What are the things you’ve always wanted to know about the future of Bitcoin, Ethereum, DeFi and the cryptocurrency industry at large but didn’t know whom to ask?

The latest Finder Cryptocurrency Predictions Report, which surveys 30 industry experts, provides some answers.

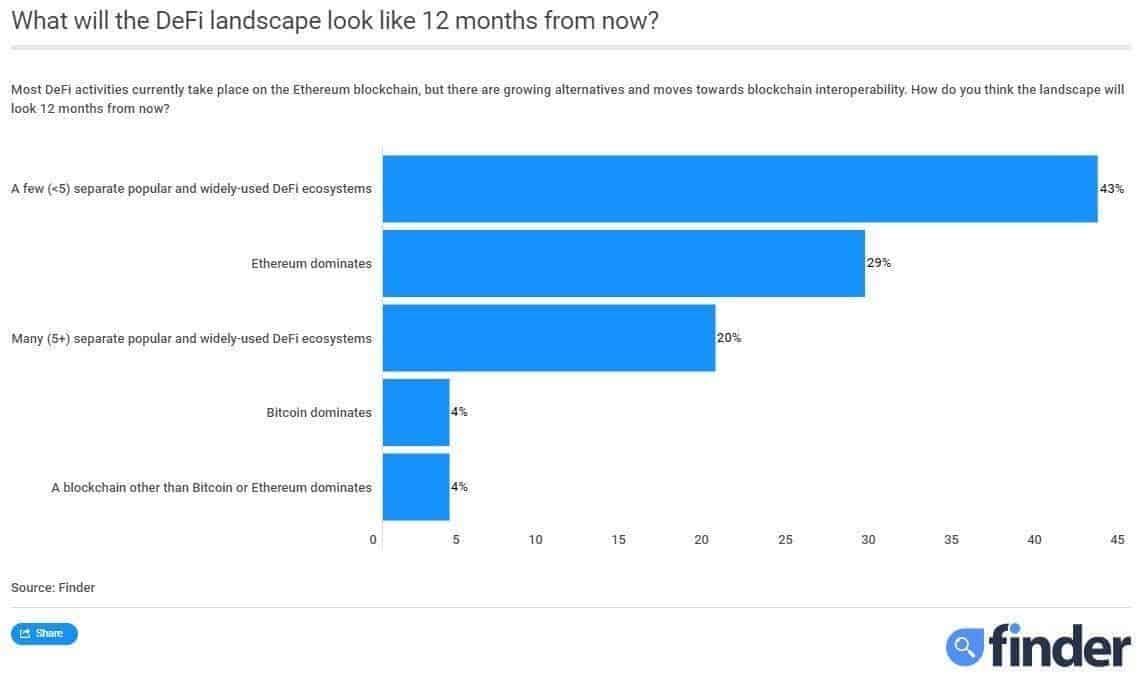

Some of the most noteworthy results — aside from whether to buy, sell or HODL bitcoin — came in response to a question about blockchain dominance and competition in decentralized finance (DeFi).

We asked our experts: What will the DeFi landscape look like a year from now?

Blockchain’s future: destination unknown

This one big question encompasses lots of little questions to which there are no decisive answers, such as:

Are we going to see Ethereum swallow all competition through the power of its network effects and composability?

Can Bitcoin realistically compete as a protocol rather than an asset through RSK smart contracts and other sidechains?

Also: When will the “Ethereum killers” show up and will they be able to stick the knife in?

It also means forming an opinion on how blockchain interoperability could affect the lay of the land, and asking oneself questions like:

What are the odds of some hitherto unknown settlement layer stealing the action?

Are different settlement layers destined to be competitive or can they be complementary?

Does the rise of blockchain interoperability change the picture, and could it counterintuitively end up encouraging the rise of a single dominant base layer? How many settlement layers can the market support, and how could the trajectory of blockchain adoption change that over time?

And what about topics like cryptocurrency regulations, and on how the technology is used?

What’s the likelihood and potential impact of regulatory intervention in decentralized finance?

Can zombie chains come to life?

Will users be directly interacting with dapps or is the end game one where it’s primarily just centralized financial institutions interacting with each other across the blockchain?

Then there are the questions that are almost unanswerable.

How do you account for crypto tribalism?

How do our biases and blind spots and knowledge gaps cloud our judgment?

We did not directly ask any of these little questions. We only asked the big questions — What will the DeFi landscape look like 12 months from now? — and then invited our experts to elaborate if they wanted to. It’s here, in the elaboration, that these small questions that many cryptocurrency enthusiasts may have always wondered about were answered.

See related article: Is DeFi’s breathtaking rise just like the ICO bubble?

While there was no clear consensus on the big question, there was a lot of agreement on some of those small questions, and several common themes emerged.

With so much uncertainty in the future of blockchain, it’s worth looking a deeper look at some of the small questions to find the undercurrents of agreement among all the differences of opinion.

What do the experts say about Ethereum?

One point of broad agreement was an inclination towards a multi-polar world of interoperable blockchain ecosystems and cross-chain transfers, either with or without one larger and more dominant chain. Ethereum was most commonly named as that dominant chain.

However, several panellists who answered “Ethereum dominates” clarified that they were expecting it to remain the largest of several protocols, rather than it dominating as the sole protocol.

The mostly agreed-on view of a multi-chain world was tempered by general agreement that there likely wasn’t room for too many of them.

As Gavin Brown of the University of Liverpool suggested, effective blockchain interoperability doesn’t necessarily mean blockchains for all. On the contrary, it could actually help limit the number of different viable protocols.

“Historical technology innovations are littered with examples of a shake-out phase and ultimate coalescence around a dominant technology protocol,” Brown said. “Interoperability relies on such a dominance of one (Ethereum) or a limited few such rival blockchain platforms.”

The market will naturally coalesce around fewer rather than more protocols, predicted Jeremy Cheah, associate professor of cryptofinance and digital investment at Nottingham Trent University in England.

“There will be many DeFi ecosystems, but there will be leaders because of the issue with trust and ease of use,” Cheah said. “[The] majority of users are followers of the herd. For example, some major cryptocurrencies will lead, so there will be a number of separate but popular and widely-used DeFi ecosystems. No one will be able to learn all the different types of ecosystems — information overload.”

Edward Hickman, founder and CEO of Anatha.io, had a different view, noting the potential for seamless interoperability to not only break down some of the technical barriers between ecosystems but to also break down the perception of there even being different ecosystems and replacing it with the simpler binary of on-chain versus off-chain.

“Interoperability means users will move freely from one network to the next, oftentimes without realising it. So while there already are many systems emerging to the end user it will seem more like they are simply part of a larger macro ecosystem,” Hickman said.

A crystal ball on Bitcoin, Ethereum and DeFi?

Overall, the maximalist, zero-sum views of cryptocurrency that are relatively common on social media were nowhere to be found, and the majority of panellists were bullish on both Bitcoin and Ethereum alike, often for different reasons. Blockchain interoperability was a common theme.

“I think there would be a few widely-used DeFi ecosystems — possibly with Ethereum still dominating,” said Dr Iwa Salami, senior lecturer in financial law and regulation at the University of East London. “There may also be the development of interoperability and interactions between DeFi ecosystems and possibly the migration of assets across DeFi ecosystems.”

She added: “There is likely to be continuing interest in bitcoin given the ongoing Covid-19 pandemic and its impact on traditional capital markets. Investors would continue to look for other assets (such as bitcoin) as a hedge against inflation and to protect their assets against devaluation. This is likely to drive the price of bitcoin up. Also, with the increasing popularity of DeFi, this is likely to drive up the price of cryptocurrencies and in particular bitcoin and ethereum.”

At the same time, Salami noted that “DeFi is likely to continue to grow over the next 12 months for the following reasons: DeFi has the potential to facilitate financial inclusion by opening access to financial products to the world’s 1.7 billion unbanked people as it allows just about anyone to get a loan. This can benefit small-to-medium enterprises and individuals without a credit history, as it does not utilise credit scoring — which inhibits access to finance in formal banking systems… closely linked to this point also is that DeFi can be adopted in developing countries as a way to hedge against inflation. It can enable people in such countries with high inflation to access stable assets to preserve their purchasing power and earn interest at the same time.”

Thomson Reuters technologist and futurist Joseph Raczynski said: “While I think Ethereum will dominate, there will be a few others that have a place as well… it’s also healthy for the market to have several.”

There unfortunately isn’t space here to unpack all the other questions in the “Finder Cryptocurrency Predictions Report” to a similar level of detail.

But between the multitudes of mini-questions lying behind — What will the DeFi landscape look like 12 months from now? — the challenge of encompassing answers in a multiple-choice format and the insightful additional commentary panellists volunteered around that question, it seemed worth going through that one in a bit more detail.

You can find the full report here: https://www.finder.com/cryptocurrency-predictions