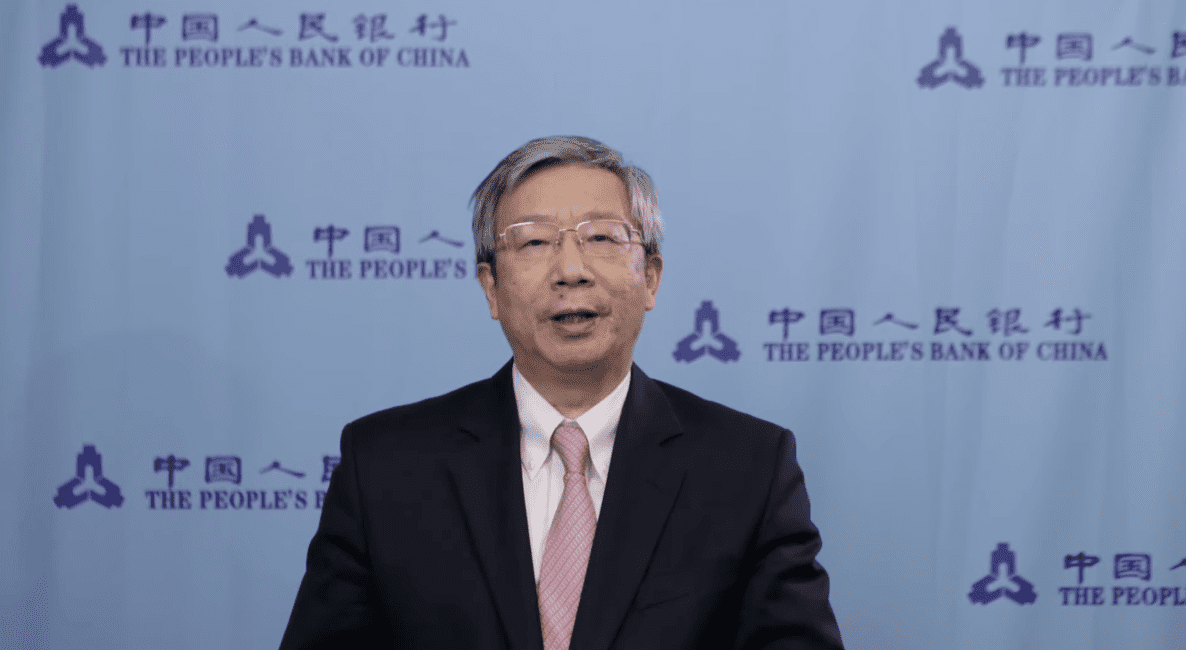

China’s central bank has again reiterated its plan to “strengthen personal data protection,” as People’s Bank of China Governor Yi Gang said today in a pre-recorded video speech at Hong Kong Fintech Week, although he did not mention the privacy concerns surrounding the country’s digital currency in trial — the e-CNY.

Yi said technologies such as artificial intelligence, big data, cloud computing, distributed ledger and e-commerce have been increasingly integrated into the financial sector, and that has led to the need for personal data protection.

“Some big techs have either collected data without permission or misused them. There are also cases of customer data leakage. Therefore, it is urgent to strengthen personal data protection,” Yi said, adding that a legal framework for personal data protection has taken shape in China, as the Data Security Law and the Personal Information Protection Law were promulgated in June and August, respectively.

In July, tech giants including Alibaba, JD.com and ByteDance announced plans to improve personal data protection for their users. For example, ByteDance said the merchants on its e-commerce platform will not obtain the full details of their customers’ private information.

Yi said that data protection has been high on the agenda of the PBOC, and that since 2005, the central bank has introduced relevant regulations in the areas of anti-money laundering, consumer protection and credit information.

However, Yi said the ultimate purpose for data protection is to promote its proper usage. “On the premise of protecting personal privacy, we will try to define data ownership in a more accurate manner, facilitate data transactions and promote fairer use of data, to unleash the vitality and innovation capacity of market players.”

Yi’s words come as the PBOC has been actively pushing ahead with the development of the e-CNY, over which many have expressed concerns over privacy.

China is pioneering the world’s first major central bank digital currency. The e-CNY, alternately called the digital renminbi or e-RMB, is issued by the PBOC. Many expect China’s CBDC to be formally launched in time for the Beijing Winter Olympics in February.

In a white paper released in July, the PBOC noted that the e-CNY is not a 100% anonymous system, but supports “managed anonymity” with tiers of complexity based on know-your-customer needs.

In the same month, three U.S. senators wrote to the country’s Olympic and Paralympic Committee to urge it to “forbid American athletes from receiving or using digital yuan during the Beijing Olympics,” due to privacy concerns.

In the joint letter, senators Marsha Blackburn, Roger Wicker and Cynthia Lummis wrote: “The digital yuan is entirely controlled by the [People’s Bank of China],” adding that the details of what and where someone used the currency could be tracked and traced by the central bank.

However, through cooperating with tech giants, the central bank could, to some degree, weaken the dominance of tech giants over consumer data, “as [the tech giants] could only obtain part of the user data given the e-CNY’s controllable anonymity nature,” Meng Liu, a blockchain analyst at research firm Forrester, previously told Forkast.News.