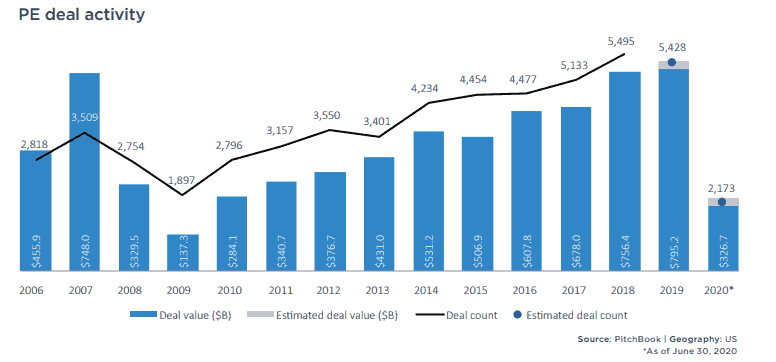

The second quarter was a bleak one for private equity investors as the Covid-19 pandemic cancelled many planned exits and put a chill on the market, pushing down PE deal value to levels not seen since 2011 — a time when the world was still recovering from the Great Recession, according to a new report from PitchBook, a investment data aggregator.

During the first half of 2020, U.S. PE firms closed on 2,173 deals totaling $326.7 billion, which pushed deal value down by nearly 20% compared to the first half of 2019, according to research from PitchBook. Quarterly figures show an even steeper fall, with Q2 2020 deal value down more than a third from Q2 2019 values.

“Many GPs sought to pull out of previously agreed upon deals, sometimes invoking the material adverse change (MAC) clause,” writes Wylie Fernyhough, a PitchBook senior analyst, referring to General Partners — the executives at funds — deciding to pull the plug on deals using a clause of last resort. “Of the deals that were completed, a high proportion were add-ons and subsequently smaller on average than platform deals.”

Looking forward to the second half of the year, PitchBook expects private equity firms to double down on investing in technology. The report notes the frequency of due diligence processes picked up near the end of H1, a sign that deal activity could be set to increase.

“The sector has proven to be resistant to recession during the pandemic and is the most represented sector in terms of minority transactions, something we believe will be more common while valuations are suppressed,” Fernyhough writes.

According to PitchBook’s data, during the first half of 2020, just under 20% of all PE deals have been in tech, and they represent just over 30% of deal value.

In a parallel report highlighting the venture capital activity of private equity funds, PitchBook highlights that fintech has been a bright spot for fundraising during the pandemic.

Stripe, for instance, raised an $850 million Series G round led by Andreessen Horowitz, General Catalyst and Sequoia. This represents the U.S. fintech VC’s largest deal since personal finance platform Social Finance Inc.’s $1 billion Series F in August 2015.

The report notes that the value of exits for VC-backed fintech companies across North America and Europe jumped to $5.6 billion during the first half of the year as big, bold bets dominated dealbooks. Alternative lending — a segment that many challenger banks were beginning to pursue — has seen some challenges as macroeconomic pressures push borrower’s credit worthiness down.

In the digital asset space, financing is still down compared to the mega-year that was 2018, but all-things-considered Pitchbook notes it’s off to a strong start in 2020. During the first half of the year, $809 million was raised in the digital asset space, dominated by two mega-deals: $300 million by Bakkt, an on-ramp for buying and selling digital assets, and $200 million by Ripple, the international payment platform.

Going forward, regulations will drive future innovation during the first years of the 2020s, according to the authors of the report.

‘Survival’ is the theme in China’s market

In China, the PE market tells a similar, but slightly different story as small and medium firms die off or get gobbled up by large companies, or whatever remains available for private equity investment.

A report from Zhongtong Capital shows that 1,606 PE deals closed in China during the first half of 2020 compared to nearly 10,000 in 2015. At the end of May, total deals closed added up to 14.35 trillion RMB (or about US$2.1 trillion).

According to another report by China Venture Investment Consulting Company, only 11% of all VC/PE capital available went to startups. The report notes that 67% of all committed capital went to firms that were already profitable. More and more companies considered alternative funding mechanisms during the first half of the year to make up for the shortfall.

Given that the “new normal” of Covid-19 means fewer in-person gatherings, the report noted that online education was the growth story of the year, and investors eagerly sought out opportunities in the space, followed by healthcare. Semiconductor companies also were big targets for investors, and the prolonged trade war between the U.S. and China has accelerated efforts for homegrown supply chains.