U.S. regulators have unveiled a new bill that would define Bitcoin and Ether as digital commodities, placing them squarely under the jurisdiction of the Commodities and Futures Trading Commission (CFTC) alongside other commodities such as corn and aluminum.

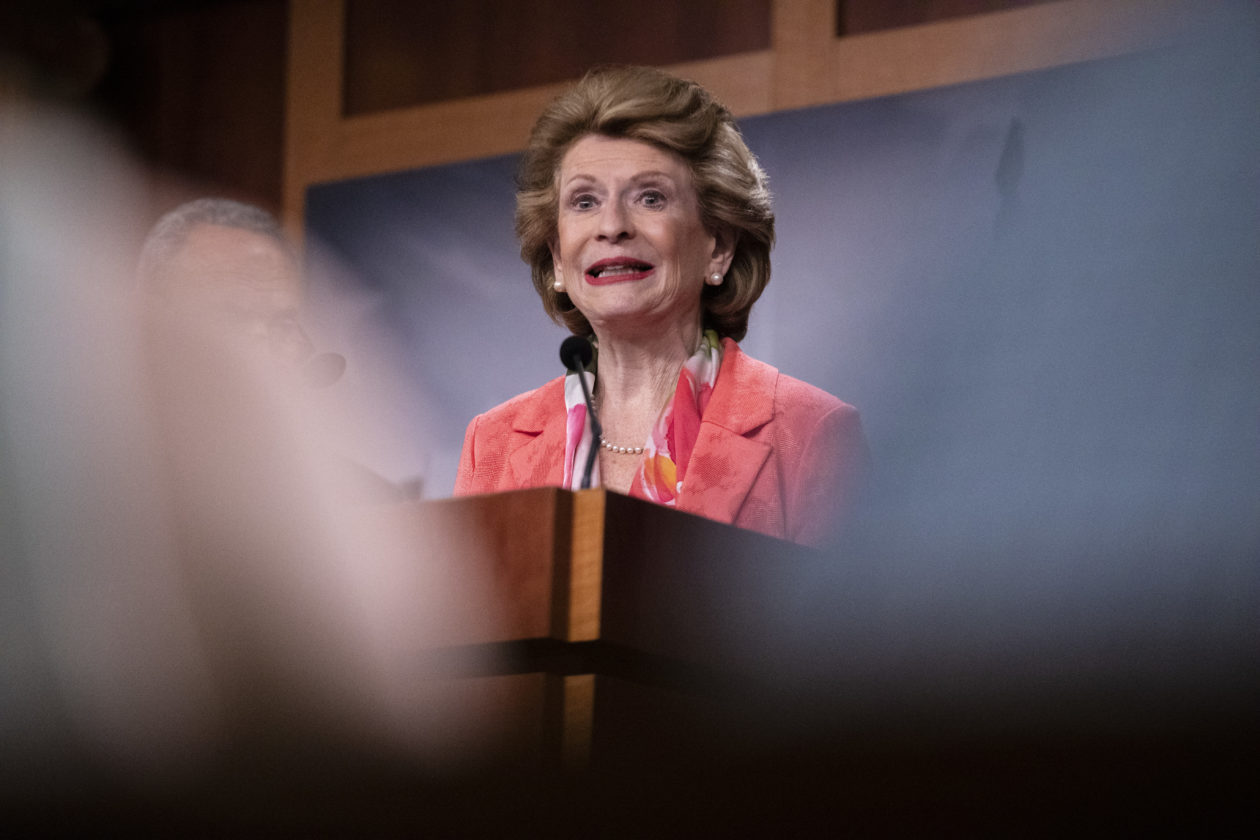

Senate Agriculture Committee Chairwoman Debbie Stabenow and the committee’s top-ranking Republican John Boozman released the plan on Wednesday as lawmakers around the world race to regulate crypto in the fallout from the collapse of Terra-LUNA.

If implemented in the current form, the bill would cement the CFTC’s oversight of the industry and put to rest any jostling by US regulatory agencies, including the Securities and Exchange Commission (SEC) to police the emerging industry.

“It will go some way towards clarifying what is at the moment a relatively ambiguous legal landscape in the US where you have — certainly at the federal level — an absence of clear rules applying to crypto assets and crypto activities,” said Hagen Rooke, financial regulatory and fintech specialist and partner at Singapore-based law firm Reed Smith, in an interview with Forkast.

The bill also outlines that any security cannot simultaneously be labeled as a commodity, firmly placing those within the purview of the SEC.

U.S. regulators have been using a legacy framework, which was designed without cryptocurrency in mind, to regulate cryptocurrency. This has resulted in a lack of clear guidance over which agency is responsible, leaving investors without clear protections in the case of fraud.

Industry ‘relieved’

According to Rooke, the industry will also be “relieved” for crypto to fall under the purview of CTFC.

“The industry’s been suffering from what it calls the SEC’s regulation by enforcement, where the SEC has sort of come down on various players quite hard with various types of enforcement action and fines.”

SEC Chairman Gary Gensler reiterated the agency’s attempts to bring crypto exchanges under its purview last week, urging them to “register where appropriate as securities.”

This is the second major piece of U.S. legislation to be proposed in recent months. A bipartisan bill about stablecoins was announced in June and due to undergo a vote in July, but the vote has been delayed by several weeks.

The stablecoin bill would also classify many cryptocurrencies as commodities and also provide guidance on regulating stablecoins.

Any bill that would help define cryptocurrency in the U.S. could have far-reaching impacts, said Michael Bacina, a digital law specialist and partner at Australian commercial law firm PiperAlderman.

“The United States, due to their market size, set standards which are often adopted by much of the Western world,” he said. “Passage of a bill of this nature would help other countries when deciding how to define digital assets and how to approach regulation of exchanges.”

Europe’s tough stance, Asia’s mixed bag

European lawmakers are taking a more hardline approach to crypto regulation than their U.S. counterparts, legislating in late June to trace the transfer of crypto assets to address money laundering and terrorist financing. The European Union also voted down a bill in March widely described as an anti-Bitcoin mining bill.

But some parts of Asia are ahead of the U.S. in regulation.

Singapore has a framework defining digital payment tokens as regulated products separate from other regulated tokens such as securities. Hong Kong has an upcoming mandatory licensing framework for virtual asset exchanges, which are also classified as separate to securities.

“In Asia, I suspect there wouldn’t be as much of an immediate impact because actually this proposed framework is quite similar to many frameworks that already exist in Asia,” said Reed Smith’s Rooke.

Following the significance of the fall-out from the collapse of South Korea-based Terra, South Korea announced the launch of a Digital Asset Committee in June to rein in the crypto industry.

Other countries, such as the Philippines, have been slow to take a definitive stance on crypto regulation. But the Philippine SEC has urged Filipinos not to invest with unregulated companies such as Binance.

“The Philippine SEC has not treated the potential securities law implications in relation to the products that Binance is offering,” said Rafael Padilla, cofounder of BlockDevs Asia, in an interview with Forkast. “Which tells me that the Philippine SEC might still be studying and investigating the nature of the various products being offered by Binance.”

Law specialist Bacina said that digital assets may be financial products if they have certain features added to them or are marketed in a particular way, but remain commodities at their core.

“The starting point [for addressing regulation] needs to be clear,” he said, “this legislation helps provide clarity on at least one point.”