In this issue

- Bitcoin crests higher in bull run

- Ethereum 2.0 gearing up for December launch

- FTX lets TRUMP crypto losers hold out hope

- What U.S. election outcome means for crypto

- Hong Kong to ban retail cryptocurrency trading

- Funding spotlight: B2B fintech in Hong Kong

From the Editor’s Desk

Dear Reader,

What does a bumpy transition of power and bitcoin prices have in common? You.

As the power dynamic changes in politics in America, so too does the appetite for alternative stores of value.

In this week’s Current Forkast, we note a possible alternative store of information (pay attention, pollsters) at play as traders around the world headed onto cryptocurrency derivatives exchange FTX to bet on the outcome of the U.S. election. As most traditional polling repeated the sins of 2016, and once again, missed the mark in some key battleground states — we should consider less conventional means of establishing direction of a political race. FTX became a platform where this became real for a lot of people. And now, as Trump creates doubt in the political transition post-election with accusations of voter fraud, FTX says that traders can hold their position for free until Feb. 1, 2021. But the fine print equally demands clarity for the American electorate, stating: “if, by then, Trump has been unambiguously reelected to the presidency, they will pay out $1. FTX reserves the right to interpret the settlement criteria here.”

This makes sense. Even in the cryptocurrency derivatives market, there are rules. It is unambiguous. Even if there are loud cries and complaints, the rules are the rules.

Just like democracy.

Until the next time,

Angie Lau

Founder and Editor-in-Chief

1. Bitcoin riding high again

By the numbers: Bitcoin — over 5,000% increase in Google search volume.

Bitcoin has been extending its bull run past US$15,000, even after the U.S. Department of Justice seized over US$1 billion worth of bitcoin, bitcoin gold, bitcoin satoshi vision and bitcoin cash related to Silk Road, the online black market. An individual whom the DOJ is calling “Individual X” is believed to have hacked and stolen the cryptocurrencies from Silk Road and moved them to a separate wallet in April 2013: 1HQ3Go3ggs8pFnXuHVHRytPCq5fGG8Hbhx (1HQ3).

- In April 2015, the address (IHQ3) sent 101 bitcoin to BTC-e, an unlicensed cryptocurrency exchange that was indicted in January 2017. Remaining funds stayed in IHQ3 from April 2015 to November 2020.

- Court documents state that the government is aware of Individual X’s identity and the person has signed a Consent and Agreement to Forfeiture.

Forkast.Insights | What does it mean?

The world in 2020 is a very different place from what it was like in 2013, and the same goes for bitcoin.

Back then, we were still trying to figure out what exactly bitcoin was going to be useful for. At the time, there was a major attempt to push bitcoin as a payment processor for tech-savvy retailers. Investor money was interested: one payment processor — BitPay — hit 10,000 retailers and crossed the $30 million mark in transaction volume. But while bitcoin as a currency for payment caught some interest, BitPay’s initial success wasn’t anything close to the volume that Silk Road was doing.

As Forkast.News senior editor Sam Reynolds wrote back in 2013, bitcoin was Silk Road: data showed that nearly 80% of all bitcoin transactions were related to the exchange. Naturally, after U.S. authorities shut down Silk Road, the price of bitcoin went into freefall, as the without the biggest retail use case for bitcoin, it suddenly became a whole lot less liquid.”Bitcoin evangelists struggle to convince regulators that there is a lawful economy for the digital crypto-currency, but figures such as this tend to sully their argument: Silk Road was the Bitcoin economy,” Reynolds wrote at the time.

But that was 2013. Since then, the world has shifted its opinion on what bitcoin is useful for, and it’s not retailers. Coinbase Commerce, now the biggest payment processor for cryptocurrency, only processes $100 million a year. For the sake of comparison, in November 2013 bitcoin had a roughly $2.4 billion market cap. Fast forward to today, and that figure is closer to $285 billion.

Bitcoin is now an institutional-grade alternative asset class. It’s not something with a primary use case of buying and selling drugs anymore. This time, when Silk Road, bitcoin, and the U.S. Department of Justice are brought up in the same sentence, it’s not going to signal the beginning of another bitcoin bear market. Times have changed.

2. Ethereum 2.0 gets ready for prime time

By the numbers: Ethereum — 2,250% increase in Google search volume.

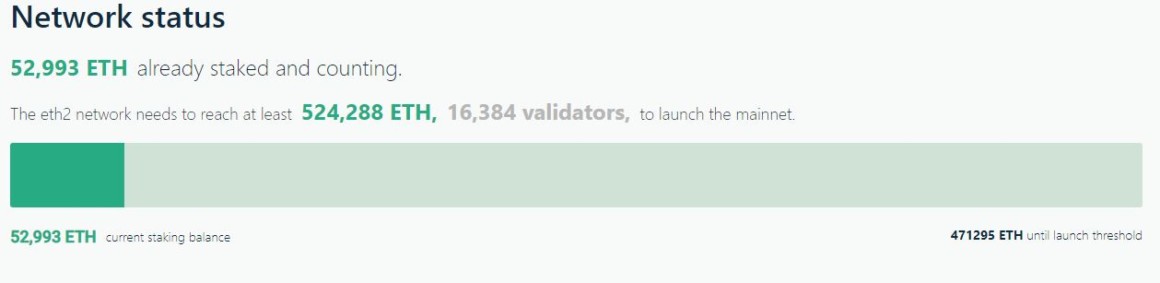

Ethereum 2.0 deposit contract goes live, and the launch date for phase 0 of Ethereum 2.0 has been set to December 1, 2020 — but only if 16,384 validators make at least 32-ETH deposits each, seven days prior to the launch date. If this threshold is not met, the genesis — or the first block mined for the new blockchain — will occur seven days after the goal has been met.

- Ethereum co-founder Vitalik Buterin has vouched 3,200 ETH for ETH 2 staking, which is roughly around US$1.5 million.

- The ETH 2 deposit contract currently holds 52,993 ether and needs to reach 524,288 ether before the December 1 launch date.

Forkast.Insights | What does it mean?

The launch of Ethereum 2.0 is going to do a lot to re-establish the protocol’s dominance as the world’s computer. But hopefully it’s not too little, too late.

Transitioning away from the current proof-of-work (PoW) system to proof-of-stake (PoS) will dramatically expand Etherum’s ability to handle scale. As we saw with the DeFi craze of the summer, Ethereum can quickly become congested to the point where it’s not really useful for much else. Hence, the latest upstart industry of new blockchains, like Solana, built with PoS in mind and ready to handle the scale.

But Ethereum 2.0 isn’t without its critics, who have lobbed its way a considerable amount of criticism — particularly about the migration of assets and decentralized apps (dApps) to the new platform. Transitioning to the new platform will involve staking assets from 1.0 to receive the equivalent on 2.0. But the problem that has been identified involves a massive run on the price of Ethereum 1.0 while the assets are staked on 2.0. If the staking-and-transition process takes too long, a form of market convexity might occur where the value of the asset on Ethereum 1.0 declines while locked in place via the stake on 2.0.

DApps will need to be re-written for Ethereum 2.0 given the shift to PoS, and the team has confirmed that there’s not a push for backwards compatibility. Although many dApps will take the effort to make the migration, there might be a chance for other blockchains to entice popular dApps over to their platforms — especially if the transition is chaotic.

December 1 is less than three weeks away, and there’s a long way to go before the threshold for network launch is met. Granted, whales could easily jump in and fill up these virtual coffers without much thought. But at the same time one has to wonder if lack of community satisfaction with the way things are going is giving people pause and hesitation to commit.

3. FTX gives free hope to TRUMP futures losers

By the numbers: FTX — 2,350% increase in Google search volume.

Cryptocurrency derivatives exchange FTX is allowing traders who bet on Donald Trump to win the 2020 U.S. Presidential Election to hold onto their bets until Feb. 1 next year, and if Trump returns to the White House, FTX will pay out US$1. It was previously reported that FTX CEO Sam Bankman-Fried donated $5.2 million to Joe Biden’s campaign.

- @FTX_Official: “Some users have complained about us following the rules, and instead want us to modify the rules to favor their preferred candidate. We have done so repeatedly, giving more and more options to those long TRUMP contracts.”

- @FTX_Official: “For instance, allowing people, in the event that TRUMP lost, to pay $0.10 to keep their contracts beyond expiration and win if TRUMP is president in February. However, some users are still refusing to accept the consequences of their decisions and the rules of the contracts.”

- @FTX_Official: “As such, we have decided, just this once, to allow TRUMP and TRUMPWIN to be held for free until February 1st, 2021. If, by then, Trump has been unambiguously reelected to the presidency, they will pay out $1. FTX reserves the right to interpret the settlement criteria here.”

Forkast.Insights | What does it mean?

Betting on politics is nothing new. The U.K’s biggest bookie, Betfair has been taking bets on big political races for quite some time now. But Betfair structures its offerings in ways only gamblers would be familiar with; a novice might not be familiar with odds structured in a way that places a candidate’s chances of winning in a moneyline or decimal format. What percentage does “1.69” mean? Predictit invented the futures market, expressing odds as a dollar figure. But the high fees have turned off many.

FTX seems to have perfected what Predictit started, with its low-fee, easy-to-understand structure. And the market seems to love it. In the hours after the White House announced Trump had been diagnosed with Covid-19, $2 million in volume traded hands. Similarly, on election evening when Trump won a number of key states and it looked like he had a pathway to victory, the token’s value took off like a rocket, getting close to 80 cents before plummeting back to earth when traditionally Republican states flipped blue.

This is real-time polling at its finest, and a great counterweight to pollsters who have been accused of undercounting the Trump vote. In the weeks before the election, The Economist gave Trump a 3% chance of winning. FiveThirtyEight put the odds in for Trump at 10%. There has never quite been a president quite like Donald Trump, and as FTX CEO Sam Bankman-Fried pointed out, the pollster models just aren’t doing enough to capture the enthusiasm of Trump’s supporters or his administration’s mad dog approach to politics.

Granted, crypto is a male-dominated industry. And markets like FTX open the gates to anyone around the world, not just Americans. The over-represented gamification of the process would encourage whales to treat the market just like traditional investment contracts by making big bold bets based on technical signals. For instance, the market treating Trump-winning states that are traditionally Republican amplified the token’s rally, while early indications of close races in swing states sent it to nearly the 80-cents market in anticipation of those states flipping and the pathway to another term at the White House solidifying. So it was very possible to be placing strategic bets on Trump throughout the evening and come out significantly ahead despite the contract not closing at $1.

Both election prediction markets and traditional polling have their flaws. But as pollsters continue to undercount potential votes and not accurately reflect a nation’s electoral mood, other methods of election forecasting need to be considered — and here’s one way to possibly win some money while doing it.

4. What does Biden’s victory mean for crypto?

By the numbers: Election 2020 — over 5,000% increase in Google search volume.

In the aftermath of a messy election that may yet head to the courts, all signs are pointing to a Joe Biden victory. In response, President Trump filed numerous lawsuits in Pennsylvania, Nevada, Georgia and Michigan.

- As U.S. media outlets called the election and announced Biden as the U.S. president-elect, bitcoin prices dropped to below US$15,000, but quickly recovered above this margin and is currently trading above US$15,400.

- Biden became the first president in history to have his election victory logged on the blockchain as the Associated Press recorded it on the EOS and Ethereum blockchains.

- Vice President-Elect Kamala Harris’s scheduling and advance director, Ryan Montoya, is the former chief technology officer of the National Basketball Association’s Sacramento Kings. The team is known for its blockchain-friendly campaigns and is also the first sports team to mine cryptocurrencies.

Forkast.Insights | What does it mean?

While the U.S. elections might have ended in chaos, it wasn’t the worst possible outcome expected by some. There were celebrations and protests in the streets, but no significant violence. American life mostly continued the next day as usual.

The price of bitcoin is up about 14% since election day, and will likely continue to rise. Why? There are not really any huge regulatory concerns at the moment. The momentum that is making bitcoin an institutional-grade asset within the United States, namely the Token Taxonomy Act and the Securities Clarity Act have bipartisan support and are unlikely to be on the chopping block. Likewise, the cryptocurrency-friendly regulators that were appointed under Trump — Heath Tarbert at Commodity Futures Trading Commission, Brian Brooks at Office of the Comptroller of the Currency, and Hester Peirce at the Securities and Exchange Commission — aren’t likely going anywhere very soon given that cryptocurrency likely would not be an immediate priority under a Biden administration.

In addition, an aggressive stimulus bill under a Democrat-led government could push bitcoin prices even higher. Unprecedented debt and deficit levels are already pushing down the USD compared to other major world currencies as investors grow concerned about the U.S. Federal Reserve’s ability to service the country’s debt. But, at the same time, news about promising new Covid vaccines might push capital back into equities that were hammered hard during the pandemic, such as airlines and hotels, or commodities like oil.

5. Hong Kong requires crypto trading to be regulated

Hong Kong’s Securities and Futures Commission (SFC) will require all cryptocurrency trading platforms to be regulated, according to Ashley Alder, the SFC’s chief executive.

- The SFC will introduce a new licensing scheme under the anti-money laundering (AML) ordinance for platforms that trade any type of cryptocurrency asset even if not classified as securities in Hong Kong or target investors in Hong Kong, Alder said in a speech during Hong Kong FinTech Week.

- It will be a replacement of the licensing scheme published last year, which allowed cryptocurrency to “opt in.”

Forkast.Insights | What does it mean?

For the Hong Kong SFC, this is quite a different direction than the direction taken by their regulatory peers at the U.S. Securities and Exchange Commission. Hester Peirce, one of the SEC’s commissioners, told Forkast.News in a recent interview that the commission needs to do some “soul searching” on the Howey Test — which defines what is and is not a security.

Peirce has also proposed an expanded three-year safe harbor that would allow projects time to determine if they were or were not a security. This would give projects some breathing room and more leeway to perfect their decentralization.

In contrast, the Hong Kong SFC appears to be casting a wide net and is looking to classify more things as securities, despite some of them only having some of the characteristics of a security. This may have the consequence of pushing projects into markets with more permissive jurisdictions.

When Warren Davidson, a U.S. congressman from Ohio, was drafting the Token Taxonomy Act, he cited the need to move jurisdiction for token products away from the SEC to other regulatory jurisdictions like the Commodity Futures Trading Commission — which would better reflect the reality of the product. Furthermore, in parallel, the Securities Clarity Act is also creating a new definition of securities laws to specifically exclude cryptocurrency tokens from what is defined as a security.

In the eyes of U.S. lawmakers, without these bills, the industry would just leave the U.S. and hunt for flags of convenience. If investors in these projects were burnt, they would need to litigate the case in Seychelles or some other far-flung jurisdiction. With these bills, lawmakers have provided a pathway for these projects to come back to the U.S.

Hong Kong is doing the opposite. The reality is, not a whole lot will likely change. While institutional-grade exchanges may now consider the territory as a better place to set up shop, retail investors will likely not be deterred by the ban as they can continue their personal crypto business as usual by using VPNs.

6. Funding spotlight: B2B fintech in Hong Kong

Statrys — Hong Kong, angel, US$5 million

Fintech startup Statrys, based in Hong Kong’s Wanchai district, announced a US$5 million funding round from an unnamed “angel investor in the region. Statrys is a B2B fintech firm that integrates existing payment platforms and forex trading to further the “ease of setting up a business account.” In a statement, the company stated that the funds would go toward advancing intermediate payment technologies, including integration with “local currency accounts and payment cards.” Statrys also mentioned further expansion into the ASEAN region, including Singapore and Thailand. The company’s founder, Bertrand Theaud, is a partner at BLF, a law firm in China’s Southeast region with offices in Shanghai and Guangdong.

Forkast.Insights | What does it mean?

We’ve seen over the last few months continued investor interest in breaking down the friction costs of overseas remittances. This can come in many forms, from providing APIs (application programming interfaces) that allow for better integration with SWIFT competitor Ripple, to providing faster payment rails for interbank transfers with RootAnt, or with challenger banks that make their money in other ways.

Traditional big finance is going to need to shape up and get ready to fight its way through the next decade. Investors are going for lean startups like Statrys that have the ability to hit pain points that have customers begging for relief and options. Given the growth of the challenger bank sector, this is going to be a battle for our times.