Last month saw the bitcoin market cross one of the most anticipated milestones of the digital asset industry — one long-awaited by investors as a potential trigger for bitcoin price appreciation — this year’s bitcoin halving. Taking place every 210,000 blocks mined on the Bitcoin network, or about every four years, bitcoin halvings see the reward for mining new blocks and verifying transactions given to miners reduce by 50%.

These events are important for traders because they theoretically reduce the number of new bitcoins being generated by the network, effectively reducing bitcoin supply — which should lead to substantial price hikes should demand remain constant. Similar movements can be seen in traditional low-supply marketplaces, like the gold market, where sudden decreases in supply have correlated with massive surges in price.

The first halving, which took place in 2012, saw bitcoin surge from US$10 to over $1,150. The second halving in 2016, meanwhile, saw BTC go from $650 to $2,800 within 12 months. Since then, BTC has never fallen below this price level — marking a minimum of 400% gains since the second halving in the long term.

However, as this year’s halving came and went, many speculators have been left wanting in the absence of a post-halving price pop. This is because, despite much anticipation, the effects of this halving will be limited to the medium and long term. From our analysis, it may take up to 12 months before investors reap the rewards of post-halving price movements. Focusing on the short and medium term, it is far more likely that the key drivers of growth will be global economic and political shifts rather than technical milestones.

Investor anticipation

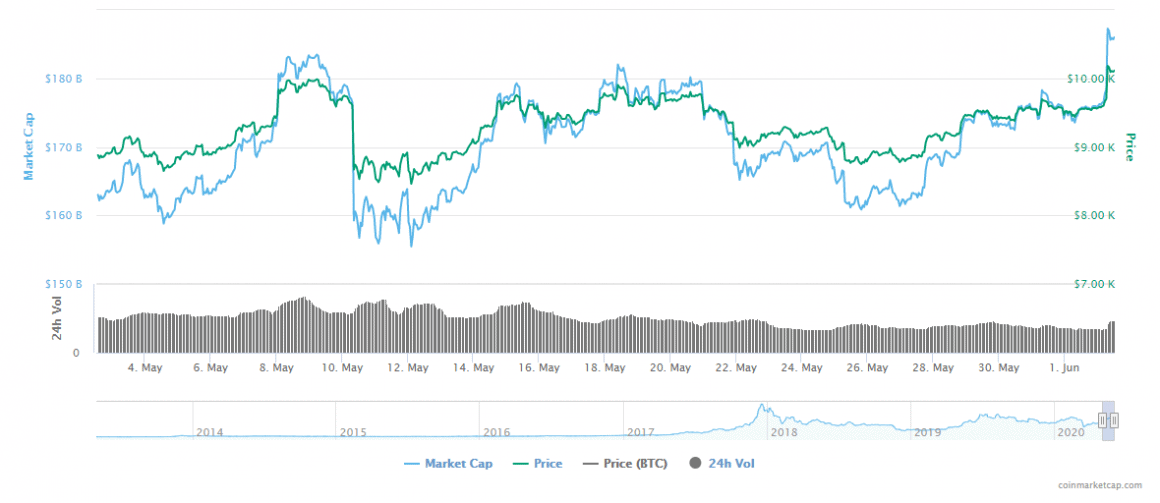

In the days leading up to the halving on May 11th, the BTC market witnessed rapid price escalation, climbing to US$10,000, before immediately retracting 19% to the $8,200 mark. These seismic shifts in such a short time frame were clearly the result of markets moving up too fast and too quickly, and were likely driven by speculation from investors hoping to make a quick return on post-halving price action. If this price-pop failed to materialise, a steep pullback was always on the cards as short-term investors were likely to sell-off their holdings.

The upward pressure experienced by bitcoin ahead of the halving event was further fuelled by news that Paul Tudor Jones, head of a $22 billion fund and highly influential investor, was publicly backing bitcoin as a store of value and means of portfolio diversification. Combined with increased investor interest in the lead up to the halving event, this news fanned the flames of speculation and caused many who were on the edge of the bitcoin market to take the plunge or increase their holdings.

Short-term frustrations as market equilibrium remains elusive

As short term speculators were left disappointed by bitcoin’s immediate post-halving performance, markets witnessed short-term drawbacks — having since consolidated around the US$9,000 and $9,500 mark. This downward pressure is most likely the result of the dissipation of “weaker nerves” within the market who bought in anticipation of high returns in a short time frame and sold their holdings when this failed to become reality. These muted gains, however, are the result of a time lag between the halving and its impact on supply. This is because although the block reward for miners has already decreased, it will take some time for miners to reposition towards market equilibrium and scale their operations accordingly.

While theoretically, block rewards for miners have halved, miners’ profits should decrease by approximately half as well. However, Bitcoin’s rate of change of hashrate has remained positive over prolonged periods, signifying that more miners are consistently joining the network. There is likely to be added stress to miners’ profits as rewards are split between larger pools. This will further compound the time needed for miners to find their break-even point and for the market to reach equilibrium.

Only once this equilibrium is found, is bitcoin likely to realize its halving-induced price appreciation — and our analysis suggests that it could take up to 12 months for markets to reach that point. That is not to say we will see no upward pressure on BTC price, however, this is likely to be the result of macroeconomic and geopolitical events on the international stage than the halving itself.

Collapse of traditional markets and investor interest in bitcoin

As investors search for the next catalyst of bitcoin price appreciation, they may not have far to look. In the wake of Covid-19 and the collapse of traditional markets, we have seen unprecedented interest from traditional financial actors in alternative assets as a means of portfolio diversification. This is to be expected in times of economic uncertainty, as investors and institutions move to hedge against economic headwinds and the devaluation of market-correlated assets. As a result, the commodities market, including gold and silver, have had a positive run over the past month.

See related article: Safe havens like bitcoin and gold are sinking in this pandemic economy. Where can investors find shelter?

Bitcoin, too, has been the subject of increased investor interest as a means of insulating their wealth from losses in traditional markets. Indeed, the digital asset has been moving in line with commodities markets, signposting its growing maturity as a store of value and hedging instrument for old-world money.

For astute market participants and spectators, the role bitcoin is playing as a means of hedging against market turmoil in the midst of the Covid pandemic should come as no surprise. Last year, the correlation between the price of bitcoin and gold became so pronounced that the two assets moved towards total lockstep from June to September. As growing political and economic tensions — such as the U.S.-China trade war, Brexit and the evolving political situation in Hong Kong — shook investor interest, capital movements to uncorrelated assets rose in 2019, leading to an upward trend in both the gold and bitcoin markets. A similarly correlated spike in gold and BTC prices occurred when the United Kingdom voted to leave the EU, briefly sinking the GBP and leading to a rush by investors to safe-haven assets.

With Covid-19 precipitating the fastest 30% sell off in history for the S&P 500 and the sharpest decline for global markets since the Great Depression, it is no surprise that we are seeing a rise in BTC’s prominence across almost all investor circles. Bullish entries to bitcoin have been further stoked by fears of another potential US$3 trillion stimulus package on the horizon. With monetary easing policies and seemingly unlimited economic stimuli being unveiled around the world, fiat currencies may face substantial inflation, sparking a new wave of demand for alternative stores of value.

Post-bitcoin halving outlook

Although off the back of the May halving, many spectators are disappointed by the lack of a meteoric rise by BTC in its wake, long term investors have accepted that this comes with the territory of more mature investment markets and asset classes with value independent of wild speculation. While it is certain that the halving event will have ramifications for BTC price moving forward, these are uncertain times and it is likely to take several months for these changes to take root and come to the fore.

In the interim, as the political situation in Hong Kong plays out, U.S.-China relations appear to sour, and the economic and political challenges of Covid-19 continue to be felt around the globe, it is these events that will likely lead to the price appreciation of bitcoin in the short to medium term as well as bring institutional finance and accredited investors into the market. These changes are already beginning to take place, and it would seem Covid-19 is set to accelerate them.

What we are about to see is Bitcoin’s triumph in adversity and baptism under fire. The digital asset which was borne out of a recession, may just prove its robustness through yet another one.