Battered by a selloff, cryptocurrencies staged a recovery on Thursday alongside other assets as the Federal Reserve approved the largest interest-rate increase since 1994 and provided guidance on monetary policy, easing uncertainty in the market to a certain extent.

The Federal Open Market Committee (FOMC) agreed to a 0.75-percentage-point rate increase at a two-day policy meeting that ended on Wednesday. The decision will increase the benchmark federal-funds rate to between 1.5% and 1.75%.

Following an after-the-fact recovery in stocks and other assets, Bitcoin gained 10.5% while Ethereum was up 15.5% in the hours after the Fed ended speculation over interest rates that had weighed on markets.

“The market, I think, appreciated that the Fed went straight with 75 [basis points] and that we have a chance of getting in front of [inflation] a little earlier,” James Quinn, a partner at Q9 Capital, said in an interview with Forkast. “Even though it might cause more short-term pain, bad news is good news for the moment, so to speak.”

“Bad news is good news for the moment, so to speak.”

“The Feds’ announcement fell in line with market expectations, and the recovery managed to get across the line for the time being,” Igneus Terrenus, head of communications at crypto exchange Bybit, told Forkast. “However, with the hawkish FOMC, and the attendant risk of rising unemployment and recession, short-to-medium term retail appetite toward risk-on assets such as Bitcoin will decline,” he said.

Read more: Cryptos slump over inflation, Shanghai lockdown and war concerns

Despite Wednesday’s recovery, CoinMarketCap listed Bitcoin’s price at US$21,844.80 — still down more than a quarter from last Friday, when a 12-month measure of U.S. consumer prices showed inflation in May was at a 40-year high.

Total cryptocurrency market capitalization, as tracked by CoinMarketCap, rose more than 10% since the Fed announcement, though it is still to recover the US$1 trillion dollar mark it had rested above since January 2021.

Other significant movers were “Ethereum killers” Cardano’s ADA and Solana’s SOL, which were up 11% and 20% at US$0.51 and US$33.48 respectively around the time of publishing.

Similar to Bitcoin, both these tokens’ gains do not offset losses as the two were down some 20% and 14% respectively over the past seven days, according to CoinMarketCap data.

Amid the market turbulence, Dogecoin got bumped out of the crypto top 10 by market cap. Despite a 15% bump on Wednesday morning to US$0.05924, the leading memecoin was down by a quarter in the past seven days.

“While there is a good chance the overnight relief rally can extend in coming sessions, the more aggressive rate hiking cycle remains a huge headwind,” guaranteeing a recession in the first half of 2023, City Index senior market analyst Tony Sycamore said in a note to clients.

Party pooper

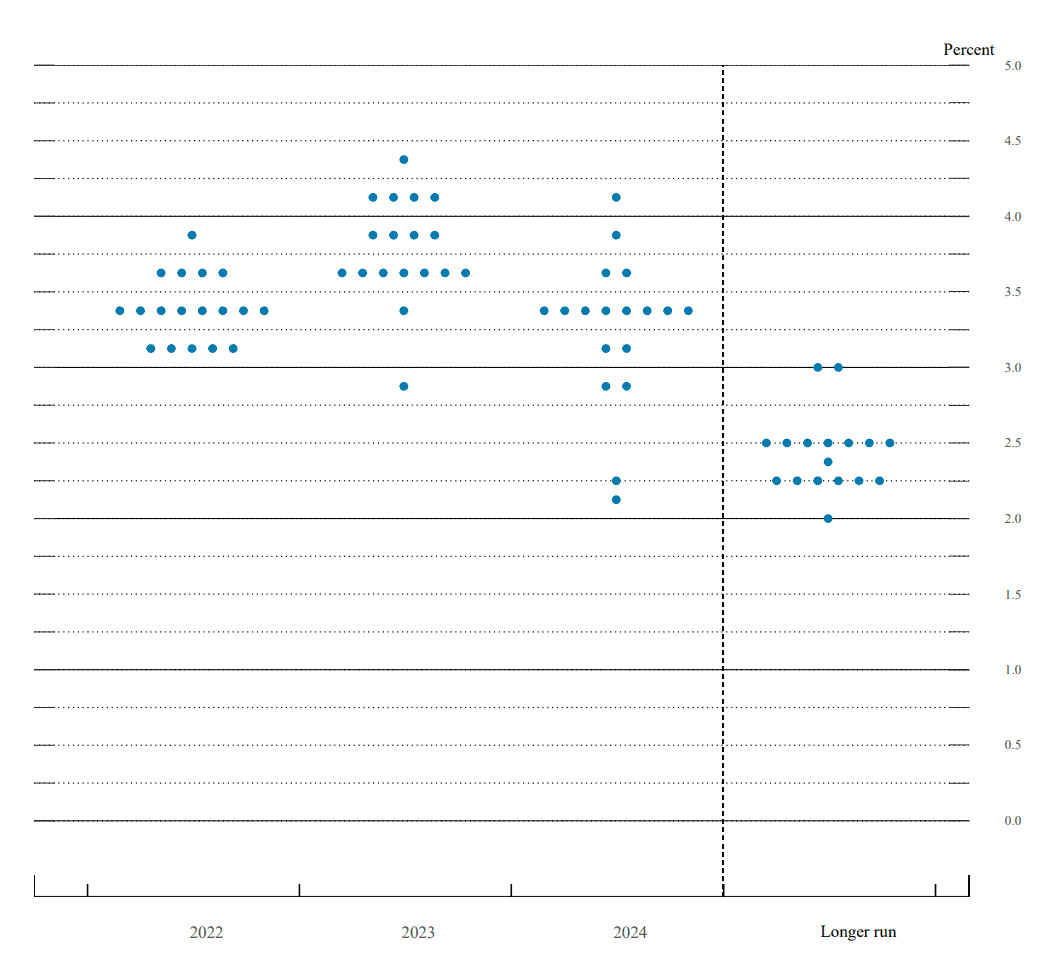

The Fed signaled it would continue raising rates this year at the most rapid pace in decades in an effort to rein in inflation. The central bank’s so-called dot plot, used to signal its outlook on interest rates, showed officials expect rates to rise to at least 3% this year.

Importantly, the FOMC’s Summary of Economic Projections, a key document watched by financial market participants worldwide, showed unanimity over this year’s rate increase among the 18 officials who participated in the meeting. At least half of them indicated the Fed Funds Rate may need to increase to around 3.375% this year.

or target level for the federal funds rate. Source: FOMC Summary of Economic Projections

However, the central bank will have to weigh that against a mandate to stoke job growth.

Interest rate increases “significantly change the topology” of the fixed-income market with wider implications in the financial system, Kraken’s Jonathon Miller told Forkast in an email. “This pertains to crypto insofar as the market participants may retreat from higher risk asset classes and redeploy their capital into savings,” he said.

But the European Central Bank’s emergency meeting to address a surge in borrowing costs in eurozone countries such as Italy indicates interest rate rises may be temporary, Miller said.

Globally, central banks may have to revert to quantitative easing in the near future, he added.

Read more: EU to introduce bill next year to plan a digital euro

Financial market observers also seem to have not fully taken into account the monetary and fiscal firepower still at the disposal of China, which is grappling with slowing growth from Covid-19 related lockdowns.

Further easing by the ECB and the People’s Bank of China (PBoC) would mean the Fed would be a lone hawk among global central banks. It may have to change course to prevent American exports from getting expensive from a stronger dollar.

This comes as the correlation between Bitcoin’s price denominated in U.S. dollars and the Nasdaq Composite, which began around late 2021 was tested this week. The world’s largest crypto by market cap along with other coins bore the brunt of the market selloff as investors, mostly institutional, sold down as troubles at Celsius Network and TRON’s efforts to support the dollar peg of the project’s stablecoin USDD brought back memories of the Terra-LUNA debacle.

Read more: Has Bitcoin become a victim of its own success?

The potential breakdown of the correlation with risk assets could dovetail well for Bitcoin and other cryptocurrencies, which mostly retain their advantage of guarding against debasement of fiat currencies.

“Despite these short-term interest rate rises, we are far from the era of sound money,” Kraken’s Miller said. “And I would not be surprised if assets like Bitcoin come back into focus as alternate hedges against devaluing equities and fiat currencies.”