Almost all decentralized finance (DeFi) transactions are now being done on Ethereum, but congestion and spiraling “gas prices” are slowing down activity — which may be giving the popular blockchain network’s competitors an opportunity to rise, according to a new report.

Decentralized app (dApp) tracker DappRadar’s report on the state of the DeFi world documents a flurry of activity in the third quarter of this year, with transaction volume exploding by more than 10-fold since Q2 and now surpassing US$123 billion. Of those transactions, 96% were on Ethereum.

Total value locked into the DeFi ecosystem now exceeds US$10 billion, up from just $1 billion as recently as June.

Booming DeFi

While other blockchains are trying to capitalize on the surge in demand for DeFi, none of them come close to the volumes borne by Ethereum — a protocol that has become explosively popular in part because of its first-mover advantage and “composability,” which allows less-experienced developers to help build out the ecosystem.

In contrast, Bitcoin’s own Lightning Network — a protocol built on top of Bitcoin to facilitate faster transactions through the use of smart contracts — has only about US$12 million in total value locked in the DeFi ecosystem.

Bitcoin holders are flocking to Ethereum instead to make use of their bitcoin. By converting bitcoin into an ethereum-based token that represents bitcoin 1:1, named “Wrapped Bitcoin,” bitcoin holders have now sunk more than US$1 billion worth of BTC into DeFi.

Q3 #DeFi report:

— DappRadar (@DappRadar) October 7, 2020

– #Ethereum’s TVL surpassed $10B.

– @ethereum, @Tronfoundation, and #EOS account for 97% of daily active wallets.

– @IOST_Official, @OntologyNetwork, and @Neo_Blockchain joined the world of DeFi.

– #Uniswap earnings have hit the roof.https://t.co/4IQQ0bzTAO

The idea behind projects like Wrapped Bitcoin is to tap into the liquidity in bitcoin and make it accessible on the Ethereum network. DeFi as a whole has attracted investors’ attention as a way to make use of their digital assets to disburse loans or borrow crypto assets through smart contracts instead of merely holding their assets in wallets.

DeFi participants who invest their cryptocurrency into liquidity pools managed by smart contracts are known as liquidity providers, and receive interest or returns for their contributions through a practice known as “yield farming.”

According to DappRadar’s report, the largest contributors to the Ethereum network were DeFi protocols Uniswap, Sushiswap, Balancer and Compound, generating a combined 56% of daily active wallets.

The growth in DeFi could be attributed to the impact of Compound protocol (COMP) in particular. “COMP was introduced back in June and we observed transaction volumes within the DeFi ecosystem exploding,” the report said. “Within just half of June, Compound transaction volume grew 27x reaching $4 billion.”

Congestion and scams

Despite the surging investor interest in DeFi, its growth over the past few months is not without risks. Observers as well as industry insiders have sounded alarms that many projects may be no more than Ponzi schemes.

“A lot of people are doing scams because a lot of people are interested in DeFi, so if you slap the word DeFi on anything, you will get a lot of money coming your way,” said Marc Fleury, CEO and co-founder of fintech company Two Prime, in a recent interview with Forkast.News.

As reported on Forkast.News, the world of DeFi has been rife with dramatic events such as SUSHI protocol’s sudden rise followed by a nosedive in value, SushiSwap’s anonymous creator Chef Nomi returning US$14 million in ETH, and more.

DeFi’s popularity is also congesting the already-popular Ethereum network, driving up transaction fees known as “gas.” These gas fees can be paid with denominations of ETH known as “Gwei.”

“Although the results of Ethereum are astonishing, one of the main issues slowing it down is congestion,” the report said. “The gas prices showed impressive heights during Q3 2020. At peak moments transaction costs were more than 400 Gwei.”

According to blockchain software developer ConsenSys, Ethereum’s congestion and scalability issues are still being worked on. Ethereum 2.0 — which co-founder Vitalik Buterin said would be a proof-of-stake protocol that greatly improves scalability — is expected to launch sometime next year.

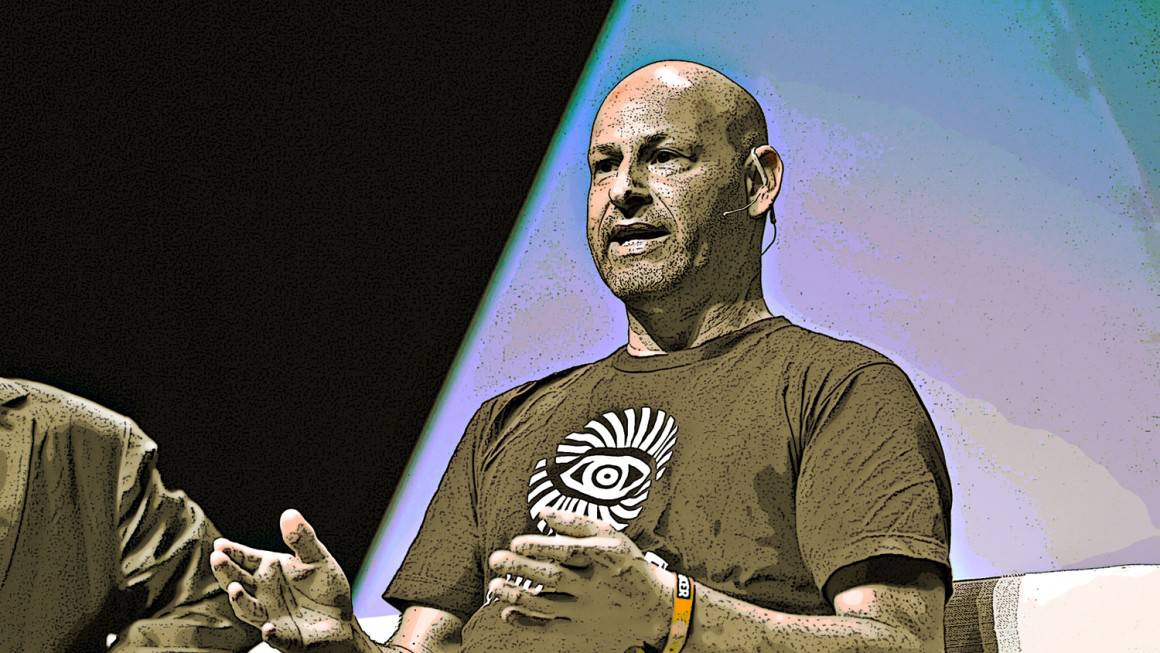

“I would be really, really disturbed if we weren’t having profound scaling issues at this point,” said ConsenSys founder and CEO Joseph Lubin, in a recent interview with Forkast.News.

“Scalability is being addressed by evolving the Ethereum 1.0 protocol, by adding literally tens or hundreds of thousands of transactions per second at Layer 2 above Layer 1, and by building out Ethereum 2.0, which will multiply all of that scalability by, probably around 500 early on, and then even more over time,” said Lubin, who is also co-founder of Ethereum.

With Ethereum 2.0 still not market-ready, the DappRadar report notes that the newly relaunched Cardano may offer users an alternative and that Polkadot and Binance are also rising as Ethereum competitors.