China’s digitized renminbi could reshape the global financial system similar to how the U.S. controls international payments through the SWIFT wire transfer system, said Adam Traidman, CEO of SBI Ripple Asia and CEO of SBI Mining Chip Co.

“The real concern we should be looking at in terms of impact to the global economy is that with the digital renminbi and China’s efforts, I think they feel like that’s going to put them in a great position to do what the U.S. Department of Treasury or the U.S. federal government did when the international wire transfer system came out,” said Traidman, who is also CEO and co-founder of BRD, one of the first bitcoin wallets.

Highlights

- “You’re seeing a significant amount of orders and you’re seeing delays because of inventory selling out in all product classes across mining hardware. So it’s a really great time to be a bitcoin mining company.”

- “You can actually make more money as a miner when the price of bitcoin goes down. It’s completely counter-intuitive, but you can only do that if you’re the last man standing, if you really have optimized your business.”

- “In my role as CEO of SBI Ripple Asia, we see and tend to a significant volume of transactions in the remittance space moving across corridors throughout Asia.”

- “With the digital RMB and China’s efforts, what we’re seeing is that as they develop that digital currency, I think they feel like that’s going to put them in a great position to do what the U.S. Department of Treasury or the U.S. federal government did when the international wire transfer system came out.”

- “The real scary part of not really modernizing our financial system in the U.S. is that if companies want to do business with China in the next, say, five years, they’re going to have to really support these new China-based currency and value transfer systems. And everyone needs to do business with China around the world.”

- “I’ve never been a fan of the anonymity angle of promoting cryptocurrency.”

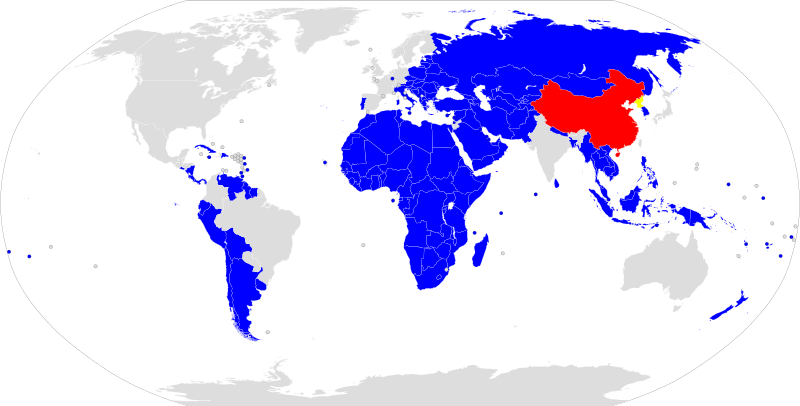

SWIFT, or the Society for Worldwide Interbank Financial Telecommunication is used by banks as a messaging system to securely transmit information about transactions between accounts in different parts of the world. SWIFT is a Belgium-based company that has a dominant role in the international financial system, handling the transfers of nearly $5 trillion worldwide each day in 2004.

SWIFT’s position as a gateway for countries to access funds also puts it in the spotlight of geopolitical controversy. In 2018, SWIFT suspended some Iranian banks’ access to its services following U.S. president Donald Trump’s decision to pull out of the 2015 Iran nuclear deal and impose sanctions on Iran. The last time Iran had been cut off from SWIFT under sanctions from former U.S. president Barack Obama, its revenue from oil sales fell by half as cash had to be moved physically.

In the long term, experts are concerned that China might exert similar measures to achieve its geopolitical goals through the use of its Digital Currency Electronic Payment System (DCEP)

“The way that China is developing the [DCEP], we should all wonder if they’re going to use that as a strategy to try to do what the U.S. did way back when, and really start to control the global value transfer system — that, I think, is a significant geopolitical concern,” Traidman said.

But cryptocurrencies and companies offering decentralized ledger technology for financial solutions could present opportunities to ensure that superpowers don’t retain too much control over the global economy. “So in that sense, I think it’s actually an opportunity for these technology companies,” Traidman said.

Tension between China and the U.S. has been intensifying over the past two years, with a trade war between the two countries and China’s efforts to internationalize its renminbi to accelerate projects such as the Belt and Road Initiative.

See related article: China hopes its new digital currency will internationalize the RMB. When might that day come?

“The real scary part of not really modernizing our financial system in the U.S. is that if companies want to do business with China in the next, say, five years, they’re going to have to really support these new China-based currency and value transfer systems,” Traidman said. “And everyone needs to do business with China around the world, so governments around the world as well as the technology companies … need to be looking at China and trying to really catch up, because we’re all way behind; and that’s not just the U.S., but other places as well.”

The DCEP could potentially be promoted as a means for greater international adoption among governments and companies dealing with China, leapfrogging over traditional financial systems such as SWIFT.

“Long term, the more consequential shift in global payments systems and reserve currencies has to do with China, which wants to chip away at the dollar’s status and pull the financial center of gravity toward the yuan and yuan-denominated assets,” according to a report from Barron’s, the financial news organization. “There are plenty of roadblocks to that goal, namely capital controls, but the aspiration is clearly there.”

Full Transcript

Angie Lau: Welcome to Word on the Block, the series that takes a deeper dive into the world of blockchain and adjacent emerging technologies like AI, 5G and IoT, all at the intersection of business, politics and economy. It’s what we cover right here on Forkast.News. I’m Editor-in-Chief Angie Lau.

Now, we’ve been talking a lot about the price of bitcoin amidst the current global economic climate. As a relatively young currency with only a decade under its belt since it was born, could bitcoin now be facing an inflection point? As we try to understand the dynamics and the fundamentals underpinning its value, we now bring in Adam Traidman, CEO of SBI Ripple Asia, a joint venture between Ripple and SBI, who also happens to be CEO and co-founder of BRD, one of the first bitcoin wallets, holding an estimated six billion dollars in cryptocurrency for customers.

Adam also leads Japanese financial firm SBI Holdings’ efforts in manufacturing cryptocurrency mining chips and systems: SBI Mining Chip. So B2B, B2C, manufacturing, three perspectives; one holistic picture, which is why I’m truly excited to welcome Adam to the show right now. Adam, that’s a lot of jobs right there.

Adam Traidman: Thank you, Angie. It’s a pleasure to be here. As you can imagine, I have nothing but free time on my hands.

Lau: Well, I’m glad you found a little bit in the abundance of free time to spend with us. These are interesting times, as we say in the journalism business. You’ve got the perspective from the customer point of view, from wallets to financial industry with Ripple and SBI’s joint venture to mining chips, with the recent bitcoin halving, you truly have a unique overview of crypto in blockchain. How is this all being impacted by Covid-19 right now?

Traidman: Well, each is being impacted in its own way, and to be honest, I’ve been rather surprised by the fact that the overall net result has been growth as a result of the coronavirus. I think on the consumer side, for our BRD consumer app, which end users around the world use for holding cryptocurrency and investing, with everyone staying at home, people are finding time to do things that they otherwise were too busy to do previously, like take a look at their investments and more actively manage their money.

We’ve seen a surge of interest since the early part of this year in new customers and purchases and trading of cryptocurrencies. I think that also goes hand-in-hand with the volatility that we’ve seen across all financial markets, and cryptocurrency markets have been no slouch when it comes to volatility, as we’ve seen the impact of Covid-19 across the global economy. And with volatility comes increased interest as well. So on the consumer side, I think that’s sort of the picture. When you look at the hardware and the manufacturing, as you can imagine here in Asia, where a lot of that is centered, there were definitely impacts, especially in China, where a lot of the system manufacturing goes on.

The net result, though, really was only a few weeks of impact to schedules of computer hardware production. In the case of cryptocurrency mining, I think it’s probably the case across the board. We found now that parties have largely caught up, and so we expect that there will be shortages in capacity later this year as non-crypto-related hardware companies like Apple, for example, re-ramp up their capacity. But right now, things are humming along.

Lau: I’m curious about the demand for mining chips as well, especially since we’ve just recently experienced the bitcoin halving. What is the appetite right now for hardware for miners? And who are these miners? Are they joining forces, are they consolidating, or are new players coming aboard?

Traidman: Good questions. If you look back historically, the miners themselves started really as hobbyists. They were the early cryptocurrency enthusiasts, kind of like the early days of the Internet where websites were run by enthusiasts and whatnot. Now it’s become an enterprise-class business that requires significant amounts of capital in order to operate, and it’s become highly commoditized, which means that it’s really economies of scale play at this point, and you have to really be big to survive. So the customers that are purchasing cryptocurrency miners are no longer these hobbyists, but rather multinational companies that are operating all over the world and seeking to find the ideal conditions — things like low electricity prices and cold climates — in order to make investments.

Now, the halving is always a very important inflection point in our industry across the board, and how it impacts miners is a really interesting study in economics. What we all know at a high level is the halving point is the point at which the reward of new bitcoins that are created for every block that is mined gets cut in half. So at a macroeconomic level, you think, “wow, well that just means that all the miners had their revenue cut in half.” And that’s actually true.

So you wonder, “well, gosh, how could you operate a business knowing that every x number of months your revenue’s going to go down” and eventually it’s going to go down dramatically, to the point of unsustainability. You think, ‘what are these people thinking,’ right? Well, let’s let that hang for a second, and let me say this.

Prior to the halving, you would expect that the orders for cryptocurrency mining hardware go up because people want to mine as much as they can before the reward is cut in half. That did happen. And then what you expect is that afterwards, the reward goes down. People aren’t going to want to order any hardware, and so you expect it to come down. Well, actually, that’s not the case. It actually goes up. And the reason why it goes up is, there’s a lot of hardware that was last generation that basically has to be shut off after the halving simply because it’s just no longer profitable to run it.

It’s like having an old iPhone or an old Android phone that just gets too slow to handle modern apps. At some point, you just have to upgrade. Well, that’s happening right now, and so you’re seeing a significant amount of orders and you’re seeing delays because of inventory selling out in all product classes across mining hardware. So it’s a really great time to be a bitcoin mining company.

Lau: That is absolutely economics at play. The other part of economics, though, is the price of bitcoin itself. Sure, you can mine bitcoin, but at what point are you able to cover all your operational costs, cover your R&D, cover all of the upgrades to equipment and still come out ahead?

Traidman: You’re absolutely right. Think of it like this: you’re operating printing presses for money. They require a lot of power, so you’ve got to find really cheap power, and at some point they require more power to run than cash that they produce, and so that’s when you upgrade them. This sort of economics of mining is actually, I think, fairly poorly understood in general, even in the cryptocurrency industry, because of what I said before. It looks like just this negative trend.

Well, in reality, here’s what happens: if you’ve got the economies of scale, which means you’ve got the low power cost, and you’ve got the highest-powered efficiency hardware that is out there, basically when everyone else has to shut off their old miners because the bitcoin price has gone down and it’s no longer profitable, you can hold on.

And if you hold on, even though the bitcoin price went down, because your power is cheaper and you’ve got the best hardware, what happens is the percentage of blocks you mine goes up, because other people had to shut off their hardware. You can actually make more money as a miner when the price of bitcoin goes down. It’s completely counter-intuitive, but you can only do that if you’re the last man standing, if you really have optimized your business.

Lau: Well, it’s kind of like the current Covid-19 environment in multinationals around the world; who’s the last man or woman standing? And that really depends on liquidity. So you’re seeing consolidation in the real world and you’re also seeing consolidation in the mining space. That is a great point that you’ve stressed.

I also know that in this role with SBI mining chips, that you have a lot of conversations with Treasury heads of countries across Asia. I’m curious what they’re talking to you about right now. Are they interested themselves? Are sovereign nations as interested in participating as miners are? Which nations are interested in this way?

Traidman: That’s an interesting question. We have seen interest from nations which have a reliance on a very specific type of natural resource, such as in the Middle East, where they are heavily reliant, of course, on oil. And because of the volatility in the oil markets, especially over the last couple of quarters, they are increasingly looking at alternative natural resources to supplement their shrinking economies and shrinking revenues to the sovereignties. We see that, however, I would say it’s still relatively in its infancy.

When it comes to other nations, let’s use an example, in Southeast Asia, I was recently talking to various folks high up in the central government in places like Cambodia and Myanmar, where they are embracing the idea of digital national currencies. Now, those don’t necessarily in those cases have to be mined. They are not necessarily decentralized like Bitcoin or Bitcoin Cash, and therefore mining doesn’t really play a role in those things.

But the digital transformation of national currencies, that is happening. And that, actually, I touch on in my other line of work as the CEO of SBI Ripple Asia, where there is a lot of interest from these nations in digitization of currencies as well as alternative means of moving money across borders that isn’t necessarily tied to the traditional systems like the SWIFT wire transfer system and the long arm of the U.S. Department of Treasury.

Lau: Well, and that in of itself is a benefit that is desired if you’re not American and you are still trying to participate in the global economy with much more seamlessness and less friction for sure. The cross-border issue is enormous.

Remittances are absolutely critical for a lot of nations in Asia, and recently, Nium which offers an API that allows banks to essentially plug and play into Ripple close to funding round, led by both Ripple and interestingly enough here, Indonesian bank BRI; another bank in the UAE opened a remittance quarter to Bangladesh using Ripple technology.

This is digital disruption for the remittance market at its finest and a huge endorsement for blockchain, but not necessarily cryptocurrency. So what’s the next step here? Does cryptocurrency have a role to play here? Is it being sidestepped? Is the focus on blockchain and focus by central banks on digital currency? Where’s the role of crypto here?

Traidman: Angie, that’s such a great question. I would say, first of all, when it comes to remittance, you hit the nail on the head — a huge, huge market opportunity to transform and disrupt an otherwise archaic system. It operates at two levels. First, at the end customer, let’s say, the immigrant to a first-world country like Japan who’s sending money back home to their family. For them, they really shouldn’t have to care about the underlying technology that is being used to send that value back. They just expect it to be cheap, fast, and safe.

So the reliance and the dependency on technology companies to provide that level of infrastructure is there, and that is an opportunity for cryptocurrency or more digital asset-based companies like Ripple, for example. In my role as CEO of SBI Ripple Asia, we see and tend to a significant volume of transactions in the remittance space moving across corridors throughout Asia. We’ve seen tremendous growth over the last year.

I will say that with Covid-19, because of stay at home orders, it’s more difficult for some people to actually go and get money out of an ATM machine for example, or take it to a place to do a remittance, that type of thing. So we have seen some slowdown in transaction volume, but it’s all temporal. People eventually send that money back; they just do it on a different schedule because of the stay-at-home-type rules, and shelter-in-place.

What I will say, though, is that this opportunity to disrupt these old systems, it exists at two levels. One is modern advances to replace messaging systems like SWIFT. When most people think of the international wire transfer system SWIFT, they think that it moves money. Can you imagine FedExing Benjamin Franklins across the world? That must be what SWIFT is the electronic version of. But actually, SWIFT doesn’t move money. All it does is it adjusts balances in different bank accounts’ ledgers between two banks. So you can essentially say, I’m going to move some of the value from here, so I have to lower the account balance in Tokyo and increase the account balance in Phnom Penh, for that remittance I’m sending back to Cambodia, for example.

There are technologies like Ripple, or products like a RippleNet from Ripple that can basically automate and modernize that, but that doesn’t actually involve cryptocurrency, as you pointed out, Angie. So what’s the next step? The next step is with a cryptocurrency that is the mechanism to move the value. And what that means is that remittance companies don’t actually have to pre-fund accounts that have FX issues between having different currencies and different countries just waiting for the remittances to start to flow. Instead, they can use technology on publicly accessible blockchains to send the value.

That is the actual electronic modern version of FedExing Benjamin Franklins, and that is starting to happen now. So we’re seeing the roll out of different products and services from a variety of companies, including SBI Ripple Asia, to provide that, and that’s the real next step, because it offers the companies that are participating a much cheaper, faster, safer alternative — way more cost-effective for them, they can scale better, and ultimately, what that means for the end users who are sending these remittances, is a better, cheaper, faster user experience. That’s going to be a real transformation that’s going to come through over the next, I’d say two years.

Lau: But do you think that the competition is getting fierce for Ripple and all of your efforts around the world, including in Asia, especially with central banks across Asia? [Numerous] central banks around the world are in some form or fashion working on their own central bank-backed digital currency. That competition is just going to get even more heated. It’s getting to be a crowded space. Do you think that could displace whatever efforts that cryptocurrency or Ripple and other firms that are in this similar space are doing right now?

Traidman: Well, I think you’re still going to need go-between value transfer systems, and what I mean by that is going between different national currencies. Just the fact that, say, to send money between the U.S. and Europe today, going between the USD and the Euro, it doesn’t really matter if it’s a physical or digital version of the Euro or the dollar, you still have to have a go-between. You still have FX issues; you are still going to see fluctuations in currency markets that are going to impact your business.

So using something like a cryptocurrency public blockchain like XRP, for example, from Ripple, affords some benefits in that regard. And it will still offer those benefits when these digital national currencies come to fruition. And it’s funny, when you ask about competition for Ripple, we naturally would think of other technology companies. But your point is a very good one, that maybe the competition is actually these digital national currencies.

I think, though, that the real concern we should be looking at in terms of impact to global society, or global economy rather, is that with the digital RMB and China’s efforts, what we’re seeing is that as they develop that digital currency, I think they feel like that’s going to put them in a great position to do what the U.S. Department of Treasury or the U.S. federal government did when the international wire transfer system came out.

The U.S. government basically created and controls that privatized systems by SWIFT and the banking network. I think with the way that China is developing the digital RMB, we should all wonder if they’re going to use that as a strategy to try to do what the U.S. did way back when, and really start to control the global value transfer system. That, I think, is a significant geopolitical concern, and I think that technology from companies like Ripple will offer an opportunity to ensure that any one superpower doesn’t retain too much control over the global economy. So in that sense, I think it’s actually an opportunity for these technology companies.

Lau: You’re absolutely right. It is an issue that we track very intensely at Forkast.News. Geopolitically you have the tensions between U.S. and China right now, the decoupling that we’re seeing happening; but in fact, this has been happening for years now, and very clearly, even before the adoption of what China calls DCEP — digital currency electronic payments, which essentially is the digitized RMB — even before that. What you’re seeing in terms of a financial system, domestically within its own border, is like night and day compared to what we see in the West.

As you know, Adam, you can’t even use physical RMB really, to purchase anything — goods or services — in China anymore. So you’re right, and what I’m curious about is, as this geopolitical fissure seems to be happening, what does the U.S. need to pay attention to? What does the West need to pay attention to? Do they understand this dynamic in the way that one needs to? Or do you think that COVID-19 is a huge distraction and potentially a subterfuge?

Traidman: I think Covid-19 is definitely a huge distraction. To directly answer your question, I don’t think they’re paying enough attention. I do not think Covid-19 is the reason, however. I think the reason is because historically, we have not had to. As a U.S. citizen, I think we look at the U.S. government as the number one superpower always having been confident in itself. And it sometimes takes fear, it takes pain, for folks to realize that there’s a problem and that they need to make some changes.

I think we’re starting to feel that now with China, with what we’ve seen the administration do over the last couple of years regarding tariffs and taxes and whatnot. Now we’re starting to feel some of that pain. So maybe things are starting to change. What I think the real sort of reason, though, or the real scary part of not really modernizing our financial system in the U.S. is that if companies want to do business with China in the next, say, five years, they’re going to have to really support these new China-based currency and value transfer systems.

And everyone needs to do business with China around the world. So I think governments around the world as well as the technology companies that can supply the infrastructure to enable these kinds of transformations need to be looking at China and trying to really catch up, because we’re all way behind; and that’s not just the U.S., but other places as well.

Lau: I spoke with Tim Draper on a Word on the Block podcast very much like this one and asked him about China and the digitized RMB and the plans for the central bank-backed digital currency, and he said it’s going to fail.

In fact, he thinks that basically all of these central bank-backed initiatives will fail because the need and the understanding of the average person for a decentralized product is going to be obvious. What do you think about that?

Traidman: As someone who got involved in the cryptocurrency industry five years ago, which isn’t as early as some but early enough to still touch that ideological component of why a lot of people like Tim Draper got involved, I would love to believe that’s the case. I would love to believe that we’re going to move to a global decentralized currency — one currency for the world based on blockchain technology, which empowers individuals with financial freedom and has dramatic disruptive and positive effects for society on disrupting the global financial system.

I think that many of us in the cryptocurrency industry still have those dreams at night, and we still talk about those things when we meet up in quiet rooms now. However, what I will say is this: it’s very difficult, as you pointed out earlier, to compete with the national government. They have a lot to lose. There’s a lot of inertia in traditional systems and there’s a lot of power. There’s a lot of money that can and will be lost by unfettered, uncontrolled digitization of economies.

In fact, I had this exact conversation with the head of a central bank from a Southeast Asian country in late Q4 of 2019. We were talking about some of these technologies, like Ripple and other crypto-related technologies, and he said to me, ‘Adam, the number one concern I have is not that this doesn’t add value, but that it gets out of control.’ He said, ‘I have a responsibility to protect my nation, my citizens, the value that they create, and our place in the geopolitical situation within Southeast Asia as well as the world. I have to be able to control all aspects of my economy.’ And so, he said, ‘we’re looking for technologies to make major transformations and make the lives of our citizens better. But we need control.’

So I think it’s those forces that are going to counter the ideological dreams that many of us in the cryptocurrency industry have, that Tim spoke of. But I do think it’s going to be a very long time before we’ll be able to see a transformation in that space. I would love to say that it’s going to happen soon and that dream will be realized, but I think it could take decades or even longer for something like that to truly happen.

Lau: It is just such a pleasure to be able to tap so many perspectives in one person, Adam, because that leads to the question of, what about the consumer? What about the average person? As CEO of BRD, where you are offering bitcoin wallets and the ability for people to host their own, store their bitcoin value, and protect it, they, and you, via BRD, also have to be conscious, no doubt, of the upcoming FATF review of the travel rule in the next 16 months. It really factors out the anonymity part of crypto. Is that aspect going to be phased out? Is our privacy at risk?

Traidman: I’ve never been a fan of the anonymity angle of promoting cryptocurrency. That’s not to say that I don’t value financial privacy; I very much do value financial privacy, and BRD has been built on leveraging cryptocurrency technologies to help people maintain and control their own wealth and their own earnings. However, I will say this: just like the ideological dream of having a global unified currency that no world government controls, just like that’s a very difficult dream to achieve, it’s also very difficult to operate any financial or value transfer system in a world where we are governed by regulations and must be compliant if we want to run legal businesses.

Certainly at BRD, we’re running a legal business and we think that the trend in the industry across all aspects of crypto, because of the FATF travel rule, because of Department of Treasury and FinCEN guidance that is coming out and the equivalent in all other countries aro

und the world, we believe that we are moving more towards seeing the same type of money laundering protections and checks. ‘Know your customer’ restrictions and rules apply to the cryptocurrency industry that we saw in the world of fiat, and so for a lot of folks who were early in the cryptocurrency industry, that kind of feels like, ‘we’re selling out, we’re losing a lot of the value that we were providing.’

But you hit the nail on the head, Angie, because what you asked about at the beginning is the customer, the consumer. Here’s the thing: the consumer doesn’t really care. They don’t really care about anonymity. They don’t really care about the fact that they have to give up their name or a copy of their passport or driver’s license or other national idea in order to make an account with a bank, for example, or a cryptocurrency exchange. The reason is they’re used to it. And so the trick then is, if you were to provide an alternative where they didn’t have to do that, what would happen?

Well, actually, BRD started that way. We now have 4 million customers in 170 countries, with 6 billion USD in assets under protection in the app. So you might say, ‘well, that proves that perhaps there is some interest in that.’ But guess what? In the practical world, you have to run legal and compliant businesses. So when users download our app, Angie, they don’t have to register. Because they haven’t done anything that requires those levels of compliance yet. That makes it really easy to get started, and that’s what we’ve always been known for.

The easy on-ramp for new users to cryptocurrency, to learn and to invest. Once you need to, for example, move USD or JPY into crypto through our app, you of course have to go through the standard AML/KYC (anti-money laundering / know your customer) process because that’s the law. You don’t avoid it. So technology companies like ours, we use the technology to make the on-boarding frictionless and to make it easier for folks. But then on the back end, of course, we have to comply. I think the whole industry is going to move to that, and you’re right, the FATF travel rule is simply going to accelerate that process.

Lau: Well, you see so many perspectives of this broad industry from a perspective as well in Asia that is very unique. You have a global view as we do, and we value that a lot here. So I’m going to ask you: in a post-COVID world — whenever that’s going to be, we are in a time of Covid where the floor seems bottomless — where is this industry going, from B2B, B2C, and cryptocurrency?

Traidman: So in general, I would say right now we are seeing all-time highs in various metrics across consumer interest. I think the halving brought in a lot of institutional interest into cryptocurrency as well, so there’s your B2B aspect. Let me separate it into the following things: first, on the consumer side, the number one thing that is leading growth is that time, as it continues to perpetually go on, creates opportunities for consumers to learn more, and to trust more, and to get more confident in new technologies and new investing, with new classes of assets for investments, such as cryptocurrency. That’s going to continue to grow. It’s evident in the numbers, even the numbers that I see in, for example, the BRD business.

And then if you think about the B2B or C2B aspect of it, which is sort of like the remittances, where the consumer is sending money, and then it goes from one business or one bank to another, we’re seeing that grow as well, simply because of the globalization of the entire world – people moving around, and all these types of things.

Once Covid is done, I think you’re going to see a resurgence in air travel. People have been pent up, they want to go places. It’s not going to be over the course of a few weeks or a few months; it’s going to be over the course of a few years, because we have to get comfortable again with everything. The way of life is going to change. However, I think all of those things are going to surge.

Then when it comes to blockchain for business and the real B2B aspect of things, I think that because of contactless payments, because of the fact that the stimulus bill talked about the digitization of the U.S. dollar and digital wallets and these types of things, I think the CEOs of large Fortune 500 companies are now thinking more than ever that they need to have blockchain and/or cryptocurrency-related projects and strategies going on in their business.

So I think we’ll see a surge in that type of interest as well. I can tell you that for BRD, we also have an enterprise product for companies that are building blockchain-based software, and we’re seeing a surge in interest right now as well, from large multinational corporations not only in finance and fintech, but in other parts of enterprise software development as well, across all industries.

Lau: And to take that conversation beyond the hushed rooms where we’re sharing the utopian views – the way that bitcoin in cryptocurrency and blockchain started, do you think that at some point we could potentially reach some sort of platform where digital innovation in transformation does give more power back to the people?

Traidman: It already does. Let me give you a simple analogy: if I wanted to communicate with my family in a different country 30, 40 years ago, I had to go write a letter. I had to go walk it to the post office, I had to have them wait for maybe 30, 60, 90 days to receive that. A mail-person had to actually go and deliver that, and then my family member could open that letter.

Email changed that forever. It made it instant and it made it free. I think we’re already seeing that happening with the digitization of monetary technologies and value transfer systems. Today, I can send a remittance between countries within seconds or at least within minutes. Sure, it’s not free, but the prices are going down. If you look at the Internet historically, I think there were a lot of utopian dreams back in the early days of that as well.

Anything that can grow fast and change the world has to be controlled in some aspects, just like we have laws governing all aspects of society. So naturally, you expect some constraints to be placed on these new technologies. Otherwise they could become too disruptive and actually could be detrimental instead of positive for society. So the trick is, as you said, how can we make sure to keep some of those benefits? Well, I think we did it for the Internet; I think we’ll do it for cryptocurrencies as well.

Lau: Well, to your point, the West also has to pay attention to what’s happening in Asia, and specifically China as to what a new system is being built right now, because that is certainly an emerging story – not only of technology, but of changing geopolitical dynamics that could truly shift relationships and the way that we all exist in a global economy.

But for now, Adam, we’ll leave it right here. You are a true gift to this journalist indeed, to have so many perspectives and such a broad perspective from so many areas of expertise, to be able to connect the dots so well. It truly has been a pleasure. Adam, thank you.

Traidman: Thank you very much for having me, Angie. It’s been a pleasure.

Lau: And thank you, everyone, for joining us on this latest episode of Word on the Block. We’re going to leave it there. I’m Editor-in-Chief of Forkast.News, Angie Lau. Until the next time.