In this issue

- OKEx embraces Latin American crypto market

- New Shelley code pushing Cardano to fully decentralize

- R3, IoTeX and iExec join Confidential Computing Consortium

- In China: global report on patents, and blockchain’s starring role in court case

- Investment highlights in Indonesia and Singapore

From the Editor’s Desk

Dear Reader,

We often don’t pay attention to the “system” until we are forced to experience it. The bureaucracy of administration, depending on your country or government agency, can be as streamlined or arcane as the technology provides. So as I sit here in yet another waiting room, in my second hour of KYC in a highly analog system, where stamps and chops are the norm (I’m trying to get a driver’s license)… the lack of efficiency and the wasted energy of an entire service layer between individuals and the “system” warrants mention this week.

It is why blockchain exists. To streamline and create efficiencies. As nations, especially those in Asia, have come to realize, it is the openness and the ease of doing business that allows foreign investment dollars to feel comfortable in the “system.” How easy it is to participate in a global system is as important as how streamlined it must feel for business to do its day-to-day operations in the jurisdiction of choice. To have to take a day off to do paperwork versus smart contracts and multilayer technology that allows for interoperability (where systems talk to each other, and more importantly, trust each other) — it makes one realize the value and the power of blockchain technology. In fact, right now, it makes me selfishly wish for a speedier adoption.

One day these analog-based bureaucracies will be a thing of the past. The future is making itself known. The investment that governments are making in this track will define the trajectory of their national economic growth. Sometimes it’s the little things that make the biggest difference. You can make the huge headline announcement… but if it isn’t backed up by innovations in how you execute the details, it will be a lost cause. People will always judge the system by the way it engages with them.

The system is changing — from more secure methods of authentication such as 2FA (the hackers have figured out a workaround, so this is important to the future cybersecurity of all) to China using blockchain-stamped evidence in a recent copyright infringement case. It speaks to a future in which the system is evolving to digital, and those still stuck in analog thinking will be left behind — economically and globally. The stories we cover this week on The Current Forkast are those who are defining what that future might look like. The future is coming for us all. You’re either defining it, or it will define you.

Until the next time,

Angie Lau,

Founder and Editor-in-Chief

1. OKEx launches Latin American gateway

By the numbers: OKEx — 5,000% increase in Google search volume.

OKEx is launching a Latin American fiat gateway. The leading Chinese cryptocurrency exchange announced a partnership with Latin American (LATAM) digital settlement network — called “Settlement Network” — to allow users to purchase bitcoin and ether with Argentine peso, Mexican peso and Brazilian real through its product, Latamex.

- One of OKEx’s leading rivals, Binance, has announced an almost identical partnership with Settlement Network last December to enter the LATAM market.

- The rivalry between two of the world’s biggest exchanges continues to escalate past professional boundaries. Earlier this year, OKEx CEO Jay Hao made public that he has been blocked by Binance CEO Changpeng Zhao, popularly known as CZ, on social media.

Forkast.Insights | What does it mean?

Building new payment rails for crypto, especially in secondary currencies, will enhance liquidity and push down the margins between the market price and the offered price in that respective currency. Competition between OKEx and Binance is helpful in this space to build out the payment rails and perfect the product. According to Coinhills price tracker, the deals denominated in Argentinian peso represent around 0.005% of global trade. Mexican Peso-denominated deals are at 0.03%, and Brazil Real at 0.007%.

With this low volume of trade denominated in these respective currencies comes a price premium, and given the economic crisis in Argentina along with murmurs of a possible coup in Brazil, there’s a strong demand for crypto assets in the region. This demand combined with the price premium from low volume creates a market ready for disruption. More liquidity would eventually bring down the margins and reduce the need for currency arbitrage to get a competitive rate.

All that being said, with capital flight being a real issue in many Latin American countries right now, crypto might soon be in the cross hairs of regulators. OKEx and Binance should be careful, lest they find that their new payment rail gets blocked and cut off from the domestic banking network.

2. Cardano finally deploys Shelley code

By the numbers: Cardano — 5,000% increase in Google search volume.

At the recent Cardano Virtual Summit, Input Output Hong Kong (IOHK) has confirmed that it has deployed the Shelley code on its mainnet, which will allow Cardano (ADA) holders to participate in staking starting today. Shelley aims to push Cardano from a centralized network to a fully decentralized one, and the process is expected to culminate in a hard fork toward the end of July.

- IOHK Founder and CEO Charles Hoskinson also surprised attendees by announcing the launch of Atala PRISM — a decentralized identity system that debuted on the Android app store on June 30.

- Atala PRISM will allow the unbanked to have access to financial services, including decentralized finance (DeFi).

Forkast.Insights | What does it mean?

Cardano has been unique in its approach to launching its products. While competitors rush for the first-mover advantage, Cardano tries to perfect the product before launch. The logic behind this is obvious. Some of the most damaging, multi-million dollar scandals in the crypto world (MakerDao, looking at you) have come from code being deployed with critical bugs.

But is there a point where delays are too lengthy and the project loses relevance? Keep in mind that Shelley was initially due in 2018. Part of the reason for the delay may be Cardano’s reliance on a relatively obscure programming language called Haskell that lacks the pool of expertise you’d find in a more ubiquitous language like C# or Java. The technical upgrades that seemed impressive then, like the integration of staking and smart contracts, are all par for the course now on Ethereum and new, upstart protocols like Tron and EOS.

If you consider Cardano’s on-chain transaction count during the past quarter, it has been non-existent compared to Ethereum and EOS. Developers and traders just aren’t interested in the project. While there has been a flurry of address creation during the last few weeks, there are also credible allegations that this is part of a multi-level marketing scheme directed at inexperienced retail investors in China and that it ultimately won’t amount to much.

As of now, the most promising and interesting part of the Cardano is the Atala PRISM identity management suite. The technology has the potential to mature and become a solution to tokenizing one’s identity and porting it to different services in a secure manner. Re-verifying your address and credit card number to access different services would be a thing of the past; PRISM would guarantee to the counterparty you are who you say you are. Unfortunately, PRISM’s marketing isn’t going in that direction. Instead, it is focusing on the impractical: “self-sovereign identities” for the unbanked, which is something crypto proponents have long championed but is a prospect that has not yet materialized.

3. Crypto companies join Confidential Computing Consortium

By the numbers: Confidential Computing Consortium — 1,500% increase in Google search volume.

R3 joins Facebook, Nvidia and Accenture to headline 10 new members of the Linux Foundation’s Confidential Computing Consortium (CCC). IoTeX and iExec are other crypto firms that are listed to join the CCC.

- Confidential computing allows encrypted data to be processed in a separate hardware-based “trusted execution environment” (TEE), such as the HTC Exodus phone’s “TrustZone.”

- All members of CCC, such as Google Cloud, Baidu and Alibaba, deal with sensitive data and will cooperate under an $800,000 annual budget.

Forkast.Insights | What does it mean?

“Trusted execution environments” are a walled-off garden within the processor where only specific code can be executed. This secure zone is where biometric data is stored, information like FaceID on the iPhone or the image of your fingerprint that allows you to log in to your smartphone.

Logically, this would be an excellent place to store keys for your crypto wallet. HTC advertises this as the ultimate solution for those uncertain about crypto custody — if you control the keys, you control the asset. Building out this technology can also lead to advancements in secure chat and communication platforms. Many chat apps advertise themselves as “secure,” yet the keys for the platforms reside on the cloud — meaning that they are not controlled by the user and thus inherently insecure.

When 2FA, or second-factor identification, was introduced nearly a decade ago, it added a new layer of security to many online platforms and services. However, it was only as secure as the platform it was built upon. The most popular form of 2FA, a one-time code sent to the user by SMS, is susceptible to “SIM jacking,” where a malicious party impersonates the user and gets a careless (or compromised) customer service representative to swap SIM cards and grant them access. This inherent vulnerability creates a market for new kinds of authentication and security measures, and the Confidential Computing Consortium has a market ready for disruption — though the $800,000 budget might not be enough.

4. In China: global patents report, and blockchain used in judicial process

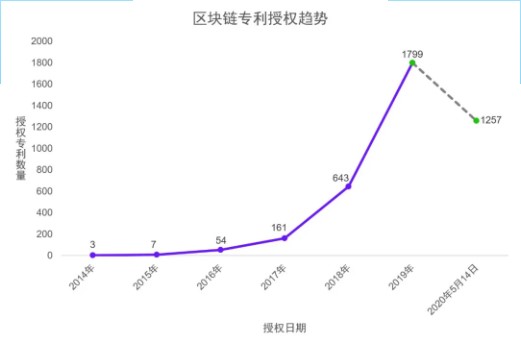

China’s Patent Protection Association’s July 2 report examines the state of global patent authorizations on blockchain technology from 2014 to May 14, 2020.

- The report showed that there have been 3,924 patents awarded globally for blockchain technology since 2014. U.S. firms account for 39% of the patents awarded, followed by South Korea at 21%. China ranks third at 19%.

- Chinese internet giant Alibaba (Alipay) is the top-ranked company, with 212 blockchain patents awarded, followed by American IBM with 136, and Coinplug from South Korea with 107.

Forkast.Insights | What does it mean?

The story that stands out in this blockchain patent “arms race” is how many patents are being filed by foreign firms in China.

Whether it is a new-found confidence in China’s IP protection system or the importance of the China market for the broader blockchain industry, firms are staking out their claim to blockchain IP in the country.

That being said, there’s still a huge disconnect in China between the number of applications and the number of patents awarded. As Forkast Insights has reported, more than 10,000 blockchain-related patents have been filed with the China National Intellectual Property Administration as of late 2019, but only a fraction were actually awarded. This high noise-to-signal ratio is reflective of the current quality of patents, but as the sector matures, this ratio should normalize.

On June 30, Guangzhou Internet Court — one of three courts in China specializing in litigation over online transactions and intellectual property — heard a copyright dispute trial. Blockchain technology, for the first time, was applied to the whole judicial process, from confirming content ownership to providing evidence of infringement.

- Blogger Shushanbixia accused a media company in China of plagiarizing one of his posts on a media platform owned by Tencent.

- Zhixin Chain, a Hyperledger-based platform powering Tencent’s media platform, provided the timestamp of Shushanbixia’s posts on chain to prove the blogger owned the content, and it became crucial evidence showing the copyright infringement.

- Fake contracts and copyright infringement have been such a longtime problem in China that shanzhai, which means counterfeit, imitation, or parody products, is now a famous term. Hence, platforms like Zhixin Chain have grown rapidly to combat the problem. Alibaba’s Ant Financial recently also launched a blockchain-based contract platform for SME, to prevent fake contracts.

Forkast.Insights | What does it mean?

Enforcement of copyright has been a major pain point for everyone from retailers to content platforms. The problem of copyright enforcement isn’t just a problem for large firms. In fact, this is a scenario where smaller rights holders like bloggers can really benefit. A timestamp created when something is written to the blockchain is immutable, because of the inherent consensus mechanisms within the technology itself. If the courts see this blockchain record as proof of ownership, the precedent could be enormous.

5. Funding highlights in Indonesia and Singapore

Payfazz — Indonesia, Series B, US$53 million

Jakarta-based finance platform Payfazz closed a $53 million round of capital funding, bringing its total funds raised to $74.1 million. This is the fourth round raised since the company was founded in 2016. Startup VC firm Y Combinator contributed to the round, while Singaporean Insignia Venture Partners and American B Capital Group led the funding. The application, which is seeing a slip in its download growth rate, according to publicly available data, is dedicated to assisting those without access to financial capital. A July 2018 mobile payments study by Google stated that roughly two out of three of Indonesians are unbanked, lacking any form of bank account or credit card. The firm hopes to stand out from the saturated payment market via advanced encryption technology for transactions.

ECXX Global — Singapore, Corporate Round, US$6 million

Singaporean digital asset exchange platform ECXX Global raised $6 million in an equity deal with Malaysian property developer Hatten Land. In exchange for 20% of the company, Hatten Land hopes to take advantage of the exchange platform’s “technology [access] and strategic human capital.” The exchange’s main offerings are cryptocurrencies, including bitcoin, ether and litecoin. Through its focus on Singapore’s finance market, the firm wishes to expand crypto access. Hatten Land’s stock price lost 11.6% of its value following the announcement, leading to a negative YTD of 37% for the stock.

Forkast.Insights | What does it mean?

This week was a slow one for funding rounds, but we can see that the action in Asia is divided between institutional faith in challenger banks and fintech as a tool to bring in emerging Asia’s lower class to the financial system, but as well as institutional skepticism about the validity of crypto exchanges and crypto assets as a business model.

Payfazz’s push to bring more Indonesians into the traditional banking system puts it in a crowded, competitive market. It’s not quite clear where the tipping point is of challenger banks servicing this market, but with legacy banks in Indonesia like BRI investing in firms like Nium to enable Ripple, and other upstart remittances companies to integrate into their existing software stack, building out a new platform could become an expensive, risky venture. But inventors still see opportunities, hence the round.

Now, on the other hand, Hatten Land’s push into crypto was met with skepticism by its investors. Conservative investors might be challenged to see the value proposition in the play, but with digital assets becoming more mainstream and tokenization opening up fractional ownership opportunities, it could also be the investors’ loss if they simply sat on the sidelines.