Covid-19 continues to ravage the world, with the global economy contracting by double digits and hundreds of millions of people losing their jobs. Venture capital activity has slowed, as firms preserve what capital they have in their chests knowing that the next funds they raise might be their most challenging, as big-ticket capital will be hard to come by in 2020.

But even in this difficult environment, is there still opportunity? Omer Ozden, the CEO of legal firm Rocktree LEX and Rocktree Capital, a cross-border investment fund, believes it’s still possible to get liquidity in this market. In fact, he says the pandemic appears to have turned the tables for many companies — sometimes for the better when there’s a decentralization and digitization play involved.

Highlights

- “It’s not a good time for startups. Clearly, cash is king and really everybody needs to make some very serious decisions, not just three or four months into this, but very, very early on projecting what might be coming down the pike for a lot of us.”

- “But in the worst case scenario that, let’s say in July, we’ve pulled out of this and we’re starting to make an upswing because really, related to talking about next year and the year after, I think that this is going to be a V-shaped comeback. It’s not going to be a slow comeback.”

- “Globally, we still have an argument to be made that crypto can fare better, and with the halving, that bitcoin can continue to go up. I’m not predicting anything, but I think that there still may be some more shocks in the equity market, and that can also impact our industry, too, in the near term, not in the long term.”

- “It’s not a significant improvement to drive traditional industry to start taking STOs on as the next wave of financing. We’re not there yet, STOs are something for the future, particularly when you talk about real estate security tokens, that the fact is that investors into real estate are traditional, they’re conservative.”

- “Token offerings are continuing to happen. There are a number of token offerings coming out before the halving, during the halving. There’s a lot of anticipation in markets that, based on the cycles 2021 will be a very promising year for the industry itself.”

“We’ve seen some interesting developments for some of our investee companies. We have one, for example, it’s an online education company in China that in 2019, frankly, wasn’t doing that well,” Ozden said. “But in 2020, they hit their full year revenue targets in the first three weeks of January. So that really relates to the entire country, mainland China, going digital, being required to go digital at that time.”

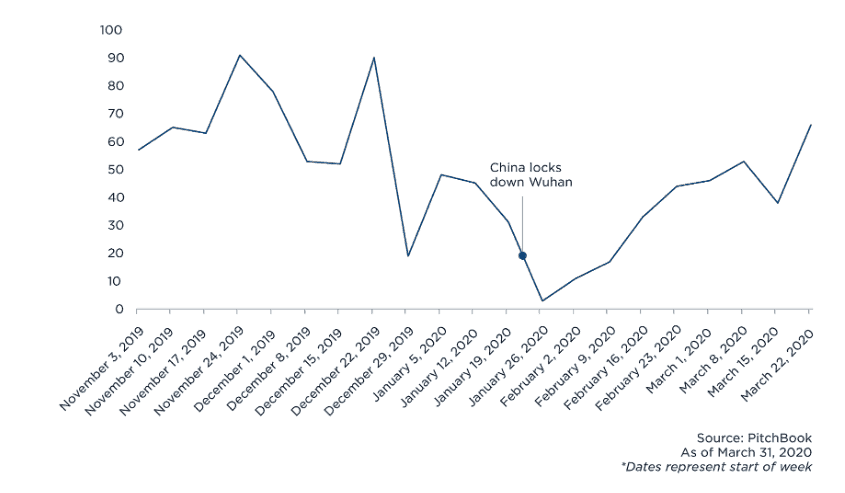

China’s VC industry is rallying after the country’s economy thawed from the earlier coronavirus freeze, with 66 Chinese firms recording deals for the week ending March 28 — just below the same time last year, according to SaaS company PitchBook, which covers private capital markets.

“But any optimism should be tempered with a note of caution,” writes Alex Frederick, analyst at PitchBook. “If a second wave of the virus were to hit China, stringent lockdown measures would be reinstated and deal activity would most likely dive again.”

Covid-19 has also stirred interest in cryptocurrencies in China over concerns about the impact of quantitative easing, according to Ozden, and perhaps also out of people’s restlessness when stuck at home. In the early days of the lockdown in China, day trading increased as people moved their capital out of the traditional markets and found a new hobby to pass the time.

“In the case of [China], it was decoupled because the equity markets were really hurting. But the equity markets in the U.S. really took a nosedive,” he said. “Bitcoin was completely correlated to that and we saw a big, big drop. I think that really relates to how much institutional money, traditional money has come into the market.”

See related article: Why invest in Bitcoin when global markets are still a hot Covid mess?

The last time Forkast spoke with Ozden, he was bullish on the initial coin offering (ICO) market, and cautiously optimistic about the security token offering (STO) sector. This hasn’t changed. The increased risk of an ICO brings a huge liquidity premium. STOs have potential, but the market hasn’t yet figured out what to do with them.

“This is an important year for cryptocurrencies and next year is anticipated to have an uptick in the markets as well, but for the financial crisis,” Ozden said. “There’s a lot of good projects out there, and we’re just getting the next round of them.”

Other experts agree that investors should be poised to capitalize on the opportunity posed by lower prices. Oppenheimer Asset Management’s management director and chief investment strategist John Stoltzfus told CNBC that a bull market may be in the distance, and that he’s preparing to invest in utilities.

“With all the rescue efforts both [from] the Federal Reserve as well as the administration on both sides of the aisle have put in, we like utilities,” Stoltzfus said. “We still have an underperform in some of the more cyclical sectors, but we like dividend yields. We think regulated utilities can hold their own in this type of environment.”

Full Transcript

Angie Lau: Welcome to Word on the Block, the series that takes a deeper dive into the emerging technology that shapes our world. It’s what we cover right here on Forkast.News. I’m Editor-in-Chief Angie Lau. Well, could we be entering this century’s first Great Depression? It’s been a century since the 1918 Spanish flu pandemic. And there’s no doubt the world economy is under extreme duress right now.

So what does this mean for blockchain and technology startups? Right now, we’re seeing startups starved of cash. They’re laying off significant chunks of their team or worse, they’re shuttering altogether. Investors who are once ready to sign term sheets are freezing all conversations. So in this episode, we’re going to explore the tough reality of what most founders are facing right now.

The pandemic continues to have the world in its grip. And there’s almost no appetite for fundraising. Joining us right now is Omer Ozden, CEO and founder of RockTree LEX, a legal and finance professional service platform focused on the blockchain industry. A lawyer and investor, Omer has spent nearly two decades in China. Welcome, Omer.

Omer Ozden: Hi, Angie. How are you?

Lau: We’re staying in place so we can stay safe. You’ve reached me here, sheltered-in-place in San Francisco. I understand while you’re normally in Beijing, Toronto, where are you right now?

Ozden: I am in Tulum, Mexico.

Lau: All right. Well, it’s not a bad place to be. But I think right now there’s no safe place. So be careful over there.

Ozden: Everything is decentralized. Everybody is doing meetings by Zoom, so might as well be in a place that has a little bit nicer environment.

Lau: Absolutely, that’s one of the things that we’re hearing more these days, that startups have been relegated to no longer having face-to-face meetings and handshakes. But hoping odd against odds that somebody is going to take their Zoom call.

Ozden: Exactly, because I live in Beijing, and then we also have an office in New York, in terms of what people are seeing now, we already saw it in China. And just with respect to the cryptocurrency community, blockchain community, we’re already used to working decentralized. So it really proves out our model and we’re prepared for it. What we’ve seen over the past two months, three months, is China really moving even deeper into the digital age, digital engagement. And so now it’s the West’s turn to do that.

Lau: I think that is what a lot of people universally are waking up to. When it comes to though, supporting the digital transformation and maybe even the revolution that we’re experiencing right now, what is the appetite for investing into some of these companies? How would you describe the Asian investing landscape right now and even the global one?

Ozden: I think if we’re talking right now, there’s a little bit more optimism, but two months ago, even one month ago the sky was falling down. We had deals in China that cratered, in Southeast Asia that cratered just at the height of the pandemic or at that point it was an epidemic. We’ve seen some interesting developments for some of our investee companies.

We have one, for example, it’s an online education company in China that in 2019, frankly, wasn’t doing that well. But in 2020, they hit their full year revenue targets in the first three weeks of January. So that really relates to the entire country, mainland China, going digital, being required to go digital at that time. And now in the West, we’re experiencing the same thing, too.

So I think certain sectors will benefit from this to a certain extent. But it’s not a good time for startups. Clearly, cash is king and really everybody needs to make some very serious decisions, not just three or four months into this, but very, very early on projecting what might be coming down the pike for a lot of us.

Lau: How are you advising some of your portfolio companies?

Ozden: First of all, if it’s in blockchain and cryptocurrency, that was all born out of 2008. And so that came out of an economic crisis, unprecedented printing of money. And now we’re in the exact same environment again, and I would say even worse, even more money is being printed this time. So 2008 was the catalyst to start our movement, and now we’re going to actually get another boost on that. But I don’t think that is really going to come to fruition.

The full impact of all this, the euphemistic word QE (quantitative easing), but really it’s just printing money out of thin air. I think that really is going to start becoming noticeable next year and the year after, which in that near term aspect it’s a good thing for our industry. But in the near-term, the next eight months, I think all the companies, we’re telling them; you have to make some very serious decisions about cash, and also you have to take a look at where there might be some bright spots geographically.

The economies in Asia are starting to see some light, so there is more optimism in China right now. There is some sense that the springtime is coming, too. But obviously, that’s not the case in the United States or other markets.

Lau: Eight months is a long time to try to survive. Even if you’ve stopped or decimated your burn rate, if you don’t have the cash, how do you survive? And so what are you seeing across the market right now? What are you seeing with promising startups who are suddenly frozen out of potential, not only revenue, but also potential investors?

Ozden: Well, I think that it’s possible that we may have this downturn for 60 days and then start to come back. There’s a lot of money being pumped into the economy as well. But when I [say] eight months, I’m just saying that people should also consider a worst case scenario. I’m not saying that’s the worst. But in the worst case scenario that, let’s say in July, we’ve pulled out of this and we’re starting to make an upswing because really, related to talking about next year and the year after, I think that this is going to be a V-shaped comeback. It’s not going to be a slow comeback.

I think that there’s a lot of good factors out there as well. So I think things can come back, rather quickly. It’s just a matter of when. And so for those companies, I think that they need to be conservative at this point in time. But, we also have another aspect specifically in our industry, which is the halving, and a lot of projects are coming to market. There are some aspects of crypto itself, bitcoin decoupling from traditional financial markets. So that’s something that people can debate for hours. I think that we have seen that in Asia.

As the coronavirus developed in Asia, specifically mainland China, and everybody was relegated to staying at home, we had a situation where people were just on their mobile devices, on their PCs actually trading. And you saw the volumes, all the exchanges go up. You saw the price of bitcoin go up, you saw the price of Ethereum, and for the first time in a long time, other alt-coins go up. I think that was led by the situation people were in in mainland China. So, in that case of that market, it was decoupled because the equity markets were really hurting.

But the equity markets in the U.S. really took a nosedive. Bitcoin was completely correlated to that and we saw a big, big drop. I think that really relates to how much institutional money, traditional money has come into the market. And they had to sell off because they needed to get cash in. So I think globally, we still have an argument to be made that crypto can fare better, and with the halving that, bitcoin can continue to go up. I’m not predicting anything, but I think that there still may be some more shocks in the equity market, and that can also impact our industry, too, in the near term, not in the long term.

Lau: There’s no doubt we have seen, as you said, a direct correlation of bitcoin prices as most markets in the West have faltered. I think that’s a great point you marked about the institutional impact of money, as a lot of people started panicking and pulling out. But you noted something very interesting because similar to 2008, we saw China inject an enormous amount of QE into its economy.

And what we saw, as the Western economies really dug into austerity, especially in Europe, and with the U.S. trying to bail out with 750 billion, you have China who really injected an enormous amount of stimulus into the economy that many argued actually pulled the world economy out of that 2008 slump. Could we potentially see that dynamic again and not necessarily from a stimulus point of view, but the fact that there is an appetite across Asia of retail investors who have direct interest and familiarity with cryptocurrencies?

Ozden: Absolutely, and I think that is coupled with or, multiplied by a confluence of many factors. You have President Xi who made a speech to the politburo at the end of October 2019, saying that China had to be a leader in blockchain. In that regard, you have a lot of demand for that industry in general. And so now you have larger, more traditional investors getting into the market. You have strategies for getting into the market. All of those things are trends that we’re going to see more and more in 2020 as China comes out of this.

Secondly, I think a lot of people in the world, not just RockTree being in China, not just people in China, but a lot of people in the world also see China as the potential engine for bounce-back for the entire globe as well. And so the investors are going to be the first in terms of global investors for crypto. Asian ones, particularly in Greater China, are going to be the ones who are going to get back into the game as soon as they can. Like I said, we already saw that in January, February, even though the markets crashed in February in China. You continued to see more volumes in trading, at least for the secondary markets and the prices went up, and that was driven by the Asian markets.

Lau: Yes, because technically cryptocurrency trading in China is still, last time we checked, illegal. But certainly there is an appetite in secondary markets across Asia. That’s a very interesting perspective. The other question is, does this give or revitalize even the STO or even the ICO movement that really chilled out in 2017?

Obviously with the ICOs, the more regulation friendly security token offerings are meant to be a little bit less adversarial with regulators, but they didn’t really seem to pick up steam as a lot of people were anticipating into 2018-19. Where do you see these two fundraising vehicles potentially going? Could this also be a revitalization moment for these ICOs and STOs?

Ozden: Great question. I think, first of all there was a lot of fanfare that STOs were going to be the next big thing. And we still believe in security tokens. Remember when we talk about securities, we’re talking about hand on heart securities, not what the SEC says is a security where they call utility tokens, securities. Most of the rest of the world calls utility tokens, utility tokens. And security tokens, security tokens. So let’s talk about real security tokens.

There was big anticipation for that market. A number of ATSs (alternative trading systems) in the United States and in other markets also had their own licenses issued. But we really didn’t see traction in that market, and I think it’s because there really isn’t that much of a need at this point in time. For public markets in the United States, we have T+2. Most markets have some sort of latency in terms of settlement, and that is an improvement.

But it’s not a significant improvement to drive traditional industry to start taking STOs on as the next wave of financing. We’re not there yet, STOs are something for the future, particularly when you talk about real estate security tokens, that the fact is that investors into real estate are traditional, they’re conservative. They’re not looking for a 10x return like the high risk taking investors in cryptocurrencies might be seeking, they’re looking for margins. They’re not going to jump on a new type of technology just because it makes settlements faster, or there’s some hype behind it. So I think security tokens will take some time.

We had a RockTree-securitized shares post. We held a roundtable back in 2008 — the future of security tokens — and I posed the question to both securitize and share’s post, the CEOs; when will we see a hockey stick? And I think the answer was totally right. It’s when we see high profile companies do a security token issuance or we see a major investment bank backing, underwriting, a security token offering. We haven’t seen that yet, and I don’t think we’re at that point.

So I still think security tokens are a while away. ICOs, on the other hand, they’re very interesting. Token offerings are continuing to happen. There are a number of token offerings coming out before the halving, during the halving. There’s a lot of anticipation in markets that, based on the cycles 2021 will be a very promising year for the industry itself. There will be offerings next year as well. I think token offerings continue, but for this financial crisis, I think a lot of people anticipated something a lot more vibrant than what we have now.

But I think something that’s really important, an advantage that token offerings have versus, let’s say, equity offerings or private offerings of equity is the liquidity factor. There’s a huge liquidity premium. We invest into early stage companies in equity and also early stage token offerings—yes, there’s a lot more risk in token offerings, but the upside is larger. But really, when you’re talking about liquidity, that’s a major, major aspect that’s attractive for token offerings themselves.

Lau: As you said, liquidity is the new boss in town. But in terms of leadership, it sounds like people are going to take a look at who’s going to make that first big step. Who do you think’s going to do that for the industry? Where do you see the fundraising efforts really coming from?

Ozden: Well, I think that there are a lot of interesting projects coming out to market in this period and also during the summer, there’s some nice Layer 1 protocols, some that we’ve invested into as well. There will be more presumably scheduled for later in the year as well. This is an important year for cryptocurrencies and next year is anticipated to have an uptick in the markets as well, but for the financial crisis. I think there’s a lot of good projects out there, and we’re just getting the next round of them.

Lau: As China recovers, the borders are letting up at least between provinces. What’s the feeling on the ground from your team in China? Is there confidence or trepidation?

Ozden: I think things are a lot better than before, it was a very difficult time. People had to stay not only at home, but actually in their hometown that a lot of people during Chinese New Year went back to their hometowns in different provinces. We’re in Beijing, but a lot of people were dispersed in various parts of the country. Everybody’s now either back in Beijing or just coming back to Beijing now, and there’s still a 14-day quarantine as soon as you get in from any other place, so you’re gonna have to do that.

But people are going back to meetings as long as you’re wearing a mask. People are meeting up, they’re a lot more social. So we can see the sunlight coming, that is what I would say. But it’s just still the early, early stages of this process. For global projects themselves, we do have that confluence of the factors that I said where, blockchain is an important part of the government’s policy. We’re going to have DCEP, the digital renminbi being issued. There’s going to be more interest from the institutional side as well in this sector, plus the potential fact that China is coming out of this first.

We see it in the early stages of that happening. So I think that’s a really interesting dynamic for global projects to really look at China and what’s available there, not only in terms of fundraising, but there are groups that want to acquire technologies that want to perhaps even have development teams outsource to develop their projects to, and that could run from anywhere.

Lau: It can come from anywhere, it could come from Asia. And frankly, it can come from wherever you’re sheltered in place in the world. And I think it’s not about geography more than it’s all about mindset. So for the founders out there who are experiencing some deep pain as everyone else is in this market, there’s a lot to do when the health of the world recovers. And there’s a lot for you to do. So just hang on, and that growth mindset must still be there.

Ozden: Absolutely, Angie, our industry is very resilient. It’s absolutely conditioned to know that there’s multiple shocks because we’ve had so many cycles. We already are used to working from a decentralized, distributed fashion. And I think we’re very flexible and we move fast. So these types of situations in some ways are really advantageous for our industry because we’re already used to it, we’re already used to crashes.

Lau: We’re already used to it, we’ve been stress-tested. We continue to remain resilient. Thank you so much for this. Omer, it’s a pleasure to talk to you and get that insight from China as well. I often say that Asia — literally when it comes to time zones — lives in the future.

And sometimes as they are seeing, on the other side of the curve of this pandemic, we are seeing business return and we are seeing a different type of dynamic that’s happening in Asia. So if that’s going to be our crystal ball, it’s a good one to reveal. And I appreciate you sharing that. So stay well, stay in place where you are and stay well.

Ozden: Angie, same to you and same to everybody else in your audience. Have a great day.

Lau: Thank you. And thank you, everyone, for joining us on this latest episode of Word on the Block. I’m Angie Lau. Forkast.News Editor-in-Chief. Until the next time.