Cryptocurrency investment products saw inflows of US$288 million last week, with total inflows year-to-date at a record of US$8.7 billion — 30% higher than the total for 2020, according to digital asset manager CoinShares.

Fast facts

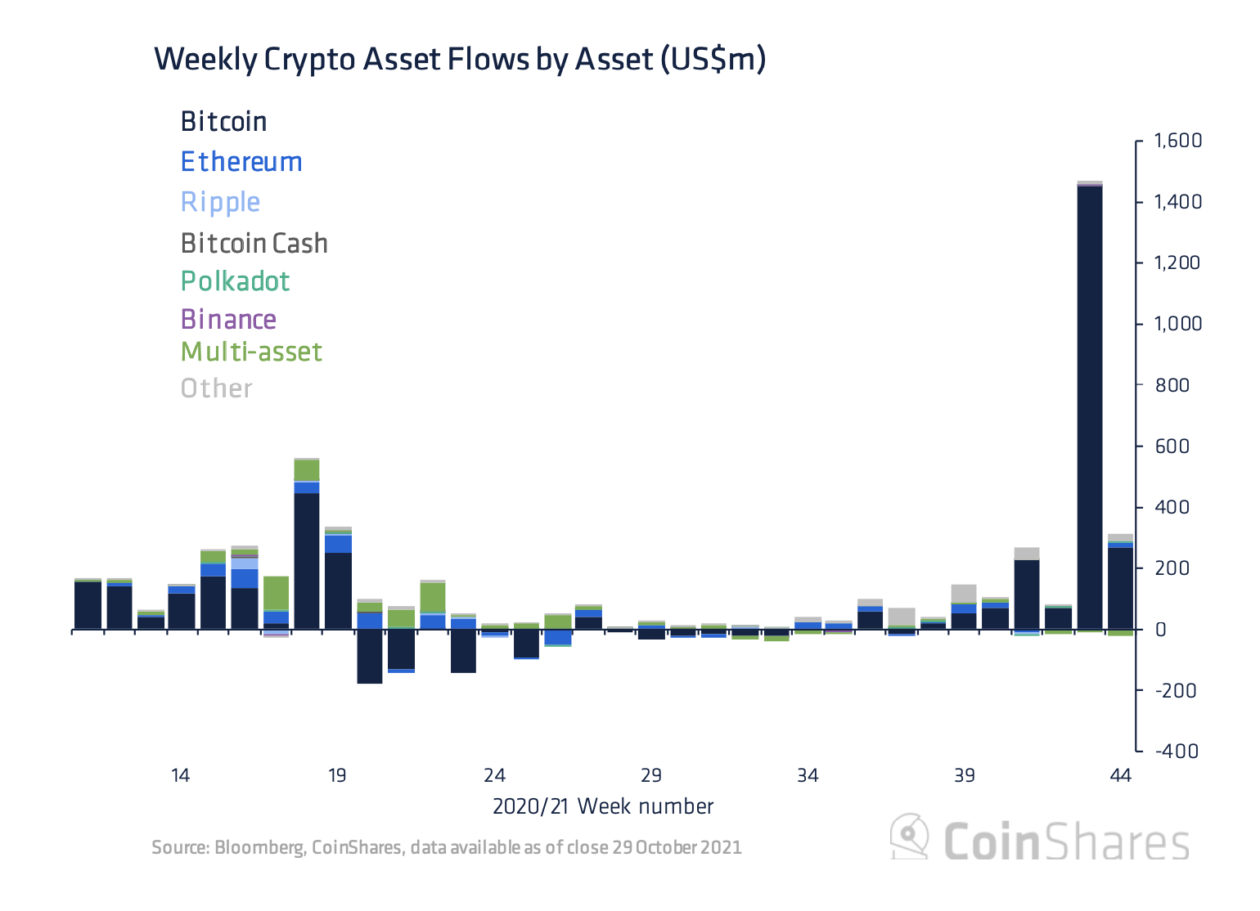

- Bitcoin continued to lead with institutional inflows of US$269 million last week, albeit at a significantly lower level compared to the week before, which saw record inflows of US$1.45 billion. “The record-breaking previous week, following the US SEC permitting a Bitcoin futures ETF decision, was not repeated last week with only US$53 million of inflows from US-based ETFs,” wrote CoinShares investment strategist James Butterfill. Bitcoin, which surged to a new all-time high of $67,276.79 on Oct. 20 according to CoinGecko data, last week marked the 13th anniversary of the publication of its whitepaper by Satoshi Nakamoto.

- Altcoins have rallied following Bitcoin’s surge in October. Ethereum — the second-largest cryptocurrency by market value — finally saw inflows of US$17 million last week after three consecutive weeks of outflows. Ethereum’s Altair Beacon Chain upgrade — the first mainnet upgrade to the Beacon Chain — successfully went live on Oct. 27. The upgrade marks another step forward in Ethereum’s transition from proof-of-work to proof-of-stake (PoS).

- Other altcoins Solana, Polkadot and Cardano saw inflows of US$15 million, US$6 million and US$5 million respectively. But multi-asset investment products saw outflows of a record US$23 million, according to CoinShares. “Investors are currently preferring single-line exposure and are becoming more discerning over their altcoin exposure,” Butterfill wrote.

See related article: What will Ethereum prices be as 2021 ends?