The decentralized autonomous organization (DAO) behind Solend, a Solana-based lending protocol, overturned Sunday’s governance vote that would have allowed it to take control of a wallet at risk of liquidation.

See related article: Contagion risk from Three Arrows Capital weighs on Bitcoin, crypto

Fast facts

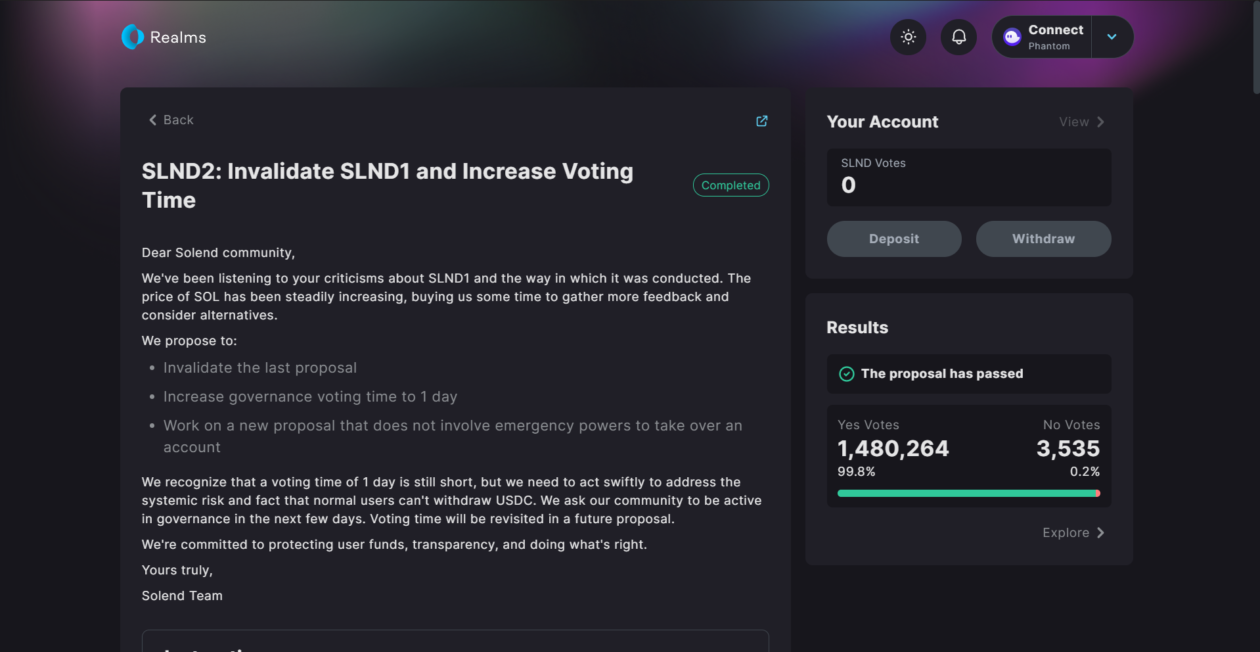

- Solend DAO on Monday voted to overturn Sunday’s decision that would have allowed the organization to take control of a whale wallet that could put the protocol at risk from a liquidation.

- The new vote increases the voting time to one day and does not involve emergency powers to take over an account.

- Solend’s anonymous founder Rooter highlighted a whale wallet on Saturday that deposited 5.7M SOL to borrow about US$108 million worth of USDC and USDT on the Solend borrowing platform.

- If SOL dropped to US$22.30, the wallet ran the risk of getting liquidated for up to 20% of its borrowing, or about US$21 million.

- The overturned vote drew backlash from the crypto community, with members criticizing that taking over user accounts “sets a terrible precedent.”

- The price of SOL has recovered 12% in the past 24 hours to US$33.70 at the time of publishing on Monday, according to CoinMarketCap data. It had fallen to US$27 on Sunday.

See related article: Bitcoin, Ether recover as Fed guidance reduces policy uncertainty