As the United Nations embarks on the monumental task of restoring natural ecosystems, one can’t help but ponder the environmental impact of cryptocurrency mining. The topic has spurred much consternation and debate lately as interest in blockchain technology and cryptocurrencies like Bitcoin continue to expand throughout the world.

The theme of this year’s World Environment Day 2021 is “Reimagine. Recreate. Restore.” Today, June 5, will also mark the beginning of the U.N.’s “Decade on Ecosystem Restoration.” According to the United Nations Environmental Program (UNEP) — the world is now facing the triple threat of climate change, loss of nature and pollution, and UNEP has now launched a 10-year plan to restore at least one billion degraded hectares of land and natural ecosystems around the world — an area that adds up to about the size of China.

Bitcoin’s carbon footprint has become a growing concern for environmentally-conscious investors as well. In fact, the recent crypto market crash initially began in mid-May, when Elon Musk suddenly declared that Tesla would no longer accept Bitcoin as payment due to environmental concerns.

Bitcoin would continue to fall dropping 37.5% in May alone, hitting a low of US$34,195 making the month’s losses the second-largest single-month drop on record after it fell 40% in September 2011.

While no one doubts that blockchain is a powerful and transformative technology being used across an ever-growing range of sectors, its energy footprint as an industry has been deemed as unsustainable at the current pace.

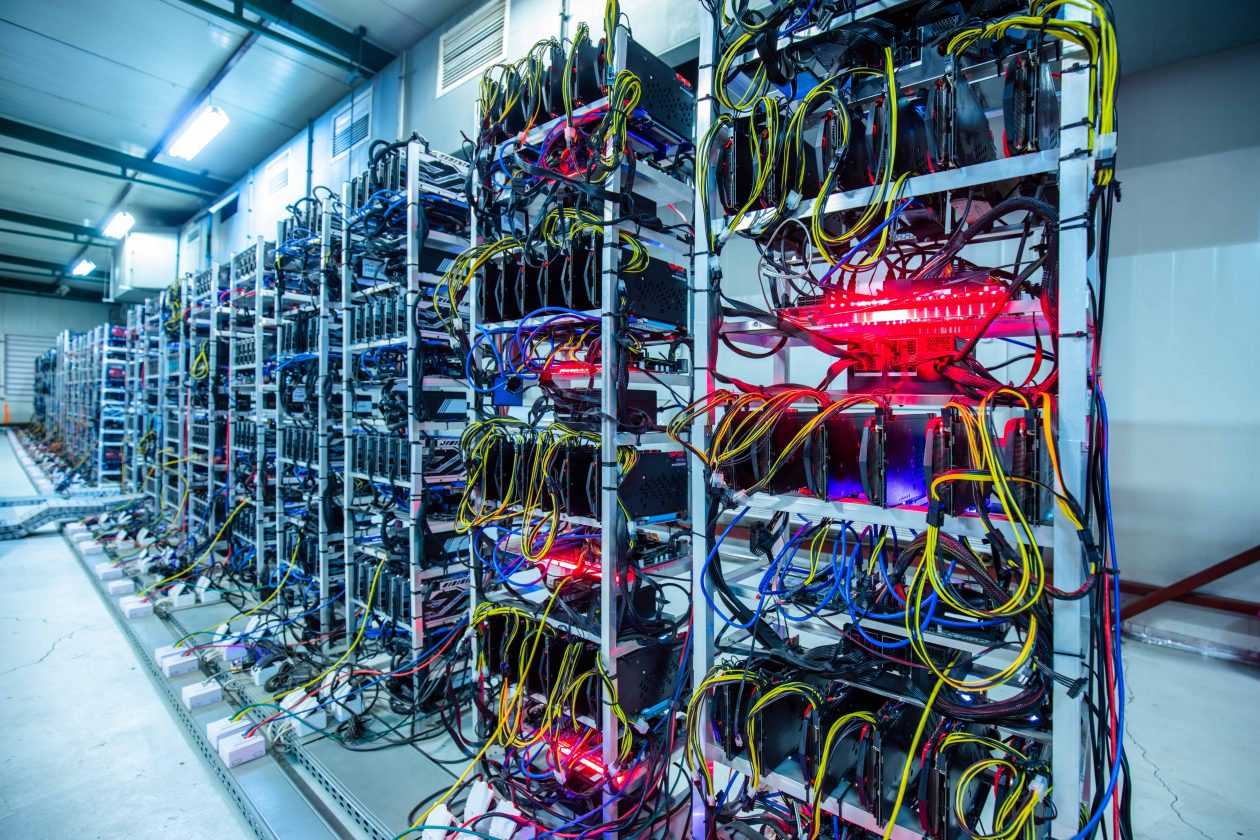

Blockchains like Bitcoin work off of proof-of-work algorithms, which must be solved by computers through cryptographic calculations in order to mine the BTC tokens. The same is true of Ethereum in its current state.

The energy required by miners for these calculations result in high energy consumption. Recent research from the University of Cambridge’s recent bitcoin electricity consumption index showed that Bitcoin mining alone is utilizing around 0.6% of the global electricity consumption — this is more electricity than a country like Argentina uses in a year.

China’s ESG goals

Influential as he is, Musk was not the sole reason for the plummet in Bitcoin transactions and price.

At the 2019 United Nations general assembly, President Xi Jinping pledged that China would halt the rise in its carbon emissions by 2030 and achieve carbon neutrality in 2060 — a central goal that is now written into China’s 14th five-year plan.

As China strives to reach these carbon targets, a growing concern for Beijing has been the nation’s crypto mining ecosystem. Chinese miners account for more than 65% of the Bitcoin network’s computing power. On April 6, academics at the Chinese Academy of Sciences and Tsinghua University published a paper stating that without the appropriate interventions and feasible policies, intensive Bitcoin mining could undermine China’s emission reduction efforts.

The paper states the annual energy consumption of China’s Bitcoin industry is expected to reach a peak of 296.59 terawatt hours in 2024 and generate 130.5 million metric tons of carbon emissions — which would exceed the total energy consumption of Italy and Saudi Arabia combined.

As a result, China has now taken an incredibly hard-line stance against crypto trading and mining that has triggered an exodus of miners from the formal middle kingdom to other parts of the world. It also has caused Huobi, a major cryptocurrency exchange in Asia, to scale back some of its offerings due to China’s increasing scrutiny against crypto trading and mining.

Bitcoin on World Environment Day

The topic of Bitcoin and environmental, social and governance (ESG) sustainability has become a focal point of the global conversation around climate responsibility. In celebration of the U.N.’s World Environment Day, Max Song, co-founder of Sustainable Bitcoin Standard Initiative (SBS), told Forkast.News that many in the crypto community recognize the importance of fully committing to a carbon neutral future, and they see incredible potential for the Bitcoin ecosystem to be a leader in its green transition.

“Traditional financial institutions are just starting to set goals for neutrality, with many banks describing carbon neutrality plans in distant decades of 2040s and 2050s. However, we need immediate action now!” Song said, in an email. “With industry associations like the recently formed Bitcoin Mining Council and methodologies like Sustainable Bitcoin Standard, we can see a pathway for Bitcoin’s entire network to converge to carbon neutrality in the next five to 10 years, decades ahead of traditional finance.”

According to Song, the digital-native nature of Bitcoin can greatly help transparent standards-setting. The full record of the public blockchain connecting the mining pools, the hashes and the contributions of mining pools, he added, “allow us to imagine a more thorough and robust framework for measuring all the energy consumption used.”

Song also argues that by creating an economic incentive to reward the miners who are using renewable electricity, we can set a precedent to encourage miners to document and share their electricity consumption as well as transition to RE100 (100% renewable energy).

“The U.N. World Environment Day is a chance for us to reflect and encourage the powerful industry drivers to take more responsibility for neutrality,” Song said. “In the digital asset revolution, we see Bitcoin’s movement to carbon neutrality as a catalytic force for other financial industries.”

Bitcoin’s carbon footprint

Bitcoin’s carbon footprint has long been an issue the industry needs to address. Although some argue that an increasing amount of Bitcoin mining activities promote energy efficiency by using renewable energy or unused energy off the grid, there’s no denying that the continued power guzzling by a large part of the sector does little to contribute to a sustainable future.

Alex Tapscott, managing director of Canada-based alternative investment manager Ninepoint — which is setting aside a portion of its management fees to offset 100% of the carbon footprint of the Bitcoin held in the exchange-traded fund that Ninepoint operates — says: “some of the fears around Bitcoin’s carbon footprint are a bit misguided.”

“Almost half of the energy input for the network actually comes from renewables,” Tapscott said, in an interview with Forkast.News. “But half of the big number is still a big number.”

This isn’t just a Bitcoin problem. Governments have been urged in myriad ways and by numerous parties to shift from fossil fuels such as coal to renewable alternatives. But Bitcoin’s energy issues, its advocates say, are also something of a red herring.

According to a report published by Galaxy Digital, a cryptocurrency investment firm, Bitcoin mining uses only half the energy consumed by the traditional banking system, and gold mining uses up to twice what Bitcoin mining does.

Others say the world suffers from much bigger environmental problems than crypto mining.

“We’ve popularized or created fear, uncertainty and doubt around Bitcoin and the sources of electricity that it is consuming, whereas we have much bigger issues to tackle from an ESG perspective,” said Stefan Rust of Sonic Capital, in an interview with Forkast.News. “The whales being killed in our oceans, our oceans that generate 60% of the world’s oxygen, and we are killing those oceans and the recycling of oxygen in that ocean, which is done by whales, kelp and dolphins, etc… as well as the plastic in the oceans that is being dumped. Those are much bigger environmentally critical areas that we should be tackling.”

While not the biggest issue for the environment, Rust concurs that the amount of fossil fuels used in Bitcoin’s network is a serious issue that does need to be addressed and it has to happen at an industry level.

“To me, every day is World Environment Day. We should be protecting our environment every day. That one single day is not going to make a difference,” Rust said. “And it’s not the individuals that make a difference. It’s far more the industrialization of what is happening that’s going to make a difference.”