In this issue

- Tether and Bitfinex get 30-day legal breather

- Bitcoin ‘double-spend’ report was in error

- Brave browser users can now access Web 3.0 content via IPFS

- Bank of International Settlements: CBDCs are of ‘critical importance’

- China to add digital currencies and stablecoins to blockchain network

From the Editor’s Desk

Dear Reader,

Another week of extremes.

From the latest in the Bitfinex / Tether investigation by the New York Attorney General’s office to central bank-backed digital currency initiatives by BIS (the central bank of central banks), there doesn’t appear to be a consistency of tone when it comes to blockchain. That’s what makes it incredibly interesting for us to be covering this space at Forkast.News.

What’s becoming more clear by the day, is that blockchain as a technology is also a startup ecosystem that is coming into its own. It takes all the stress points that we are experiencing online on a daily basis, and offers up new solutions either via protocols or products. The ecosystem is developing new tentacles by the day, extending its reach. Governments and global entities are paying attention, and some like China are actively building out technical infrastructure to support this innovation. It is the first page of a new playbook being written here in Asia.

This week’s curated top stories reflect the polarity of welcome for this emerging technology. While new investors arrive by the day and get excited about new all-time highs, they’re also getting spooked by a single tweet over an issue that turned out to be a technicality of bitcoin. What is clear is that everyone is playing catch up — as new developments, insights and innovations emerge every day. The dust is far from settling, and it explains not only the volatility we see in bitcoin prices, but also the frenzy of sentiment from all the various stakeholders.

Just another day in blockchain.

Until the next time,

Angie Lau,

Founder and Editor-in-Chief

Forkast.News

1. Temporary legal reprieve for Bitfinex and Tether

By the numbers: Tether — over 5,000% increase in Google search volume.

On Jan. 15, iFinex, the parent company of stablecoin issuer Tether and cryptocurrency exchange Bitfinex, was supposed to provide all documents to New York state’s attorney general in response to a court order in the government’s fraud case alleging that Bitfinex covered up the loss of customers’ funds through a US$850 million loan from Tether. But iFinex legal counsel Charles Michael, a law partner at the firm Steptoe, won a 30-day extension to produce supplementary documents. DigFinex, a company registered in the British Virgin Islands is the majority owner of iFinex.

- The investigations kicked off in April 2019, when the NYS Attorney General Letitia James filed a court order against iFinex, putting the company under investigation for fraud. Subpoenas were issued to Bitfinex and Tether in November 2018.

- Over time, Tether’s stablecoin USDT — the world’s largest stablecoin by market capitalization and daily transaction volume — has come under increasing scrutiny and criticism. Its claims to be 1:1 backed by the U.S. dollar have not yet been proven nor disproven.

- Deltec Bank deputy CEO Gregory Pepin, whose Bahamas-based bank offers banking services to Tether, recently told journalist Laura Shin that he can confirm that the stablecoin is fully backed by fiat reserves.

Forkast.Insights | What does it mean?

Tether (USDT), was created as a way to digitize the U.S. dollar to be used on centralized cryptocurrency exchanges. The stablecoin serves three main purposes — to act as a portable unit of exchange that is pegged to the U.S. dollar, to serve as a gateway between different cryptocurrencies, and to be a gateway between crypto and fiat. USDT is highly leveraged on crypto exchanges, particularly in Asia.

As Tether is under investigation by the state of New York for allegedly committing fraud and making false claims, Tether’s parent company iFinex — which also operates the crypto exchange Bitfinex — has continued to delay proceedings, which is worrying to say the least for the cryptocurrency community.

The main problem with USDT is that it is no longer fully backed by USD as Tether initially claimed. The company has silently changed the peg of its stablecoin, and now Tether’s is instead pegged to a basket of assets that includes “loans made by Tether to third parties” that are subject to the risks like default and insolvency.

In other words, Tether’s underlying reserve could include virtually anything. Furthermore, as yet, there are no applicable accounting or auditing standards for the cryptocurrency world and therefore no way of knowing whether Tether is telling the truth.

The market has grown to a point where truth may be dangerous to an entire industry. If indeed the New York fraud investigation turns into criminal charges against Tether and Bitfinex (both of which have Hong Kong roots), the real question will be whether it will shake the confidence of the market to its core.

Stablecoins play a critical role in providing collateral and thus liquidity in cryptocurrency trading. If critics of one of the biggest stablecoins in the world are proven right, that fiat reserves don’t match the full digital value, one must be worried about the “run” we may see on this digital bank and the drain we could potentially see from the market.

At the start of 2020, the total value of stablecoins in the market was about US$5 billion. It now stands at US$34.6 billion as of publication. This market is becoming almost too big to fail. If it does, a lot of people will get hurt beyond New York’s original accusation of misappropriation of funds against New York-based investors. One wonders if the 30-day reprieve buys a little more time for both sides to figure out how to deal with any potential fallout as the industry watches with one hand on its collective digital wallet. This must be managed delicately.

2. You can exhale now: No bitcoin double-spending after all

By the numbers: Double spend — over 5,000% increase in Google search volume.

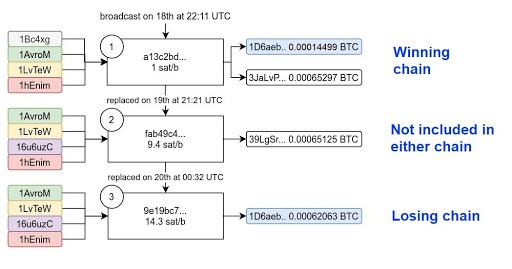

Bitcoin briefly tumbled to below the US$30,000 mark before recovering back above this mark. The reason? According to media reports, a “mass sell-off” was triggered by a tweet sent out by BitMEX Research suggesting that BitMEX had detected a possible double-spend of around 0.00062063 BTC. BitMEX Research clarified in a subsequent tweet about 30 minutes later that the suspected incident of double spending was actually a replace-by-fee (RBF) transaction. This could happen when an older unconfirmed transaction is replaced with a new version of the transaction with a higher transaction fee.

- Coin Metrics network data product manager Lucas Nuzzi was one of the analysts who broke down the events of Jan. 18. Nuzzi documented that a user broadcasted a bitcoin transaction with low fees, which delayed the verification as miners prioritized transactions with higher fees.

- The user then made a RBF transaction on Jan. 19 as his or her transaction still hadn’t been verified, meaning the user broadcasted the same transaction — that was stuck and hadn’t actually gone through earlier — with higher fees.

- The bitcoin blockchain was split into two versions until miners reached a consensus on which transaction to favor. In this case, the transaction with the lower fees was selected as the winning chain.

- Double spending is the occurrence of spending the same digital currency more than one time. Previous iterations of decentralized digital currencies have existed, but failed to solve the issue of double spending until Satoshi Nakamoto’s bitcoin white paper proposed timestamping of hashed transactions into a blockchain based on hash-based consensus mechanism, proof of work.

Forkast.Insights | What does it mean?

Double spending? Isn’t that exactly what blockchain should be protecting cryptocurrency against? Isn’t that why crypto is supposedly safer than fiat?

It’s the equivalent of digital counterfeiting.

One can only imagine the race to the doors on this one tweet from a certain BitMEX researcher stating that’s what was seemingly found, only to clarify later it was a bitcoin trader who didn’t offer enough fees to miners to record the transaction. Indeed that’s what we saw in the markets, albeit temporary. It also shows a jittery, and still relatively fresh new group of investors who are jumping on the BTC bandwagon. What is the underlying technology that provides the floor of value to cryptocurrency?

There’s a lot of theory still that a lot of wealth is riding on. Double spending (and the near impossibility of that thanks to computational defenses built into the blockchain) to the 51% attack deemed near impossible (because surely in a decentralized network, one could not amass the 51% dominance of all nodes in existence to push forward an attack). And yet… we’ve seen it repeatedly.

In Forkast.News’ recent conversation with Kobre & Kim partner Benjamin Sauter, whose client Ethereum Classic suffered a 51% attack on its protocol, these attacks are not a hypothetical impossibility. In fact, it is very much possible. Blocks are disrupted. Millions upon millions of dollars stolen. It also shows early code must be constantly updated, and forked. Protocols with clear governance guidelines (that allow consensus changes to code) are better equipped than those that don’t. We have observed and seen it for the last few years in Layer-1 (the underlying main architecture of blockchain) blockchains. New protocols are being developed every day and this is why they still have clear value propositions in an ever-evolving industry.

It also should help you, dear reader, understand why we see so much volatility in this space. There are not only market dynamics at play, but also ones that are built into the code of blockchain. Most investors may only understand the former, but fully aware that the integrity of the code architecture is exactly why people have affixed actual fiat value to crypto.

3. Brave integrates IPFS

By the numbers: IPFS Brave — over 5,000% increase in Google search volume.

On top of the regulatory developments this past week, bitcoin showed the risk of holding Brave, a decentralized web browser, has announced a native Interplanetary File System (IPFS) integration as centralized web services continue to raise concerns on privacy, censorship and availability around the globe. The version 1.19 update to Brave’s desktop browser allows its 24 million monthly active users to access content from IPFS. IPFS is authored by open-source development and research company Protocol Labs, which is also the creator of the decentralized storage network Filecoin.

- This week, Google is also threatening to discontinue its search engine in Australia if it is forced to pay Aussie media companies for presenting their content on its searches. Prime Minister Scott Minister responded to Google by saying, “We don’t respond to threats.” Australian treasurer Josh Frydenberg also hit back, saying that Google and Facebook paying Aussie media for original content is “inevitable.”

- Australia is just one of many countries that are trying to navigate the growing power of centralized servers. “Today, Web users across the world are unable to access restricted content, including, for example, parts of Wikipedia in Thailand, over 100,000 blocked websites in Turkey, and critical access to Covid-19 information in China,” said IPFS project lead Molly Mackinlay, in a statement.

- While Ethereum co-founders reached out to Twitter CEO Jack Dorsey last week in regards to Dorsey’s decentralized social media project Bluesky, Dorsey released an “ecosystem review” over the weekend that revealed cooperation from the blockchain industry, including contributions from developers and engineers from IPFS and Hedera Hashgraph.

Forkast.Insights | What does it mean?

Centralized servers, thy day has come.

Big Tech has its own acronym: FAANG. Facebook, Amazon, Apple, Netflix and Google (now renamed Alphabet) are the firms that make up FAANG — American tech giants that have more than doubled in growth over the last half decade. We’ve also seen the congressional testimonies, user backlash, government push back and cancellations… all leading up to the current state of affairs for centralized servers of digital services that have kept us all busy during these Covid-19 times, stuck at home and virtually dependent. In 2020, the growth accelerated and now may have come to a fulcrum. At the tipping point of that and on the other side is a real alternative, and the promise of blockchain.

We love to hate on our digital addiction. Imagine how you’d feel if all of a sudden you have zero access to your Android or iPhone for a while. And yet users have been surprised by outage failures, including most recently Google and Slack. Cut off access to globally popular apps, and you cut off access to our digital world.

Now Brave (in this digital Brave New World of ours) is on-ramping millions of its users onto Web 3.0 and IPFS. Thanks to the decentralized network, access to content is assured regardless of unilateral decisions by states or firms. It is only the beginning.

4. Brain trust for world’s central banks: CBDCs are of ‘critical importance’

By the numbers: Central Bank Digital Currency — 110% increase in Google search volume.

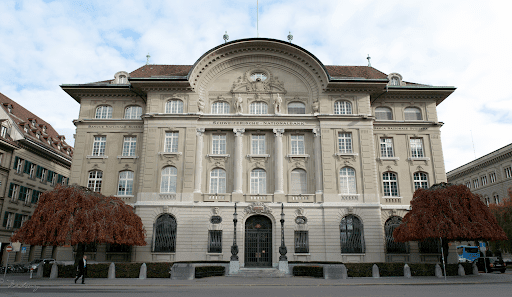

The Bank of International Settlements Innovation Hub (BISIH) has outlined a work program for 2021-22, which identifies wholesale and general purpose CBDCs as one of BISIH’s key themes of “critical importance to the Hub and to the central banking community.”

- The document highlights continuation of existing CBDC projects such as the Swiss National Bank’s Project Helvetia, which is exploring the settling of tokenized assets with wholesale CBDCs, and Project Inthanon-Lionrock, a collaboration between the Hong Kong Monetary Authority (HKMA) and the Bank of Thailand that is looking into using distributed ledger technology to increase efficiency in cross-border payments.

- BISIH is also exploring projects such as distributing retail CBDC through commercial banks and payment service providers through a hybrid CBDC or private CBDC-backed stablecoins. BISIH is additionally looking into establishing an international settlement platform, which would allow central banks to issue multiple wholesale CBDCs for banks and financial service providers to use as a mid-point for common settlement infrastructure.

Forkast.Insights | What does it mean?

The Bank of International Settlements is one of the little known but powerful gems of global finance. Think of it as a bank for central banks. In fact, that’s exactly how it describes itself. As such, the group thinks about how the global monetary system should work together. After all, seamless transactions make for greater efficiency, productivity and all those good things we cherish when the bureaucracy of money becomes as frictionless as possible.

So it is a big deal to know that BIS Innovation Hub is recognizing the hodgepodge of CBDCs that are currently in development. How will each country design its own CBDC? What’s the best practice? What’s built into the code? How will central bank authority and monetary policy be baked into every transaction we choose to make? Monetary policy is to money, what puppet strings are to wooden figurines. And nothing happens in its own sovereign vacuum.

In this initiative, we see Asia clearly in the front seat. BIS Innovation Hub Centres in Hong Kong and Singapore play key roles, alongside Switzerland. Singapore will work on CBDC interoperability — tasked to build an international settlement platform where all transactions, regardless of which sovereign CBDC is used, will be settled. Hong Kong is working on Forex onramps for CBDCs, along with tokenizing green bonds in the area of blockchain-supported green finance — something that the Asian Development Bank is also keen to explore.

We already know that China has a now clear seven-year lead in CBDC, most recently dropping some e-RMB to lucky citizens who can use it to purchase items at local bricks-and-mortar retailers via their mobile phone. ConsenSys, the Ethereum blockchain software development firm, is working with other APAC countries to design their own CBDC. BIH is in the right part of the global neighbourhood to develop its own digital playbook for international settlements.

5. China’s nationwide blockchain network to support CBDC payments

China’s national blockchain service network (BSN) is integrating a digital currency payment network that will support CBDCs and stablecoins.

- In BSN’s 2021 outlook post, BSN announced it will focus on developing a new universal payment network based on blockchain technology, which means developers will be able to pay their gas fees with CBDCs and stablecoins in the future.

- Other BSN plans for this year include adding more public city nodes and portals to expand the current BSN network, and promoting BSN to further build out its ecosystem.

- ConsenSys, the blockchain development company, announced this week a new partnership with China’s BSN, to make blockchain more accessible for government entities as well as other companies. As part of the partnership, ConsenSys Quorum, an open-source protocol layer, will be available in about 80 cities in mainland China through BSN’s public city nodes.

Forkast.Insights | What does it mean?

BSN is a Beijing-endorsed infrastructure network for blockchain that has onboarded protocols like Ethereum, and more recently Ethereum’s Quorum, Polkadot, Oasis and Bityuan. More are coming.

That’s on the back end. But now comes the fun part. On the front end, BSN says it now plans to develop a digital currency payment platform. After all, how can there be innovation and growth without fuel? In any enterprise and commercially-driven society (of which China is no doubt), consumer behavior and activity is at the core of everything. If you thought that the developments in digital payments in China via WeChat and Alipay were enormous (in the West, we’re still playing catch up, and most consumers still get by with credit cards and cash), get ready for one giant playground that will show us all in real time what a fully integrated blockchain-driven societal, commercial and government structure might look like.

What might mass adoption using blockchain to transact on a nationwide scale look like? Keep your eyes on China.