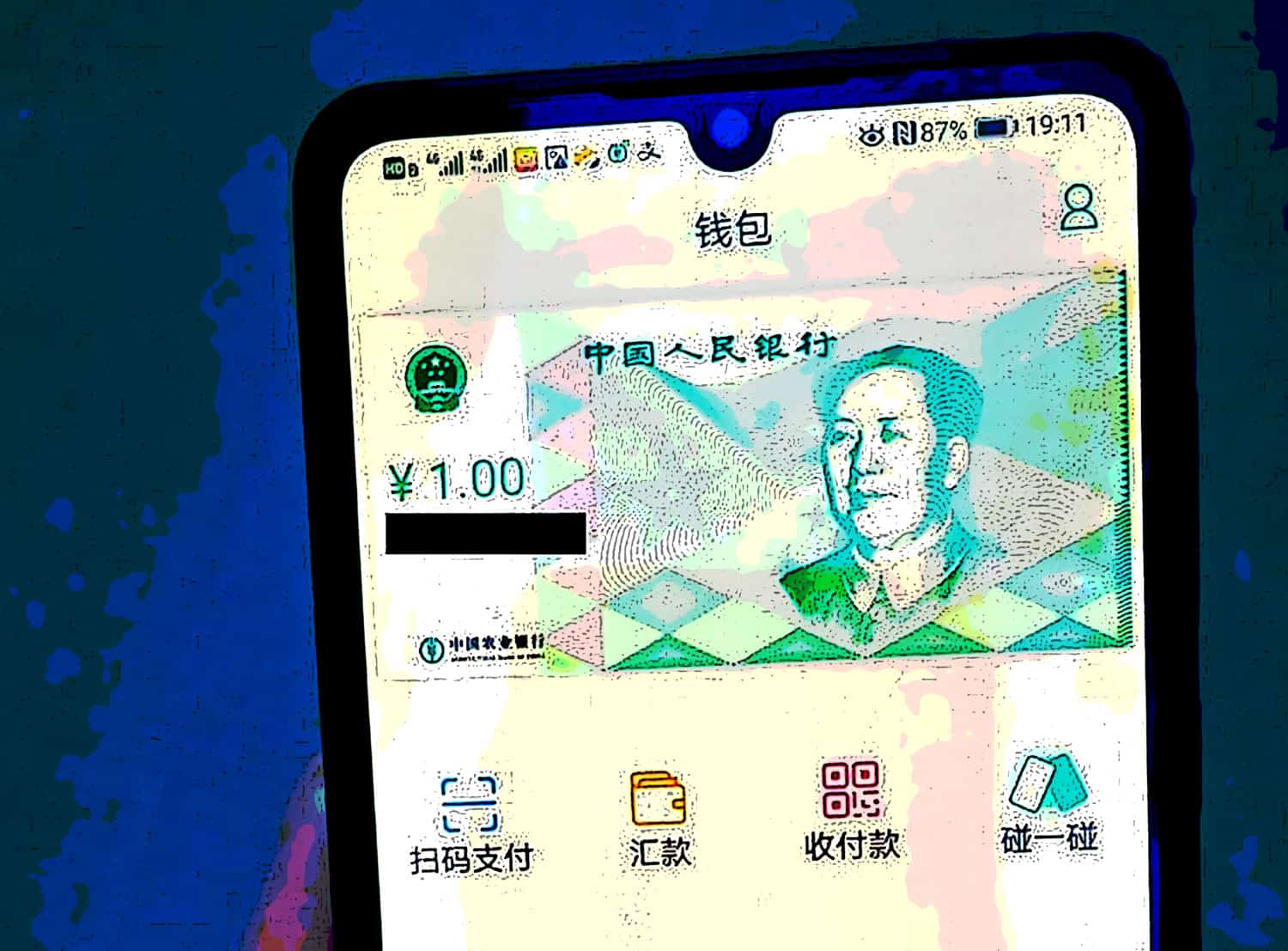

First, alleged screenshots of a mockup of the People’s Bank of China central bank digital currency’s mobile app were published, giving the public a taste of the apparent functionality of the platform and apparent proof that it’s edging closer to its much-anticipated launch.

Then, Facebook’s Libra announced a significant retreat from the blockchain project’s earlier grand vision: the Libra coin will now be offered not as one singular coin for the world, but rather a series of stablecoins tied to a list of fiat currencies. Libra will no longer be denominated in USD; rather it will be available in a plethora of different currencies. The list has yet to be revealed, but it’s safe to assume that Libra will be available in most of the world’s significant currencies.

To be sure, at a top-level, China’s Digital Currency Electronic Payment (DC/EP) system and Libra 2.0 have different intents, but as you drill closer to the surface, their intentions begin to align. With China’s DC/EP, the top-level rationale for the project is to wrestle control of the nation’s currency away from WeChat and AliPay — which are already digitizing vast sums of money in circulation.

Here’s an explainer from Forkast Insights’ “China Blockchain Report” published in late 2019:

The central bank’s digital currency efforts, ironically, would give it more control over the economy. According to reports and the PBOC’s statements, the digital currency would replace M0, or the money in circulation, of which central banks generally have the most control. For China, this is important considering how private companies are digitizing currency through popular mobile payment platforms WeChat Pay and Alipay. A substantial portion of the payments that drive the consumer economy has shifted to these platforms, which means they have moved from M0 to M2, of which central banks have less control. While M2 includes M0 (in addition to M1, the amount of cash held in checking accounts), it largely refers to the funds and credit in commercial bank accounts — where WeChat Pay and Alipay currency is held.

Money supply makes up the core of the broader economic cycle, and with the proliferation of these digital payment platforms, the control over money had begun to slip from the PBoC’s control. The supply of M2 had exploded as transactions bounced from WeChat wallets to merchants, and back and forth, reducing the PBoC’s influence and ability to intervene in the economy.

There’s also the geopolitical angle. Despite Beijing’s hegemonic ambitions, economic dominance and political influence in Asia and elsewhere in the world, the RMB is effectively illiquid outside of China’s borders. No one except Chinese tourists use RMB, even in countries bordering the mainland — without this nexus to China that tourists bring, the currency, abroad, just isn’t that useful. Commercial transactions within China’s sphere of influence in Southeast Asia are much more likely to be settled in USD, Not RMB. Countries like Cambodia and Myanmar even use the USD alongside their own official currencies, much to the annoyance of Beijing.

This is where Libra’s pivot and downgrading of its earlier ambitions start to make sense. Libra has the potential to be the world’s largest currency thanks to Facebook’s global audience. If Libra were to be backed by the USD, it would only solidify the dollar’s status as the world’s most used currency — which is not even something the U.S. wants. Democratic Congresswoman Maxine Waters, who heads the U.S. House Financial Services Committee, in the past has asked Facebook to halt the Libra project, expressing concerns about “allowing a large tech company to create a privately controlled, alternative global currency” and arguing that Facebook would have outsized control of the USD and may prevent the Fed’s own monetary policy from being effective.

Facebook already has enough interest from regulators around the world over its status as one of the globe’s biggest custodians of data. Allegations over its role in elections interference, the propagation of fake news and disinformation, and the demise of local media have caused a public backlash and kept its government relations staff busy. Facebook doesn’t want to start another war, especially with the monetary regulators of the world’s largest economy.

See related article: Analysis: Are the ‘digital dollars’ in the $2 trillion stimulus plan the first step toward an American CBDC?

By now offering this basket of different currencies, Libra is trying to nullify these fears, while also giving central bankers an easy on-ramp to digitize their respective currencies. Binance was said to be working on this with Project Venus, and planned a non-adversarial approach to dealing with government stakeholders.

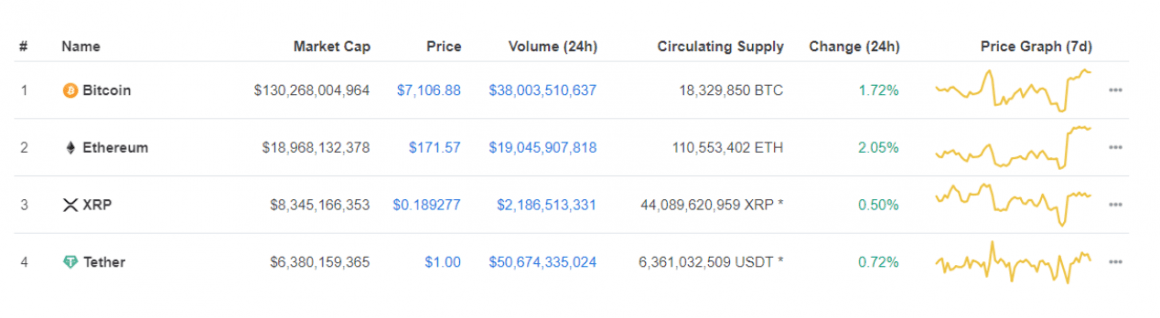

Even with its new stance, Libra would still get to challenge incumbent financial institutions that own the global remittances business by pushing down costs given its scale. Unlike challenger banks that may be reliant on fundraising during Covid-19, Facebook has plenty of capital for funding the Libra project. Stablecoins have long been touted as the answer to the global problem of high remittance fees, but there hasn’t been a large-scale and mainstream attempt to make this happen until Libra. While Ripple and Tether, both pegged to the USD, have some of the highest liquidity in the entire crypto market, neither are mainstream contenders to replace existing remittances systems such as SWIFT or Western Union.

Tying it together: an east-west digital divide

Although Libra has pivoted away from being backed solely by the USD, to multiple currency offerings, its repositioning is setting it up as a more formidable competitor to China’s DC/EP.

Libra will help strengthen the currencies of smaller nations everywhere, creating classes of liquid competing currencies that are now viable options for remittances, settling commercial contracts and other cross-border payments. Though China’s DC/EP will encourage the RMB as a medium of settlement, everyone knows that will likely come part and parcel with the lurking influence from Beijing. Washington would certainly be much happier to see Southeast Asian transactions being settled in Thai baht or Malaysia ringgit rather than RMB.