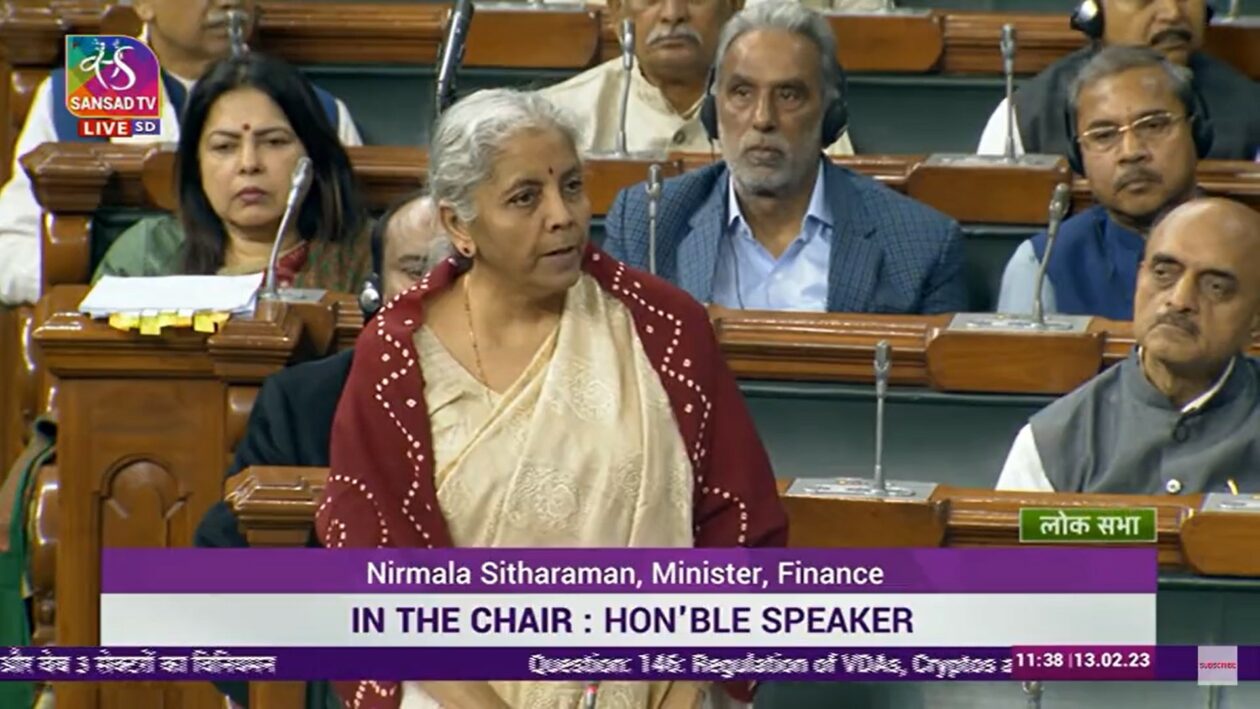

As India moves forward with its one-year presidency of the Group of 20 (G20), it is discussing cryptocurrency and regulation with the group’s members, India’s Finance Minister Nirmala Sitharaman said.

See related article: India’s CoinDCX exchange says crypto tax rules are reducing government revenue

Fast facts

- “Whether it’s crypto mining, asset or transaction, we recognise that it’s completely driven by technology and a standalone country’s effort in controlling and regulating it is not going to be effective,” Sitharaman said on Monday in response to a question in the lower house of the Parliament.

- “In the G20, we’re raising it and having detailed discussions with members so that a standard operating protocol emerges which results in a coherent, comprehensive approach where all countries work together in bringing some regulation,” Sitharaman said.

- India assumed the presidency of the G20 from Dec. 1 to Nov. 30, 2023, and is likely to hold over 200 meetings across the country.

- India’s cryptocurrency and Web3.0 industry has pinned hopes on these discussions as they await clarity on this nascent asset class.

- “India needs strong crypto regulations more than any other nation in the world as we are witnessing the mass adoption of digital assets in India at an exponential rate,” Shivam Thakral, cofounder of crypto exchange BuyUcoin, said in a statement shared with Forkast.

- The G20 discussions are significant since India has long viewed digital assets with suspicion, going so far as to impose a 30% flat tax on all crypto income and a 1% tax deducted at source (TDS) on all crypto trades above 10,000 Indian rupees (US$120).

- India also does not allow crypto traders to offset losses against gains, and has ignored requests from the industry to lower taxes on cryptocurrency trading. According to Esya Centre, a technology policy think tank in India, about US$3.8 billion may have moved to offshore crypto exchanges from India between February and October 2022, as traders sought to avoid paying the tax levies.

- Almost as a reaction to deter tax evasion, Sitharaman has introduced a penalty equal to TDS for non-deduction, interest of 15% annually for late payment, and even imprisonment, crypto tax firm KoinX explained on Twitter.

- “While the current Indian environment may seem unfavorable for crypto institutions, it is surely a start wherein the government is actually acknowledging crypto and digital assets,” said Dhruvil Shah, senior vice-president of technology at Liminal, a digital wallet infrastructure platform. However, one policy for all may not work for India’s diverse digital asset industry, Shah said in a statement shared with Forkast.

- See related article: The last 12 months the year to forget, says India’s WazirX crypto exchange