In this issue

- Joe Biden’s $1.9 trillion rescue plan

- What will crypto regulations be like in 2021?

- How not to lose your bitcoin password (don’t ask Stefan Thomas)

- Twitter’s new decentralization initiative

- In China: Conflux scores another government deal

From the Editor’s Desk

Dear Reader,

It was New Year’s Eve. The year was 1879.

An excited 32-year-old Thomas Edison showed off his newest invention to the world: the lightbulb… and the world would never be the same. It wasn’t as if Edison came up with electric lights per se, but he created the first practical and affordable lighting solution for the average person. He made it accessible. And he changed the world — by illuminating it.

As Edison’s light bulb opened up new opportunities — even if it was to provide an environment for continued productivity well past sundown — so, too, is how bitcoin and other cryptocurrencies should be considered in our modern age.

As we enter a new phase of regulatory attention, from blockchain-literate Gary Gensler, who was just nominated to head the SEC, to Christine Lagarde, the European Central Bank president who expressed an outdated and overused cliche that crypto means “funny business,” we should ask ourselves some questions. What opportunities does cryptocurrency create for the average person… beyond buying low, and selling high? How is it changing the world?

We see those opportunities every day, and we cover those stories — where business and enterprise can fund itself directly through its peers, leaving out intermediaries like governments or banks. While it is no doubt important to have a level of order and regulations to provide clarity, fairness, and level of protection to a market; regulators must also be mindful that the world is changing and innovation will always lead the way. If it is useful; if it creates opportunities where none existed before, the invention will thrive and become a new standard.

That day is already here.

Until the next time,

Angie Lau,

Founder and Editor-in-Chief

Forkast.News

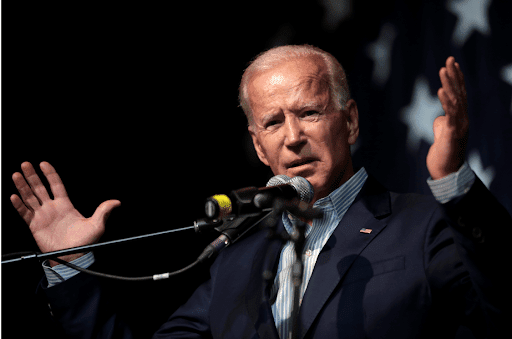

1. Joe Biden’s American Rescue Plan

By the numbers: Biden American Rescue Plan — over 5,000% increase in Google search volume.

A third Covid relief stimulus package may be coming to the United States — which would be the first under President-elect Joe Biden. In addition to Biden’s US$1.9 trillion “American Rescue Plan,” Federal Reserve Chair Jerome Powell pledged that the Fed’s monthly US$120 billion bond-buying scheme will continue, and interest rates will stay near zero until inflation has risen to 2%.

- Outside the U.S., International Monetary Fund (IMF) managing director Kristalina Georgieva spoke at Russia’s annual Gaidar Economic Forum and delivered a message to policymakers around the world: “In terms of policies for right now, very unusual for the IMF, starting in March I would go out and I would say, ‘please spend. Spend as much as you can and then spend a little bit more.”

- In reaction to the news, bitcoin saw a slight decline in prices, while the U.S. dollar appreciated. Bitcoin prices saw a seven-day high of US$39.966 and a low of US$34,069, at the time of publication.

Forkast.Insights | What does it mean?

If the “American Rescue Plan” is signed into law in its current form, we may well see a continuation of the bull run in asset prices that started in the spring of 2020. We could also see an increase in U.S. unemployment in response to the same proposal’s calls to increase the federal minimum wage to US$15 per hour.

Generally speaking, higher unemployment would lead to worsening economic conditions and lower asset valuations, but as we saw in 2020, that’s not always the case.

Last year, we saw a massive surge in retail trading that offset one of the largest sell-offs in U.S. history and rallied nearly every market, including bitcoin and other cryptocurrencies, to new all-time highs. Some believe that asset prices — traditional as well as crypto — are now well into bubble territory. Still, the institutional investors who recently jumped onto the bitcoin bandwagon may be even more willing to go long now in a situation where the U.S. Federal Reserve is indirectly propping up the stock market.

2. What will crypto regulations be like in 2021?

By the numbers: Lagarde Bitcoin — over 5,000% increase in Google search volume.

European Central Bank (ECB) President Christine Lagarde has called for global regulation of bitcoin during the Reuters’ recent Next conference, stating that the cryptocurrency is a speculative asset that has been used for “funny business.” Her remarks are now heating up the already hot topic of digital asset regulation and what to expect in 2021.

- What might bode well for the industry: U.S. President-elect Joe Biden has confirmed reports that he would nominate MIT professor and former CFTC Chair Gary Genslerto lead the U.S. Securities and Exchange Commission (SEC). Gensler’s former Goldman Sachs colleague and Galaxy Digital CEO Mike Novogratz predicts that Gensler may have a friendly approach toward crypto. “He has taught a class at MIT on blockchain and bitcoin,” Novogratz told Yahoo Finance. “He likes the space.”

- But at her U.S Senate confirmation, Treasury Secretary-nominee Janet Yellen — a previous critic of bitcoin — expressed concerns about crypto’s role in such crimes as money laundering and terrorism-financing.

- Rep. Ted Budd has reintroduced the Financial Technology Protection Act in hopes to lessen cryptocurrency-related criminal activities. The bill — which has two previous iterations and both passed the White House.

Forkast.Insights | What does it mean?

In a year-end interview with Forkast.News, Hong Kong fintech lawyer Urszula McCormack said that one of the biggest developments in the crypto space in 2020 was the industry’s growing recognition of the need for regulatory clarity. Three weeks into the new year, the industry should not be surprised if more government actions related to crypto come down the pipelines soon.

European Central Bank President Christine Lagarde had some stern words for the applicability of bitcoin in everyday life and asserted her belief that crypto should not be viewed as a currency but rather, a highly speculative asset in the light of bitcoin’s price volatility over the past few weeks. She called for more global regulation.

Echoing Lagarde’s concerns about cryptocurrency being used for criminal activities, Janet Yellen — the probable new secretary of the U.S. Treasury — also suggested that there would be heightened government scrutiny and more enforcement actions over crypto. “We really need to examine ways in which we can curtail their use, and make sure that anti-money laundering [sic] doesn’t occur through those channels,” Yellen said, at her confirmation hearing.

A push for more legal clarity could also come from the next SEC Chairman, Gary Gensler. The MIT professor and former chair of the Commodity Futures Trading Commission — who also spent a good part of his career on Wall Street — knows the value of regulatory clarity for doing business. Therefore, it would not be unexpected if Gensler helps lead the charge to craft more regulations and guidelines around cryptocurrencies.

Gensler himself has told Bloomberg: “You want some form of regulation, you want traffic lights and speed limits, because then the public is confident to drive on the roads.”

3. Bitcoin paradise lost

By the numbers: Man forgets bitcoin password — over 5,000% increase in Google search volume.

On top of the regulatory developments this past week, bitcoin showed the risk of holding cryptocurrency. Bitcoin can make a person’s fortunes, but a slip of mind can also put a holder’s gold mine out of reach forevermore. Just ask Stefan Thomas, the German computer programmer based in San Francisco who has forgotten how to unlock his growing bitcoin treasure chest.

- Around a decade ago, Thomas was given 7,002 BTC (over US$250 million today) as payment for producing a cryptocurrency explainer video. Thomas has since lost his password to his IronKey hard drive. He has reportedly already made eight attempts to access his wealth, which will auto-encrypt for good after the 10th failed attempt.

- But for every Stefan Thomas, there is also an Alicia Dawn — a YouTuber whose real name is Ali Spagnola. Dawn recently shared how she “accidentally got bitcoin rich.” In 2013, Dawn — who paints images upon request and accepts donations for her work — received US$50 in bitcoin from someone who had asked her to create a painting of bitcoin. She said on her Jan. 13 YouTube video that her bitcoin was now worth US$39,000. Bitcoin is currently trading at US$34,232 at the time of publication.

Forkast.Insights | What does it mean?

While it might be easy to dismiss Stefan Thomas as a careless person, cases like these are actually not all that unusual. Passwords and private keys are finicky items, and they could get lost at any time. Thomas is certainly not alone. A U.K. computer engineer, James Howells, is reportedly offering the Newport Council more than £55 million, or US$75 million to dig up a landfill that contains his bitcoin, which is reportedly worth US$314 million. Howells mistakenly threw out his hash key when he accidentally threw the wrong hard drive into the trash.

Increasing losses due to lost or inaccessible bitcoin continue to mount. Bit by bit, they may be eating at the bitcoin market’s liquidity. Chainalysis data showed that 20% of all bitcoin in circulation are either lost or inaccessible. The U.K.’s National Cyber Security Centre shared a similar analysis in last week’s threat report, claiming that about US$140 billion in bitcoin had been lost.

There are really no processes for recovering lost wallet passwords. It doesn’t work like your Facebook account. If you forget it, you have to try to remember it. There could also be a way around it using the services of wallet hunters. Wallet hunters are a group of digital sleuths who offer wallet recovery services for investors using a series of traditional to remedial tactics. This involves using brute force, hypnosis and other methods to decrypt the wallet passwords. But it costs a lot, and there’s no guarantee of the desired results.

4. Twitter reaches for the sky

By the numbers: Twitter — over 5,000% increase in Google search volume.

As Twitter CEO Jack Dorsey took to his own social media platform to explain its recent ban of departing U.S. President Donald Trump’s account, he opened the discussion on Twitter’s Bluesky initiative, which aims to develop an open and decentralized standard for social media with Twitter as a client. Ethereum co-founders joined the conversation, with Charles Hoskinson urging the Dorsey to make the Bluesky initiative open source to allow the community to contribute.

I do not celebrate or feel pride in our having to ban @realDonaldTrump from Twitter, or how we got here. After a clear warning we’d take this action, we made a decision with the best information we had based on threats to physical safety both on and off Twitter. Was this correct?

— jack (@jack) January 14, 2021

5. I see two interesting paths for @jack, radical in different directions. One path is to make Twitter itself democratic and lawful: create a structured process with appeals, and a moderation panel at the top based in Switzerland (NOT USA!). Allow users to vote on panel members.

— vitalik.eth (@VitalikButerin) January 12, 2021

We are working on something Jack. You shouldn’t build this in house. Make it an open source project and our entire industry can contribute.

— Charles Hoskinson (@IOHK_Charles) January 14, 2021

Forkast.Insights | What does it mean?

Twitters’ decision to permanently ban the President of the United States from its platform may have also created a discomfiting precedent.

Following the Capitol riots, Facebook, too, permanently banned Trump. Google and Apple removed Parler — a small social network popular with the far-right — from their app stores while Amazon kicked Parler off of its cloud service, forcing the app to go offline entirely.

Regardless of whether one believes that these were acceptable and reasonable decisions by private companies, it is undeniable that a few unelected big tech executives now have a lot of power over public speech. This begs the question, is big tech too big for the public good? The E.U., for one, has become increasingly wary of the monopolistic nature of such companies, which have grown at rapid rates in part by buying up competitors. In fact, German Chancellor Angela Merkel objected to Big Tech’s decision to ban Trump and said that the U.S. ought to follow Germany’s lead in adopting laws that restrict online incitement, rather than leaving it up to big tech platforms to dictate the rules.

A potential solution could effectively come in the form of decentralizing the social media platforms, which would redistribute the power held by tech executives to their grassroots users, with protocols that would oversee user moderation as well as processes for appeals.

Twitter’s Bluesky initiative may have the potential to be just that. It is planned to be a decentralized social media network. Like the Bitcoin blockchain, the Bluesky initiative is supposed to be free from the influence of any one person or entity. Twitter is currently in the process of interviewing and hiring a small team to build it in-house. While Buterin and Hoskinson have both reached out to Dorsey and pleaded with him to make the initiative open source, no official plans to do so have been outlined.

5. In China: Conflux scores another government deal

Conflux has received another endorsement from China in the form of a US$5 million research grant from the Shanghai Science and Technology Committee (STC) and the Changning District government.

- News of the endorsement follows the company’s deal with the Hunan Province government in August 2020 and a cooperation pact with the Shanghai government in 2019.

- According to Shanghai STC’s announcement, the Shanghai government approved 57 emerging technology innovations, including Conflux’s permissionless public chain infrastructure project. The projects will receive 185.92 million yuan, or US$28.7 million from STC Shanghai.

Forkast.Insights | What does it mean?

Founded in 2018, the Conflux Network (CFX) is a layer 1 protocol aiming to solve three issues with the Ethereum network regarding security, scalability and decentralization. What makes Conflux unique is that the company has strong ties with the Chinese government.

Conflux has been tasked with building out regional blockchain infrastructure to accelerate China’s GovTech initiatives. Last year, the Hunan Province government made plans to build out the blockchain industry to accelerate the systems used for supply chain management, tax compliance and digital contract signing.

Engaging companies like Conflux are part of China’s drive to invest and build out blockchain technology as a core strategy for the nation. The country operates the Blockchain-based Service Network (BSN China), a controlled infrastructure for launching blockchain projects in China. But permissioned blockchains limit the boundaries of any application scenario. This is why the BSN International Portal was created out of the BSN China Portal. BSN International will support open blockchains like Conflux, so developers can create decentralized solutions and expand the use cases for both public and private chains.