Despite a tumultuous month in cryptocurrency markets due to coronavirus fears, industry experts believe that bitcoin’s time to shine has arrived.

“If there’s a time for [bitcoin] to appreciate, if there’s a time for it to really prove its worth, it’s now, and hopefully over the next six months we’re going to see that,” said Matthew Dibb, COO of digital securities investment marketplace Stack.

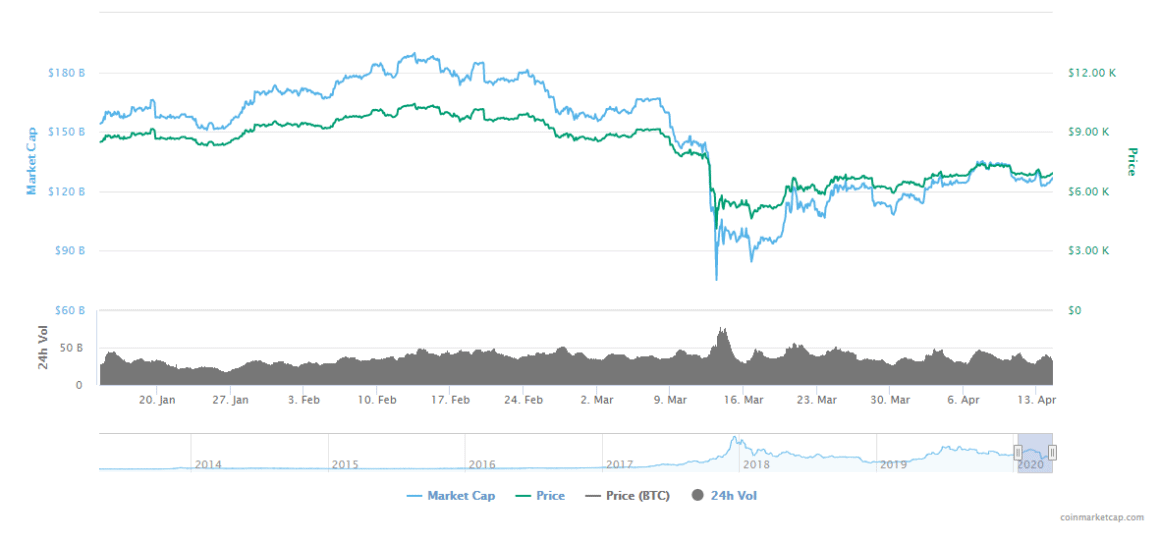

On the back of bitcoin’s “black swan event,” which saw its price drop below $4,000 in March, the number one cryptocurrency by market capitalization — around $133 billion as of this article’s publication — has almost reverted back to previous highs from earlier this year.

Highlights

- “Bitcoin really is still an uncorrelated asset. I think too many people are probably getting a bit too caught up in what’s happening day to day within these moves of cryptocurrency.”

- “Demand [for bitcoin] is definitely there. Is it a green light for some of these investment companies that have been sitting on the sidelines? We think that time is certainly approaching.”

- “If you are a longer term investor then we believe that around these levels is certainly a great place to get set. And that sort of ideology is quite consistent with the investors that we’re dealing with at the moment.”

- “From our perspective we still see [the halving] as of the next 6 to 12 months as a really bullish catalyst for basically a pop of bitcoin of over 10,000 again.”

- “Honestly, if we saw the equities market continued to fall in increased volatility, you can’t see with any certainty that bitcoin will be safe. You can’t say with any certainty that miners would be safe or that they would stop mining to hopefully bring the bitcoin price up. Again, I think that we’re still in extremely volatile times and that’s going to continue to happen. That will continue to occur over the coming few months.”

However, due to the volatile nature of traditional markets which are still grappling with the economic effects of the Covid-19 pandemic, Dibb warns that it may take some time for bitcoin to be stabilized.

“Bitcoin being the cheapest that we’ve seen in quite some time, it’s great, take some exposure now,” said Dibb. “However, would you really be surprised if it went back down to $5,000 in a month? We don’t want to sound bearish but short term fluctuations are definitely there — there’s a lot of uncertainty across all markets, not just Bitcoin.”

See related article: Bitcoin’s ‘black swan event’ — should investors worry?

Although cryptocurrencies such as bitcoin have previously been seen as uncorrelated to traditional asset classes, it still took a dive along with alternative investment sources such as gold as investors liquidated their portfolio holdings to cover their positions. Other experts agree that the so-called safe havens such as gold and bitcoin are still subject to market sentiment, particularly during times of economic crises.

“Cryptocurrencies are not immune to market turbulence, with natural fluctuations illustrating regular asset class behavior in so far as smart money trading and herd mentality tendencies are clearly visible in the market,” said Nick Cowan, CEO of the Gibraltar Stock Exchange Group, in a statement.

“In terms of a post-pandemic market, I don’t expect cryptocurrencies to suddenly become a fixture in the safe haven category with gold for example,” said Cowan. “Rather, adoption levels will continue to increase, particularly as major financial institutions and fintech platforms continue to show interest in this asset class.”

Bitcoin’s adoption may continue to widen as investors see the decreased prices as an opportunity to gain some exposure and to diversify their portfolios. However, a long-term view is needed to assess the outcome as the pandemic continues.

“There should be more speculators out there allocating part of their portfolio to bitcoin, but I don’t think we’re going to necessarily see that in the coming weeks,” Dibb said. “I think we need to look at a little bit of a longer time frame before that happens and measure on that basis.”

Full Transcript

Angie Lau: Welcome to word on the block, the series that takes a deeper dive into the emerging technology that shapes our world. It is what we cover on Forkast.News. I’m Editor-in-Chief Angie Lau. Now on this episode we follow up on the very current piece on Forkast.News that’s making the rounds from Matthew Dibb, COO of Stack.

This is an Asia based platform of cryptocurrency index funds. And we’re going to dive a little deeper now into his piece on bitcoins’s black swan event. You know what we’re talking about here, it’s Covid-19, it’s taken investors, markets, sentiment and confidence by storm, a massive hit on the overall global economy. And it’s really begging the question: should cryptocurrency investors and stakeholders worry? So, Matthew Dibb, welcome.

Matthew Dibb: Hello, thank you very much for having me.

Lau: It’s great to have you on. You’re a veteran in capital markets, Matthew, with more than a decade worth of experience, including beginning your career at Macquarie bank. You cut your teeth in trading derivatives, then expanded into investment equity, small cap analysis, venture capital. So you’ve really participated in traditional markets.

So this is where we find ourselves here. You’ve tracked bitcoin, other cryptocurrencies, I think there’s two realities we’re talking about, pre-Covid and — we’re in the thick of Covid-19 right now. But really, when it was back to a pre-Covid world, bitcoin and cryptocurrencies really served as more of an alternative asset or a hedge play, really uncorrelated to the markets. We can’t say that now though.

Dibb: Yeah, I think people have different views about this and day in and day out investors and speculators are talking about, risk on risk off with bitcoin and cryptocurrencies, or today it’s tracking the SPX and it’s fine, and tomorrow it’s not. We need to take a step back every now and then because we talk about correlated assets. But we can’t really just look at a period of two or three weeks can we, and we can’t really look at a period for this at the same time, for example, [as] safe havens for [just] two or three weeks.

It’s more important to have a look at a longer period of time. And I think people are getting caught up a little bit because when we go back to the last two to three years of looking at cryptocurrency, and for the purpose of this I’ll talk about bitcoin, it really is still an uncorrelated asset. Now that doesn’t mean that it’s inversely correlated to the SPY or anything like that, but it is uncorrelated at that period of time. So I think too many people are probably getting a bit too caught up in what’s happening day to day within these moves of cryptocurrency.

Lau: Well, truly, that is a fair point. The markets are behaving in such a way that we’ve not seen. When U.S. Treasury markets are experiencing illiquidity, that’s a true concern, we’ve not seen the kind of stimulus efforts from central banks around the world in such a concerted effort. These are unprecedented times. So having said that, how is Stack Funds, through which you launched your Bitcoin Index Fund earlier this year? How has it been impacted since Covid-19 started to really take shape and hold of global market concerns?

Dibb: It’s been pretty interesting, a wild ride in fact. We saw a huge increase in commitments and subscriptions leading up to this insane period. A few weeks ago when we saw that pretty substantial drop, we’ve seen a little bit of hesitation amongst some of these different investors. At this point it’s important to note that our target market for investors is more so family offices and venture capital and institutions. So looking at more of a traditional point of view, our feeling in what we’re observing right now is that demand is certainly there, particularly those that were on the sidelines and looking to get in at a cheaper price, particularly for bitcoin.

However, at the same time, we need to realize that bitcoin is still considered an alternative asset. It’s there with gold, as some people like to compare it to, but it is still an alternative asset. So when you have family offices or VC funds, traditional hedge funds that are in the equities market, right now they’re trying to put out fires left, right and center on the other 99% of their portfolios. So then trying to have such a market focus on bitcoin when they have the rest of their portfolio to look after in these very, very strange and volatile times can be a little bit difficult. And that’s, what we’ve noticed over the last few weeks. Demand is definitely there. The real question is, is it time for them to pull the trigger? Is it a green light for some of these investment companies that have been sitting on the sidelines? We think that time is certainly approaching.

Lau: Well, there’s one thing about Covid-19 that I don’t think anyone can predict, which is the massive scale of how big this impact is going to be on human lives. Since you wrote that article, those diagnosed with Covid-19 have surpassed 1 million around the world. How is cryptocurrency on the tier of priorities, as you’ve said, the family offices, where do you think cryptocurrency actually lies for people?

Dibb: Very tough one, isn’t it? From our perspective, as I said before, I think the highest priority right now is the large majority of their portfolio of liquid assets being equities as well as bonds. Now at the moment there seems to be this fight between ‘goldbugs’ and ‘bitcoiners’ or cryptocurrency, and much like even crypto, we’ve seen gold take a pretty substantial hit over the last couple of weeks and now come back up, same as bitcoin as well. So to answer your question, in terms of priorities, it’s really hard to say bitcoin looking at it today, as of right now.

We saw volatility in Asia where it hit that 7,200 to 7,300 [price point], and now it’s come back down. People are waiting for this confirmed breakout to really make a decision as to whether we’re back in an uptrend or not from a technical basis. So I would say to you that there’s most definitely a lot of people still on the sidelines looking at liquidity amongst a lot of the exchanges, particularly BitMEX over the last few weeks.

We’ve seen volumes drop, and so I think there’s no doubt that the market is much thinner than what it was. The large drop that we saw was effectively a long squeeze. The market was very heavily leveraged at that point in time. And that cascade of liquidations has really put a lot of different investors out of the market right now. So we are dealing with lower volume. I think there is a little bit of nervousness as to which way we go now. But the thing that we’d like to say is that if you are a longer term investor then we believe that around these levels is certainly a great place to get set. And that sort of ideology is quite consistent with the investors that we’re dealing with at the moment.

Lau: And so this black swan event is certainly not just Covid. What’s the other thing on the horizon for bitcoin?

Dibb: For bitcoin, in the short term we’ve got the halving coming up.

Lau: Explain the halving for people who are unfamiliar with the term or the event.

Dibb: Essentially, every few years the reward from miners is essentially cut in half. We’ve got this mechanism that’s built in to what Bitcoin is, and this has happened a number of times. It’s a difficult one to talk about because we can say with some confidence that the market should perform pretty well based on this halving. Miners are out there and it’s getting harder and harder to mine the same amount of bitcoin and anybody with half a mind in economics can say, well, the price should go up. Unfortunately, there’s not a lot of history to go by on this because it hasn’t happened that often.

The times that it has happened, we actually generally see bitcoin appreciate after the fact, not necessarily leading up to. So from our perspective, we do believe that this is going to have an effect on the price of bitcoin. Many people right now will be asking the question to themselves; is it already priced in? Could it be priced in based on the fact that the market is currently moving up again? These are all really unknown unknowns as we like to call them. From our perspective we still see it as of the next 6 to 12 months as a really bullish catalyst for basically a pop of bitcoin of over 10,000 again.

Lau: Well the interesting thing is that the market dynamics is such where Covid-19 has really dampened every industry including miners. Some mining companies have thrown in the towel. The price of bitcoin with the halving coming up, it doesn’t make business sense to stay in business. Is that a good or bad thing for the industry?

Dibb: Sure, there’s a lot of speculation that miners can turn off their rigs up to 4,800 or break-even price. That happens for some of them. That’s their type of business model, but for many, they’ll continue to produce at a loss as well. They’ll continue to mine at a loss even if it did go down further. So you can look at that both ways. Covid in recent weeks has basically affected everything from safe havens, risk on risk off assets, pretty much everything. There hasn’t been anywhere to hide except for bonds essentially.

Honestly, if we saw the equities market continued to fall in increased volatility, you can’t see with any certainty that bitcoin will be safe. You can’t say with any certainty that miners would be safe or that they would stop mining to hopefully bring the bitcoin price up. Again, I think that we’re still in extremely volatile times and that’s going to continue to happen. That will continue to occur over the coming few months.

Our view right now is that this Covid-19 epidemic is going to last a lot longer than anyone really thinks. And so from an investment point of view, when we talk about bitcoin and cryptocurrency trading, in and out every day is pretty hard. We look at this as a get set in dollar cost, average approach to longer term investment, because I think any other way right now is extremely difficult. We’ve seen that amongst a lot of the traders in the industry, a lot of the funds in the industry that had a really hard time with this volatility and who knows what’s around the corner.

Lau: So it sounds like what you’re saying is that investors right now don’t want to catch a falling knife as they say in the business. You don’t want to try to get in and out of the volatility but if you do want exposure you might find your own personal strike price and then go in, but then expect to hold it based on your own short or long term horizon?

Dibb: Yeah, you don’t go all in at today’s price, 100% of your capital allocation into bitcoin if you’re a new investor. We like to be quite objective, the market is surprising. Our investors, as part of Stack, seek to get in for a number of years, not a number of months. So, bitcoin being the cheapest that we’ve seen in quite some time, it’s great. Take some exposure now. However, would you really be surprised if it went back down at 5,000 in a month? We don’t want to sound bearish but short term fluctuations are definitely there. There’s a lot of uncertainty across all markets, not just bitcoin.

Lau: And so then how do you take in also central bank actions from around the world, the Federal Reserve trying to shore up the U.S. economy, jobless claims coming in record highs more than 6 million Americans now filing for jobless claims. How is this affecting the cryptocurrency markets in the foreseeable future — and by foreseeable three to six to even 12 months.

Dibb: It’s a hard one to answer because the real question is how’s it affecting the equities markets right now? Jobless claims came out and the market started going up once again and then we’ve seen some more volatility down overnight and the market’s really unsure as to what to do with these figures. One thing remains constant and that is the stimulus that’s going into the economy. And once again, we can speculate on how that’s going to affect the markets.

Is the Fed going to stop buying up ETFs and equities from balance sheets? Who knows? Again, it’s all short term, but a lot of people right now are looking at bitcoin’s time to shine. If there’s a time for it to appreciate, if there’s a time for it to really prove its worth, it’s now, and hopefully over the next six months we’re going to see that. I think that the very nature of what bitcoin is, it really should be getting a lot more adoption. There should be more speculators out there allocating part of their portfolio to it. But I don’t think we’re going to necessarily see that in the coming weeks. I think we need to look at a little bit of a longer time frame before that happens and measure on that basis.

Lau: Well, there’s two perspectives, right? The first perspective is if you’re an investor, you want to diversify your portfolio. You want to have a foot in every asset class and this is an investment play for you that diversifies all of your assets. And the second one is, is this a currency? Is this an answer to a system that has been shaken to its core first in 2008 and now definitely in 2020. And what is the promise of what a system looks like with cryptocurrency? I think these are two very distinct points of view.

Dibb: It’s pretty hard to say that, is bitcoin money right now? Is it currency? Is it being used for the purpose in which it was invented? I would argue at least for the time being, I’m not saying it’s going to continue being like this, but bitcoin is currently for speculation. It is more of a store of value. It is more of a safe haven than it is a currency in our opinion. Look at the market and the infrastructure that has been built around it so far. We’re looking at large players like the CME and CVOE come in. The infrastructure around trading custody, it’s all there and more of it is coming.

But if we look at the amount of interest and demand for adoption of payments to it, it’s not quite there. So I think before it does get to that level, and it would be great out of this whole mess that has happened, bitcoin ends up really proving some relevance as a currency. But how could that possibly be right now with the amount of volatility associated with it? I think that’s what we keep coming back to is stablecoins. They’re getting a lot of traction, it’s great. Bitcoin however is not seen in the same light. It wouldn’t be a great way to try to bring investors in on that basis either, because it purely is for speculation at this point in time.

Lau: Well, I’ve asked your professional view, let me ask your personal one. Have you increased your ownership of bitcoin and cryptocurrency?

Dibb: I have, yes. Over the past 6 to 12 months I have really become a bit more of a maximalist you could say. We have traded everything in the past from alt coins to ICOs, pretty much everything. But what we’re seeing particularly in terms of liquidity shifts in terms of where the market is looking at, it’s purely bitcoin, and we’ve increased our allocations personally on that basis. Realistically, if we look at, for example, the interest from say institutional investors, what we’ve noticed is that all they really do know is bitcoin right now.

So it is a bit of an education issue because do they know Ripple? They might have heard about it, but do they know about Ethereum and Cardano, any of these? Not really. So the interest there in terms of if you look outside of the crypto sphere — people that are already part of the cryptocurrency industry — really all they know about is the Bitcoin outside of that. So that’s where we’re seeing most of this interest.

Lau: Well, everyone would like a crystal ball but I’m afraid they are as rare as canned goods these days. But I hope you’re well. Thank you so much for the article on bitcoin’s black swan event, which you can find on Forkast.News, and certainly digging a little deeper here on this podcast with me. Matthew Dibb, thank you so much and stay safe and well in Singapore.

Dibb: Thanks for having me, really enjoyed it.

Lau: All right, and thank you everyone for joining us on this latest episode of Word on the Block. I’m Forkast.News Editor-in-Chief Angie Lau, until the next time.