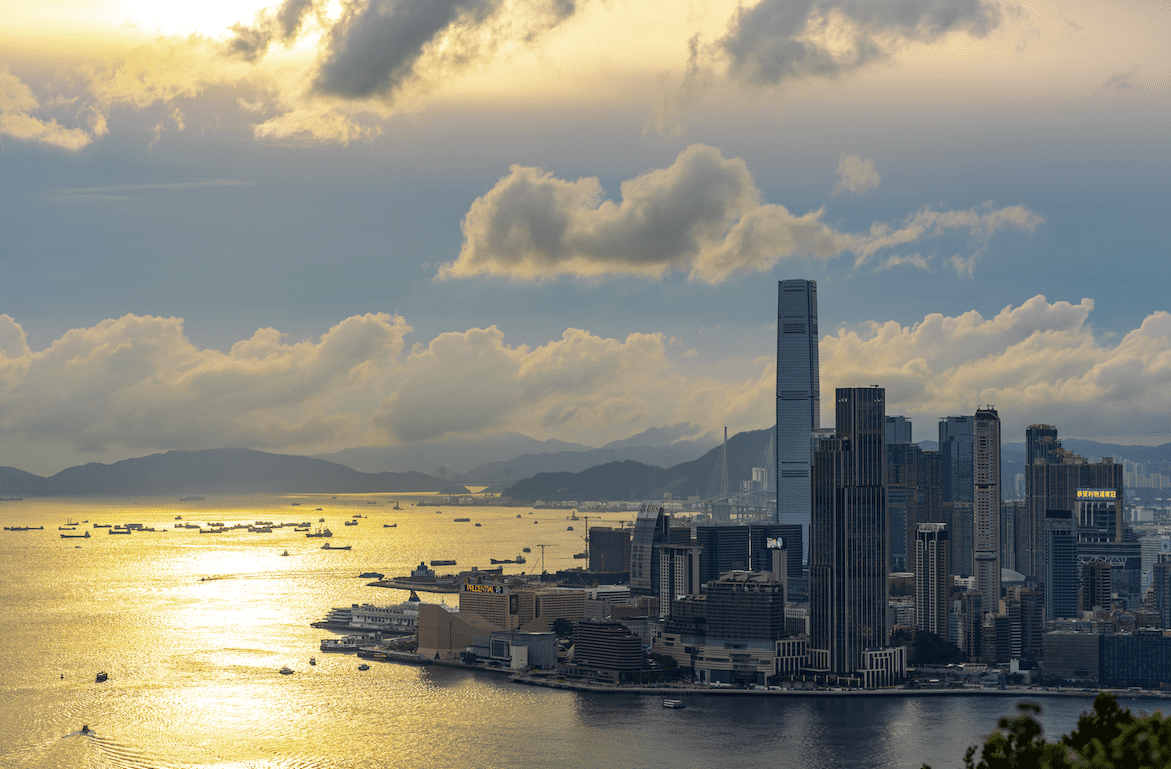

China has been throwing thunder and lightning on the cryptocurrency industry, cracking down on crypto activities within the mainland’s borders with all its might. However, Hong Kong — under the one-country, two-systems regime — still reigns as one of Asia’s crypto hubs.

As more crypto companies look to go public, those in Hong Kong might not be as popular for special purpose acquisition companies (SPACs) when they seek potential merger targets.

The latest example is Crypto 1 Acquisition Corp., a U.S.-incorporated blank-check company. It announced Friday the completion of its initial public offering (IPO) with gross proceeds of US$230 million.

“We intend to focus on the acquisition of a significant digital assets and cryptocurrency exchange, payment system and/or related financial services company, including wallets, lending and decentralized finance (“DeFi”),” according to Crypto 1’s filing with the U.S. Securities and Exchange Commission. “A significant number of cryptocurrency exchanges are located in Asia (such as Korea, Japan, Singapore and the Philippines), Europe, North America and Latin America. We will not pursue any target nor consummate an initial business combination with any entity that is incorporated, organized or has its principal business operations in China, Hong Kong or Macau.”

Crypto 1 executives were not immediately available for comment.

SPACs are known as blank-check companies set up for the purpose of raising money through an IPO. It is then used to eventually acquire or merge with a target company, which can go public without the paperwork of a traditional IPO, a practice that’s also referred to as backdoor listing.

Acting as a SPAC, Crypto 1 — whose CEO Michael Zhao served as co-chairman of the Hong Kong Blockchain Association in 2018 and worked at China’s State Foreign Exchange Administration from 2010 to 2011 — will be primarily focused on the digital assets industry, including crypto exchanges, payment systems including wallets and decentralized finance.

Going public via a SPAC deal is one of the popular ways for crypto companies to go public. For example, Singapore-based digital assets group Diginex, which operates a crypto exchange and has since been renamed EQONEX, went public in October last year via a SPAC merger.

Just last month, Griid Infrastructure, a U.S.-based Bitcoin mining company, said it is going public through a merger with Adit EdTech Acquisition Corp., in a SPAC deal that would value the combined company at about US$3.3 billion. Also in November, Bitdeer, a Singapore-headquartered crypto mining company with Chinese roots, also announced its plan to list on Nasdaq through a SPAC deal. In October, U.S.-based Bakkt, a cryptocurrency custodian and trading platform, went public on the New York Stock Exchange, also through a SPAC merger.

While listing via a SPAC transaction is nothing new for crypto-related firms, it was surprising for a U.S. SPAC to announce that it wouldn’t merge with or acquire any crypto company in Hong Kong, which has witnessed a vibrant crypto scene.

“Personally I think this case (Crypto 1 Acquisition Corp) has little to do with Hong Kong’s crypto stance but more likely about the tension between the U.S. and China, as recently stocks with potential China background have [faced] difficulties getting listed or raising fund in the U.S.,” Kevin Hoo, co-founder of blockchain investment consultancy MICA Fund, told Forkast.News in an email. “Institutions might try to avoid relating their portfolio with China influence because of that, while currently Hong Kong is viewed as closely related to China so the situation occurs.”

Originally from Hong Kong, Hoo said “atmosphere” could have a certain impact when a crypto-related company decides where to go public.

Richard Turrin, a Shanghai-based fintech consultant, shares a similar view. “Hong Kong will not lose its position as crypto leader but is certainly falling victim to increased scrutiny in the U.S. of all things related to China,” he said.

“It’s likely that in order to grow, the Hong Kong crypto industry will have to develop local fundraising capabilities rather than look to the U.S.,” Turrin added.

Indeed, the U.S.-China tension could take a toll when it comes to going public. Chinese artificial intelligence giant SenseTime had to delay its US$767 million Hong Kong IPO on Monday after it was put on a U.S. investment blacklist last Friday. The U.S. Treasury said the company has “developed facial recognition programs that can determine a target’s ethnicity, with a particular focus on identifying ethnic Uyghurs.”

See related article: What is the regulatory outlook for virtual asset exchanges in Hong Kong and Singapore?

Benjamin Quinlan, CEO and managing partner of Hong Kong-based consultancy Quinlan and Associates, said Hong Kong faces multiple headwinds on the crypto front, but the refusal of a SPAC to merge with Hong Kong-based crypto companies is “more of a symptom of those headwinds than the underlying cause.”

“Indeed, this symptom does reflect poorly on the market for crypto companies in Hong Kong, as it makes it tougher for them to gain access to funding by listing on public markets,” Quinlan told Forkast.News. “This could push them to look for greener pastures elsewhere outside of the city.”

Fintech firms would normally choose a destination with sound regulations in place to go public. Raymond Hsu, co-founder and CEO of Cabital, a Hong Kong-based cryptocurrency wealth management platform, said most fintech firms go public in the U.S. “because of the country’s clear regulatory regime, deep liquidity in its capital markets and the ability for sellers to find a buyer quickly without losing money.”

“But I don’t think Hong Kong is going anywhere in the short and medium term,” Hsu added. “Hong Kong continues to be a major hub for traditional finance, law, trade and fintech.”

Many industry watchers still hold faith in Hong Kong. Malcolm Wright, advisory council chair of Global Digital Finance, an industry group, said it’s important to recognize that some of the largest crypto firms are not publicly listed or have no intention to be.

“[Hong Kong Exchanges and Clearing Ltd.] proposed in September to introduce Hong Kong-based SPACs that might support more options for both SPAC listings and their acquisition targets,” Wright said. “There are still some areas of clarity that the wider industry seeks around regulation, and once this has been concluded our desire is to see Hong Kong lead the way as the leading hub both in and beyond Asia.”

Hong Kong has proposed legislation to require virtual asset service platforms (VASPs) to obtain licenses to operate. In May, Hong Kong’s Financial Services and the Treasury Bureau published its Consultation Conclusions, with legislative proposals to introduce a licensing regime for VASPs, following a 2019 volunteer program that allowed exchanges to opt in and commit to compliance.

Once the new licensing regime comes into effect, licensed VASPs will be subject to relevant anti-money laundering requirements, and Hong Kong’s Securities and Futures Commission (SFC) will be able to supervise such entities with broader power.

Angelina Kwan, senior advisor to the board of HashKey Group and a former SFC regulator, told Forkast.News in a September interview that more rules and clarity will make for a better market, and that investor education is vital. “If you don’t understand it, if it doesn’t sound right, if it sounds too good to be true, it normally is, and is a scam,” she said.

Singapore continues to beckon

While many industry watchers remain optimistic about Hong Kong’s crypto development, some crypto firms from the city have expanded or relocated to Singapore, which has been touted as one of Asia’s crypto hubs.

Singapore has taken a proactive stance towards regulating cryptocurrencies. The Monetary Authority of Singapore in 2019 passed the Payment Services Act (PS Act), which came into force in January 2020, to regulate the crypto industry primarily for money laundering and terrorist financing risks. MAS has granted licenses to FOMO Pay, a Singapore-based payments fintech, DBS Vickers, the brokerage arm of DBS Bank, and Independent Reserve, an Australian cryptocurrency exchange and TripleA, a cryptocurrency payments provider.

Carney Mak, head of fintech investment of Singapore-based money manager FXHB Asset Management, told Forkast.News that crypto regulation frameworks globally are getting more clarity these days.

“Hong Kong on the other hand is clouded by China’s cryptocurrency ban,” Mak said. “[The] lack of long-term certainty and the weakening prospects of capturing mainland business have seen some crypto companies to shift their operations to other markets such as Singapore where regulators are moving more proactively to roll out rules that support the industry.”

“As many crypto companies in Hong Kong are considering relocating to Singapore due to regulatory considerations, many may similarly consider SPACs in Singapore — where a SPAC market is just emerging — for their future IPOs,” Winston Ma, managing partner of U.S.-based CloudTree Ventures and the author of “The Digital War — How China’s Tech Power Shapes the Future of AI, Blockchain and Cyberspace,” told Forkast.News.

See related article: How Singapore is emerging as a safe harbor for the Chinese crypto industry exodus

Hsu of Cabital said if Hong Kong is the crypto capital for North Asia, then Singapore is considered the crypto capital of South Asia, and that Cabital has also applied for a crypto license at the Lion City.

“Singapore is striving to strike a fine balance between supporting the crypto industry and regulating it,” Hsu added. “The authorities are attracting enough companies to help transform the city-state into a crucial player for crypto-related businesses, while maintaining high regulatory and compliance standards.”

While Singapore is establishing a supportive regulatory regime allowing crypto companies to secure licenses and become regulated entities, “Hong Kong has opted for a much more conservative stance, restricting retail participation,” Quinlan said. “Moreover, the crypto ban enforced in mainland [China] may also have a ripple effect on players operating in [Hong Kong].”

However, as Binance — the world’s largest crypto exchange — announced this week that its Singapore entity has withdrawn its application for a license to operate a regulated crypto exchange in the country, “it’s clear it isn’t for everyone,” Turrin said.

“It won’t be regulations alone that make a crypto hub but integration into normal banking activities,” Turrin added. “With a well-developed digital banking sector, Hong Kong is better positioned to integrate crypto with traditional banking than any other. So don’t count Hong Kong out just yet.”