Justin Sun: Next generation traders will prefer NFTs and DeFi

Gen Z and millennials will transform investing. Here’s why one of their own — TRON CEO Justin Sun — thinks NFTs and DeFi are the wave of the future.

This interview is a prequel to GBA Blockchain Week 2021 taking place March 30 to April 1.

The new generation of investors are not like those who came before them. Everything is going digital — even valuables like one-of-a-kind art. They won’t be shouting buy orders from a trading floor or hunched over a Bloomberg terminal; more likely, their investing will happen in a home office or on the living room sofa.

Justin Sun, 30, is part of this new generation. After narrowly missing out on buying digital artist Beeple’s “Everydays: The First 5000 Days” non-fungible-token (NFT) collage in a recent US$69 million Christie’s auction, the CEO of TRON and BitTorrent got a consolation prize: a different Beeple NFT artwork — “Ocean Front” — for US$6 million.

“For NFT in the arts industry, I think the trend is that all kinds of arts are going to be moved online,” Sun told Forkast.News in a video interview. “Instead of seeing all the art pieces in an art gallery, I think in the future, everybody will start to take digital arts [in] their collection.” Sun is mulling a US$100 million endowment fund to display his NFTs online in what he calls “Justin’s Gallery.”

With over US$220 million worth of NFTs sold over the past month, the demand for NFTs has exploded this year, with digital art leading the way.

The art world is not the only industry that is being tokenized. Music, sports, and celebrities have also joined the craze by minting digital collectibles — mostly on the Ethereum network through its ERC-721 standard — which allows the creation of unique tokens on the Ethereum blockchain.

But Ethereum is also becoming a victim of its own success. Ethereum’s explosive popularity with decentralized finance and now, the NFT sector have led to congestion and high transaction fees — or gas fees — for developers and users.

As Ethereum attempts to address its congestion and gas fee problems with Ethereum Improvement Proposal (EIP) 1559 — which introduces a minimum transaction fee per block and an optional miners’ tip to minimize miners’ manipulation of gas fees — a window of opportunity is also opening for dApps and NFT creators seeking alternatives. Up and coming competitors to Ethereum when it comes to DeFi or NFT projects include Cardano, Polkadot and Tezos. Another is Sun’s TRON.

As a project, TRON was once plagued with negative publicity in its early days, such as accusations of plagiarism in its white paper. TRON has now emerged as one of the most popular substitutes to Ethereum after releasing its TRC-721 standard and surpassing US$8 billion total value locked in its decentralized finance (DeFi) ecosystem.

DeFi and NFTs — which TRON will soon support — are on the rise because they are tailor made for the new breed of investors like Sun.

“The younger generation people are willing to make their own decisions on trading,” Sun said. “Instead of putting all their money in a pension fund, mutual fund, hedge fund, and let those funds trade for themselves, they would rather just trade on the couch with the Robinhood app on their mobile phone.”

“That’s why social media sentiment is extremely important for the future generation and for the future traders,” said Sun, who will be a special speaker at next week’s GBA (Greater Bay Area) Blockchain Week 2021. “This is a trend for the future, not only [in the] United States, but also in China.”

Watch Sun’s full conversation with Forkast.News Editor-in-Chief Angie Lau to learn more about alternative blockchains hosting DeFi and NFTs, the new generation’s engagement with art, what the next generation of leaders and investors, especially those in Asia think of blockchain and crypto, and more.

Highlights

- Future of the art industry: “For future billionaires, they will not show off their art pieces at their home but share their art pieces online. They can just share the links, tell a friend, ‘This belongs to me.’ And also, in the future, if you want to buy art pieces from your friend, you don’t need to go through today’s Christie’s — you need to clear customs, you need to send art pieces to another country which takes like half a year to do so. But right now, you can just send TRC-721 — only send a token to a friend.”

- How to regard US$70 million — what Sun was willing to pay for Beeple’s collage: “Today, US$70 million seems high, but if you see the ranking of the top 100 most expensive arts right now, Beeple’s art is ranking 52 or something. But I think in the next 10, 20 years, 80% of the top 100 most expensive arts are going to be NFTs or NFT-related art.”

- Why NFT needs anti-money laundering regulations: “I believe any NFT website — as today, we have Nifty Gateway and also have other NFT trading platforms — KYC/AML is the first thing we should do. Those NFT websites should have the same regulations and basically, anti-money laundering regulations as exchanges do. The exchanges should know who is buying those NFTs and who is receiving the money, [and] where the money goes. I think this is the number one priority for regulation on the platform.”

- Next generation of investors: “The younger generation people are willing to make their own decisions on trading. Instead of putting all their money in a pension fund, mutual fund, hedge fund, and let those funds trade for themselves, they would rather just trade on the couch with the Robinhood app on their mobile phone…. So that’s why the whole trading behavior changed dramatically. That’s why social media sentiment is extremely important for the future generation and for the future traders.”

- Why Warren Buffet eschews crypto: “The biggest concern Warren Buffett had on crypto is that crypto doesn’t have dividends. I believe that Warren Buffett’s investment philosophy is heavily dependent on the dividend. He is a huge believer in dividends. So he believed you can get investment back, not because of the volatility of the stock price, which is, of course, unpredictable. He is willing to get the price back based on the dividend from the stock in the first place.”

Full Transcript:

Angie Lau: What gives an NFT value? Must DeFi be on more blockchains for its own good? And what do the next generation of leaders in Asia think of crypto?

Welcome to Word on the Block, the series that takes a deeper dive into blockchain and the emerging technologies that shape our world at the intersection of business, politics and economy. It’s what we cover, right here on Forkast.News. I’m Forkast Editor-in-Chief Angie Lau.

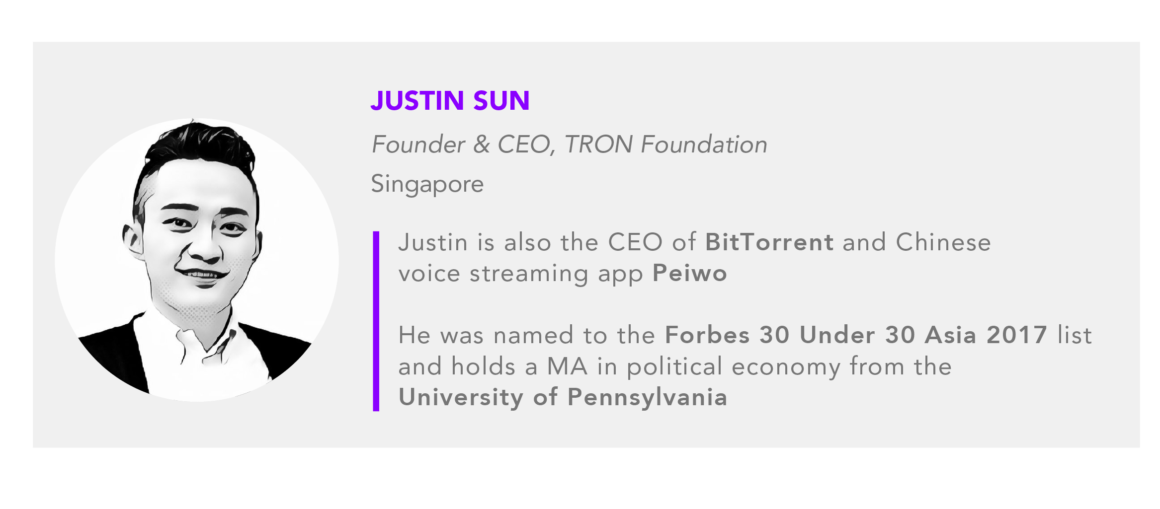

You may love him or hate him, but he has been one of Asia’s most influential tech wizards in the last decade. Nowadays, you can see him chasing after the world’s most sought-after NFTs or promoting the rapidly surging DeFi ecosystem on TRON. So let’s welcome the CEO of BitTorrent, the founder of TRON Foundation, Justin Sun himself. Justin, it’s a pleasure to have you on the show.

Justin Sun: So nice to meet you. Thanks, everybody.

Lau: Absolutely. So right ahead of our fireside chat at GBA Blockchain Week. That’s coming up on April 1st. Let’s consider this Part 1.

I want to dive into NFTs right now. Beeple’s “EVERYDAYS: the First 5000 Days” auctioned by Christie’s for $69,346,250. You were this close to winning it, and you would have if they had registered your last-second bid. Why were you willing to drop $69 million on what essentially is an original JPEG?

Sun: Basically, I believe in the next 10, 20 years, the majority of the arts will migrate to an IT form. The first generation Web 1.0 helped everybody move media online. Today, the New York Times, Wall Street Journal, [and] Bloomberg, everybody reads the news online, not the physical form of the paper anymore. Web 2.0 moved all the connections online. So your relationship with your friends, and also all the conversation has moved online. And Web 3.0, which we are doing today, helped us move all the financial infrastructure online. So today, when you are sending money, you will not ever give paper cash anymore. So everybody is using blockchain, sending USDT, USDC, TUSD, those online stablecoins. Basically, this is [what] Web 3.0 is doing. For NFT in the arts industry, I think the trend is that all kinds of arts are going to be moved online. Instead of seeing all the art pieces in an art gallery, I think in the future, everybody will start to take digital arts [in] their collection.

I think for future billionaires, they will not show off their art pieces at their home but share their art pieces online. They can just share the links, tell a friend, ‘This belongs to me.’ And also, in the future, if you want to buy art pieces from your friend, you don’t need to go through today’s Christie’s — you need to clear customs, you need to send art pieces to another country which takes like half a year to do so. But right now, you can just send TRC-721 — only send a token to a friend. Everybody knows the transaction happened. You are the owner of these art pieces. It’s going to be moved to a completely new blockchain.

I believe this is the trend of the future generation. That’s why I heavily invested into this NFT blockchain space from day one. Even today, US$70 million seems high, but if you see the ranking of the top 100 most expensive arts right now, Beeple’s art is ranking 52 or something. But I think in the next 10, 20 years, 80% of the top 100 most expensive arts are going to be NFTs or NFT-related art.

Lau: That’s the art world. I get the art world. But $2.5 million for Twitter founder Jack Dorsey’s first-ever tweet. Is that also art? What is that?

Sun: Yes, I believe this is also art. We have lots of definitions [of] artworks. First of all, I believe Jack Dorsey’s tweet is a very important milestone for Twitter and for the history of the internet. This is the first tweet ever of Twitter itself and tweeted by Twitter’s founder and CEO Jack Dorsey. If you have one piece of art in Twitter’s history — this is definitely going to be one of the most important pieces of Twitter’s history. This is just like when a queen crowned herself, and this is like one of the pieces in the crowning ceremony. That’s why I believe this is definitely one of the important moments of internet history, which [is] definitely going to be appreciated by the internet generation. That’s why I believe [the making of] this tweet, tokenizing it, and the exchanging by blockchain is very important.

I think, in the future, we will see even more of these kinds of art pieces in the future. For example, like the first Instagram [pictures] and also the most viewed Instagram pictures. I think this is also a trend. In the future, we will see a lot of the landmarks in the internet’s history turned into NFT arts and people can trade them.

Lau: I get that. I mean, digital artifacts. We’re talking about a moment in human civilization that has been on-boarded onto the internet, and what is the digital representation of that experience, that cultural moment? I get that. But with an NFT, how do you share it? What’s the value in owning it? Is there value in just owning it? Isn’t it already free for people to consume and experience already?

Sun: Yes. First of all, I believe in the future, NFT arts [are] not only [exclusive] —this is something that only belongs to you — [but] I feel like art’s value comes from sharing. Basically, that’s also some idea I want to advocate here. For example, the blockchain spirit itself is bank unbanked people. So basically, we provide the financial infrastructure to those people [that] can’t even get access to a bank in the first place. For example, today, everybody can generate their TRON addresses, Ethereum addresses, Bitcoin addresses for free, and receive the money for free. There is no intermediary and there is no middleman [who] controls the infrastructure or takes money from these kinds of infrastructure in the first place. It’s fully decentralized. Everybody can own it. So this is also, I think, something that NFT arts or blockchain arts are trying to advocate here. We believe in the future. Every art piece can be available online and everybody can visit it. And I believe, the value also comes from these kinds of sharing economies in the first place. Why Bitcoin has a huge amount of value is because Bitcoin is easy. Everybody can access it without anybody’s consent. So everybody can own Bitcoin. Everybody can send Bitcoin. Everybody can share Bitcoin. There are no central parties [to] approve all these kinds of transactions. I believe NFT arts [and] crypto arts have the same value. Everybody can see it and everybody can share it. Everybody can yield it without the owner’s consent. The value will come from these kinds of massive traffic in the first place.

Lau: You’re already doing it. I mean, you’re creating the ecosystem that actually allows the democratization of NFTs. You just launched, publicly, the TRC-721 standard that allows the creation of TRON native NFTs. It’s also going to be fully compatible with — what we’re more familiar with — smart contracts in Ethereum that is driving a lot of NFTs as well.

I’m curious — as you see this democratization, what are you hoping people will pick up on? What are you hoping that they will build with the TRON NFT? And I note that, already, you have some celebrities on board.

Sun: Yes, definitely. We have Lindsay Lohan, who will create the first TRON NFT on the TRON ecosystem. First of all, we offer several advantages compared to our competitor network, Ethereum. First of all, it’s [the] extremely low mint and gas fee. Today, if you try to mint some art pieces on Ethereum, the gas fee is extremely high. It costs you around, US$500 to US$1,000 to create art pieces at peak price. Also, at the same time, Ethereum transaction speed is extremely low, so it’ll take quite a long time to complete all the transactions. Today, if you want to mint on Ethereum, complete all of the mint process, it may cost you like half an hour to do so. But on a TRON transaction, we charge almost zero fees and also instant speed.

We can process 20 times more transaction volume than Ethereum daily. Right now, Ethereum processes like one million transactions per day. Our transactions have already reached four million transactions [a day], which was three million a week ago. I think it’s going to increase to 50 million very soon. That’s why I believe we can consume much more volume than Ethereum is doing. So that’s why we reduced the threshold of minting TRC-721 for our developers.

Of course, we welcome not only celebrities, but also common people. Everybody can mint their NFT on the TRON network and share to the market. I believe the market is like the judge of everybody’s artwork. Eventually, the art with lots of value will find a buyer. This is a very fair market. Eventually, everything that has real value will prevail in the future. So that’s why I believe, as long as we create a very robust ecosystem, the ecosystem itself will select the most valuable artwork in the ecosystem.

Lau: So there’s a lot of excitement about NFTs. There’s no doubt. There’s a lot of criticism and a lot of apprehensions as well. And a lot of that apprehension is, “Wow, there’s a lot of money that is swirling and is getting into the NFT space,” and it’s reminding a lot of people of the ICO craze in 2017 — everybody was flooding capital into new tokens, and then we had the celebrities. We had the celebrities that were pushing out some of these ICOs in the same way we’re now seeing celebrities, some on your network, some on others — musicians, artists, and the rest — pushing out into NFT.

Are you concerned about that aspect of it when people say, ‘Wait a second, what is this?’ And especially if they are regulators. Regulators coming in and saying, ‘Wait a second, the enormous amount of money that is coming into the space needs to be regulated. Who are these people? Who’s bidding? Who’s getting retention of it?’ And is this a real thing?”

Sun: First of all — I want to remind everybody else, when you invest into NFTs or just like five years ago, the ICO space, always be aware to only invest the money you can afford to lose. I recommend you not to invest more than 10% of your wealth into the crypto industry in the first place. I think the concerns, we can tackle those concerns in two aspects.

First of all, it’s the KYC/AML side. Definitely, I believe any NFT website — as today, we have Nifty Gateway and also have other NFT trading platforms — KYC/AML is the first thing we should do. Those NFT websites should have the same regulations and basically, anti-money laundering regulations as exchanges do. The exchanges should know who is buying those NFTs and who is receiving the money, [and] where the money goes. I think this is the number one priority for regulation on the platform. I think that’s the first thing.

And then the second thing, I believe, is the selection of those arts. We are trying to protect people’s investments here. I believe the platform should take the responsibility for the artwork selections. That’s why we only collaborate with [people with] good reputations and good actors in the industry. For example, like Beeple’s art, and also collaborating with Christie’s, collaborating with Jack Dorsey. For the NFTs we promote, we definitely want to take those responsible artists and responsible platforms to promote the NFTs to make sure the quality of the NFT work is also extremely important.

Lau: That’s a really good point to note. Because at the end of the day an NFT — anybody can create an NFT. It is actually the platform, that community, that marketplace essentially is what gives that value. So if it’s an NFT from somebody unidentified, it’s just there, and there’s no real provenance — I’ll just use that word from the art world. There’s no real provenance to that NFT, that’s another thing. That’s a great point. Let’s talk about what you would have done with Beeple’s art — and before we go on to our next topic. But what would you have done with Beeple’s art, had you won it? What would you do with the Jack Dorsey tweet? And in the future when you have your NFT art collection as it were, how would you as a collector be sharing that?

Sun: First of all, if I won the auction of Beeple’s art, I think the first thing I’m going to do, I’m going to build my own online gallery. I know lots of billionaires, they only build their gallery offline. So this is all onsite [and] you need to come to the gallery to see all the artworks. But I think, if I won the Beeple art at that time — it’s 5,000 pieces all together for the art piece — I would make these available for everybody online, so everybody can visit these 5,000 pieces. Everybody can copy it [and] share it with my art gallery website. That’s definitely something I’m going to do. I think that’s also some commitment that I can make here.

Not only Beeple’s art but all the artworks I own in the future, I will make these available online. It’s going to be the easiest art pieces that you can get access to online in the future. I believe, as I just said before, the value comes from the traffic. If you even make Van Gogh’s art distanced from people — so everybody can’t even get access to the art in the first place — the art itself is going to lose value immediately.

I’m a huge believer of sharing. That’s why I believe all the art pieces I have, I will share online immediately, and also post them on my Twitter, Instagram, so you can always very easily find the link in the first place. Everybody can enjoy the artworks in the first place. I think that’s the first thing I’m going to do.

And also, the second thing I will build when I collect lots of art, I will build a community so everybody in the community [can] appreciate those artworks. We can all together make decisions on, which art we’re going to go after, [or] what’s the next [artwork] you believe we [should] buy. That’s why I believe I want to create a community to make a community decision on which artwork we will buy in the future, and which artist has the most value in the future. I want these kinds of private art galleries, and we want to turn them into a public decision making process. Basically, we want to create and turn these from private to public.

Lau: Would you also buy physical art? Physical art and old pieces and turn them into NFTs?

Justin Sun: Yes, yes! I believe this too. So definitely, I think that’s something we can do in the future as well. Not only digital art but also physical pieces. Like Picasso, Monet, Jackson Pollock — we can turn those classic art pieces, physical art pieces into NFTs as well.

Lau: How big of an endowment fund are you planning? Picassos aren’t US$69 million. They’re a lot more than that. How much money are you planning on funding this idea?

Justin Sun: Initially, I’m thinking about taking around US$100 million. So we will put US$100 million first to see how it goes. If this goes very well and the people in the art world really appreciate [it] and the crypto industry people are really excited — if this really plays well, I think I would put in more money.

Lau: Have you thought of what you’re going to call your digital museum?

Justin Sun: Right now, I’m just thinking about “Justin’s Gallery.”

Lau: “Justin’s Gallery”! It’s self-explanatory right there. We’re going to track that. That’s fascinating. And I’m sure there’s a number of curators and consultants who would love to help you with that. But it is a very interesting space.

Another interesting space is DeFi. You’re also building ground and clout in DeFi, as you shared, US$7 billion of TVL, total value locked in DeFi.

Sun: Yesterday, already 8.5 billion.

Lau: Every time we talk and every time you watch this, you might want to check the total amount of value locked on TRON, because it’s probably changed. Two seconds passed, so it’s probably changed again. But let’s talk about the ecosystem that you’re building in the DeFi space. Why are you getting traction? How are you addressing the gas fees? And what are we seeing being built up in DeFi?

Justin Sun: I believe TRON has become the most important infrastructure in our industry. But also, of course, not only our industry but also, I think for the future generation. So today, we handle around five times more traffic and volume than PayPal. PayPal only moves around like US$2 billion every day. At peak, we are managing around US$11 billion per day. On average, we are handling around five to six billion US dollars for transaction volume every day. You can see not only TRON but also USDT, USDK, BTC, Ethereum have been transacted on the TRON network as well. I believe this year — at the end of this year — we will handle more BTC transactions [than] even the BTC network itself. So basically, I believe lots of assets, they’re going to use the TRON network as a network [where] they can make payments on in the first place. I believe that’s how we get a lot of traction in the first place. You can use the TRON network to transact your assets instantly with almost zero fee. So that, I think, is always our biggest advantage.

The second thing is; we want to build TRON network [as] a very powerful DeFi network. So you can not only use the money on the TRON network to transact those assets — basically send from A to B — but also you can lend those assets, you can borrow those assets, you can put them as collateral and against stablecoin. You can put, for example, BTC on TRON and get USDT, and you can pay back the BTC, and also get BTC. And also, at the same time, you can lend to earn interest. You can borrow and pay interest. You can just use the TRON network as a place you can generate revenue, just like banks. And you can also borrow assets from the TRON network. Also, we are trying to build a very large network today. Right now, we have over US$8.5 billion in assets on our platform right now. And I believe it’s going to grow to US$100 billion within the next five years. I believe the TRON ecosystem itself will become a very self-sustainable ecosystem in the future.

Everybody in the TRON network, can build a very powerful ecosystem in our network.

Lau: The overall concept of DeFi has just really gained a lot of traction since the GameStop incident, which, by the way, you also invested in. Are you still holding GameStop? And we already know that there’s just this incredible influx of retail investors who became really frustrated when trading was stopped. And that really catapulted a lot of people into DeFi, into crypto. Do you think that that’s going to continue?

Sun: Yes, first of all, I believe GameStop is even more volatile than the Bitcoin world. The first three days I invested into GameStop, I lost almost all my money. I had like a 90% loss. I bought around like US$280. It dropped, to like US$30 to 40 dollars. So in three days. In three days. And then, after like two weeks it pumped back to like US$300. I even earned some money from the GameStop investment. If you don’t have a very strong heart, I don’t encourage you to start investing in GameStop. You can lose like 90% of your money in three days and get it back in two weeks.

Lau: What was interesting, Justin, about that, though, is more of the movement itself. We’ve seen this in crypto. We have seen it on Reddit boards. We have seen this type of communication on social media — which you’re really good at. But this all lives in the social media space. The sentiment of traders and that really was introduced to a broader market — the Wall Street market — that did not experience that before. For those who are just starting to realize the impact of this new breed of traders, describe them. This is your generation. Describe this generation of digital traders who are more than just retail. But there’s a broader context that should be shared.

Sun: Yes, definitely. I think this is a trend in the future. So basically the younger generation people are willing to make their own decisions on trading. Instead of putting all their money in a pension fund, mutual fund, hedge fund, and let those funds trade for themselves, they would rather just trade on the couch with the Robinhood app on their mobile phone.

That’s why those trades can be very volatile. And also, at the same time, they make those decisions based on their own sentiments and their own judgment of the stocks. Because everybody these days has very easy access to stock trading in the first place. Because before Robinhood, people need to open their computer, and then trade based on the financial analysts’ analysis.

These days, people can very easily just trade on the mobile phone while they might be driving home, based on the advice of their friends and based on the news they just saw on the internet. So that’s why the whole trading behavior changed dramatically. That’s why social media sentiment is extremely important for the future generation and for the future traders. I know some of the Wall Street traders may think, “This is not okay”. They feel more comfortable with people trading — maybe they need to wear a suit and then sit on the Bloomberg Terminal and then make all the financial decisions based on Goldman Sachs, Morgan Stanley’s financial advice. But I believe this is like a trend for the future, not only [in the] United States, but also in China. We see the same trend, you know. Futu [Bull] is extremely popular these days in Hong Kong. Everybody trades their stocks on Futu instead of a Bloomberg Terminal.

Lau: This is kind of like a Robinhood. This is a digital online brokerage house.

Sun: Yeah, exactly. This is like the future generation. People are going to invest based on these kinds of sentiments in the first place. And all the stocks they’re going to pay attention to are the ones that really have social media traction. Even Coinbase started to talk about [making] their roadshow on Reddit, instead of a physical or traditional channel roadshow in the future. I believe, in the future, we’re going to even see a very big company’s CEO do their AMA on Twitter or Telegram instead of traditional phone call channels with investors from investment banks.

That’s why I believe this kind of paradigm shift will shape the future ways [in which] we communicate with investors, how we communicate the company’s strategy with everyone in the future, which I believe is definitely progress. Because in the future, investors definitely [will] demand more frequent communication and more transparency from the company. I definitely believe a company’s CEO [that] communicates with their investor in social media will definitely have more transparent and more frequent communication with investors in the first place, which I think in the long term, is an even better way.

Lau: And how should we be thinking about China here? In your biography, it notes that Jack Ma — we all know Jack Ma, one of the founders of Alibaba who started Hupan University. This is a corporate business school located in Hangzhou where Alibaba is based. He hand-selected you to study there. In that group, the next generation of Chinese founders and entrepreneurs — what is the next generation in China thinking about crypto?

Sun: I believe the younger generation in China will embrace crypto eventually. But right now, I believe we still have some regulatory concerns to clear before we can move to mass adoption. But I definitely feel it’s going to come. First of all, I can give you some examples. I’m the advisor to several Chinese government institutions on blockchain. The Chinese government is very familiar with blockchain and they are trying to find a good way out without disturbing the current regulations on foreign currencies. We all know those regulations in China.

And then also, we’ve seen China’s central bank start the virtual currency project in China and start to use this as a way to basically trade other traditional assets inside of Mainland China. I believe in the future we will definitely see a lot of progress happen in Mainland China. But I believe it’s first going to start from Hong Kong, of course. So Hong Kong is part of China, but more like a special region. That’s why I think a lot of the things China wants to do, they will put in Hong Kong first to try it out and to reduce the financial impact it would have in mainland China.

Lau: But there’s already considered regulation and a new policy that proposes restricting crypto trading for retail investors. And we’ve also seen Weibo recently banning the accounts of Binance, and OKEx and Huobi. And is your Weibo account back online, or is it still offline?

Sun: My Weibo is back online, yeah. Its name is sūn gē shuō (孙哥说).

Lau: It’s just an example of how still, really, tentative China appears to be on specifically, crypto. And so what can we expect, especially since that China, as we know, is top-down and yet there’s a generation that is a little bit more open to crypto. And to your case in point, what’s happening in Hong Kong could very well be a test case for China.

Sun: Yes. Hong Kong recently started to issue licenses for OTC crypto trading in Hong Kong. As we all know these days, Hong Kong’s policy is highly related to mainland China. So every policy, they need to get approval from the central government in the first place. That’s why I believe this is definitely one important moment for Hong Kong crypto trading. But of course, right now, Hong Kong doesn’t allow retail trading of crypto. They only issue a license for OTC, which are credit investors, to invest in crypto. And of course, we see a Hong Kong publicly-traded company Meitu also started to invest in Bitcoin and Ethereum. I’m optimistic about the crypto future in Asia. We’ve seen Hong Kong as a place to start to embrace crypto. And after, I believe if we have positive feedback from Hong Kong, we will start to see a change in mainland China.

For the Weibo accounts [being] shut down for Huobi and Binance, I believe this is more Weibo’s decision rather than anything related to government regulation. Because right now, these days, Weibo is always trying to control the financial risk they might take in their platform. Not only crypto but also Weibo shut down lots of the stock price analysis accounts. Because Weibo generally thinks stock price analysis is also kind of a risk because if people lose money, they are going to blame Weibo for having those accounts in the first place. That’s why I feel like this is more like Weibo’s own decision on financial risk control rather than government regulation of those accounts.

And also, I feel optimistic [for] — eventually — crypto in China. First of all, China is a very innovation-friendly country. I think ByteDance and also Tencent, Alibaba, Meituan also gained a lot of success in China. I believe China will eventually embrace these blockchain innovations.

Lau: Before I let you go, I got to ask you about one more auction. You’re very famous for winning and being close to winning auctions. But that US$4.5 million one for a lunch date with Warren Buffett in January 2020, before Covid shut the whole world down. He is one detractor of crypto that has not changed his mind, nor his very close friend Bill Gates. How important are these voices in crypto adoption? What were those conversations that you had with Warren Buffett and what are the kind of questions he asked you about?

Sun: First of all, looking back, I feel like I’m so lucky to have arranged the dinner with him in January. So if in March or something, it might [have been] canceled again because of Covid. I believe Warren Buffett’s [and] Bill Gates’ opinions are definitely extremely important for our industry. I believe they have huge power. If they had recognized crypto earlier, we might even [have gotten] to mass adoption earlier than what we have done today. But just as I predict — I believe if Warren Buffett is not willing to get into crypto, eventually Warren Buffett’s son and Warren Buffett’s grandson will get into crypto eventually, someday. We’ve already seen, [that] after Warren Buffet and Bill Gates didn’t recognize the value of crypto, but Elon Musk is willing to put like US$1.5 billion into crypto. And his investment already got 100% on return. That’s why I believe, eventually, everybody in the top Forbes 400 list will recognize the value of crypto. Today, we only have maybe Elon Musk himself in that list. But, eventually, I think, 80% of the people in the Forbes 400 will start to recognize the value of crypto.

Lau: What did he ask you about crypto? Anything specific?

Sun: I think the biggest concern Warren Buffett had on crypto is that crypto doesn’t have dividends. I believe that Warren Buffett’s investment philosophy is heavily dependent on the dividend. He is a huge believer in dividends. So he believed you can get investment back, not because of the volatility of the stock price, which is, of course, unpredictable. He is willing to get the price back based on the dividend from the stock in the first place. You can see all the stocks he is willing to invest in — like for example, Apple — it’s those companies that have a huge amount of cash on their bank account and are willing to give dividends to the investor all along the way. After 10 years, he can make his money back, not because of the volatility of the stock, but because of the dividends he can receive from those stocks in the first place. So that’s why when he looked at Bitcoin, he’s like, “The only thing you can depend on Bitcoin is the volatility of the Bitcoin price. But you can’t get any reward back [from the] investment you put into crypto.” That’s why I even took Warren Buffett’s advice when I invented TRON — so TRON is also crypto you can stake in and get a reward. Today, if you participate in the governance of the TRON network, you can get the block reward from the TRON network. That’s something I think I learned from Warren Buffett.

Lau: You going to name that reward after Warren Buffett?

Sun: Yes. Maybe we can take this mechanism to, like a ‘Warren Buffett’ block reward.

Lau: Let’s see if he’ll agree with that. Probably, you know, maybe just his initials in a nod to the story. Do you hope to be one of the future digital versions of Warren Buffett? How are you amassing, not only your corporate wealth, but also your personal wealth?

Sun: Yes, I believe in the future — blockchain is definitely still our main focus. But also, I will start to allocate my personal wealth and other company wealth into a place it can help bridge crypto to the traditional world. That’s why we take lots of money and we to invest into NFT and traditional art, because I think this is a very good window. We can connect crypto with traditional arts and mass adoption.

Lau: Well, we are looking forward to our invitation to the inauguration of Justin’s Museum. And we’ll be personally interested at Forkast to see what’s hanging on the digital wall. But until then, we will see you again at GBA Blockchain Week. It was a pleasure speaking with you here, Justin. It will be a pleasure speaking with you at Blockchain Week. And I want to thank you, for now, for joining us on Word on the Block and this latest episode.

Sun: Thanks. Thanks, everyone.

Lau: And thank you everyone for joining us on this latest episode of Word on the Block, I’m Forkast.News Editor-in-Chief Angie Lau. Until the next time.