In this issue

- Japan — a new frontier for Binance?

- AI art sweeps NFT sales

- ETF buzz electrifies Bitcoin

From the Editor’s Desk

Dear Reader,

It’s been quite the week for Binance. The world’s largest cryptocurrency exchange has been headline news on our pages for some time now. And that’s no mean feat considering the Sam Bankman-Fried trial is still only a few weeks old and readers all over the world remain glued to their screens, waiting to learn the fate of crypto’s most (in)famous individual.

Second on that list, arguably, is Changpang Zhao, known to most as CZ. The Binance CEO and co-founder was a one-time mentor to SBF. Something of a crypto-older-brother to the FTX founder, Zhao was there for Bankman-Fried in the early days of the collapsed exchange, becoming one of the first investors and helping FTX off the ground.

But he was also reportedly there as it all came crashing down. At one stage in November last year, when rumors of a multi-billion dollar shortfall in customer funds at FTX came to light, it appeared as though Zhao may step in to bail SBF out. But it wasn’t to be. Zhao and Binance pulled out of an agreement to buy FTX at the last minute and… well… we all know what happened next.

For some time before Bankman-Fried’s rapid fall from grace, there had been whispers that Zhao was less than impressed by the FTX boss’s apparent cozying-up to U.S. regulators. Some reports even allege that he had a hand in exposing the balance sheet discrepancies that brought the curtain down on FTX. It was Zhao, after all, who contributed to the run at FTX when he said he would sell all Binance’s holdings in its native token FTT.

Regardless of Zhao’s alleged involvement in FTX’s demise, this could and should have been a triumphant moment for Binance. The exchange’s main rivals are no longer part of the picture. The company continues its outward expansion into territories new — Japan in particular representing a particularly promising growth market for the brand.

But it’s not exactly smooth sailing elsewhere. Binance said it will no longer register new users in the U.K. on Monday in response to the country’s new overseas promotion rules, while on Tuesday Binance.US announced it has suspended U.S. dollar withdrawals for U.S. customers. Add that to the announcement last week that Brazil’s regulators want to indict Zhao for running a pyramid scheme, and the picture starts to look far less rosy.

Of course, Binance remains a juggernaut. Its website claims the exchange has 150 million users worldwide, enjoying a daily transaction volume of US$65 billion. But the lay of the land has without doubt turned a little bumpy, while there’s some really mountainous terrain up ahead.

Where the journey leads is yet to be decided. But knowing Binance and Zhao, it’s bound to be one heck of a ride.

Until the next time,

Angie Lau,

Founder and Editor-in-Chief

Forkast.News

1. Japan — a new frontier for Binance?

Binance Japan started trading operations Aug. 1, launching with an impressive 34 coins on its platform. The number might be a fraction of what Binance’s global exchange offers, but for the Japanese crypto market, it marks a significant leap. The number places Binance Japan at the forefront of the domestic industry in terms of cryptocurrency variety.

- The official arrival of Binance, the world’s largest cryptocurrency exchange, as a licensed entity in Japan, signals challenging times ahead for the multitude of smaller domestic exchanges already grappling with dwindling liquidity and an oversaturated market. As noted by Norbert Gehrke, founder of the Japan FinTech Observer newsletter, the dominance of Binance could potentially kill off many of these smaller competitors.

- Binance has faced regulatory hurdles in Japan in the past. It received reprimands from the Financial Services Agency (FSA) for operating as an unlicensed online exchange in both 2018 and 2021. However, the company’s strategic acquisition of the Sakura Exchange BitCoin platform last year fast-tracked its official re-entry into the country.

- Binance’s interest in the Japanese market showcases an industry-wide pivot toward the Asia Pacific market amidst growing U.S. resistance to crypto.

- Despite past frictions, the country’s pro-crypto stance — led by Prime Minister Fumio Kishida’s endorsement of Web3 technologies — hints at a promising future for foreign crypto investments in the country. But some local competitors have raised concerns over Binance’s swift licensing process, suggesting a potential double standard.

- While Binance’s global operations face legal scrutiny in various countries, experts like Tokyo-based fintech lawyer So Saito believe that existing Japanese regulations will safeguard local investors. As they were during the FTX collapse, Japanese assets are expected to remain secure even if Binance Global encounters challenges.

- On the positive side for Binance and Japan, the entry of a global giant might just be the spark the domestic crypto industry needs to really get up and running. The market is shifting away from one-note cryptocurrency trading to the broader potentials of Web3. If developers can integrate Japan’s traditional strengths in areas like anime, manga, and video games, then the future seems ripe with opportunity.

- The hope, as expressed by industry advocates, is that Binance’s presence will rejuvenate Japan’s crypto space, drawing in more foreign interest and innovation much like the crypto hubs of Dubai and Singapore.

Forkast.Insights | What does it mean?

The picture can look a little bleak for Binance in the West. U.S. regulation in particular and the threat of legal action there has slowed the company’s momentum. It has been forced to beat a hasty retreat from Canada and a host of European jurisdictions. The business landscape is also growing increasingly complicated in the U.K. The exchange announced Monday it will no longer accept new customers in the country in compliance with local regulations.

Binance is far from alone in facing these challenges. Crypto businesses are struggling across the board. It’s just that Binance’s size and industry heft means it inevitably attracts a lot of the ire aimed at the wider industry. And like the wider industry, it’s now looking for opportunities beyond Europe and the U.S. — powerhouses for both traditional finance and the digital economy — toward the Asia-Pacific region, which is emerging as something of a crypto haven.

One key region for the company is Japan. Blockchain intelligence firm Chainalysis shows that while India leads the world in crypto adoption and other APAC regions such as Indonesia and Vietnam are accelerating their crypto uptake, blockchain adoption in Japan is also significant.

The nation’s government is never shy about promoting Japan as a regional hub for Web3, which it has positioned over the past year as a key economic growth strategy. It aims to use blockchain technologies like non-fungible tokens (NFTs) and decentralized autonomous organizations (DAOs) to unlock hidden value in Japan’s graying society and address the rapid onset of regional depopulation.

But exactly how it aims to do that remains unclear. While the will is there, Japanese developers express a lack of blockchain understanding among policy-makers. There is therefore a sense that a current wave of government enthusiasm for Web3 could fizzle out without any specific strides for the industry. Which is where Binance could step in.

The exchange was able to fast-track its official arrival in Japan this August despite past run-ins with regulators. Despite the legal baggage it carries elsewhere, there is clearly a desire among policymakers and industry advocates to leverage the experience and technical knowhow that Binance brings to the table.

Could Japan emerge as a home-away-from-home for the company? The official arrival of Binance Japan has at least stirred up a lot of conversation and crypto interest in the country.

2. Art and charity over apes in NFTs

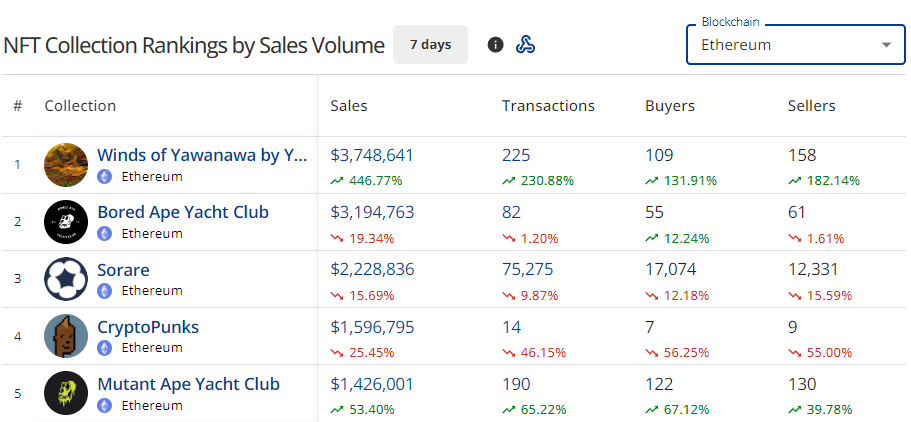

Refik Anadol’s artificial intelligence (AI)-created art collection “Winds of Yawanawa” is currently the top non-fungible token collection on the Ethereum blockchain.

- Over US$3.7 million in secondary sales of the collection have been recorded over the past seven days, marking a 446% increase since the collection’s unveiling last week.

- Winds of Yawanawa was responsible for 11.4% of Ethereum’s US$32 million in total NFT sales the past week.

- The highest sales within the collection include one NFT for 23 ETH (US$36.560.17), and 17 individuals sales at more than 15 ETH (over US$23,000) each.

- Refik Anadol’s art was featured on the exterior of The Sphere, an immersive events structure in Las Vegas, during the venue’s opening in September.

- The Museum of Modern Art welcomed Refik Anadol’s “Unsupervised — Machine Hallucinations” NFT into their permanent collection, making it the first NFT to be owned by MoMA.

Forkast.Insights | What does it mean?

It’s not often that art gets a chance to take center stage in NFTs, but when a milestone such as Refik Anadol’s recent accomplishments arrives, it must be talked about.

For the past few weeks, Refik has represented the heart of NFTs, serving as a much needed distraction from the current 33-month low point for the NFT market. His art and its success has reminded the collective community about the roots of NFT technology, which is the provenance it preserves, and the financial opportunities it offers to artists.

While Anadol’s art being featured on the Las Vegas Sphere and being acquired by the Museum of Modern art are milestones for NFTs, they’re equally as important for the world of AI art. His work lives at the cutting edge of two fronts, showcasing how AI can be used as a tool to create beauty, while using technology to preserve it.

Using data from Acre Brazil’s Yawanawa tribe’s village in the Amazon rainforest, Refik painted wind speeds, direction, gusts, and temperatures onto a digital canvas with AI tools to create the iconic 1,000 edition “Winds of Yawanawa” collection.

The collection also highlights another important side of NFTs, one that is rarely talked about. We’re accustomed to hearing about scams and manipulations across the blockchain industry, but seldom do we hear about good deeds in the NFT ecosystem. The “Winds of Yawanawa” collection was co-created with artists from the Yawanawa tribe, and because of that collaboration, the tribe earns royalties for each NFT sold on secondary markets.

To date the “Winds of Yawanawa” collection has traded for over US$9.4 million, with 10% of all sales going directly to the Yawanawa tribe. While royalties are no longer enforced on marketplaces, most art collectors happily honor artists’ requested royalties. In a space that witnessed a US$6.2 million generative art sale over the summer, a US$69 million Beeple NFT sale in 2021, the Art Blocks platform’s US$1.4 billion in all-time sales, and now Refik Anadol’s milestone collection of AI art, a picture is being painted on the blockchain that may help you understand just how significant the art movement in NFTs really is.

3. Finks forecast: Golden Bitcoin era?

BlackRock CEO Larry Fink addressed the recent fleeting surge in Bitcoin prices during an appearance on the Fox Business broadcast on Monday, highlighting the immense global interest in cryptocurrency.

- This surge was initially fueled by a rumor that the U.S. Securities and Exchange Commission (SEC) had given the green light to BlackRock’s application for a spot Bitcoin exchange-traded fund (ETF).

- Fink refrained from delving into specifics but noted that the rally wasn’t solely based on the rumor. He attributed the upswing to worldwide concerns about the current Israel-Palestine conflict and what he described as escalating global terrorism. He discussed the growing trend of investors moving towards safer assets, whether it’s treasuries, gold, or even — at a time of global disruption in traditional markets — cryptocurrencies.

- The ETF rumor and spike in Bitcoin price originated from Cointelegraph, a cryptocurrency news platform. It claimed early Monday on social media platform X (formerly Twitter) that the SEC had approved BlackRock’s spot Bitcoin ETF application.

- However, Cointelegraph later retracted the claim. In the meantime, Bitcoin’s value briefly spiked to nearly US$30,000 before stabilizing back to within the US$28,000 range.

- In June, BlackRock lodged an application for its iShares Bitcoin Trust with the SEC. Should it gain approval, the firm plans to collaborate with Coinbase Custody as its custodian.

- Despite an influx of spot Bitcoin ETF applications from various institutions, the SEC has delayed a decision on approvals. Nevertheless, Steven Schoenfeld, a prominent figure in the industry, anticipates the SEC to approve all applications in the coming three to six months.

Forkast.Insights | What does it mean?

Bitcoin’s latest major price swing was fueled by the industry’s longing to see a spot Bitcoin ETF open for business in the world’s largest economy. It not only demonstrated investors’ appetite for cryptocurrencies, as noted by BlackRock’s Larry Fink. It also revealed the asset’s responsiveness to unfolding events and hearsay.

The quick correction from Cointelegraph after the outlet’s mistaken ETF claim reflects the lightning-fast dissemination of information in the internet era. It fires a clear message to the financial community about the importance of due diligence in today’s rapid information age.

BlackRock’s flirtation with the Bitcoin ETF sphere is a sign of the times, pointing toward a growing institutional interest in digital assets. A potential alliance with platforms like Coinbase Custody, contingent on regulatory blessings, could mark the beginning of an advanced framework for further institutional forays into the crypto world.

For investors, a spot Bitcoin ETF would become another channel to legally bet on the success of digital assets. But for existing cryptocurrency industry participants, it would serve as a lifeline that brings much needed funds, liquidity and mainstream interest into the sector.

The so-called “crypto winter” and wider macroeconomic headwinds have hastened the demise of multiple Web3 firms. Even the strongest and the fittest companies left behind now tend to operate with a much smaller workforce and war chest. The introduction of a spot Bitcoin ETF would be a turning point.

While rejuvenating the dwindling reserves of these firms, this new financial instrument could also instill renewed confidence among stakeholders. As mainstream investors gain an easier and more regulated avenue into Bitcoin investment, the resultant inflow of capital could stabilize the volatile crypto market, fostering an environment ripe for increased growth and innovation.