In this issue

- DeFi hatchling YFI flies past bitcoin

- ConsenSys acquires Wall Street bank’s marquee blockchain project

- OMG launches integration of Tether transfers

- In China: Flooding devastates bitcoin-farming region; crypto capital flight

- VC spotlight on India

From the Editor’s Desk

Dear Reader,

Blockchain-based smart contracts are starting to change the world’s financial infrastructure faster than anyone expected… and it’s truly decentralized. DeFi has in a short amount of time catapulted disruptive finance into mainstream financial institutional thinking. Why? Because all of a sudden, via transparency and immutability, DeFi is allowing people to take control in a way they’ve never been able to do before. It is peer-to-peer financing, all the while skipping the banking institutions that used to provide the platform to do the same thing. That’s the idealistic way of describing it. Another is, leveraging cryptocurrency holdings by allowing you to loan and borrow what you’ve got without much hassle or fuss — and with a whole lot of anonymity.

These are the stories of note in this week’s Current Forkast. DeFi has fueled the YFI token (that behaves more like an ETF, or exchange-traded fund) to reach higher climbs than the current value of bitcoin. DeFi has also spiked the value of Ethereum, the platform that fuels these transactions, as a surge in network activity forces users into paying more to avoid congestion. And then there’s yield farming, where users can park their cryptocurrency and watch it grow at 2%+ — which, once upon a time, was the standard savings rate. Today, we’re lucky that we’re not charged interest for keeping money in the bank.

At the end of the day, what is really fueling DeFi? The chase for yield. Hedging against a system that is sputtering under the weight of politics, Covid-19 and global tensions. When investors think that the value of holding USD in 30 years is worth only 1.34% (the yield on the 30-year U.S. Treasury bond), it’s time to look for innovative ways to find value elsewhere. That’s what traditional markets are telling us. That’s what DeFi is showing us.

Until the next time,

Angie Lau,

Founder and Editor-in-Chief

1. DeFi hatchling YFI flies past bitcoin

By the numbers: YFI — over 5,000% increase in Google search volume.

Yield farming’s latest scalp is none other than the almighty bitcoin. YFI has now surpassed bitcoin prices, peaking at over US$16,000. YFI is the governance token of Yearn.finance (yEarn) and was priced at around US$4,000 in mid-August. As the decentralized finance sector continues to soar, YFI prices have jumped by more than 250% over this past week alone.

- YFI is the only cryptocurrency with relevant market cap that has surpassed bitcoin in prices. However, bitcoin’s market cap exceeds US$200 billion while YFI sits just above $400 million

- Launched just last month, yEarn is a yield aggregator that uses DeFi protocols such as Compound and Aave.

Forkast.Insights | What does it mean?

Before we get too excited about a newbie cryptocurrency “beating” bitcoin on price, let’s take a step back to make sure we understand what yEarn is.

yEarn is a low-supply governance token that acts like an exchange traded fund (ETF) of sorts for DeFi investment opportunities. It’s a fund, not an individual token. Capped at 30,000 tokens, which is significantly lower than most other cryptocurrencies or tokens, the token automatically allocates your assets to DeFi investment opportunities that execute on Ethereum. As a governance token, its holders have a stake in deciding how its portfolio should be balanced, and like many other DeFi tokens, it can be farmed as well.

As of August 25, it had an impressive US$789 million in value locked in, split between USD, ETH and BTC, according to DeFi Pulse.

To be sure, yEarn isn’t a substitute for bitcoin in anyone’s portfolio and will likely not follow bitcon’s pricing relationship to commodities or the macro economy. As people aren’t buying it as a substitute, its rise in value over bitcoin is merely psychological. Its worth comes from its limited supply and potential for dividends. The structure of YFI is something that could be emulated down the road and more of these may appear. And that’s a good thing. Bitcoin will likely always have the highest market cap, but not necessarily the highest value.

2. ConsenSys acquires JPMorgan’s Quorum blockchain

By the numbers: Quorum — 2,150% increase in Google search volume.

ConsenSys has announced its acquisition of JPMorgan Chase’s marquee blockchain project, Quorum. However, even before ConsenSys had gone live with the announcement, the keywords were already trending and social media buzzing.

- Quorum is JPMorgan’s open-source blockchain powered by Microsoft Azure, with its use cases mostly in the financial sector such as the Interbank Information Network, which connects 300 banks.

- Although some in the crypto community laud ConsenSys for expanding blockchain into the mainstream, crypto purists have been critical of the blockchain company for cooperating with JPMorgan, a Wall Street mainstay.

Forkast.Insights | What does it mean?

Quorum was an attempt to fork Ethereum into a permissioned blockchain to make it ready to serve as institutional grade infrastructure for the banking sector. The technology showed a lot of potential and was a very logical asset for JPMorgan considering the inefficiencies in clearing, derivative settlements and cross-border payments. There have also been proposed use cases like ensuring the security and liquidity of loyalty program points.

However, internally, the project never seemed to take off. JPMorgan CEO Jamie Dimon notoriously called cryptocurrency a fraud, and vowed to fire any trader caught dabbling in the devil’s depository. Of course, he walked back those comments: “The blockchain is real. You can have crypto yen and dollars and stuff like that.”

Quorum does play a role in JPMorgan’s Interbank Information Network. But to be sure, the technology does not assist in the transferring of funds. It only assists in Financial Action Task Force (FATF) compliance and also in tracking down missing payments that might have been stuck at a correspondent bank. It’s a way to make SWIFT more efficient, but not replace it. Not something revolutionary, but evolutionary.

Quorum will have a better home at ConsenSys given its enormous potential. Its deployment with JPMorgan’s Interbank Information Network was interesting, but the technology could do more than that. If partnered with the right challenger bank, there could be something revolutionary in the oven.

3. OMG Network integrates Tether transfers

By the numbers: OMG Network — 2,650% increase in Google search volume.

Along with DeFi’s explosion in popularity, Tether has been congesting Ethereum’s network. Alongside Ethereum’s soaring popularity and demand, its gas fees (transaction fees) have also been soaring. In response to increasing complaints from the community, OMG Network — a finance scaling solution for Ethereum — has launched its integration of Tether transfers.

- Tether has been receiving the blame for Ethereum’s high fees, as Tether transfers are responsible for almost 15% of gas spending in the Ethereum network.

- Tether had been live on seven other blockchains, including EOS, Algorand and Tron. After its integration with OMG Network, the world-leading stablecoin is now on its eighth blockchain.

- Just days later, US$1 billion worth of Tether was moved from the Tron blockchain to the Ethereum blockchain. Transaction records show that Binance performed the move.

Forkast.Insights | What does it mean?

Ethereum — which aspires to being “the world’s computer” — is starting to show some pretty serious cracks in its infrastructure. For any sort of application that’s not DeFi, it’s no longer economical to run on Ethereum. It’s simply too expensive.

DeFi’s transaction-heavy nature is straining Ethereum’s proof-of-work consensus mechanism, which relies on commodifying computing power to incentivize the network to keep transactions flowing. According to ETHGasStation, DeFi has been a big money maker for nodes on the Ethereum network: in the last 30 days, 16,100 ETH, or US$6.3 million has been spent on Tether; 17,700 ETH, or $6.9 million has been spent on Uniswap, while many other of the top DeFi protocols have six-figures of spend to their name.

At the same time, all of this is incentivizing other blockchain networks to mature to the point where they can become competitive with Ethereum — on network strength and reach. For all of the other, competing blockchain networks that are out there, like TRON and Neo, they weren’t really being utilized because Ethereum was simply good enough. But this is changing. Despite Ethereum’s track record, and the potential pitfalls of engaging with a blockchain that doesn’t have the same strengths, the fact is, there’s a major need for alternatives given the congestion on the Ethereum network. It probably won’t be just one, but many. OMG, a blockchain network that only appeared recently, is effectively a hack for Ethereum — a solution that batches transactions and allows proper scaling. But that’s simply a band-aid. The time may be ripe for competing blockchains to take the limelight.

4. In China: Floods devastate Sichuan bitcoin farms; $50 billion in cryptocurrency takes flight

Severe flooding and landslides in China’s Sichuan Province recently devastated the region’s many bitcoin mining farms, leaving a trail of power outages and soaking wet mining rigs.

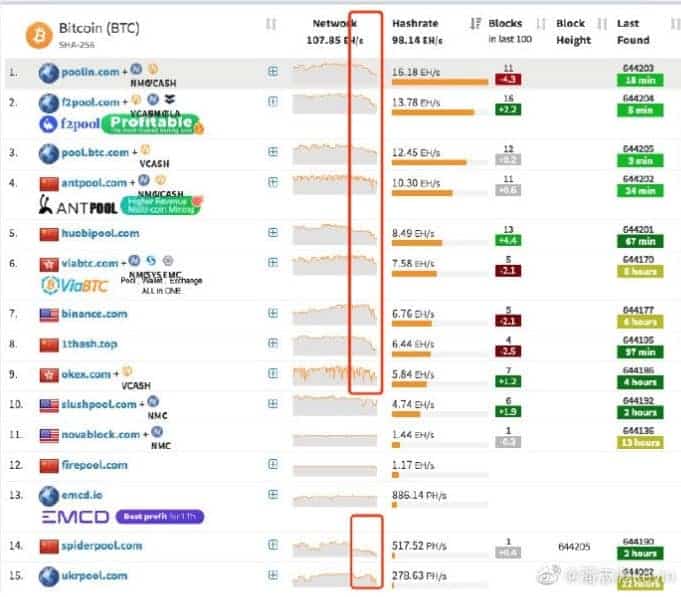

- Sichuan’s abundant and inexpensive hydropower has made the province one of the most popular places for bitcoin mining, after Xinjiang Province. However, the recent flooding is on record as the worst in 70 years. The natural disaster caused a distinct drop of BTC hashrate in Chinese mining pools, including Poolin, F2Pool and Antpool.

- Poolin, a Chinese crypto mining operation, posted on Twitter a video showing a mining farm in Sichuan region that has been totally destroyed, with overturned and soaked crypto mining machines.

A mining farm located in the Sichuan region has been hit HARD by the recent floods: pic.twitter.com/bwajpYqwEh

— Poolin (@officialpoolin) August 18, 2020

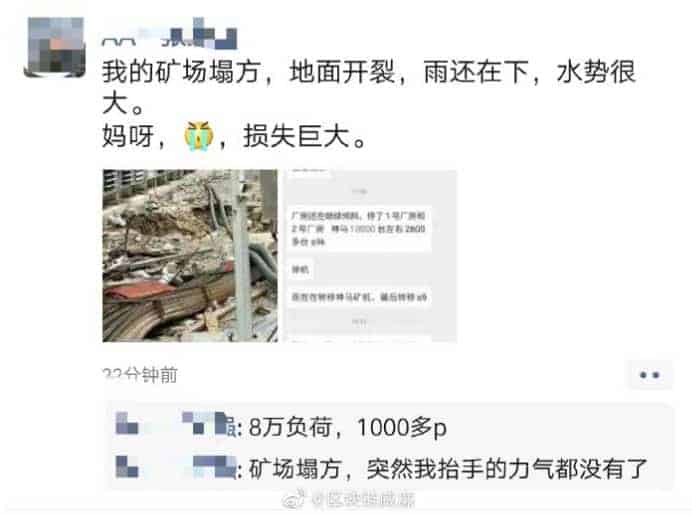

- A screenshot from WeChat’s “friend circle” believed to be posted by a crypto mining operator in Sichuan has been circulating in mainland China. The poster wrote that his bitcoin mining farm was hit by a landslide, and the factory’s 10,000 Whatminers and 2,600 Antminers were destroyed.

Forkast.Insights | What does it mean?

Despite Bitcoiners promoting the ethos that bitcoin mining is all about a decentralized future, in actuality, this couldn’t be further from the truth. Given Sichuan’s cheap hydroelectric power, the cryptocurrency mining industry — as energy intensive as it is — has clustered in the region for economic reasons. On one hand, that’s a good thing for the crypto sector at large — hydroelectric power is not only cheap but also carbon-free. Clean energy bitcoin mining regions like Sichuan could undercut research showing Bitcoin as an environmental disaster. Canada’s British Columbia and Quebec are also crypto mining hotspots and happen to have an abundance of clean hydropower.

The question now is, what will all these formerly clean-energy bitcoin mines that have been literally swept out of business do next?

The problem with Sichuan is that the region is geographically precarious. Thanks to climate change and overdevelopment, the heavy rains that produce the cheap clean power also can cause dangerous soil erosion. When rain-induced landslides happen, it’s very damaging to the region, especially equipment-heavy businesses like bitcoin mining.

Will Sichuan’s bitcoin farmers set up their crypto-mining factories again on the same land after the waters completely recede, or move to another place — like Xinjiang? Xinjiang is also a top region for bitcoin mining in China, according to a recent study.

Like Sichuan, Xinjiang also offers cheap power, which may be why more than 30% of the country’s monthly hashrate is now believed to be located in that Chinese province according to the Cambridge Center for Alternative Finance. But unlike Sichuan, Xinjiang produces coal — and the inexpensive electricity fueling its bitcoin factories there comes from dirty coal-burning power plants.

Chainalyis, a blockchain forensics firm, reported that up to US$50 billion in assets during the past year have moved out of China via cryptocurrency, suggesting that capital flight may be heating up.

- China limits its citizens to moving US$50,000 a year outside the country. However, local appetite for overseas real estate and a desire to shield wealth from Beijing means a market for vehicles to bypass these restrictions is alive and well.

- Since Beijing’s 2017 ban on direct conversions of RMB for cryptocurrency, the dollar-pegged stablecoin Tether has gained in popularity in the China market.

- Given Tether’s liquidity and restrictions on capital leaving China, many cross-border transactions are being settled in Tether, according to the report.

- DCEP, China’s soon-to-be-launched digital currency, would enable more liquidity in RMB-denominated cross border transactions, but would also have measures in place to prevent capital flight.

Forkast.Insights | What does it mean?

China’s relationship with blockchain and digital ledger technology is complicated. On one hand, as Forkast has covered in-depth before, China is embracing both technologies as a pillar of the next industrial revolution. However, the most popular use case of the technology — cryptocurrency, which allows moving capital around the world in an efficient manner — is only allowed in a limited, monitored and highly controlled sense inside the DCEP.

Stopping capital flight is going to be a tough proposition. Capital flight happens when the markets believe that an economy is structurally unsound. Chainalysis notes that the biggest spike in demand for Tether came on March 17 this year, as most of the world declared a Covid-related state of emergency and economies shut down while equities entered a state of ultra-volatility. During this time, the economic outlook for the world looked bleak. Wealthy Chinese were no doubt spooked. The Chinese economy at the time — as China and the U.S. engaged in a trade war — was just reopening, and demand was soft. With the other major world economies about to shut down, it looked like a possible and prolonged period of malaise was in store for the rest of 2020.

For as much as DCEP is praised as a necessary tool to challenge the hegemony of the U.S. dollar, putting a software layer on the currency isn’t going to change the fundamentals of the economy. As Tim Draper recently said, in a special Forkast.News podcast: “If you digitize the dollar or the renminbi, you are still stuck with most of the problems that you have with current political currency, with fiat currency. I wouldn’t want to take Chinese digital currency anymore than I’d want to take renminbi.”

As the risk of major sanctions on China increases, the demand is there for a non-U.S.-led system of international settlement. However, if this is backed by the RMB, the market might not be interested. As we’ve seen with Tether, when people need to put their money on the line — and have confidence — it will probably still be denominated in USD for some time to come.

5. Funding spotlight: DeFi in India

Blacksoil — debt financing, US$3.37 million

Blacksoil Capital, an Indian credit platform offering “venture debt, special situation lending, and real estate funding” solutions to Indian developers and startups, closed a $3.37 million round from a syndicate of international investors this week via a series of non-convertible notes. The company’s cumulative funding is $28.4 million, with $10.1 million raised since January. Blacksoil’s main interest is in tech-focused IT and financial consulting, focusing on new economy small and medium enterprises in India’s growing tech sector.

Forkast.Insights | What does it mean?

“Digital India,” a McKinsey & Company report from March 2019, found that in India, while VC and private equity investments are growing — topping US$33 billion in 2018, the country still faces a challenging startup environment, with only 2.6% of global private equity volume. Now, under the spotlight of COVID-19, India’s VC tech sector seems surprisingly resilient, and investors continue to have an interest in challenger banks and FinTech. A recent BCG report states that Indian VC in the tech space is “dominated by global firms” as fund managers maintain “promising long-term growth prospects” in the APAC region. In general, despite the “rising geopolitical risks in the region,” the outlook for India in the latter half of 2020 remains positive, with Moody’s reporting that the country will “end next year above pre-coronavirus levels.”