It can be an opportunity for Taiwan to boost its development of blockchain and cryptocurrency, especially when China has phased out crypto trading and mining on the mainland as of September, a founding director of Filecoin Foundation said Saturday at the U.S. Taiwan High Tech Forum.

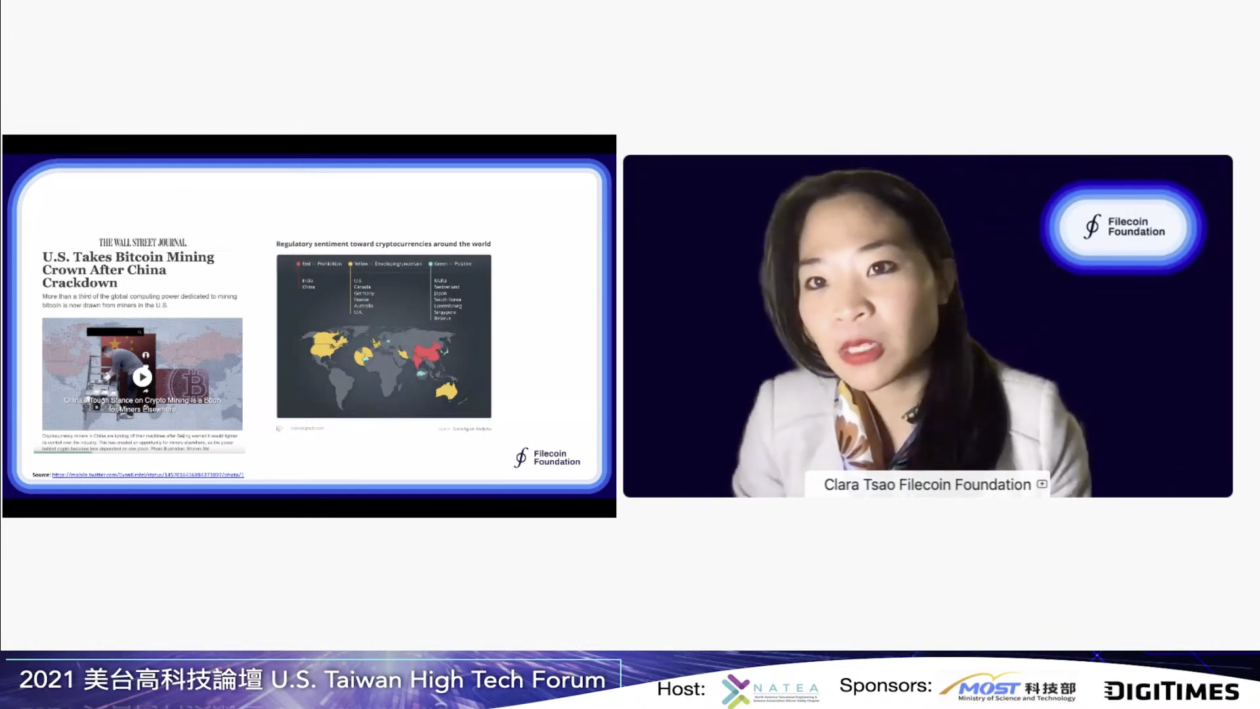

Regulatory headwinds in certain regions have hindered the development of the crypto industry. “We saw just a few weeks ago China doing a very, very strict crackdown on Bitcoin mining — and not just on Bitcoin. A number of projects were impacted because when folks started to mine Bitcoin, a lot of people in China also started to mine and create the infrastructure for other crypto projects,” Clara Tsao, founding officer and director of Filecoin Foundation, said at the online forum.

“Even [for] our storage providers based in China, they are all already decentralizing and moving to other locations,” Tsao said. “There are actually a lot of miners that have moved to the U.S., to North America and other parts of Asia.”

Tsao said that this is a “huge opportunity for Taiwan,” adding the policy space is probably always five to 10 years behind how far the market trends have developed and that there are a lot of projects that have chosen to move to greener or more policy-positive locations. “Hopefully, Taiwan can be on the positive green side too … I think a lot of regulators in Taiwan are still wrapping their head around what exactly blockchain versus DeFi versus everything else is.”

Taiwan does appear to have a vibrant blockchain and crypto scene. For example, XREX, a Taipei-headquartered crypto-fiat exchange and trade technology platform, closed its pre-A funding round — which was oversubscribed — raising US$17 million from prominent investors.

Even though the XREX’s fundraise reflected Taiwan’s ambition to take part in the investment and development of the technology, its strict banking regulation environment could somewhat be a hurdle, XREX CEO and co-founder Wayne Huang told Forkast.News at the time.

“Our banks are highly regulated. It’s harder and slower for our banks to innovate and to expand business outside of Taiwan,” Huang said.

Tsao shared a similar view. She said one of the limitations to Taiwan’s growth is the mentality that everyone needs a certification of some type to feel like they are prepared to get into a new field.

“I went to a bank, and I was told by the VP of this bank that everyone working at the front desk there had 10 different certifications,” Tsao said. “That’s really, really great to show mastery in a topic. However, I do think that it almost limits the way people feel like they can take their own risk to explore careers that are emerging — like blockchain — that don’t necessarily have very black-and-white certifications that require people to just try it out, learn and then see where things go.”

The Taiwan Ministry of Economic Affairs today confirmed that cryptocurrency-related businesses will be labeled under the “finance, insurance and real estate” category as “virtual currency platforms and trading businesses,” as reported by Taiwan News.

In July, Taiwan enacted new anti-money laundering rules to boost reporting requirements for cryptocurrency exchanges operating on the self-governing island. Crypto exchanges now need to fulfill know-your-customer requirements such as authenticating the identity of their clients, according to the new rules.

Tsao also noted that there’s a talent shortage in the industry in general, and Taiwan could take the opportunity to nurture the talents.

“My hope is that we can bring a new era of engineers and talent in the blockchain space out of Taiwan,” Tsao said. “I have one wish, which is that Taiwan can really ramp up on talent and drive a talent pipeline that allows for innovation of all types in the blockchain space.”

“We just need to make the bridge to make sure everyone can quickly ramp up on everything else that is happening in the blockchain space that China is very ahead of the rest of the world in,” Tsao added.

Tsao’s words come as authorities in China are looking for new ways to grow blockchain while they are trying harder than ever to stomp the cryptocurrency industry out of existence.

For example, China is actively pushing ahead with the development of its Blockchain-based Service Network (BSN) — a public-private nationwide infrastructure project to spur mass adoption of blockchain technology — as well as what appears as a soft rollout of the country’s digital currency — the digital yuan, or e-CNY.

BSN, as a whole, aims to build a global blockchain-based cross-cloud, cross-portal and cross-framework public infrastructure network. It has recently announced it is setting up BSN portals in Hong Kong, South Korea, Turkey and Uzbekistan, for local developers to work in a more cost-efficient way.

Meanwhile, China is pioneering the world’s first major central bank digital currency (CBDC). The e-CNY, alternately called the digital renminbi or e-RMB, is issued by China’s central bank, the People’s Bank of China. Many expect China’s CBDC to be formally launched in time for the Beijing Winter Olympics in February.