Fall. A season that welcomes pumpkin-spiced lattes, the National Football League, peak leaf forecasts, and… regulatory coordination?

Indeed, participants in the digital assets space, in particular, have witnessed a flurry of regulatory activity within the past several weeks from federal and state agencies whose latest actions contribute to the development and legitimization of the blockchain industry. While several significant actions have been undertaken or brought forth on an individual or agency-by-agency basis, this season has also brought with it a renewed effort, if not continued interest in, intra-governmental coordination over regulating digital assets.

Recently, the Office of the Comptroller of the Currency (OCC) published an interpretive letter providing clarity to national banks and federal savings associations’ authority to hold reserves on behalf of customers that issue stablecoins. At the time of the announcement, the Securities and Exchange Commission’s (SEC) Strategic Hub for Innovation and Financial Technology (FinHub) published a statement on the OCC’s interpretation, stating its belief that market participants “may structure and sell a digital asset in such a way that it does not constitute a security and implicate the registration, reporting, and other requirements of the federal securities laws.”

The coordinated letter and statement were followed separately by the SEC’s Division of Trading and Markets issuing a no-action letter to the Financial Industry Regulatory Authority providing further guidance regarding the role of alternative trading systems in the settlement of digital assets. The no-action letter specified a three-step process for broker-dealers that operate an alternative trading system (ATS) that trades digital asset securities to follow.

Similarly, at the first of three Empower Innovation events put together by the Commodity Futures Trading Commission (CFTC), Chairman Heath Tarbert mentioned the agency’s interest in having an open dialogue with the SEC, noting that the CFTC’s strategic plan includes working closely with the SEC to, wherever possible, make regulations of digital assets consistent if there is overlap.

There is no question that regulatory coordination is imperative at a time when finance is increasingly turning digital and where previously held distinctions, industry silos and geographic boundaries are either converging or collapsing. In 2014, at the launch of the Milken Institute FinTech program, co-authors Chris Brummer and Daniel Gorfine identified several “disruptive characteristics” of financial technology, including their borderless nature and potential to propel industry convergence. These remain even more true today.

Ongoing developments in the payments space perfectly embody the disruptive characteristics identified in the above-mentioned report. Today, the very nature of what a payment is, what form it takes, and the medium used to conduct a transaction, continue to evolve, and previously held distinctions are converging.

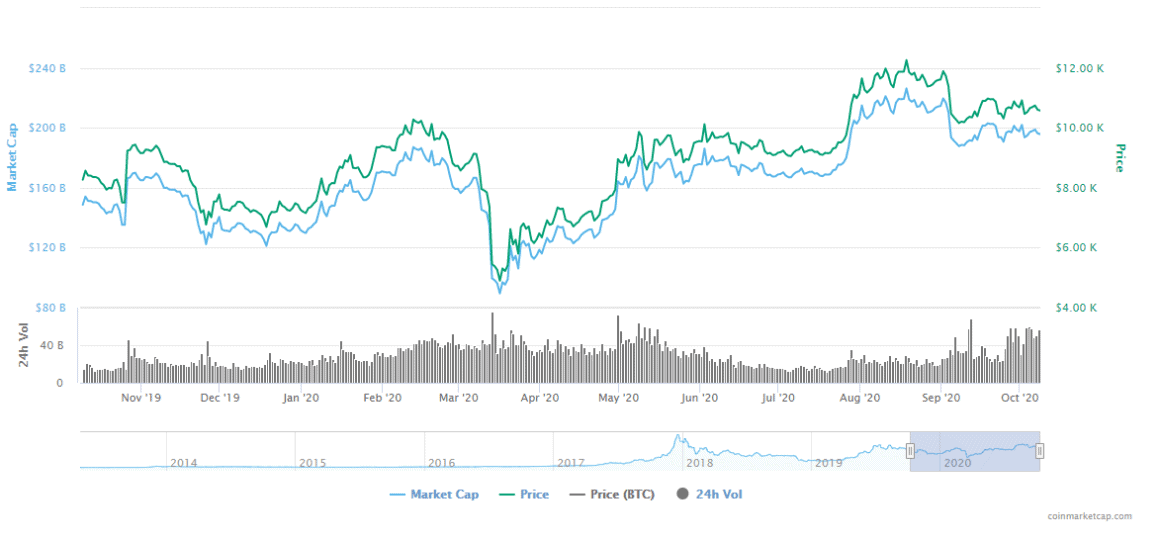

We are far beyond the use of cash, check or card to conduct transactions. When one considers the bridging of traditional investment assets as payments — the launch of Libra, Mastercard’s launch of a CBDC testing platform, PayPal offering direct sales of cryptocurrency, or the intersection and interaction between a digital dollar, stablecoin, and other digital assets — what a payment looks like and how it is transacted continues to morph, blurring previously-held regulatory distinctions and militating toward regulatory coordination in the complex and fragmented mesh of state and federal regulators.

See related article: Chris Giancarlo: digital dollar technology is coming ‘fast and furious.’ Can US seize the CBDC momentum?

A Government Accountability Office (GAO) report published in 2016 highlights this complexity and the vast expanse that is our financial regulatory system. It is a system that is increasingly challenged to respond rapidly to the continued evolution of our financial services ecosystem. It is a system in which the combination of overlapping jurisdictional interests, and new digital assets technologies has clouded the lines of how certain firms or activities are treated and, in some cases, created significant confusion as to who has primary regulatory purview. It is a system in which state and federal regulators continue their longstanding jurisdictional power-struggle. It is also a system that, for all its flaws, has contributed to a vibrant, competitive, and rich financial services ecosystem that houses the world’s largest and most robust economy. And, it is a system that will likely remain in place for the foreseeable future.

Ripping up and starting over simply is not an option anymore. We are nearly a century beyond that opportunity. What is needed — especially at a time when the financial services industry is undergoing profound changes by actors from within and outside traditional boundaries and where blurred lines are becoming, for lack of a better word, “blurrier” — is even greater exertion on the part of federal and state regulators to coordinate and collaborate on areas where overlapping frameworks make it extremely difficult for industry to responsibly function, innovate, and grow.

Yesterday’s regulatory turf battles are today’s opportunity to join together, to unlock U.S. innovation from the bonds of regulatory uncertainty over digital assets and drive U.S.-based standards internationally.

Recent announcements and statements once again demonstrate regulators’ interest in joining together, where appropriate, to provide for greater clarity and regulatory certainty for the digital assets world. Technological innovations will continue to bring to the surface new (and old) regulatory challenges as firms and the products themselves transform and further stretch, or make obsolete, the siloed regulatory structures upon which our current system is based. Collaboration is key.

As the seasons change, will the regulators’ appetite for further collaboration change with it? It appears so, and with Thanksgiving not far away, we leave you with that tasty metaphor.

These issues were examined further in the recent webinar, “Two Sides of the American Coin: Innovation & Regulation of Digital Assets” with speakers including SEC Chairman Jay Clayton and OCC Acting Comptroller Brian Brooks. Take a look back at the webinar here.