As the 2020 U.S. presidential election comes to a close today, a new way of forecasting voting results is being put to the test: the cryptocurrency betting market.

While both the traditional polls and cryptocurrency betting markets are predicting a Biden win, of interest to observers has been how in the last days of the campaign betting markets have given Trump a much better shake at retaining the White House — while traditional polls have maintained a comfortable lead for Biden.

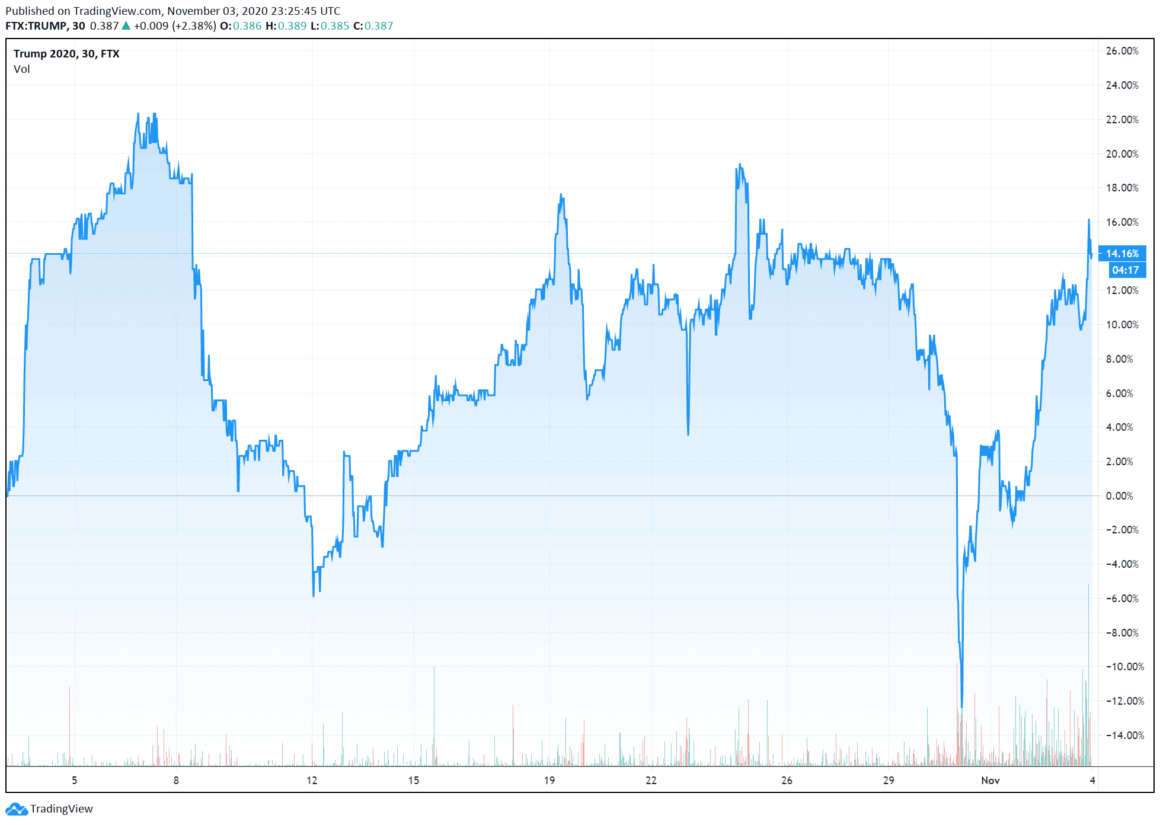

Per poll aggregator FiveThirtyEight, Biden has maintained a 9-10% lead over Trump during the last leg of the campaign. However, on FTX, intense trading by those on the long and short side of the bet pushed the value of the president’s eponymous token up 14%.

During the last election, Trump’s polling — which initially lagged behind Clinton’s — crept slowly upwards creating a pathway for victory. Pollsters promised to do better next time around.

As FTX allows leveraged positions on either side of the Trump token, the cryptocurrency exchange took notice and this past weekend increased the margin requirement for those who held a long position on the token — meaning, they believe Trump will lose the election and the token’s value will be at $0, as opposed to $1 if Trump wins. Traders would be required to increase the collateral in their accounts to maintain that position, as FTX predicted the token’s price to increase. For those with a long position, a rapid increase in price would trigger a margin call and liquidate their holdings. A mass liquidation would have ill effects for other markets on the platform, as traders cross-leverage tokens.

Over on Augur, the exchange noted that the election had garnered $5 million in volume with approximately $3.6 million in open interest. In the last twenty-four hours, traders had added one million in volume.

Augur’s #Election2020 markets have passed $5M+ in volume and $3.6M+ open interest with over $1M+ in 24 hour volume 🚀

— Augur (@AugurProject) November 3, 2020

With only ~24 hours left, who are you betting on? pic.twitter.com/J3fsUoZnCX

Polls vs. markets: why is there a difference?

While pollsters take great pains to survey a randomized, statistically significant segment of the population, cryptocurrency election betting markets are anything but.

In a tweet, Ethereum co-founder Vitalik Buterin fielded two theories. First, he believes that markets price in the uncertainty over the outcome of the election: meddling, voter suppression or even Florida-style recounts can add uncertainty into the electoral process. Secondly, whales with a political axe to grind can jump in and influence the markets with big bets.

2. Prediction markets are difficult to access for statistical/politics experts, they’re too small for hedge funds to hire those experts, and the people (esp wealthy people) with the most access to PMs are more optimistic about Trump

— vitalik.eth (@VitalikButerin) November 3, 2020

(This is the pro-stats-model explanation)

Sam Bankman-Fried, the founder of FTX, speculated that the usual pollster models were undercounting the Trump vote and not accounting for the enthusiasm of his supporters.

9) Prediction markets are running _way_ above models.

— SBF (@SBF_Alameda) November 3, 2020

There are basically three theories here:

a) models don’t understand how volatile the race is, or are missing Trump voters’ enthusiasm

b) people are buying way too much Trump on prediction markets

c) contested elections

But who will be right?

Criticisms of pollsters is nothing new and is a common refrain when there’s an electoral upset. The most famous example, aside from Trump’s victory in 2016, is the Brexit vote of 2015. A so-called “shy” voting bloc, unseen by pollsters, turned out to vote and things didn’t go exactly as planned.

“Pollsters deserve praise for their efforts to address the methodological challenges they face, but it remains an open question whether these and other concerns about traditional surveys can be overcome, and whether new techniques or improved old ones can address the problems that have been identified,” wrote Karlyn Bowman of the American Enterprise Institute in National Affairs in 2018.

One of the issues Bowman identified was a low response rate in polls, which can be as low as 9% — which could creates a methodological bias of underrepresenting certain groups, according to Pew Research Center, a non-partisan think tank.

Pew, for its part, says “that the bias introduced into survey data by current levels of participation is limited in scope.” But there are so many pollsters that don’t have the resources of Pew. Would they have the ability to, in the face of declining participation, keep the effort going to ensure a statistically significant, diverse cross-section of society is examined?

Which touches on a similar theme to the criticisms of prediction markets: too few people participating. But tonight will tell which people are a better cross section of the political will of American society.