More than 50% of cryptocurrency owners regard crypto as a source of income, with 15% considering it as their primary source of income, according to a report released today by Binance Research. Binance is the world’s largest cryptocurrency exchange by volume.

Cryptocurrency investing is still viewed as a hobby or for personal interest by 48% of retail cryptocurrency owners, noted the “2021 Global Crypto User Index” report, which was based on an open online survey of over 61,073 crypto users across 178 countries and regions. The survey was conducted between Sept. 15 and Oct. 25 last year — prior to bitcoin breaking above US$15,000. Bitcoin is currently trading around US$31,000.

The report also highlighted the concentration of wealth in crypto by crypto users — 57% of users had more than half of their portfolio in cryptocurrencies, mainly as part of a long-term investment plan.

The total number of global crypto users grew to 101 million in the third quarter of 2020, compared to just 5.8 million in the second quarter of 2017, reported Binance Research.

Bitcoin’s dominance

Unsurprisingly, bitcoin (BTC) dominated crypto users’ portfolios — the cryptocurrency was held by 65% of users who own any crypto, with 30% of BTC owners allocating 1% to 20% of their crypto portfolio to the digital asset, according to the report. The total global cryptocurrency market cap now exceeds US$941 billion, with bitcoin’s market cap at more than US$581 billion at the time of publication, according to crypto data aggregator CoinGecko.

See related article: Binance’s CZ on bitcoin prices: Is crypto in a bubble or bull run?

Retail interest in cryptocurrencies has grown significantly around the world following high profile moves by companies such as MicroStrategy, Square and MassMutal to add cryptocurrency to their portfolios. Global online payments platform Paypal’s announcement in October 2020 that customers could buy, hold and sell bitcoin and other virtual currencies using their PayPal accounts brought the nascent asset class to its more than 300 million consumers and merchants, demonstrating the utility of cryptocurrency in e-commerce.

Today, we are announcing the launch of a new service that will enable customers to buy, hold and sell #Cryptocurrency directly from their PayPal account. https://t.co/QS6JRmG9hs pic.twitter.com/uHBatfZkbF

— PayPal (@PayPal) October 21, 2020

Binance co-founder and CEO Changpeng Zhao — popularly known as “CZ” — told Forkast.News in an recent interview that “especially given the high profile institutions coming in the U.S., worldwide, there are many institutions coming in now…. They have to manage their corporate treasuries. They’re now allocating into bitcoin or other cryptocurrencies,” he said.

“And then this kicks off a race — that’s the institutional race right now that we’re seeing in North America and also in the rest of the world,” Zhao added. ”Then once the price starts to go up, all the retail guys flood in as well, because everyone wants a piece of the rising value.”

Drivers for crypto adoption

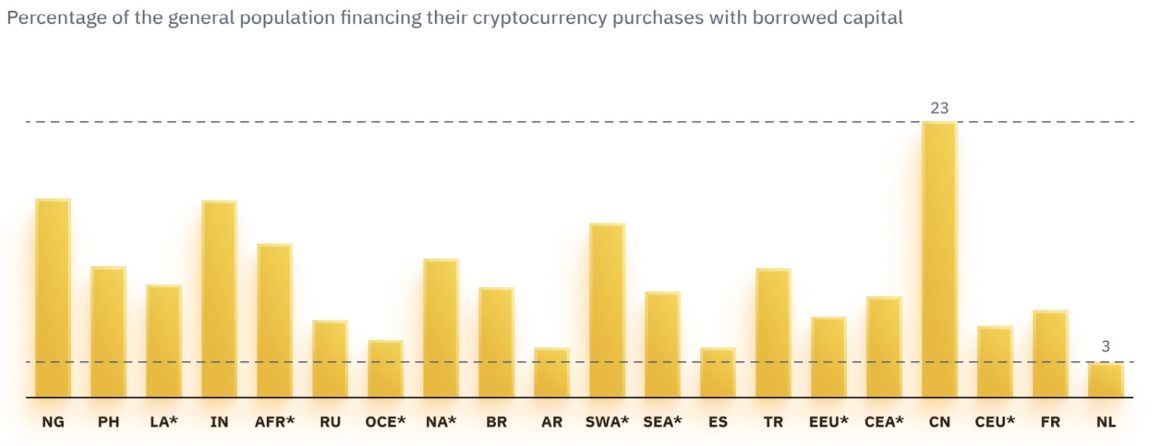

Financial freedom was a common reason cited by users for crypto adoption, and crypto users tend to be a well-heeled bunch. The majority of users (63%) reported buying crypto with disposable funds. Debt financing of cryptocurrencies was the most common in China, with 23% buying crypto with borrowed capital, and least common in the Netherlands. Only 3% of Dutch respondents said they bought crypto using borrowed funds.

“We’ve seen borrowing and lending balances increased by 10 times [in 2020], gone from US$1 billion of assets to about US$10 billion of assets being lent out in the space,” Richard Byworth, chief executive officer at Diginex, a Nasdaq-listed company with a cryptocurrency exchange, told Forkast.News in a recent interview.

“I think with the growth of bitcoin, other cryptocurrencies going into [2021], we’re likely to see those balances increased by another 10-fold. This is what you really need for a developing asset class — you need to be able to borrow these assets so that you can short them or you can provide them for positions, for financing, whatever it might be. That’s how we see the industry evolve and grow.”

Some 60% of crypto users stored their digital assets on exchanges, with security of the platform as a key consideration. The report noted that those who took out loans to buy cryptocurrencies were 10 times more likely to store the cryptocurrencies on exchanges than respondents who used other sources of funding.

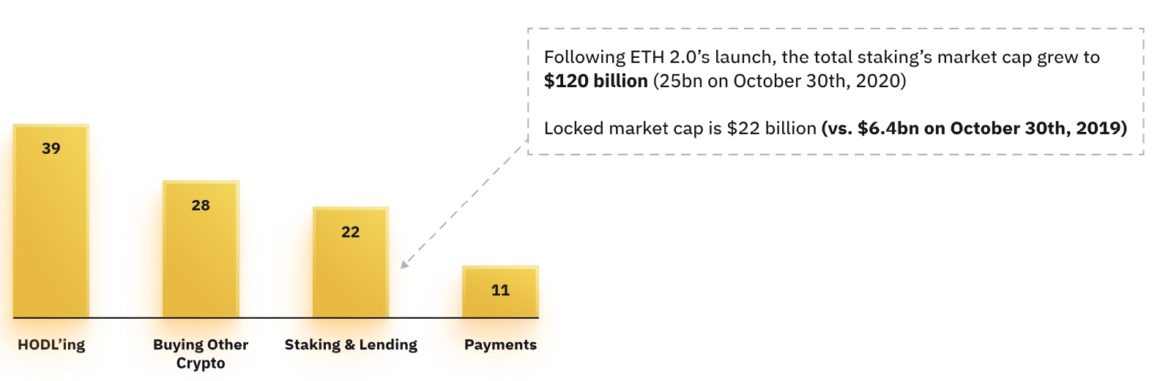

According to the report, the use of crypto was dominated by holding (or “hodling,” in crypto lingo), followed by staking and lending, and payments.

The use of cryptocurrencies for payments in day-to-day life is still not commonplace, according to this survey. Only 11% used cryptocurrencies for payments or money transfers, such as remittances.

Part of the reason could be a country’s legal barriers to cryptocurrency use.

For example, “China’s third-party payment service will not accept digital currency or digital assets still, because China’s financial regulation is quite strong — they control almost every kind of [financial] scenario,” said Jun Li, founder of Ontology and co-founder of Onchain in an earlier interview with Forkast.News. “And traditional financial services are also convenient enough. We already have digitized services — we have third-party payments, cards… So that is unlike [the situation in] the United States,” he said.

The adoption of decentralized finance (DeFi) — one of the biggest cryptocurrency trends of 2020 — was also highlighted in the report, with 66% of surveyed users saying that they used DeFi applications. DeFi was most popular in Southeast Asia, where more than 54% of those surveyed used decentralized applications, compared to 7% of crypto users in China.

Despite its explosive rise in 2020 fueled by the popularity of decentralized exchanges (DEXs), DeFi still represents a small sliver of the nearly US$950 billion total cryptocurrency market.

According to a recent report by ConsenSys Codefi, user adoption of DeFi applications continues to grow and monthly volumes on DEXs have reached an all time high, surpassing $30 billion, approximately double of that in September 2020. The market cap for DeFi now exceeds US$45 billion and the total value locked in DeFi protocols has surpassed US$25.7 billion. The ConsenSys report predicts that new products such as tranche lending products and ETH2 derivatives further increase the accessibility and variability of DeFi.

But Binance’s Zhao isn’t quite as bullish on DeFi, for now.

“We’re seeing the first iteration of DeFi right now….And as in any industry, there’s a very high chance of failure. Most DeFi projects probably will fail. There will be a few that will be successful and a very high likelihood those are going to be second generation DeFi projects,” Zhao said. “At the same time, if you look at the population mass adoption as a whole, 99.8% of the population still don’t have crypto of any kind.”

“When we speak about DeFi, we’re talking about the marketplace in that 0.2% market share,” Zhao added. “The rest of the world are still figuring out how to buy bitcoin, and those guys are going to go on a fiat to crypto exchange to buy bitcoin.”