The Japan Digital Currency Forum has released a white paper examining the possibility of a new cryptocurrency backed by bank deposits.

Fast facts

- The forum consists of over 70 companies, including the country’s top banks such as MUFG Bank, Sumitomo Mitsui Banking Corp., Mizuho Bank, Japan Post Bank, among others. Several government agencies also are part of the project, with the country’s finance ministry and central bank acting as observers.

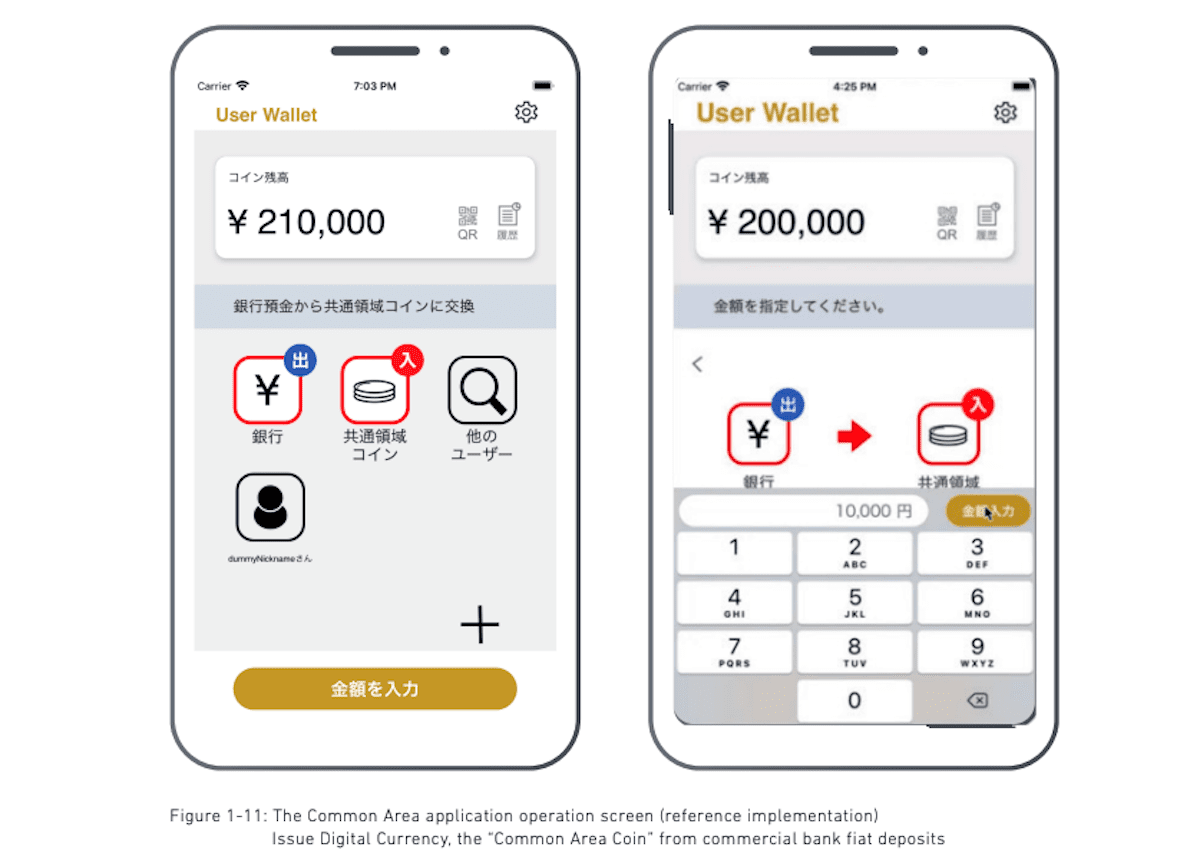

- The digital currency, temporarily called DCJPY, would be issued by commercial banks as their liabilities. The currency would be backed by bank deposits and not bear interest, the white paper notes. Users would be allowed to mint the currency by withdrawing deposits from their bank accounts and posting the equivalent amount in DCJPY to a digital currency account.

- The white paper describes the digital currency platform as two-tiered — it has a “Common Area” where simple transactions are recorded on the blockchain and a “Business Process Area” for smart contract transactions. According to the white paper, DCJPY is expected to foster innovation, reduce cost and improve the efficiency of digital payments.

- The forum is exploring a range of use-cases for the currency including security tokens, retail payments, industrial settlements and non-fungible tokens, among others. The consortium is hoping to roll-out DCJPY by the latter half of 2022. In the meantime, the forum will test the digital currency starting as early as this year.

- In the meantime, Japan’s central bank is exploring the feasibility of its own central bank digital currency. The CBDC project is currently in its proof-of-concept phase while the government carries out several studies to figure out the technical details as well as its economic impact.