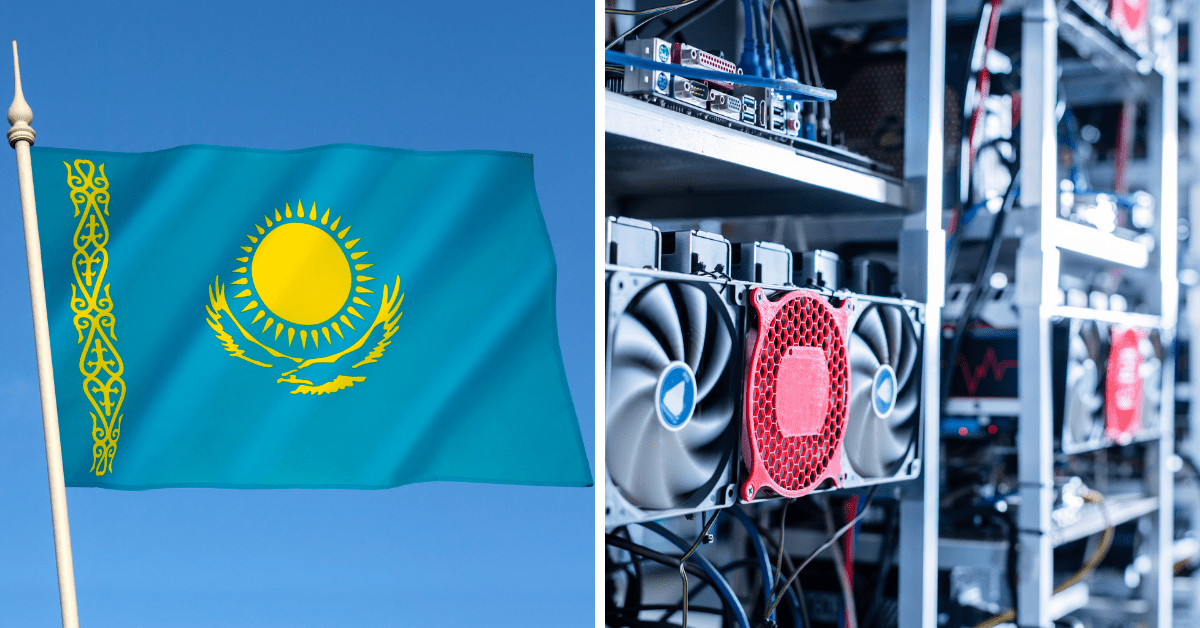

A new wave in crypto’s Great Migration is starting — this time, out of Kazakhstan, which only recently swelled with crypto miners to become a global Bitcoin-producing hub.

Driven out of China through crackdowns starting last spring, crypto miners resettled en masse in neighboring Kazakhstan, and in a matter of months turned the landlocked Central Asian nation into the world’s second-largest Bitcoin producer.

But Kazakhstan’s political chaos and frequent power outages are now driving many crypto miners to pack their bags — and gear — to move again. This time, many are headed overseas and possibly leaving Asia for good.

“Around nine companies started moving equipment last week,” Alan Dorjiyev, president of National Association of Blockchain and Data Centers Industry in Kazakhstan, told Forkast today, adding the country continues to suffer from shortages in electricity.

Bitmain-backed cloud miner BitFuFu is among the new wave of migrants.

BitFuFu announced last week it had decided to relocate cloud hosting servers from Kazakhstan to North America. The mining company had just last year shipped 80,000 machines from China to farms in Kazakhstan, according to Financial Times.

“The international mines can effectively lower the regional risks and keep our users’ assets safe,” BitFuFu said in a statement.

BitFuFu told Forkast its servers for leasing are being deployed to mining facilities in the U.S. and other countries and are operating as usual. “The company will assess the remaining computing power in Kazakhstan after the local power supply resumes its usual capacity,” a company representative said.

The crypto mining industry has seen tremendous geographic shifts over the past year — with some mining companies now having to migrate twice. Last year, China — home to 75.5% of the world’s total Bitcoin mining in September 2019 — began cracking down on crypto mining prompted by energy concerns, forcing miners to flee to friendlier destinations.

Many decided to relocate to Kazakhstan, a large coal producer just across the border from the northwestern Chinese region of Xinjiang, which was a major Bitcoin-producing hub. By August 2021, so many Chinese miners had poured into Kazakhstan that the country accounted for 18.1% of the global Bitcoin hashrate share, up from 8.2% just four months before, according to data from the Cambridge Centre for Alternative Finance.

However, the business environment in Kazakhstan for crypto mining quickly deteriorated. In October, Kazakhstan’s energy authority started to ration power for certain miners amid electricity shortages. The deadly civil unrest against energy shortages and the internet blackouts earlier this month also made for an increasingly fraught business environment for Kazakh miners.

This week, Kazakhstan authorities cut off power supplies for crypto miners, a day before massive electricity blackouts occurred on Tuesday. Miners there currently have no power to use through the end of this month, Didar Bekbauov, a co-founder of local miner Xive, told Forkast.

Dorjiyev, the president of the Kazakhstan blockchain association, said the power shortages will likely last for a while and the deficit in supply cannot be replaced by imported electricity due to legal bottlenecks at the moment.

Only two weeks ago, Dorjiyev told Forkast that local miners remained hopeful because their facilities were not damaged during the political mayhem and street violence that killed over 200 people. But the ongoing power shortages are dampening that hope.

Alejandro De La Torre, a mining industry veteran who most recently served as a vice president at mining pool Poolin, told Forkast that one popular destination for some Kazakh miners could be Russia, adding that the miners who have been “playing by the rules” could be able to navigate the rough waters for now.

Although the U.S. has cheap electricity with clearer rules as well as a stable government, which allure many miners, what’s not been spoken about is the fierce competition among crypto miners in the U.S. — now the largest Bitcoin producer in the world — and the lack of electrical equipment available for mining farm setups, De La Torre said.

“On a more personal level, too much hashrate concentrated in one country always makes me a bit nervous,” De La Torre added. “Be it China or USA.”

BitFuFu, founded in 2020 with early investment from rig maker Bitmain, has acted quickly to abandon its operations in Kazakhstan to set up shops in North America — where it’s now planning to go public.

The Chinese cloud miner announced on Tuesday that it has entered into an agreement to go public on Nasdaq in the third quarter via a merger with a publicly-traded special purpose acquisition company. The deal values the company at a pro forma enterprise value of US$1.5 billion.

Bekbauov, however, doesn’t seem to have the same luck. He said Xive’s operation in Kazakhstan will be affected until Feb. 1 due to the latest power cuts.

In fact, Bekbauov has just returned to Kazakhstan last week from a U.S. business trip to look for partnership opportunities.

“It’s not an easy process to enter a new market,” he said, adding that he’s still in the process of finding a good new location for his crypto mining business — away from Kazakhstan.