In this issue

- Bankman-Fried’s memory lapses seek jury’s doubt

- Betting that NFTs are Back

- ETF dreams inspire Bitcoin’s October revival

From the Editor’s Desk

Dear Reader,

There’s really only one place to start. The criminal trial of Sam Bankman-Fried entered a new decisive phase over the past week as the one-time crypto poster boy took to the stand to testify in his own defense. The founder and former chief executive officer of failed cryptocurrency exchange FTX faces seven charges at his trial in New York, including money laundering and wire fraud. If found guilty, he could spend decades in jail.

But the interesting thing is, no matter how much crypto is dragged through the mud throughout the trial, the market isn’t faring too badly.

To be sure, crypto is, through its SBF avatar, airing its dirty laundry in public. The level of wrongdoing on display, be it as part of a labyrinthine criminal scheme or — as Bankman-Fried and his lawyers would have us believe — just some poorly handled startup highjinx, is staggering.

Still, crypto — and Bitcoin in particular — is on the rise.

What started as fake news about a spot Bitcoin exchange-traded fund (ETF) approval in the U.S. has snowballed over the past couple of weeks into genuine positivity. The so-called ‘Uptober’ bounce for October struck again, with Bitcoin recording a 26% rise for the month. A host of other altcoins are also riding the tailwind, with Ether — the second largest cryptocurrency after Bitcoin — recording a 6.8% monthly increase.

Some analysts are still advising caution. Bankman-Fried and a host of other former crypto darlings have done serious damage to the industry, with US$2 trillion wiped off the market since the Terra stablecoin platform collapsed in May last year.

That is a hard bell to unring. But as a spot Bitcoin ETF for the U.S. — the world’s largest economy and traditional source of much of crypto’s funding — edges closer, the prospect of institutional scale money flooding into the market at a time when the next Bitcoin halving event is only around the corner, has other analysts expressing optimism.

Bad actors can harm any industry and crypto has faced a number of serious setbacks over the past 18 months, not least the collapse of FTX — the second largest centralized crypto exchange after Binance. But with the witness testimony in, damning as it is, the SBF trial does not appear to be setting the industry back any further.

With the damage done, the crypto world keeps turning on its axis. The industry has weeded out many of its bad apples and, as the muted market reaction to the SBF trial seems to suggest, may finally be ready to move on.

Until the next time,

Angie Lau,

Founder and Editor-in-Chief

Forkast.News

1. Bankman-Fried’s memory lapses

Bankman-Fried’s fate now rests in the hands of a 12-member jury after his testimony concluded in a lower Manhattan courtroom on Tuesday. Facing potential life imprisonment if convicted on fraud charges related to the collapse of FTX and its sister hedge fund Alameda Research, the 31-year-old has pleaded not guilty. Both the defense and prosecution made their closing arguments Wednesday, with jurors now set to deliberate.

- Assistant U.S. Attorney Danielle Sassoon led the cross-examination, focusing on Bankman-Fried’s relationship with the Bahamian Prime Minister, Philip Davis. Sassoon asked if Bankman-Fried had proposed paying off the Bahamas’ US$11 billion national debt. He claimed not to remember such discussions. The attorney also probed into other alleged favors given to members of the Bahamian government, such as the prime minister’s visit to an FTX-sponsored Miami Heat basketball game.

- The key issue in the case is the US$8 billion hole in FTX’s balance sheet, and Bankman-Fried expressed regret for not investigating it further. He claimed that when he asked his deputies about the missing funds, they brushed off his inquiries, stating they were too busy to discuss it.

- Bankman-Fried’s defense strategy revolves around convincing the jury that he did not intentionally divert customer money to fund a luxurious lifestyle involving private jets and a penthouse in the Bahamas.

- During the redirect examination, Bankman-Fried discussed his frustration with regulators and how his comments might have influenced the regulatory landscape. He also addressed why he didn’t fire anyone upon discovering the US$8 billion liability, stating that his focus was on moving forward rather than assigning blame.

- He defended his use of a private jet as a valid CEO expense, stating it was essential due to logistical challenges in traveling between the Bahamas and Washington, D.C.

Forkast.Insights | What does it mean?

Bankman-Fried’s defense opted to place the defendant in the witness stand during his criminal trial. Grilled by prosecution attorney Sassoon, Bankman-Fried attempted to sidestep direct questioning, repeatedly using the phrase “I don’t recall” to dance around various issues. The judge, on occasion, had to intervene with the admonishment: “Mr. Bankman-Fried, just answer the question.”

Bankman-Fried’s defense strategy centers on convincing the jury of his lack of intent to funnel customer funds away from FTX for a multitude of purposes — including to offset Alameda’s losses, buy his opulent Bahamas residence, finance venture investments, and obtain the naming rights for the home stadium of basketball team the Miami Heat.

Following a month replete with witness testimonies, Bankman-Fried’s destiny now rests squarely in the hands of the jurors. The scales appear tipped against him, with testimony from former associates turned prosecution witnesses providing formidable evidence.

Throughout the trial, the defense has labored to establish the narrative that Bankman-Fried’s actions were not driven by fraudulent intent. Rather, his lawyers have attempted to show that his actions were the consequence of teething problems during FTX’s inception, exacerbated by a dearth of robust risk management.

This week’s testimony represented Bankman-Fried’s final, desperate gambit to sway the jury in his favor. His chosen strategy, replete with memory lapses, may not win over all 12 of the jurors. But it doesn’t have to. Bankman-Fried needs to convince just one jury member there is reasonable doubt in his culpability to produce a hung jury — a winning outcome for his defense.

When a jury is “hung,” the jurors are divided in their opinions and cannot agree on whether the defendant is guilty. As a result, the case remains unresolved, and the trial may end in a mistrial.

It’s unlikely the case would just go away and Bankman-Fried faces trial for another set of civil charges brought by regulators in the new year. But if his strategy has worked, and doubt about his guilt exists among the jury, crypto’s most notorious figure could — for the time being at least — walk free.

2. Betting that NFTs are back

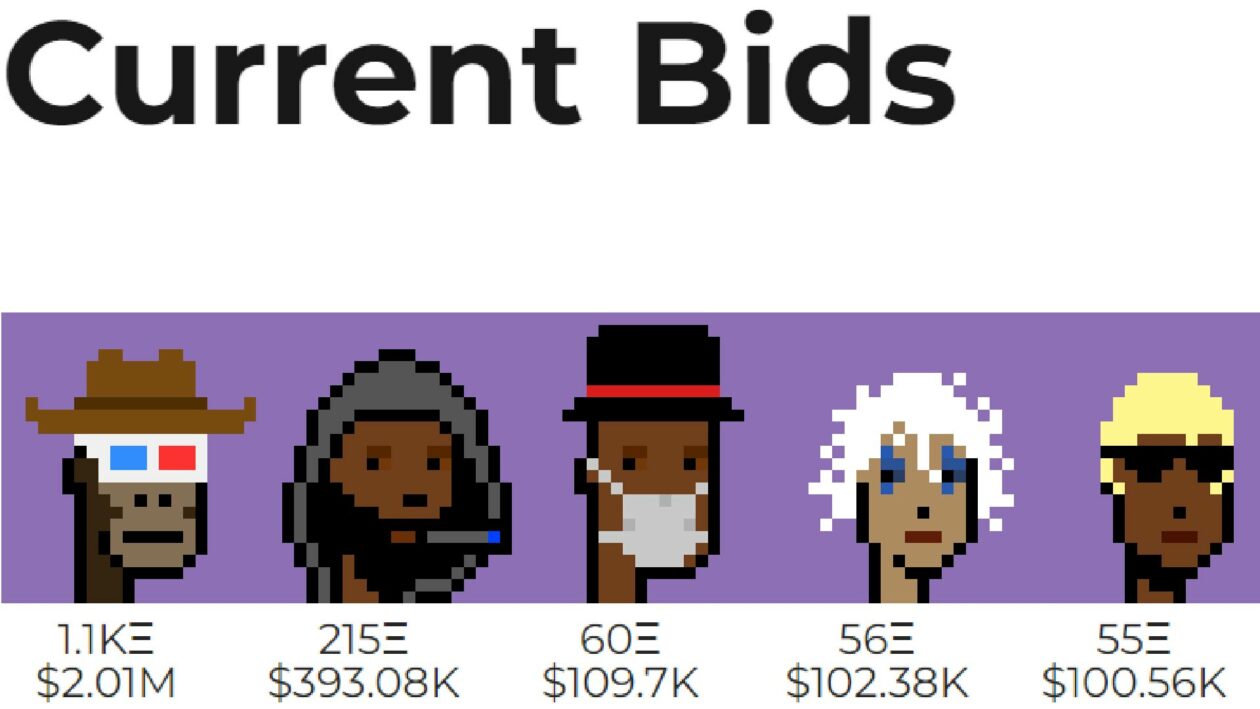

CryptoPunks are on the move and large offers are starting to roll in for some of the rarest Punks in the iconic Larva Labs collection.

- CryptoPunk #9280 has a current active bid of 1.1k ETH (US$2.01 million) on Larva Labs’ CryptoPunks website.

- There are currently 2,099 ETH worth of open bids for CryptoPunks on the Larva Labs website.

- Over US$4 million worth of CryptoPunks have been sold on secondary markets over the past seven days.

- The floor price of CryptoPunks is up 9.0% this week to 46.88 ETH.

- Eleven CryotoPunks have sold for over US$100,000 over the past week.

Forkast.Insights | What does it mean?

CryptoPunks are widely considered to be a barometer for the broader NFT market. When CryptoPunk sales are up, many see it as a sign that collectors are gaining confidence both in the market, and in the idea that the iconic collection may be on the up again.

CryptoPunk #9280’s has a US$2.1 million active offer, which is particularly noteworthy because large Punk sales are often forward indicators of a run on NFTs. In the peak bull market, rare CryptoPunk sales show the potential of these major NFT investments. CryptoPunk #5822 sold for US$23.7 million in Feb. 2022, CryptoPunk #7523 sold for US$11.7 million in June 2021, and the most expensive Ape CryptoPunk #4156 (the same rare trait of the Punk with the active US$2.1 million bid), sold for US$10.2 million in Dec. 2021.

This year’s top CryptoPunk sale was CryptoPunk #5066, a rare Zombie Punk that sold for US$1.4 million. If Punk #9280’s holder accepts the current US$2.1 million offer, it will mark the highest CryptoPunk sale in well over a year, and could lead to a run on rare Punks.

It’s not just large CryptoPunk sales that indicate the start of a bull market. Recent large NFT sales like Bored Ape #6022 which sold for 169 ETH (US$303,000), Azuki #3309 for 115 ETH (US$204,000), and DeGod #3251 sold for 110 ETH (US$196,000), all represent sales that usually only happen when collectors feel there’s a risk other collectors could beat them to the purchase.

Right now it feels like big collectors are starting to bet on NFTs again. The market is improving, with October breaking a seven month streak of declining monthly NFT sales. Public figures have started uttering the phrase “NFTs” once again, with Elon Musk, Joe Rogan and Mark Cuban all weighing in on NFTs this week. While not all of their words were positive, it is a certainty that when people like them talk about NFTs, the public begins to get curious about non-fungible tokens again.

3. ETF dreams inspire Bitcoin’s October revival

Bitcoin experienced a notable rise in October. It was down to around US$26,600 half way through the month before starting its sudden rise. The coin is now sitting pretty at over US$35,000 as we go to print. The price pump saved the ‘Uptober’ narrative of October rises in the crypto market. The catalyst? Anticipation that the U.S. Securities and Exchange Commission will approve at least one of a number of spot Bitcoin ETF applications in the near future.

- The “Uptober” narrative is driven by historically strong Bitcoin performance in the month of October. While dismissed by some analysts as coincidence, the narrative is backed up by data, with only one negative October for the coin since 2015.

- Many crypto advocates feel that an ETF approval could usher vast institutional investment into Bitcoin, potentially boosting the crypto market by US$1 trillion.

- After losing US$2 trillion in value over 18 months, the crypto industry is therefore pinning much of its hope for recovery on the imminent arrival of a spot Bitcoin ETF in the U.S.

- Beyond cryptocurrencies, other sectors of Web3, including NFTs and the metaverse, face an uncertain future despite Bitcoin’s uptrend.

- Analyst views on Bitcoin’s performance are split between an upcoming bearish November and a positive long-term outlook.

- Kaiko’s Clara Medalie underscores the need for more than just an ETF approval to counteract the market’s volatility after 18 months of losses.

Forkast.Insights | What does it mean?

In an interview with Forkast, Kaiko’s Medalie spoke about ‘Uptober’ as one of the many narratives driving the crypto market. What may seem like historically strong performance in October could be just coincidence. The month of February, for instance, also tends to perform just as well, without the fanfare. But this October, the Uptober narrative is driven by some genuine positivity in the market sparked by a potentially needle-moving development.

The prospect of an imminent approval for a spot Bitcoin ETF has electrified the market. A host of huge investment names led by Larry Fink’s BlackRock are lining up to become the first firm to get in on the action. What was shaping up to be a damp squib of an October turned around in the month’s final weeks as news emerged that these applications may be further along than first thought.

The rise saved the Uptober narrative, with many analysts speculating that the 18-month long bear market may now be drawing to an end. Markus Thielen, head of research at crypto services platform Matrixport, used the October upswing to highlight another, more prevalent theme emerging in the Bitcoin market.

“Bitcoin has gone through four bull market cycles, each driven by a distinct narrative,” he said in a weekly report. Those four cycles go: Bitcoin’s emergence as a payment option; crypto adoption in China; the emergence of initial coin offerings (ICOs) as a means to fund companies; then the so-called DeFi (decentralized finance) summer and the NFT minting craze.

“The fifth Bitcoin bull market appears to be primarily driven by the expectations of institutional adoption,” Thielen said. “Bitcoin’s characteristics, which were traditionally associated with assets like gold and other safe-haven investments such as treasury bonds, have led institutions to consider Bitcoin for diversifying their asset allocation.”

The key to unlock that diversification? The dominant narrative says it’s a spot Bitcoin ETF. Whether or not the financial instrument, when finally approved, can have the galvanizing effect the industry craves, the narrative has at least brought some optimism back to crypto. It’s an exciting place to be again.