Two U.S. Federal Reserve officials have called for new regulations specifically for stablecoins and reiterated the new asset class holds risks similar to traditional finance.

See related article: Financial Stability Board calls for high regulatory standards for stablecoins

Fast facts

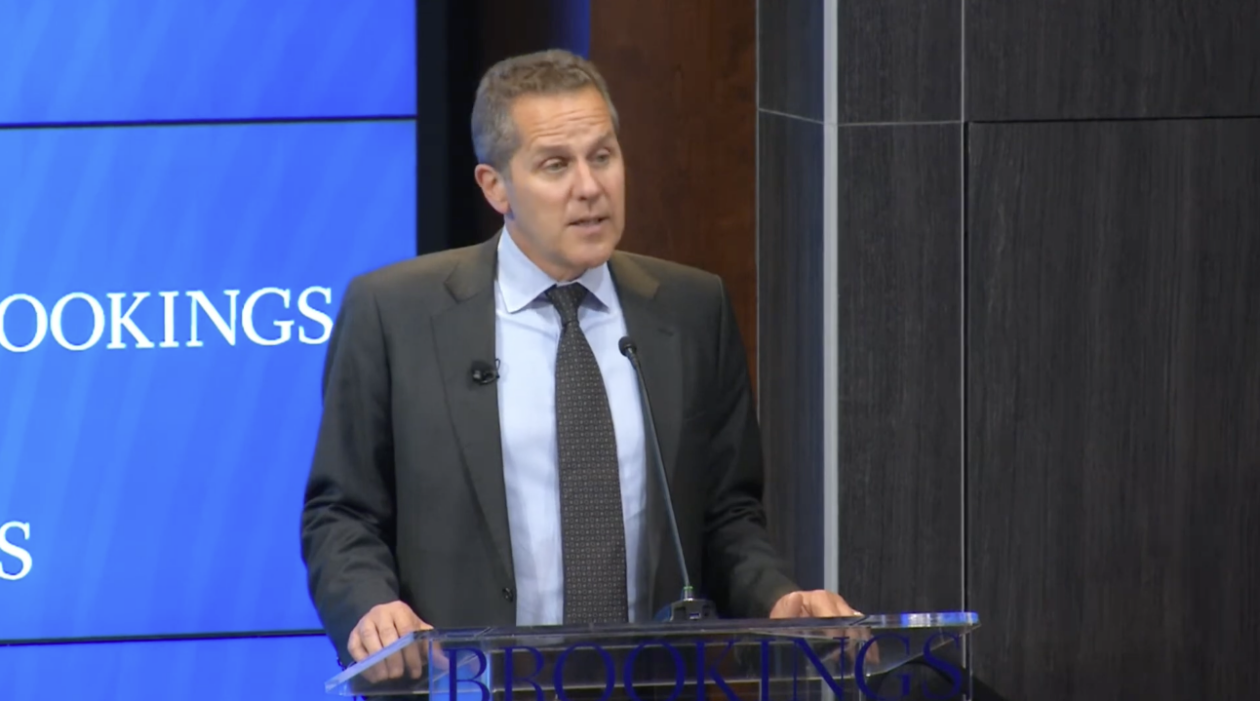

- Michael Barr, the Fed’s vice chair for supervision, said on Wednesday at a Brookings Institution event in Washington, D.C. that stablecoins, like other unregulated private money, could pose financial stability risks.

- “I believe Congress should work expeditiously to pass much-needed legislation to bring stablecoins, particularly those designed to serve as a means of payment, inside the prudential regulatory perimeter,” Barr said.

- Meanwhile, Fed Vice Chair Lael Brainard said on Wednesday in a speech at a conference organized by The Clearing House and Bank Policy Institute that the crypto financial system “has all the same risks that we’re very familiar with from traditional finance,” CoinDesk reported.

- Brainard added stablecoins are one of the areas that have the most potential for risks if not properly regulated and such risks could spill into the main core financial system.

- Brainard also said the Fed is committed to its campaign of rising interest rates to tackle inflation but the central bank will be data dependent and remain conscious of over-tightening.

- In November 2021, the U.S. President’s Working Group on Financial Markets published a report on stablecoins, urging the Congress to act quickly to enact relevant legislation.

- U.S. Treasury Secretary Janet Yellen has repeatedly said that it’s “highly appropriate” to have a stablecoin regulatory framework ready by the end of this year.

See related article: Binance move to remove USDC and others raise questions about market conduct