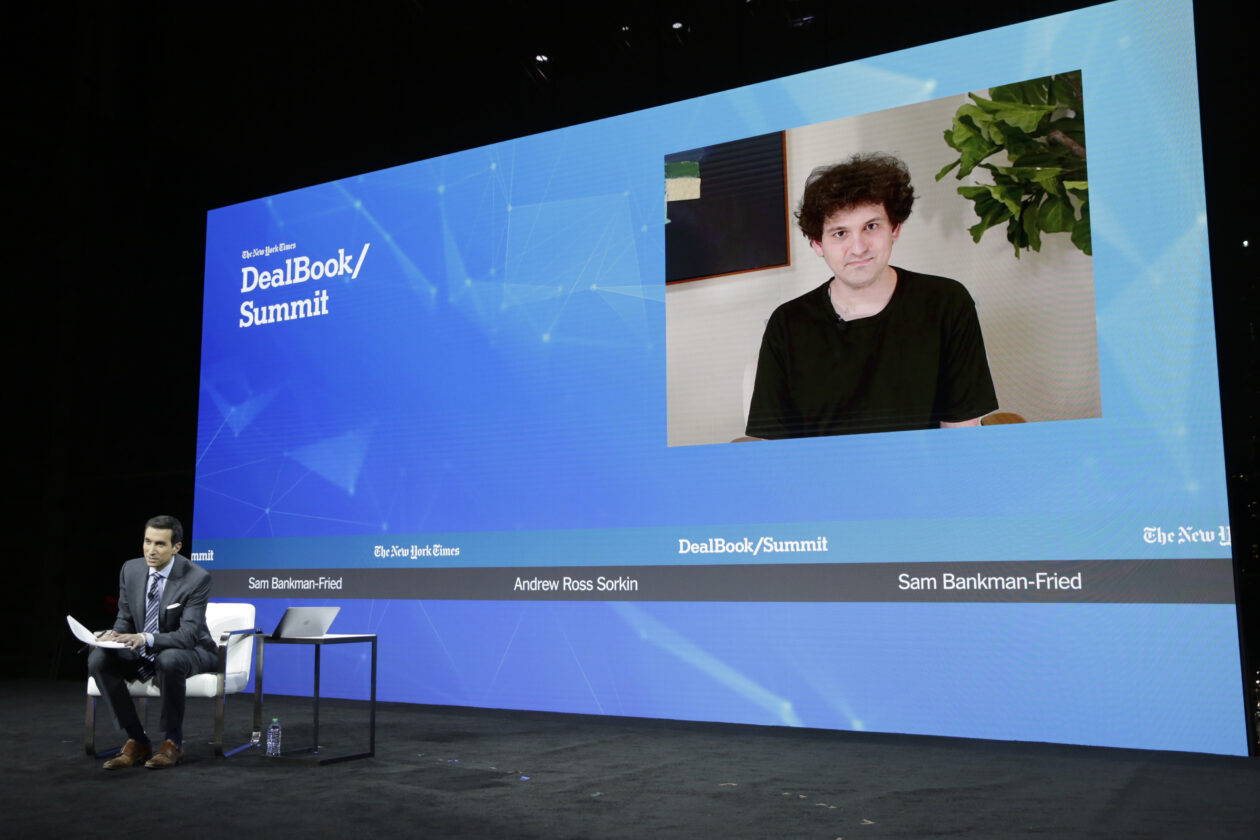

Sam Bankman-Fried, former chief executive officer of failed cryptocurrency exchange FTX, seemed to point to the activities of his company’s brokerage arm as the reason his business collapsed, when he spoke at the New York Times DealBook Summit on Wednesday.

In response to allegations client funds at FTX were siphoned off and used for crypto trading at Alameda Research, he said he “didn’t knowingly commingle funds.”

Speaking by video link from the Bahamas, where the company was based, Bankman-Fried said: “I wasn’t running Alameda, I didn’t know exactly what [was] going on. I didn’t know the size of their position.”

He said he was nervous about getting too involved with Alameda because of conflict of interest, adding: “I was frankly surprised by how big Alameda’s position was, which points to another failure of oversight on my part.”

FTX, formerly one of the world’s largest trading platforms for cryptocurrencies and valued at US$32 billion earlier this year, filed for Chapter 11 bankruptcy protection on Nov. 11, along with Alameda and dozens of other affiliated companies.

However, the FTX failure is spreading to crypto platforms with exposure to the company. Cryptocurrency exchange BlockFi declared bankruptcy on Tuesday and more are expected to follow.

James Bromley of law firm Sullivan & Cromwell, who was appointed counsel by the new FTX leadership, said last week at the first bankruptcy hearing that a “substantial amount of assets” of FTX have either been stolen or are missing, and that the organization was run as a “personal fiefdom” of Bankman-Fried.

FTX Trading and its affiliates were found to owe their 50 largest creditors about US$3.1 billion, according to Forkast’s calculation based on the estimates listed in a bankruptcy filing last month.

The accountants?

Anthony Sabino, a professor at St. John’s University School of Law in New York, has told Forkast that John J. Ray III, the new CEO of FTX, has raised issues of misstatements, deception, missing assets and wrongful transfers in the company’s recent filings with the Delaware bankruptcy court.

Bankman-Fried, 30, said at the DealBook summit that he only became aware of how serious the problem was in early November.

“The time that I really knew there was a problem was Nov. 6,” he said, attributing the FTX implosion to an accounting mistake.

“I think that there is a substantial discrepancy between what the financials were, what the auditing financials were, the true financials, what the exchange understood — all of that was consistent — versus what the dashboards that we had displayed for Alameda’s account there, which substantially underdisplayed the size of that position,” he said.

He maintained that the U.S. platform is “fully solvent” and “fully funded.” He added: “I believe that withdrawals could be opened up today, and everyone could be made whole from that and none of these problems plague the U.S. platform.”

Despite facing investigation and possible prosecution by U.S. and Bahamian authorities, Bankman-Fried, who no longer represents FTX, has continued making public statements.

Lawyerly advice

He spoke to Vox last month and gave an interview to ABC News anchor George Stephanopoulos, who flew to the Bahamas. It will reportedly air on Good Morning America on Thursday.

He also agreed to join a Twitter Space discussion on Friday morning Asia time with Mario Nawfal, founder of crypto venture capital firm IBC Group.

He said his lawyers have advised him not to talk. “The classic advice, right: Don’t say anything. Recede into a hole,” he said.

“I think I have a duty to talk to people. I have a duty to explain what happened,” he added. “I don’t see what good is accomplished by me just sitting locked in a room pretending the outside world doesn’t exist.”

Braden Perry, former senior trial attorney at CFTC and partner at law firm Kennyhertz Perry, told Forkast that Bankman-Fried should stop the public statements.

“No matter how much he may want to justify certain things, it’s detrimental to his potential legal defenses,” Perry said.

The embattled founder could face more than 20 years in prison depending on the scale of potential legal violations related to the collapse of FTX and if he is convicted, two lawyers have told Forkast.

Bankman-Fried told the Wednesday conference that criminal liability is not his biggest concern. “It’s not what I’m focusing on,” he said.

“It’s — there’s going to be a time and a place for me to think about myself and my own future. But I don’t think this is it.”