A US$3 million incentive to lure a major non-fungible token (NFT) project from one blockchain to another appears to have brought consequences some may not have expected.

According to data from Forkast Labs’ NFT index — a measure of the performance of the top tokenized assets across all blockchain networks — Polygon’s seven-figure transfer to DeLabs in January to move y00ts over to its blockchain may have cost its own users and ultimately its own ecosystem.

In recent weeks, NFT titans y00ts and DeGods started migrating from the Solana blockchain. DeLabs, the Los Angeles-based startup behind both projects, moved y00ts to Polygon, while DeGods ventured on to “explore new opportunities” on Ethereum. The allure of being in the company of the biggest brands in the world, including Disney, Starbucks, Reddit, Budweiser and countless more, is appealing to intellectual property-creating NFT projects. Many investors have wondered if these moves will pay off for the NFT projects. Will proximity to big names have an amplifier effect? And what about Solana, the blockchain that both projects left behind?

Let’s take a look at the data:

Because Forkast indexes exclude collections less than six months old, we can get a more macro view of the entire ecosystem and the overall impact these moves have had on these blockchains.

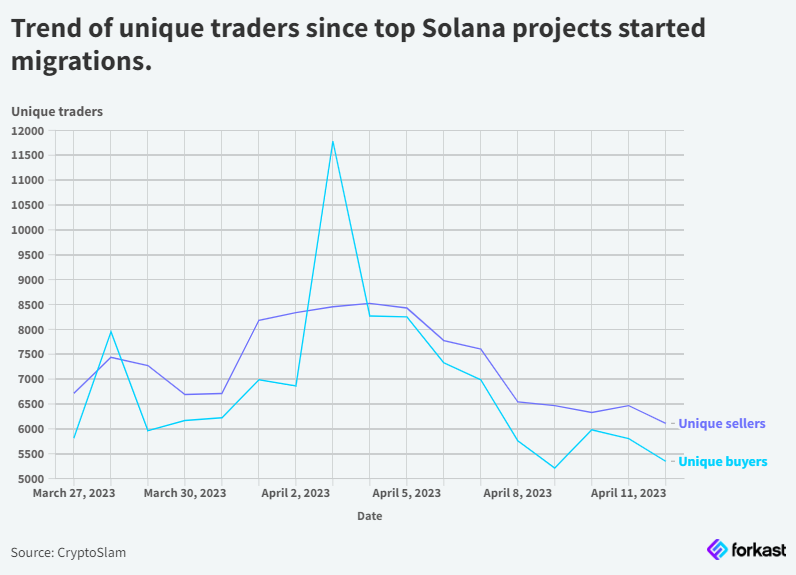

Since y00ts started its departure from Solana on March 27, the Forkast Solana NFT Composite has gained close to 7.5%, suggesting that investors did not leave with y00ts. Instead, they found other Solana projects to invest in.

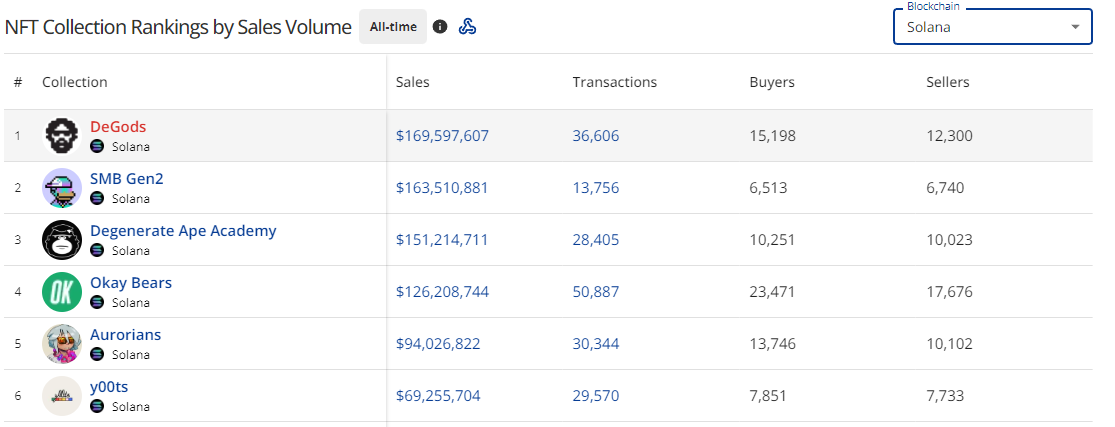

The activity of unique traders agrees with the Solana NFT Composite. As of April 13, there were 9,128 Polygon y00ts and Ethereum DeGods owners, including staking holders. However, the number of unique traders on Solana has not reflected the mass exodus of investors from the network.

The Polygon ecosystem has paid an unexpected price beyond the US$3 million Polygon-funded incentive paid to y00ts for calling the EVM blockchain their home.

Existing Polygon collections bore the brunt of this hidden cost, evidenced by the Polygon NFT Composite — which currently excludes y00ts — losing nearly 6% of its weighted value since the move. This is reflected on the Polygon NFT Composite from March 27 to April 13 and shows what is referred to as the NFT casino. Simply put, traders sold their existing Polygon NFTs, hoping to take part in the latest hot NFT collection.

We can see a similar effect on Solana and Ethereum lining up with DeGods’ move to Ethereum. From March 31 to April 13, the Forkast SOL NFT Composite, a proxy measure of the Solana NFT market, gained nearly 6%, while Ethereum (without DeGods) lost over 2%.

If there was market concern that y00ts and DeGods’ moves would deliver a crushing blow to Solana’s chances at remaining relevant, the blockchain’s community has backed up its supportive words with their wallets. While the Forkast Ethereum NFT Composite has declined nearly 8% year-to-date, Solana has strengthened over 13% for the year.

We continue to see the trend of traders valuing hot items over big brands and the latest fads over veterans of NFTs. But it appears that Solana investors believe in the young blockchain more than had been realized. Solana investors appear more loyal to the ecosystem rather than projects that live on that blockchain. While most would be willing to bet on the success of Polygon, Ethereum, and their two newest blue chip projects, Solana has benefited from the strong foundation they built with its community.

Over the next many months, we will begin to see the bigger impact, cost, and benefits of the y00ts and DeGods moves, as they are expected to enter their blockchains’ respective Forkast NFT Composites after they hit their six-month requirement for entry into the indexes and become key players in their ecosystems.

It may be a difficult road ahead. According to the Forkast 500 NFT Index, the NFT market continues to trend downwards. But strategically, for blockchains, it may be that winning over the community is more valuable than winning projects.