Layer 1 blockchain Waves, which has been mired in a liquidity crisis, will go ahead with a revival plan recently approved by the community behind its decentralized finance (DeFi) lending protocol Vires.Finance, to allow certain account holders to withdraw funds or keep their positions for later repayment.

See related article: Waves’ Neutrino USD loses peg amid price manipulation allegations

Fast facts

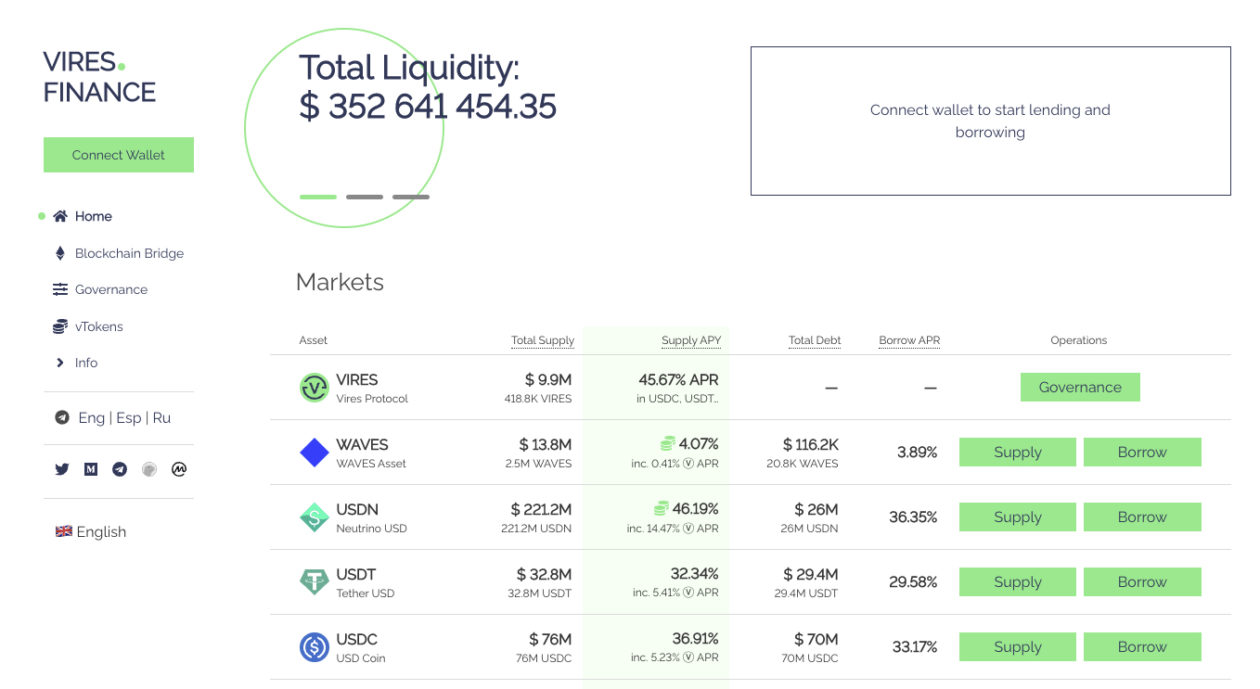

- The price of the blockchain’s native token WAVES and its ecosystem’s stablecoin USDN dropped drastically in April following price manipulation allegations.

- USDN depegged from the dollar in April, triggering a liquidity crisis.

- As a result, the Vires.Finance team submitted a proposal to have users who hold over US$250,000 to choose to exchange their position for USDN with a 365-day vesting period and a 5% liquidation bonus, or keep their funds in USDT or USDC on the platform with a 0% annual percentage yield and receive repayments depending on market conditions.

- The proposal was voted on and approved on Friday, according to the lending protocol’s website.

- USDN was changing hands at US$0.9903 at 10:30 a.m. HKT on Wednesday, while WAVES was trading at US$5.6, down from an all-time high of US$62.36 on March 31, according to data from CoinMarketCap.

See related article: Recovering crypto from insolvent companies may be easier than you think