Vitalik Buterin explains how Ethereum 2.0’s launch would unfold

In a 2019 speech, the visionary creator and co-founder of Ethereum describes Eth2’s launch in phases, including proof of stake, data sharding and scaling.

To celebrate the end of 2020, here is a Forkast.News editor favorite from our archives — a story that still rings fresh, true and — in a world now measured in nanoseconds — timeless.

Vitalik Buterin, the visionary creator and co-founder of Ethereum, explains how Ethereum 2.0 will launch in four main phases: proof of stake, data sharding, execution and scaling solutions.

“Over the course of the next one to two years, then we’re going to be on this interesting journey together of taking the Ethereum ecosystem and upgrading it to a new and more secure … on top of it,” Buterin said. “So things coming soon, more developments to rollup, more developments to scaling technology, improvements to security, including wallets, including clients, including a lot of things, improvements to usability, improvements to privacy.”

See related article: In Conversation with Vitalik Buterin, Co-Founder of Ethereum: On Eth 2.0, Finance, and China

Highlights

- “Eth 2 is radical and Eth 2 is great, and Eth 2 is potentially a 100 to 1,000 factor scaling increase, and Eth 2 is the future. But at the same time Eth 2 is not literally tomorrow.”

- “There’s a lot of people who love Ethereum and want to be part of it, but who are just waiting for scalability technology to let them.”

- “This is more of an update from really my last one-and-a-half months of travels through almost every country in East Asia as well as in Europe and other places, which is that public blockchains are being legitimized even in the mainstream.”

- “A blockchain, fundamentally, is not a technical improvement. From a technical point of view, blockchains make things less efficient because you need every transaction to be verified a bunch of times, the benefit is social. The benefit is basic, whether you have this platform that really is neutral, this platform where it’s not controlled by one single company that’s running the application and has the ability to change it in whatever way it wants.”

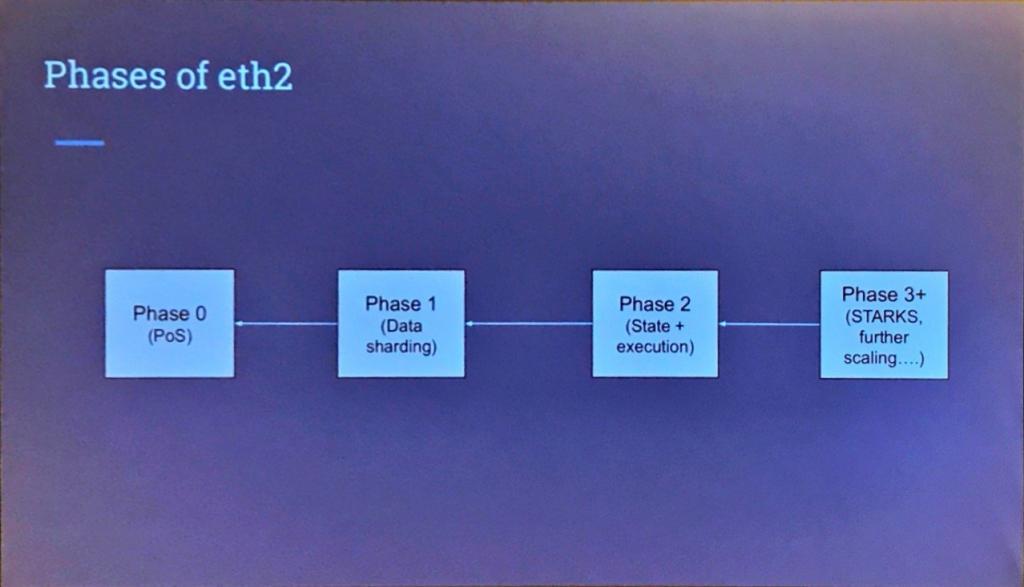

- “So Ethereum 2.0 progress. Quick summary, phases of Eth 2; there are basically four major phases. Phase 0, get proof of stake running. Phase 1, sharding, so scalability, but starting with data. Then phase 2, add stake and execution which basically just means computation and smart contracts. And Phase 3 is basically other stuff that we want to add down the line.”

- “A lot of very active progress all around, and we’re continuing to expect for early next year to have the phase up to have proof of stake network running.”

- “Basically optimistic rollup is the scalability technique that says, “We’re going to put the computation off chain. We’re going to put data on chain.” And data is generally cheaper than computation and we’re going to try really hard to compress the data.”

- “So the big news story in privacy technology this year has been general purpose zero-knowledge proofs. General purpose zero-knowledge proofs basically allow you to prove things about computation and prove things about information that you have or even prove things about transactions without publicly revealing that information.”

- “Quadratic funding is this interesting and unique approach to funding public goods that basically says if you can gather some money together and put it into into some central pot, then what people donate money to individual projects and based on how much money people donate and based on how many people donate money for different projects, use this mathematical formula to determine what kind of subsidy each project gets from a central pot. It’s actually this really clever market mechanism that’s halfway in between a market and a voting system.”

Speaking at The Hong Kong Jockey Club University of Chicago Academic Complex | The University of Chicago Francis and Rose Yuen Campus in Hong Kong on October 16, 2019, Buterin explained the progress and applications of Ethereum 2.0.

See accompanying article here: Vitalik Buterin: Ethereum 2.0 promises better privacy, scalability in 2020

Full Transcript

Vitalik Buterin: Okay, great. Thank you all for coming. Who here is feeling happy today? So let’s start off. We’ll probably talk a bit about my own view and what I’ve seen about just who’s using his Ethereum. So the Ethereum community is big, there’s many kinds of people in the Ethereum community, there’s individual developers, there’s startups, there’s enterprises, there’s people living in far flung countries that just use ether as a pretty currency to get money back home. There’s students, there’s people building things and different people are using Ethereum for different things, and at Devcon all of these communities definitely did come together. The number of people there was not small. We sold over over 4000 tickets. It’s definitely harder to see because the conference was split between 10 different groups in a way that it wasn’t before.

I think that the turnout was good. The thing that impressed me even more than the turnout at the conference is also just that the range in content and the range of things that people talked about. So this year, for example, we had a lot of speakers from the Ethereum community. We also had people from groups like UNICEF announcing they’re doing things. We had a co-founder of Occupy Wall Street come in and talk about his ideas of using blockchains for social movements. A lot of different people from a lot of different communities actually we’re thinking about not just Ethereum from the point of view or Ethereum, but Ethereum from the point of view of outsiders that have their own things that find Ethereum useful.

Ethereum is clearly being used for things. Recently we increased the gas limit of the Ethereum blockchain from 8 million gas per block to 10 million gas per block, a 25 percent capacity increase. Guess what happened? Before the capacity increase, the blockchain was about a hundred percent full. After the capacity increase, the blockchain was a hundred percent full. Increase the capacity and more people just come in. There’s a lot of people who love Ethereum and want to be part of it, but who are just waiting for scalability technology to let them.

This is one of the things that I’ll be talking about today. So there is a lot of different kinds of users of Ethereum. Financial obligations are a big one. For a long time we’ve been talking about simple payments, we’ve been talking about Eth, Die and other kinds of ERC20 tokens, decentralized exchanges. Uniswap has made exchanging between different assets on Ethereum extremely convenient and this is something that did not exist as an option one year ago. Literally Uniswap launched a one and a half months ago and it’s been doing really well ever since.

Other kinds of assets on chain, there’s people doing financial contracts on chain. There’s people who are launching asset backed tokens on chain. There’s people who actually try to use financial contracts for non-trivial and interesting things. So it for example, there is a group that’s doing hurricane insurance in Sri Lanka and there is a couple of other pilots that are using smart contracts that hook into data sources on the Internet and try to just write simple 50 and 100 line code programs that just do insurance using smart contracts. This is something people are actively starting to use. [Regarding] other kinds of financial instruments, even on the enterprise side, there are more and more things happening.

So one in one of the recent headlines that we’ve seen is Ikea just allowed an invoice to be paid using a basically fiat backed token that’s living on the public Ethereum blockchain. A [bank did a] bonds trade and then implemented the business logic of a bonds trade on the public Ethereum blockchain. And this is sort of a big highlight I wanted to share. This is probably even less from Devcon because Devcon is more of the Ethereum community and people who already like Ethereum are talking to each other. This is more of an update from really my last one and a half months of travels through almost every country in East Asia as well as in Europe and other places, which is that public blockchains are being legitimized even in the mainstream.

Three to four years ago when people were thinking enterprise blockchain, they were thinking, “Oh, no public blockchains are way too radical. Look, we need to just get 15 of our own guys together and make a little cartel — sorry — information blockchain between them. Get these fifteen computers to talk to each other and do a little thing and create some 5 percent efficiency gains between a couple of businesses.” And people tried doing this for a long time and a lot of these projects just did not go anywhere. A big reason why I think these projects fail is because they didn’t see what was the biggest benefit of a public blockchain.

A blockchain, fundamentally, is not a technical improvement. From a technical point of view, blockchains make things less efficient because you need every transaction to be verified a bunch of times, the benefit is social. The benefit is basic, whether you have this platform that really is neutral, this platform where it’s not controlled by one single company that’s running the application and has the ability to change it in whatever way it wants. These are benefits that more limited systems just don’t have the ability to provide.

There are just so many cases of people saying, “Oh, I’m going to make a consortium or I’m going to get up to 10 of the biggest companies together” and the first company enthusiastically joins on. And so they think ‘yay this is a great idea’. The second company does not enthusiastically join on, because as soon as the first company enthusiastically joins on, the second company and the third and the fourth, all think that this project is just the puppet of the first company. So they think it’s not really an neutral thing they’re signing on to. This is something that I’ve seen happen multiple times.

Even Libra has been seeing big challenges in convincing people that it’s not Facebook-coin or Mark Zuckerberg-coin. I think in a lot of ways the last few years have really legitimized the position of public blockchain specifically as this special grounds that has very unique properties. While other kinds of platforms, including centralized platforms, including consortium platforms, can be useful, public blockchains as a building block in many kinds of applications, and possibly even the glue between these consortiums are just indispensable. This is something that people are recognizing everywhere. I was visiting China for a week and people were recognizing it in China. People are recognizing this in Europe. It’s a big step forward. I think enterprise = permission is something that’s rapidly going away. There’s enterprises that as leaders, really are willing to collaborate and participate with the public ecosystem.

So other applications… blockchain goes far beyond finance and a lot there’s allocations involving non-financial assets, game assets, even something as simple as selling conference tickets. For example, even for Devcon, we had an experiment where we used a smart contract to sell some conference tickets and it worked really well. Selling conference tickets on the blockchain is actually a good user experience.

You don’t need to get two different databases, the money database and the ticket database to talk to each other. You just do the payments on one database and the computer program transfers both assets in one transaction and it’s great. Different kinds of non-fungible tokens, non-financial applications, many of them also tend to revolve around revoking things. For example, putting university degrees on the blockchain, revoke them on the blockchain, check the blockchain to verify that some university degree or some other certificate or even some key that you’ve registered is still valid.

There’s more and more people trying to do things like that. There’s a large chunk of non-financial industrial applications that are basically some version of “publish thing on chain and at some other time verify that thing has not been published on chain,” even that one simple pattern is something that you don’t need to build much of a special platform for, you can just do it on Ethereum today.

Financial business logic; so the Santander Bank’s bonds and different issuing, different kinds of financial instruments. So all of these things are happening. And more interesting uses of payments are also happening. There’s more and more people using cryptocurrency to distribute money to refugees, for example. And this is something that we’ve been seeing pilots of happen in a lot of different countries. So a lot of use cases and a lot of people want to do things on the blockchain. And right now there’s not that much space on the blockchain. Fortunately, this is a problem that we’re rapidly moving towards solving.

So Ethereum 2.0 progress. Quick summary, phases of Eth 2; there are basically four major phases. Phase 0, get proof of stake running. Phase 1, sharding, so scalability, but starting with data. Then phase 2, add stake and execution which basically just means computation and smart contracts. And Phase 3 is basically other stuff that we want to add down the line.

There’s been already quite a huge amount of work… Recently we’ve had this interoperability workshop in Toronto where all of the engineering teams that are implementing Eth 2 clients got together and got the clients to follow the same protocol and speak the same language and talk to each other. A lot of progress happened in the last one and a half months, and now we’re basically hurtling full speed ahead to having a public test network, which is the last major milestone before we can have a main network.

At the same time, phase one is continuing to be worked on. It saw a fairly significant simplification recently, the simplification basically says instead of having shards, talk to each other once every 10 minutes so that you need … layer two protocols if you want to move your stuff around more quickly. We just have shards talk to each other every 10 seconds and we do the work of making that happen efficiently enough.

It turns out that this is something that significantly increases the simplicity of the protocol, also really decreases the complexity of the infrastructure that you need to build to make the protocol useful. Also, there’s some Eth 2 teams that are starting to look at implementing phase one in parallel with all of the work involved in getting phase zero to production quality. A lot of very active progress all around, and we’re continuing to expect for early next year to have the phase up to have proof of stake network running.

Aside from this, Eth 2 is radical and Eth 2 is great, and Eth 2 is potentially a 100 to 1000 factor scaling increase and Eth 2 is the future. But at the same time Eth 2 is not literally tomorrow. Fortunately, there are there are things that are literally tomorrow. These are things that are not literally tomorrow, these are things that are literally today; client improvements. A year ago, running an Ethereum full node was very difficult. Now running an Ethereum full node — despite the higher scalability, despite the increased amount of time accumulating junk in the blockchain — running a full node is less difficult.

This is all possible thanks to the hard work of the development team, which has done a really good job over the last year improving efficiency. You can now sink in 4 hours instead of 11 hours. Or if your internet is slow, instead of 40 hours, 14 hours, if your Internet is fast instead of three hours, one hour. You know how to divide by 3. Also, we’ve seen to the … client. So this is a new team that’s developed a new Ethereum client, and so you should try it out, you should run it. It works, I’ve tried it, my computer is still intact.

Optimistic rollup is a layer two scaling solution that provides significance and a medium level of scalability gains now. It provides scalability gains that are not as large as you can get with sharding or with plasma or stay channels, but it provides scalability gains that are very real. After the Istanbul network operations is expected to happen on the test net this month, on main net maybe a month from now, we can expect to see, I think it’s about 4000 transactions per second in the absolute best case. In the absolute best case where people are just doing payments and everyone is running the rollup.

But even in a more realistic case, I can see getting over a thousand transactions a second. And unlike things like plasma channels, optimistic rollup does not have a hard time supporting things that are more complicated than payments. You can just run smart contracts on the thing. Third instead of just being an Eth research post or some idea or broken hunk of code in theory, there’s a demo of the exchange at unipig.exchange. Basically optimistic rollup is the scalability technique that says, “We’re going to put the computation off chain. We’re going to put data on chain.”

Data is generally cheaper than computation and we’re going to try really hard to compress the data. You could get something like two orders of magnitude of scalability gains, and this is something that you can use today and it will continue to get better tomorrow. Honestly, even if Ethereum 2.0 was delayed by another two or three years, this thing could easily carry us all the way until then. So that’s scalability.

Privacy technology, who here thinks privacy is important? So the big news story in privacy technology this year has been general purpose zero-knowledge proofs. General purpose zero-knowledge proofs allow you to prove things about computation and prove things about information that you have or even prove things about transactions without publicly revealing that information. Many people are probably familiar with zero-knowledge succinct non-interactive argument of knowledge (zkSNARK), which have existed for a while. They’re already used in Zcash.

But this year and especially over the last two months in large part thanks to a Ethereum foundation funded work, but also supported by Zcash Foundation and company supported by a lot of academic groups, we’ve seen a huge alphabet soup of protocols with funny names like PLONK, Sonic, Marlin, Shark — there’s there’s a bunch of them. These protocols are more efficient than before. They’re more general purpose than before. The trust, the setup requirements are much simpler and lighter than before. So for example, before with snarks, you had to do a separate trust that setup for every new program you wanted to prove things about. With PLONK you only have to do one trusted setup for every program. It made it much easier for developers to work with. So a lot of progress happening on this front, and a lot of progress on using these technologies.

One of the things that I’ve always talked about and liked in the Ethereum community is that the Ethereum community is diverse in many ways. First of all, the Ethereum community obviously has people in every continent in the world. We have even been to Africa this year, there’s a lot of people and for locals based there building, cool things. Also, we have people from the pure blockchain world and also people from the enterprise world, and it’s always been part of my vision to try to get these communities to collaborate with each other because ultimately they have the same needs. If you’re a regular human being, just an individual that wants to use blockchain applications.

You want privacy. If you’re an enterprise, you want privacy. So a lot of the time, there’s a lot of overlap in things that people want. When one of these groups build something for its own use then a lot of the time that code can be taken and it can be re-purposed in other communities. Here we have enterprise-focused groups. One is Nightfall by Ernst and Young. The other is Zeth by Clearmatics which is a company building permissions settlements based on Ethereum for some major banking institutions. They both created privacy solutions, they’ve open source to code.

There’s a lot of progress that’s been happening on both of these [examples]. Developer community driven privacy tech Tornado Cash sends 0.1 eth, gives 0.1 eth out to some other address. This is really nice because basically it’s something that you can already use if you just want a bit of privacy so you can send some eth to a separate account to pay transaction fees for financial obligations. So if you want some sub separate account that you can use to interact with ENS or whatever, then you can just do that and you can have some separate accounts and you don’t need everyone to see the connection between all of your activity.

A lot of progress on privacy. So one other piece of good news is that all of these different technologies stack on top of each other. So optimistic rollup; medium scaling. Sharding; high scaling. Optimistic rollup on top of sharding; very high scaling. ZkSNARKs; privacy. Sharding; scaling. ZkSNARKs inside sharding; privacy and scaling. Optimistic rollup, scaling. ZkSNARKs on top of optimistic rollup; privacy and scaling. Basically you have all of these different parts of the ecosystem that are trying to make Ethereum more powerful and useful in different ways. They combine with each other, they multiply with each other. There’s a lot of really cool combinations that are coming out of this. That’s scaling and privacy.

Another thing that there’s been a lot of work on its governance technology. So governance is something that matters for a lot of things. First of all, there it’s just funding public goods inside of the Ethereum ecosystem that are just irrelevant to users and developers. So one example of this would be Ethereum clients. One example of this would be just research. One example of this would be getting smart contracts audited. One example of this even be developing things like optimistic rollup or things like things like Uniswap.

We don’t really have good ways of funding these public goods. Sometimes you can make a project, you can kind of stick a coin into it and try to ICO, but we know there’s a lot of problems with that. Sometimes you can make a business and sometimes there is a business model, sometimes there isn’t. Then if trying to come up with ways to direct funding toward public goods better is a governance question. Governing parameters to on-chain applications, something like Maker DAO, for example, that has this decentralized U.S. dollar on the blockchain needs to have some parameter that says, well, where do we get the price of one dollar relative to ether? And this is something that needs to be maintained, needs to be updated over time, and it’s also a governance question.

Gathering community sentiment from protocol changes. There’s controversial things happening in blockchain land all the time, whether someone wants a wallet recovered, whether there is a protocol change that is really necessary for safety, but breaks five contracts that were written in some special way, whether it’s a change that increases efficiency at the cost of security or increases security at the cost of efficiency. There’s always a controversial protocol changes that you want to gather opinions for and try to come to some kind of legitimate consensus.

Decentralized social media applications. There’s a lot of people that want to do things like this and like make some better social media thing on the blockchain, possibly using coins, possibly using something else. And it’s figuring out these algorithms and even implementing these algorithms is arguably a governance question. There’s different kinds of governance technology. Privacy preserving voting infrastructure, one example.

A lot of the time decentralized governance involves some form of voting. But if all votes are public, then this creates many problems. If votes are public, then if you see how people vote, then you can pay them to vote for you, you can punish them if they don’t vote for you, you can interfere with the mechanism in a bunch of ways. We’ve been seeing this happen in some other blockchain ecosystems. Now, it turns out that a lot of this is something that can be solved with cryptography. And there’s people that are actually trying to implement this now.

Quadratic funding. So quadratic funding is this interesting and unique approach to funding public goods that basically says if you can gather some money together and put it into into some central pot, then what people donate money to individual projects and based on how much money people donate and based on how many people donate money for different projects, use this mathematical formula to determine what kind of subsidy each project gets from a central pot. It’s actually this really clever market mechanism that’s halfway in between a market and a voting system. I definitely encourage people to learn about it, there’s good articles about this.

It’s also something that we’ve been out testing on a small scale within the Ethereum ecosystem, with the most recent round seeing about 200,000 dollars in subsidies and the round just ended. These are actually doing a pretty good job of selecting projects that deserve community support and helping to fund things that would otherwise potentially have a hard time getting funded. To Ethereum clients, a wallet, a couple of independent developers, a podcast, I think if things like this work well, and we can I think even next year, literally see at least 5 to 10 people that are able to describe their full time job as working for a DAO. That would be really interesting to see. So you don’t have a boss, the community is your boss.

So where do we go from here? There’s a lot of improvements happening in the Ethereum ecosystem to meet the needs of growing Ethereum usage, there’s a lot of Ethereum usage. What’s the plan? After phase 0 launch, there’s basically three big things that have to happen, and the good news is they can happen in parallel. The Ethereum ecosystem is good at doing things in parallel because everything that I just talked about happened in parallel. So we need to have a big public test network, a final review of the protocol, a security review. We’ve already seen a couple of things that we need to change as a result existing security reviews.

Protocols, Some protocol simplifications. Security audits of the of the clients. So not of the protocol, but of the implementations of the protocol. And all of these things are either starting to happen already or are going to happen soon. After this, we get the launch of phase zero and we get the dawn of proof of stake and the rest of Eth 2 will get added over time, adding on new pieces as each piece proves itself.

Over the course of the next one to two years, then we’re going to be on this interesting journey together of taking the Ethereum ecosystem and upgrading it to a new and more secure … on top of it. So things coming soon, more developments to rollup, more developments to scaling technology, improvements to security, including wallets, including clients, including a lot of things, improvements to usability, improvements to privacy. Generally, ideas are tomorrow’s demos, and today’s demos are tomorrow’s reality. Thank you.