In this issue

- ICP takes crypto world by storm

- Will Ethereum be the next Bitcoin?

- Goldman Sachs breaks the ice on Bitcoin trades

- Dogecoin to the moon… literally

- China links digital yuan to biometric data collection

From the Editor’s Desk

Dear Reader,

Lonely at the top? Not anymore, it seems.

Bitcoin has been the pre-eminent name in cryptocurrency circles for as long as anyone can remember, but in recent days other tokens have stormed the ramparts of the crypto castle, giving investors plenty to think about and marking a further step toward the maturing of the market.

Just on Monday we saw the debut of Dfinity Foundation’s Internet Computer — or ICP — coin, which powered into the ranks of the world’s top cryptos in no time flat. And although its price has dropped back to less stratospheric levels than its US$737 first flush, the new token’s early success makes it worthy of everyone’s attention — especially, perhaps, thanks to the novelty and promised speed of the Dfinity network, which it powers.

This week also marked a fresh high for Ethereum as it topped US$4,300 for the first time. ETH appears to be closing the gap with Bitcoin, heading toward 20% of total cryptocurrency market cap. That’s still less than half of the share enjoyed by its better-known crypto counterpart, but it’s not to be sneezed at, and institutional interest in ETH is only growing.

Speaking of which, it hasn’t been all bad for the world’s first and still-biggest crypto. In the latest sign that Wall Street is warming to it — and other digital currencies — Goldman Sachs has launched a cryptocurrency trading desk, and was revealed to have already carried out Bitcoin futures trades. It’s not the first big bank to get its crypto on. Where one goes, others generally follow. Expect more moves like this going forward as the crypto space fills up and serious players pile in.

Until the next time,

Angie Lau,

Founder and Editor-in-Chief

Forkast.News

1. ICP takes the crypto world by storm

By the numbers: ICP — over 5,000% increase in Google search volume.

After five years of toiling in obscurity, Dfinity Foundation — which has an ambitious goal of being the “blockchain computer” — is suddenly hitting the big time, with its Internet Computer (ICP) token catapulting this week into the top 10 cryptocurrencies by market capitalization. While being listed on major crypto exchanges such as Coinbase and Binance introduced ICP to many investors, its mainnet was launched on December 18, 2020.

- The public blockchain platform, which its founder Dominic Williams calls an “extension of the internet,” aims to run smart contract functionalities at the speed of the internet.

- Smart contract innovator Ethereum — nicknamed “world computer” — currently has an average block time of around 13 seconds. Ethereum’s average block time peaked at around 30 seconds in 2017 but has since been reduced through a series of network upgrades.

- Dfinity has an average block time of five seconds.

- Dfinity has data centers in France, Japan, Burkina Faso and Jamaica.

Forkast.Insights | What does it mean?

Blockchain startup Dfinity’s newly unveiled “Internet Computer” has stunned many in the crypto space, with the ICP token now listed in 8th spot in the CoinMarketCap official rankings just days after its launch last Friday. The cryptocurrency currently has a market capitalization of US$41.9 billion.

The ICP token, which allows users to participate in and govern Dfinitiy’s Internet Computer blockchain network, first went live on crypto exchange Coinbase Pro on Monday. Since then the coin has experienced some extreme price volatility — swinging in value as the cryptocurrency was subsequently listed on other major exchanges including Binance, OKEx and Huobi.

The cryptocurrency is currently valued at US$339, according to CoinMarketCap, up by 132% after it crashed from a high of $737 to US$146 on May 10.

Although the ICP token may have launched only recently, catching much of the crypto world by surprise, the project has actually been in development for the past five years, led by Zurich-based not-for-profit organization Dfinity. The Internet Computer has also managed to attract some serious backing, including venture capitalists Andreessen-Horowitz and Polychain Capital.

Although ICP is causing shockwaves in the markets, the price of the token will likely become less volatile as the days progress and the market matures.

Dfinity’s blockchain platform for smart contracts promotes itself as being able to operate at internet speed. The ICP token’s underlying network uses smart contracts, and is expected to be a major new competitor to the Ethereum network — adding its name to the list of other potential “Ethereum killers” such as Polkadot, Binance Smart Chain, Cardano and Solana.

Wilson Withiam, an analyst at cryptocurrency research firm Messari, said: “A lot of people are looking for the next, best thing — what is the newest, shiniest token on the market. It seems absurd for a network that’s just launched. But on the other hand, it’s a high-profile project.”

The Internet Computer is a group of technologies designed to support next-generation decentralized apps and services currently under development in the blockchain space.

Dfinity founder Williams describes the Internet Computer as a single platform for Web 3.0 and a natural extension of the internet, hosting a complete set of technologies that could duplicate what Ethereum and others were doing. He said Web 3.0 could rival technology giants such as Google and Facebook.

2. Will Ethereum be the next Bitcoin?

By the numbers: Ethereum — over 5,000% increase in Google search volume.

Ethereum has breached US$4,300 for the first time ever, and is trading at US$4,310 as of publishing time. Ethereum’s rise is eroding Bitcoin’s market dominance, now down to 42.1% as Ethereum rises toward 20%. The total market cap of cryptocurrencies is US$2.5 trillion.

- US investment manager VanEck kicked off the Ethereum exchange-traded fund (ETF) race in the U.S. by filing an application with the Securities and Exchange Commission, which is currently considering an application by VanEck for a Bitcoin ETF.

- Former HSBC executive and FTX’s new head of institutional sales Jonathan Cheesman asked on Twitter: “Ok seriously who’s buying all the ETH?”

- Real Vision’s Raoul Pal replied: “Not sure but every single investor I have spoken to is shifting allocation to ETH over BTC. All our mutual friends and that billionaire finance circle…”

Forkast.Insights | What does it mean?

Although the performance of Bitcoin has been the major driving force for professional and institutional investment in the cryptocurrency space, there is now an undeniable growing demand for Ethereum.

Bitcoin first passed a market capitalization of US$1 trillion on February 19, 2021 — at the time Ethereum had a market capitalization of around US$220 billion, roughly a quarter of the value of BTC. At the time of writing, Bitcoin still has a market cap of around US$1 trillion, while Ethereum’s market cap has surged to just shy of US$500 billion, roughly half that of Bitcoin’s.

Bitcoin is the pioneer cryptocurrency that began the blockchain movement. It’s the best-known crypto, and has birthed more mainstream derivatives products. But despite being recognized as the best-performing asset of the past decade, Bitcoin also appears to be losing its market dominance as many are recognizing the potential of Ethereum over the long term, which may yet knock Bitcoin off its perch.

Ethereum has been on a tear since breaking through the US$3,000 level on May 3, its price hitting a new all-time high of US$4,346 just over a week later on May 12. Multiple factors are driving Ethereum’s price rise, from institutional adoption to decentralized finance and non-fungible tokens.

Ethereum’s surge also comes amid increasing institutional adoption of the cryptocurrency. “Another evidence [sic] that U.S. (institutional) investors are buying $ETH at @Coinbase. $ETH Coinbase premium has been significantly increased since early 2021,” tweeted Ki Young Ju, CEO of crypto data firm CryptoQuant. “New money is flowing into the crypto market.”

Last week, VanEck submitted an application to launch the VanEck Ethereum Trust, an ETF tracking Ether’s price performance, according to an SEC filing. If approved, it would be the first Ethereum ETF in the U.S. Three Ethereum ETFs are already in operation in Canada and available on the Toronto Stock Exchange (TSX).

Bitcoin has been rising largely due to its recognition as a scarce asset with a limited supply of 21 million tokens. Ethereum theoretically has an unlimited supply, which has led to it being ignored as a store of value, but another factor that could be driving interest in Ethereum is the impending implementation of Ethereum Improvement Proposal (EIP) 1559.

The EIP, first proposed by Ethereum co-founder Vitalik Buterin in 2018, aims to introduce a base fee to Ethereum transactions. Most importantly, it will add a deflationary mechanism to the economics of Ethereum, as well as scarcity, which may signal Ether’s transition to a recognized store of value, similar to Bitcoin.

3. Goldman Sachs breaks the ice on Bitcoin trades

By the numbers: Goldman Sachs — 4,900% increase in Google search volume.

Goldman Sachs has launched a cryptocurrency trading desk, according to an internal memo that was first obtained and reported by CNBC. The copy of the memo shared by CNBC confirms that Goldman has already executed BTC non-deliverable forwards and CME BTC future trades. CNBC says the bank is “not in a position to trade bitcoin, or any cryptocurrency (including Ethereum) on a physical basis.”

- But another Wall Street heavyweight, JPMorgan Chase CEO Jamie Dimon, reaffirms that he is not a crypto fan. “I don’t care about Bitcoin. I have no interest in it,” Dimon said during The Wall Street Journal CEO Council Summit last week.

- It was reported last month that JPMorgan is preparing to launch a Bitcoin fund this summer. Dimon went on to praise blockchain technology.

Forkast.Insights | What does it mean?

Bitcoin is well and truly entering the world of mainstream finance, with several major banks making announcements that are set to rock the cryptocurrency sphere. Following the news last week of S&P Dow Jones launching a Bitcoin index, Goldman is now wading deeper into the $1 trillion Bitcoin market, offering investors access to NDFs, a derivative tied to Bitcoin’s price that settles in cash. Both offerings provide Wall Street with a way to put major capital into Bitcoin.

Goldman is not alone, with JPMorgan already announcing a Bitcoin fund for the summer, and Citibank is rumored to be the next in line. Other lenders, including BNY Mellon and Deutsche Bank, have also entered the crypto space.

The truth is that while banks have been critical of Bitcoin for most of the past decade, there is evidence that they have been preparing for cryptocurrency’s mainstream adoption for some time.

A Citibank note authored by Managing Director Thomas Fitzpatrick, addressed to institutional clients but leaked to social media last November, when Bitcoin was trading at around US$18,000, predicted that BTC prices would soar to around US$300,000 by the end of 2021.

Even Dimon’s negative take on the world’s largest cryptocurrency can’t stop his own bank’s increasing appetite for it, with institutional clients demanding Bitcoin exposure from banks.

But amid rising popularity and exploding institutional interest, Bitcoin’s transaction fees are soaring. And with institutions becoming Bitcoin holders, the crypto’s narrative continues to shift. Once derided as a scam, a ponzi scheme, drug dealer’s money and or a joke, Bitcoin — which started out as a putative “people’s currency” — is quickly evolving to become a financial instrument for institutional investors.

4. Dogecoin to the moon… literally

By the numbers: Dogecoin — over 5,000% increase in Google search volume.

Dogecoin tanked from an all-time high of 73 cents during Elon Musk’s “Saturday Night Live” appearance. But Doge didn’t stay down for too long, as Musk’s SpaceX announced a new satellite mission for the first quarter of next year — Doge-1 Mission to the Moon. The new mission will be funded with Dogecoin. Doge is now trading at US$0.49 as of publishing time.

- Dogecoin dropped to about 43 cents following a skit on the show in which Musk compared the meme cryptocurrency to the U.S. dollar and called it a “hustle.”

- But a copycat meme coin — the Shiba Inu — suddenly shot up by more than 1,000%. Here’s what happened.

- On May 7, U.N. Special Envoy Hiro Mizuno tweeted: “Fine if investors want to trade Shiba coins for short term. But don’t even think of doing the same with Shiba dogs. Once you adopt, you must keep them well though their lives. They are lovely creatures and friends of human.”

- Musk replied: “I’m looking for a shiba pup!”

- The Twitter exchange sparked a rally of more than 1,000% in Shiba Inu.

- SHIB’s price surge extended through the weekend, allowing the ERC-20 token to steal Dogecoin’s thunder. Shiba Inu is now the 20th largest cryptocurrency by market capitalization, ahead of the likes of TRON and Filecoin.

Forkast.Insights | What does it mean?

Just moments before last week’s episode of “Saturday Night Live” aired, Dogecoin was hovering at around 69 cents, but as Musk took to the stage as host, the price of Doge began to plummet, crashing to a loss of more than 30% by Sunday.

Although Musk made some truly terrible Doge-centric jokes throughout the evening, did the Dogefather’s attempt at comedy really cause the meme crypto to crash? Of course not. The truth is that Dogecoin holders never stood a chance of reaching the desired US$1 on the night, and Digital Currency Group CEO Barry Silbert appeared to have seen that coming.

“Okay $DOGE peeps, it’s been fun. Welcome to crypto!” Silbert wrote onTwitter, “But the time has come for you to convert your DOGE to BTC [disclosure: we’ve gone short DOGE via https://ftx.com/trade/DOGEBEAR2021/USD…]”

Around five minutes into Musk’s appearance on the show, a Dogecoin whale started dumping around US$1.9 billion of the currency, and panic selling soon followed.

While Silbert had taken a short position on everyone’s favorite “joke” coin with FTX trade, it is not known whether he had any knowledge of the impending sell-off by the whale. However, an investor may take a short position when there is anticipation that the value of a stock will fall in the short term.

But the episode raises the question of how a U.S. firm was able to go short on Dogecoin leveraging FTX, as the exchange is off limits to U.S. clients.

The news of Silbert’s short was not taken well by the Dogecoin faithful, who accused the CEO — whose company owns Grayscale Investments and Coindesk — of trying to stick it to ordinary investors and make the rich elite richer. The news of the short also sparked a bit of a social media war by the “Doge army” against BTC in Silbert’s thread.

However, the events of last weekend should be a cautionary tale for those investing in low market cap coins with no real utility based on memes. Although these types of meme-cryptocurrencies continue to pop up, with new additions practically daily, such as “Tiger King’s” Carole Baskins’ $CAT token or the Doge-inspired Shiba Inu coin — which is now the 20th most popular crypto and at one point had a higher market cap than DeFi darling Solana — the market may need to take a step back and assess what is really driving the prices of these coins.

While Bitcoin may be an asset many of us may one day pass on to our grandchildren, just like the family gold, Dogecoin is an entirely different proposition.

“Dogecoin and its price movements are captivating the community, both the kind of the old guard community and, you know, newbies coming into the space,” Ben Caselin, head of research and strategy at AAX, told Forkast.News.

Caselin said it was very clear the Dogecoin pump had nothing to do with sound money qualities, because the main narrative heard online is about how it “started as a joke” and it’s “so funny that it’s growing.”

And the joke is no secret. Galaxy Digital, a financial services firm dedicated to digital assets, has released research on the meme-cryptocurrency entitled “Dogecoin: The Most Honest Sh*tcoin.”

“This is a community-driven token,” Caselin said. “It’s an anti-establishment token in a kind of double sense of the word ‘anti-establishment’ against fiat, anti-establishment against kind of the wider crypto narrative, which is about a store of value, et cetera. I think we can have a conversation about Doge price appreciation, but not in the same way that we would talk about, let’s say, a Bitcoin price appreciation.”

Perhaps one day, Dogecoin could continue what Bitcoin started — the democratization of capital. But for now, Bitcoin is favored by banks all around the world, entering institutional markets and custodians, while Dogecoin continues to be pumped and dumped at will for its largest shareholders.

5. China links digital yuan to biometric data collection

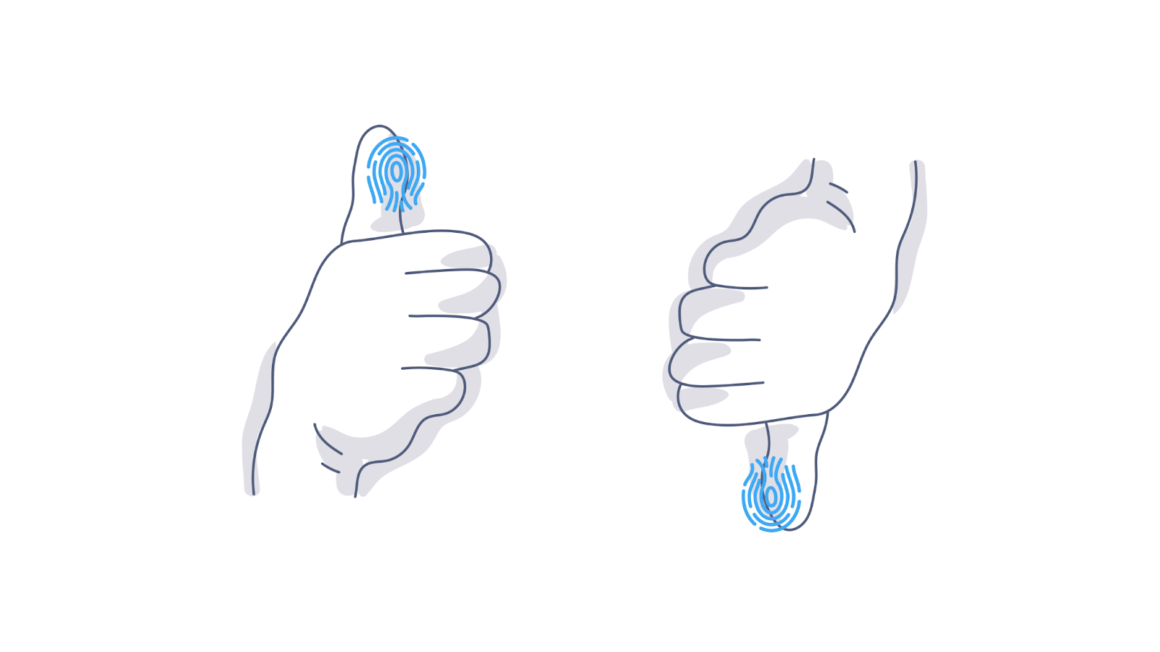

China takes another stride forward in developing its digital currency this week. A new smart card-like digital yuan wallet will be equipped with fingerprint authentication technology. Alipay, one of China’s biggest mobile payment platforms, will also allow its users to set up digital yuan wallet accounts.

- IDEX Biometrics, a Nasdaq- and Oslo-listed biotech company, will cooperate alongside Chutian Drago, a Chinese smart card manufacturer, on the new e-CNY wallet. According to a press release from IDEX Biometrics. Installing fingerprint authentication on card-like digital yuan wallets will help to protect the stored value of digital currency, said IDEX Biometrics CEO Vince Graziani.

- Following moves by China’s six major commercial banks, Alipay started accepting applications from individuals to open e-CNY payment wallets in the Alipay app. Alipay, one of the country’s leading online payment products, owned by e-retailing giant Alibaba, is the first online payment service provider to test e-CNY payment functions, according to Shanghai Securities News, a newspaper run by state news agency Xinhua. Experts said it would further expand the digital yuan’s application to online and mobile payments.

Forkast.Insights | What does it mean?

As China continues expanding the testing of its DCEP project’s digital yuan, there is a new twist, and one not everyone might be comfortable with: the new card-like DCEP wallet will come equipped with biometric fingerprint authentication technology. IDEX Biometrics and Chutian Dragon — a Chinese smart card manufacturer — will cooperate to work on this new DCEP wallet.

According to IDEX Biometrics and Chutian Dragon, “Fingerprint biometrics are an enabling feature for the card-based form factor of the ‘digital yuan,’ assuring ease of use for safe and secure consumer transactions.” However, this new development will also likely increase privacy concerns for those who have already raised eyebrows at the idea of a central bank-backed digital currency.

Although many will see China’s inclusion of biometrics in its DCEP wallet design as an extension of the surveillance state, similar types of security are being considered by even the most liberal countries, such as Canada.

Biometric technology is a very powerful means of identification and personal verification. Modern authentication methods such as fingerprints and face recognition can easily satisfy the desire for both convenience and security, particularly when they transact online. In comparison to verification methods that use personal identification numbers and passwords, biometric technologies offer many advantages, such as never having to worry about forgetting your password.

It is very useful, particularly for governments, businesses and banks, for protecting sensitive data and quickly confirming a user’s identity. It will come in handy as China continues to build infrastructure for mass digital payments, which could benefit millions of unbanked and underbanked citizens, and the nearly 45% of the Chinese population that does not even have access to a smartphone.