Three-quarters of all stablecoins are now issued on the Ethereum blockchain, compared to only half of stablecoins a year ago. The collective value of stablecoin transactions on Ethereum now also greatly exceeds that of ether (ETH), the blockchain’s native cryptocurrency, according to an Ethereum DeFi report released today by ConsenSys.

Ethereum and what happens on the popular platform is of immense interest to the blockchain and cryptocurrency world because the vast majority of DeFi protocols and stablecoins now operate on Ethereum. ConsenSys is a blockchain software developer for Ethereum.

Two of the biggest cryptocurrency trends of 2020 were the rise in decentralized finance (DeFi) and the growth of stablecoins. The market cap for decentralized finance (DeFi) now exceeds US$45 billion, and the total value locked in DeFi protocols has surpassed US$25.5 billion.

Swift rise of stablecoins

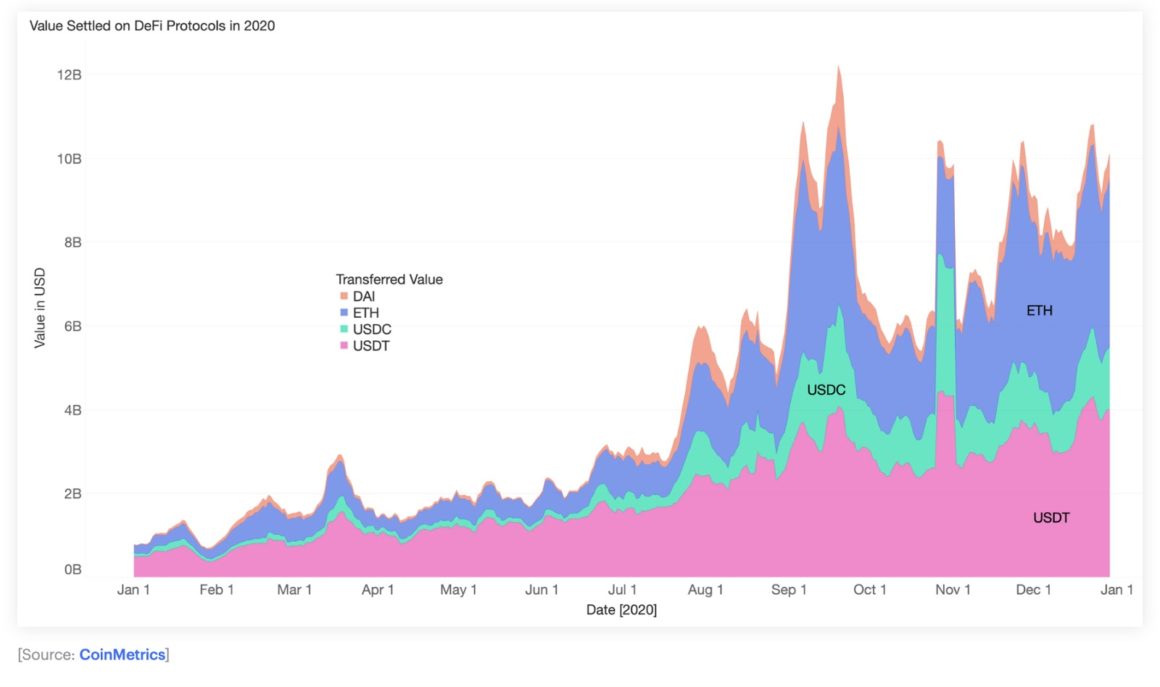

According to the ConsenSys report, over US$1 trillion in stablecoins were transacted on Ethereum last year. Tether, the most popular stablecoin, alone settled US$580 billion on Ethereum in 2020 while ETH’s transaction volume was US$385 billion.

As of Jan. 1 this year, 74% of all stablecoins were issued on Ethereum and worth about US$20 billion, according to the report. And the stablecoin population has evolved from formerly being mostly fiat-backed (e.g. USDC, USDT) to many “new flavors” such as crypto-collateralized (e.g. USDT), interest-bearing (e.g. cUSDC, aUSDC, aUSDT), synthetic (e.g. sUSD), and algorithmic (e.g. AMPL, yUSDC).

The report notes that as stablecoins gain prominence, they’ve also drawn increased government scrutiny — recently in the form of the controversial STABLE Act. DeFi has also become the topic of regulatory discussions.

SEC Commissioner and “Crypto Mom” Hester Peirce told Forkast.News in an interview that regulating DeFi would be a challenge “because most of the way we regulate is through intermediaries — and when you really build something that’s decentralized, there’s no intermediary.”

Regulators could help provide clarity, Peirce said. “It’s important for us to provide some help there for people trying to understand, ‘How does DeFi interact with the securities laws?’”

Demand for DeFi liquidity

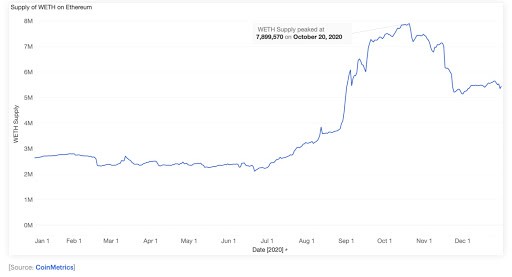

Other key trends from 2020 include the increased demand for DeFi liquidity. Decentralized exchanges (DEXes) like Uniswap surged in popularity in the middle of 2020, leading to new inflows of value tokenized on Ethereum — from the wrapped tokens (such as Wrapped Ethereum, Wrapped Bitcoin) and decentralized storage network Filecoin, to increased demand from institutions and other blockchain-based protocols. The report predicts that the momentum will continue, and more protocols will launch wrapped versions of their tokens on Ethereum in 2021.

But regulatory and technical challenges remain, and new types of standards, such as ConsenSys’ proposed Universal Token for Assets and Payments, could be a way to bring traditional finance to decentralized finance, says the report.

Fabian Vogelsteller, founder and chief blockchain architect at LUKSO and former Ethereum developer said in an earlier interview with Forkast.News:”it’s all about standards [such as ERC-20 and ERC-725]. It’s all about defining the basic pieces.”

Growth of non-fungible token (NFT) designs and marketplaces

Within DeFi, NFT designs and marketplaces gained traction in 2020 and are poised for greater growth, according to the report. NFTs offer ownership rights for digital art, games and other virtual assets. Digital artist Mike Winklemann, also known as “Beeple” sold a collection of NFTs with a winning bid of $777,777.777.

AND THAT’S ALL SHE WROTE!!! The auction ends on a ridiculous last second bid of $777,777. This brings total PRIMARY MARKET sales from @beeple‘s collection to over $3,500,000+

— Nifty Gateway (@niftygateway) December 13, 2020

CONGRATULATIONS TO THE LEGEND BEEPLE and thank you to the entire community!!! https://t.co/pp4fm0j6iJ

Alongside the explosive potential of NFTs, NFT marketplaces have flourished since marketplaces for collectibles like CryptoPunks and CryptoKitties came on the scene. There are now at least 27 unique digital art marketplaces on Ethereum, with SuperRare, MakersPlace, Async Art and Known Origin facilitating up to US$8 million in sales since they launched, according to the report.

Community-based social tokens are also catching on as artists and creators try new ways of connecting with their fans and monetize online given the on-going Covid pandemic. Celebrities like Lil Yachty, Akon and Ja Rule are launching social tokens through Roll, a platform which allows users to instantly send social money or “fancoins” to another user on the network. The estimated size of the social token market is US$81.2 million, according to the report.

DeFi’s vulnerabilities

DeFi holds much potential, but the report points out that the risks of smart contract security are real, as evident from hacks and exploits.

Several DeFi protocols were victims of flash loan-based exploits in Q4 2020. Harvest Finance lost US$34 million, Cheese Bank lost US$3.3 million, Akropolis suffered a US$2 million loss and Value DeFi lost US$6 million, according to the report.

See related article: Is DeFi a $10 billion Ponzi scheme?

“As long as there is value on the internet, there are going to be people intent on trying to take it. But in other cases, it is a truly novel invention, such as Aave’s ‘flash loan’ or the ‘flash swap’ by Uniswap, that have enabled arbitrage schemes at a scale and speed not previously imagined,” the report stated.

DeFi trends to watch in 2021

New tranche lending products and Ethereum 2.0 derivatives are a trend to watch in the first quarter of 2021, according to the report. Tranche lending involves using derivatives to allow users to mitigate their exposure to interest rate or market price volatility by depositing their digital assets in pools.

Following the successful launch of the Ethereum 2.0 Beacon Chain, the network is transitioning to be cheaper and more scalable with Layer 2 technologies like rollups which reduce the burden of computation and primarily use the blockchain for its security guarantees.

But with a movement from “proof of work” to “proof of stake” protocols and Ethereum’s high gas fees, competing blockchains dubbed as “Ethereum killers” have emerged to challenge Ethereum’s dominance and first-mover advantage.

“Currently, the leader here is Ethereum with ETH2.0. And obviously, we’re hellions on their heels nipping at them,” IOHK and Cardano founder Charles Hoskinson told Forkast.News in a recent interview.

“Polkadot or EOS or Tezos or Cardano — we’re trying to say that proof of stake is much better than proof of work. At least the Bitcoin flavor of proof of work. And ETH2.0 is the 800-pound gorilla that’s really pushing that,” added Hoskinson, who was a co-founder of Ethereum but left the company in 2014 before its public launch.

Solana, another challenger to the Ethereum blockchain, has its sights on cornering the Asian DeFi market. FTX, Hong Kong-based cryptocurrency exchange, built its decentralized exchange called Serum on the Solana blockchain. In November 2020, Serum generated US$111 million in volume, significantly less than the US$17 billion in volume on Ethereum-based DEXes in the same month, but also not negligible, the report stated.

See related article: ConsenSys’ Joe Lubin on Ethereum, DeFi and regulation in 2021

ConsenSys does not seem much concerned about competition to Ethereum for now. According to the report, “Interoperability between blockchains remains an active research space, and while we predict more more projects to consider moving to other protocols ahead of ETH 2, we think the gravity of Ethereum will push more activity to Layer 2 protocols already interoperable with Ethereum.”