How the layer 2 race is scaling Ethereum before ETH 2.0

While the world waits for Eth 2, blockchain developers like Enya.ai and OMG Network are trying to solve Ethereum’s scalability issues via layer 2.

Editor’s note: This article previously mentioned Chiu’s excitement for layer 2 solutions and included developments from Polygon as an example. The mentioning of Polygon in this article does not relate to Chiu’s excitement for upcoming developments in the layer 2 race.

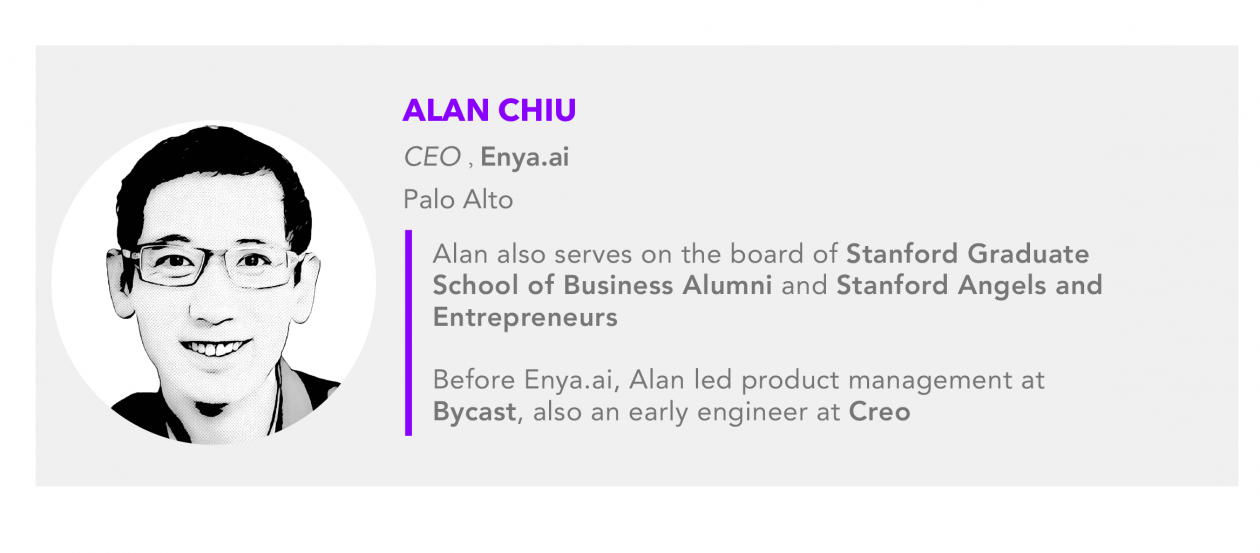

In the blockchain world, all eyes are on Ethereum and the roll-out of ETH 2.0 — which is expected to solve Ethereum’s scalability issues. But others, like Alan Chiu are trying to do the same sooner in a layer 2 race.

Chiu, the founder and CEO of Enya.ai, says scalability in Ethereum is already making headway while the world waits for the next level Ethereum — a project already infamous for its many delays.

“Ethereum has a rather limited capacity for computation and this has been a known problem for several years,” Chiu told Forkast.News in a video interview.

“What happened more recently is, Vitalik [Buterin] and many other Ethereum researchers have come up with an alternative solution rather than trying to do everything in ETH 2.0, scaling both computation and data.”

One approach to scaling is called rollups, which moves transactions off the main Ethereum chain before recording on the main chain. The off-chain transactions can also be executed in layer 2 chains before moving back to layer 1 to store proofs. The aim is to move transactions off-chain for faster throughput of transactions, and potentially reduce transaction fees.

Chiu expressed excitement for the up-and-coming layer 2 developments. Enya.ai and OMG Network have also launched the public testnet of OMGX — a layer 2 Ethereum scaling solution which allows off-chain computations.

While not discussed in the interview, commit chain Polygon — which aims to connect layer 2 solutions — has garnered the industry’s attention in the layer 2 race through its immunity to the crypto crash of May.

“By implementing computations on layer 2, moving them off the main chain, we are freeing up the precious blocks on the main chain so that in aggregate we can — as an ecosystem — handle a lot more transactions,” Chiu said. According to Chiu, the layer 2 solutions like rollups will provide lower transaction fees and increase capacity for more transactions without having to wait for ETH 2.0.

While the industry waits for the final form of ETH 2.0 for improved scaling and less network congestion — which has been leading to slow and expensive user experience — a variety of layer 2 projects are looking to solve Ethereum’s network clogs.

The Ethereum development team has also scheduled network upgrade EIP-1559 as part of the London hard fork slated for July. That upgrade seeks to further lower transaction fees by introducing measures to discourage miners from manipulating gas fees.

“So, over the next several months, there’ll be several layer 2 solutions that will be moving into mainnet and it will be an exciting time,” Chiu said. “We’ll see how that changes to gas fees that people have to pay to use these DeFi projects.”

Watch Alan Chiu’s full interview with Forkast.News to learn more about Ethereum scalability, the “scalability trilemma,” privacy and more.

Highlights:

- Ethereum is getting bogged down by its own success: “That permission-less, censorship-resistant participation in decentralized applications that many of these that have taken off have to do with decentralized finance or participation in non-fungible tokens — that’s revolutionary because you don’t need anyone’s permission to participate and take advantage of these applications. However, because of their popularity, Ethereum has become cost-prohibitive for a lot of mainstream users. That prevents a lot of new users from even just trying out what it’s like to use these applications.”

- How layer 2 can decongest the network: “By implementing computations on layer 2, moving them off the main chain, we are freeing up the precious blocks on the main chain so that in aggregate we can — as an ecosystem — handle a lot more transactions. So without even waiting for ETH 2 to become broadly available, we’ll immediately start seeing lower transaction fees and many more transactions happening between the combination of layer 2 solutions and the current implementation of Ethereum.”

- Solving the scalability trilemma: “The trilemma is very real, and the trick in navigating through this trilemma is: Don’t try to optimize for all three dimensions with one solution, but rather come up with solutions that are complementary and bring them together. It’s like putting a puzzle together. Rollout and ETH 2 actually would be a great complimentary example, where optimistic rollout, let’s focus on that because that’s the OMGX architecture.”

- The downside of transparency in public blockchains like Ethereum: “The role of privacy is essential to protecting individual users from being exploited by more sophisticated actors with ill intent on the network. After all, Ethereum is a public blockchain. Any transactions that you proposed and want to be included in the network are visible to anybody. As a result, frontrunning, for example, is rampant currently in DeFi where these bots basically software programs that monitor orders, and if they spot an order that it is worthwhile frontrunning, they will do that. And I know many folks have lost money to front-running bots.”

Transcript

Angie Lau: By introducing smart contracts, Ethereum has changed the world of finance. But as Voltaire said, ‘With great power comes great responsibility.’ As revolutionary as Ethereum has been, its popularity has been its own kryptonite. Network congestions have led to high gas fees, but also brought a historic race for us to experience, the layer 2 race — the race to scale Ethereum.

Welcome to Word on the Block, the series that takes a deeper dive into blockchain and the emerging technologies that shape our world at the intersection of business, politics and economy. It’s what we cover right here in Forkast.News. I’m Forkast Editor-in-Chief Angie Lau.

So, can Ethereum’s scalability puzzle ever be cracked? Is layer 2 the answer? And how can ETH 2 push DeFi and NFTs to the next level?

Joining me right now is the co-founder and CEO of Enya.ai, that has partnered with OMG Network that scales and augments Ethereum, playing a critical part in the evolution. He is also the co-president at Stanford Angels & Entrepreneurs, and also a great friend. Alan Chiu, Welcome to the show.

Chiu: Thanks for having me, Angie. So happy to be here.

Lau: I’ve wanted to chat with you for a while. I heard about the Enya.ai and the OMG tie-up and this is really our first opportunity to dive a little deeper. Let’s explain the problem at the moment — scaling Ethereum. That’s something that Vitalik Buterin and other developers are aiming to solve with ETH 2.0. But how are already developers trying to solve that problem with layer 2? What is layer 2?

Chiu: That’s a great question to start us off. Ethereum has a rather limited capacity for computation and this is a known problem for several years and Vitalik and team have been working on potential solutions since then. ETH 2 is certainly on the horizon. And it’s going to be really helpful in solving this problem.

But the original vision for ETH 2 was quite ambitious. We’re trying to scale both computation and data at the same time. What happened more recently is Vitalik and many other Ethereum researchers have come up with an alternative solution rather than trying to do everything in ETH 2, scaling both computation and data. We are going to scale computation through an architecture called rollups, which is one form of implementing layer 2 — a blockchain that is secured by Ethereum. But we’re moving computation off the main chain, performing the computation, and then storing proofs back on the main chain to prove that the computations were performed correctly, and this actually makes ETH 2 scaling much easier to implement. For those who have been following the news Vitalik has actually moved up the estimate of rollup timeframe for ETH 2. So the latest approach of scaling Ethereum is through a combination of rollups on layer 2, and ETH 2 itself.

Lau: So, in fact, layer 2 even for the original smart contract blockchain, really an answer to the scaling solution. We know that computationally, proof-of-work is so much heavier and energy-laden and all of those things that we’ve talked about that actually impacts the speed and latency rates and the number of transactions. Layer 2, by removing some of these needed operational, computational processes to another layer for lack of a better description, actually frees up the pipelines a little bit. Is this what the concept is? Is this essentially what we’re seeing right now?

Chiu: Absolutely. By implementing computations on layer 2, moving them off the main chain, we are freeing up the precious blocks on the main chain so that in aggregate we can — as an ecosystem — handle a lot more transactions. So without even waiting for ETH 2 to become broadly available, we’ll immediately start seeing lower transaction fees and many more transactions happening between the combination of layer 2 solutions and the current implementation of Ethereum. And as we move forward to ETH 2, we will see an even greater increase in transaction rate, as well as more capacity for handling more applications and hopefully lowering gas fees accordingly.

Lau: And when you say we, you’re speaking from the collective, as in all of us. But I want to ask about you. Enya has recently launched the public test net of OMGX, which is a layer 2 Ethereum scaling solution for OMG network.

Tell us what work you’re doing at this tie-up with OMG and Enya. You’re working on a layer 2 Ethereum scaling alongside what ETH 2 is already working towards. Tell us a little bit about what you’re seeing is necessary in this space. Not only really from you, we’re seeing so many more layer 2 solutions that are trying to solve this exact problem.

Chiu: So let’s take a step back and look at the promise of Ethereum and what decentralization offers. That permission-less, censorship-resistant participation in decentralized applications that many of these that have taken off have to do with decentralized finance or participation in non-fungible tokens — that’s revolutionary because you don’t need anyone’s permission to participate and take advantage of these applications. However, because of their popularity, Ethereum has become cost-prohibitive for a lot of mainstream users. That prevents a lot of new users from even just trying out what it’s like to use these applications.

Now, this problem is well known, but there’s an even bigger danger to the health of this decentralization movement. And that is, the barrier to entry for developers to join the movement and build decentralized applications. Because as many attempts at scaling Ethereum have led to increasing complexity in code bases, and that means unless you are a real expert who’s been following these movements for a long time, it’s really hard for you to contribute to improving and maintaining these code bases. And on top of that, if we want more developers to be able to build decentralized applications, we need to enable them to take what they already know, what they’ve already learned in computer science classes, what the skills that they’ve picked up, building Web applications to use as many of those skills as possible in building decentralized applications.

That’s really the vision that we went into this space with, is how do we build a more inclusive ecosystem that could bring in more developers and more users at the same time.

Lau: So in other words, I am no developer. Sometimes I don’t even know how to reprogram my microwave. And yet, potentially, I could also participate in this new ecosystem in DeFi by easier user interface that you’re going to design on the front end — so front end, it’s going to be easier for me — but on the back end, the enter button might have all of the functionalities, the coding that allows me to execute, one thing or simple instructions. But on the back end, you might have already taken care of that? Is that the concept?

Chiu: Absolutely. So for you as a user to take advantage of these new decentralized applications, not only do we need to lower the cost for performing these transactions, which we want there to be as many of these applications as possible so that you as a user would have more choices. And competition leads to ever-better product quality. And that’s why we want to be able to bring in many more developers to help build out that decentralized application ecosystem.

That’s why we decided to work with OMG Network together and to build on an optimistic rollup architecture that has been created by the Optimism team. And we looked at many other options, too. We decided to build on Optimism because Optimism itself is just a modified version of Ethereum, which means going forward, it is so much easier to stay in sync and ensure forward compatibility with Ethereum, even though you’re running your smart contracts on our platform. And so that’s critical because that would make the job of developers so much easier to migrate smart contracts onto us.

But we’re not stopping here. We’re also researching and investing in capabilities so that you can perform more complex computations off-chain and then bring the results back to your smart contract, and that means the latest advances in machine learning and risk modeling and in many other fields of computer science, including what Enya brings to the table, which is secure privacy, preserving computation, you can now take advantage of all of these complex computations in the context of a smart contract, which you couldn’t do before.

Lau: There are so many layer 2 branches that are kind of growing out of Ethereum. OMG starting its test net, about to launch mainnet. If there’re so many layer 2 solutions, why are we still seeing congestions in the Ethereum network, as opposed to,other blockchains, when there are other options out there?

Chiu: First of all, Ethereum has really earned the trust of a lot of users and developers because of its scale, because it’s been battle-tested. And the fact that there are many other options actually is great, it pushes the whole decentralized movement forward. But Ethereum still has the largest mindshare amongst developers. By all developing on Ethereum, these different projects, DeFi projects, for example, can build on each other’s work. And that’s one of the key benefits of staying within the Ethereum ecosystem.

Now, why are we still seeing congestion? Yes, there are many layer 2 solutions that have been in the works, but most are still in the Testnet phase. But this summer is going to be an exciting period when many of these projects are finally coming to fruition and becoming mainnet ready. So over the next several months, there’ll be several layer 2 solutions that will be moving into mainnet and it will be an exciting time. We’ll see how that changes to gas fees that people have to pay to use these DeFi projects. We’ll see how that helps drive user growth and also create even more opportunities for DeFi developers.

Lau: I want to ask you about the privacy aspect that you’re really bringing on with Enya. Do you, I mean, increasingly, as all of us have experienced, either on an individual level or part of a group that was exposed to a bigger hack of a corporate, how important is privacy? And as a value proposition for either a token or a platform or even a layer 2 solution, in your view, where do you see the role of privacy?

Chiu: The role of privacy is essential to protecting individual users from being exploited by more sophisticated actors with ill intent on the network. After all, Ethereum is a public blockchain. Any transactions that you proposed and want to be included in the network are visible to anybody. As a result, frontrunning, for example, is rampant currently in DeFi where these bots basically software programs that monitor orders, and if they spot an order that it is worthwhile frontrunning, they will do that. And I know many folks have lost money to front-running bots. There’s a school of thought that believes that, you know what, this is the price we pay for transparency, for operating on a public, blockchain-based computation platform. Our philosophy is that’s not necessarily the case, we can actually provide privacy, preserving capabilities to smaller contract developers so that they can protect these orders from being front-run. Now, is the knowledge so widespread that any developer can just start doing it using cryptography to protect these orders or other pieces of sensitive information? No, but that’s what we’re trying to do here is to make it accessible and easy for developers to take advantage of cryptography, to put privacy where it matters.

Lau: I mean, I guess that’s one of the reasons why the tie-up with OMG, I wanted to get more of the origin story of how that happened. This is an Asia-born partnership. But do tell how did Enya and OMG get together?

Chiu: It’s a great story, actually, so we’ve known OMG Network was acquired by GBV towards the end of last year.

Lau: Genesis Block Ventures?

Chiu: That’s right.

Lau: Out of Hong Kong.

Chiu: Based in Hong Kong — yes. Another part of the Asian story.

And we’ve known the team at GBV for several years and we have a lot of respect for them, not only for their savviness but for how they treat their partners, how they’ve supported the portfolio companies that they’ve invested in. After the acquisition, they came to us and said, no, we saw this potential synergy between what you guys are doing at Enya and the potential here OMG network, we should talk. One conversation led to another. We believe that, especially given the timing of this partnership where Ethereum is going through some growing pains, massive congestion, and at the same time, we’re seeing a lot of issues such as front running that have their root causes in the lack of privacy-preserving technology in these decentralized applications.

We thought it made perfect sense to bring the two together.

Lau: In blockchain, a lot of the conversation has centered around the scalability problem. The ‘scalability trilemma’ is a phrase coined by Vitalik Buterin himself to describe what is not possible. You can’t equally maximize three desirable attributes of blockchain. They are decentralization, scalability, and security. If you’re going to dominate in two, you’ve got to scale back on one. So, for example, so many cases of that — Binance Smart Chain, for example, gave up decentralization for scalability.

Where are we on the scalability trilemma? I do know of a number of projects that say they are solving it and they have solved it. But where are we in terms of the next phase of technology?

Chiu: The trilemma is very real, and the trick in navigating through this trilemma is: Don’t try to optimize for all three dimensions with one solution, but rather come up with solutions that are complementary and bring them together. It’s like putting a puzzle together.

Rollout and ETH 2 actually would be a great complimentary example, where optimistic rollout, let’s focus on that because that’s the OMGX architecture. The sacrifices that the architecture has made on the dimension of decentralization is a single sequencer that controls the block order or the transaction orders. And that allows automatic roll-ups to optimize for security and for scalability.

Now, how do we make up for the sacrifices in decentralization? Well, one, there are four approvers of verifiers monitoring just a single sequencer to make sure the single sequencer doesn’t commit any fraudulent transactions. And then, of course, because this layer 2 ultimately is secured back to the mainchain Ethereum, which is decentralized. So we’re bringing the mainchain, which is decentralized and secure, but not very scalable, and combining that with a layer 2 solution that is scalable and secure, but not decentralized. So between the two, we’re hitting all three dimensions.

Lau: How important is that for ESG, for sustainability?

A lot of the recent narrative, especially tied into the market crash that we saw in crypto this past couple of weeks, really centered around the carbon footprint issue. And there is a root cause, I guess, there that potentially explains a little bit of the market pullback. Where can technology play here and does scalability also play a part here? I’m talking about – reducing the latency by reducing the computational requirements and all of those things that actually take up a lot of energy.

Chiu: You’re absolutely right in a proof-of-work protocol. The reason it’s so energy-intensive is because we’re replicating the same computations across all the nodes in the network, which is overkill, frankly. By moving computations off chain to layer 2 solutions, for example, we are eliminating a lot of that duplication. By performing the computations off-chain and then only soaring the state roots back to the mainchain, and that dramatically eliminates a lot of the wasted and duplicate computations.

And of course, as Ethereum itself moves to ETH 2 and transitions from a proof-of-work model to a proof-of-stake model, that will further reduce its energy footprint. But even before that happens, simply moving a lot of the transactions from mainchain to layer 2 solutions will dramatically reduce the energy footprint per transaction required.

Lau: Yeah, and this also ties back to the fundamentals of the actual crypto market that we’ve often talked about, which is it’s really technology-based rather than, EBITDA-based, if you will, an equity-based fundamental analysis.

If you were to take a look at the recent pullback that we saw in the market, a lot of people said that “the technology is no good. I don’t believe in this space. It’s speculative, it’s x, it’s x, it’s x.” You are in it. You’re participating in it. You’re building in it. You’re developing products in it. Where is the technology here? What is the application use case that actually is the true underlying technology of a lot of the things that we’re talking about.

Chiu: Asset prices often run ahead of what’s happening on the ground in terms of technology development and adoption, and that’s in part a natural cycle of price discovery of investors trying to figure out how much is an asset worth at the end of the day. When there’s something new on the horizon, what the future holds is often hard to predict. And different investors could come up with very different predictions. And that’s what drives pricing volatility, while in the meantime, technologies continue to build, and if we technologists are building something valuable, users will continue to come.

What we can look at is forget about price volatility, let’s look at actual adoption. Let’s look at total value logged in DeFi projects, total number of the growth in the number of wallets, the amount of assets that are participating. Not just on Ethereum., but across different chains. The growth has been more than steady, has been explosive in the past couple of years. And so while pricing will continue to fluctuate, I believe that as long as we continue to build something that people want the whole ecosystem will continue to grow and investors over time will find the right prices for different assets over time.

Lau: Yeah, it’s prices up or down is not the story. This is the story here. What is the most frustrating headline that you read recently and you want to debunk? You can only pick one.

Chiu: I read one that blamed ransomware on crypto. The writer of that article argued for banning crypto because nefarious actors are demanding to be paid in crypto for ransomware. And I’m like, that whole notion of holding people hostage for ransom has been around long before the invention of cryptocurrencies. So blaming this new currency or blockchain technology in general for an age-old problem seems off to me.

Even if we banned cryptocurrency worldwide today or if cryptocurrency never were invented, to begin with, there will still be nefarious actors who would hold companies and hold people ransom. They would just ask for whatever they want, could be U.S. dollars or whatever form of payment they desire. Crypto just happens to be in the headlines and the attackers that held Colonial Pipeline hostage, they wanted Bitcoin, that’s why they made it into the news. But to connect the two and then blame crypto for the emergence of ransomware to me didn’t make any logical sense.

Lau: You are there in Silicon Valley right now. But pre-Covid, I saw you a lot in Asia and the U.S. I mean, when the world was a little bit different. Where do you see Asia’s role in DeFi in particular, as we see the space continue to grow?

Chiu: There are a lot of DeFi actions in Asia, which is why we actually love the position that we’re in, where we’re able to bring the best of both worlds together — the innovation and the drive of Silicon Valley with the innovation in Asia and the hustle and strong work ethics across Asia. We’re benefiting from both ecosystems. My co-founder is a Stanford professor. We have very strong ties to Stanford and Silicon Valley. We can recruit the best engineers in the world here. We also have access to talent in Asia and in Europe and with the broad combined network of Genesis Block Ventures as well as OMG network. We are in a very enviable position to really bring the best together.

Just to speak to the importance of Asia in DeFi. I know a lot of my crypto trader friends in the U.S. who actually would become very active right around dinnertime, which is when Asia wakes up and they monitor the market until Asia goes to bed. That speaks to the pull and the importance of Asia in the whole DeFi space.

Lau: We also saw Asia’s role in the latest market volatility. And I guess this last question, we’re seeing a lot of policy pullback from Korea, from China, that seems to make a lot of people nervous. Would you explain that a little bit from your perspective, how you view how you feel some of the policy changes in Asia might impact the market.

Chiu: I think we’re still going through this phase where collectively, we’re learning how to best protect consumers and protect the stability of existing financial systems while still encouraging innovation in DeFi and the broader blockchain space, and a lot of regulators themselves are still learning and some are further ahead than others. So we’ll continue to see, I think, policy position changes over time as regulators learn about the risks and potential benefits. It’s incumbent upon industry actors like ourselves to engage with regulators and keep them informed and not try to leave them behind while we just continue pushing forward and pushing the frontier of innovation without bringing the regulators along. If we continue to live in separate worlds, it won’t be the best for our industry, it wouldn’t be the best for other mainstream participants that we want to bring into the ecosystem. We really need to work much more closely with policymakers.

Lau: I think for sure there has been a parallelism that we’ve experienced for a long time, legacy systems and then in parallel, emerging. First, Bitcoin and then blockchain technology and then all of these parallel systems, and now we’re seeing a convergence. And this is also what explains a lot of the viewership that is joining us right now. They’re not necessarily crypto natives or you know, crypto converts, of which we welcome as well, and super hanging on to every word. But it’s this combination of interest in two worlds merging together that’s the future. Alan Chiu, you are part of that future. And I thank you so much for sharing a little bit more insight into what you’re doing it Enya.ai. in Defi space and also with OMG. And we’re going to welcome you back again next time for deeper insights on Word on the Block. Thanks, Alan.

Chiu: Look forward to it. Thanks again for having me.

Lau: And thank you, everyone, for joining us on this latest episode of Word on the Block. I’m Forkast.News Editor-in-Chief Angie Lau. Until the next time.