Eqonex Ltd.’s announcement to shut down its crypto exchange to improve its financial position has highlighted challenges faced by such operators in a business where a race to the bottom has weighed on fees and profitability.

The Nasdaq-listed financial services firm on Monday said it will “streamline its operations” to focus on businesses that offer potential to grow revenue and deliver “sustainable” profits in the longer term.

“When you talk about spot exchanges, it has this kind of inherent vulnerability during bearish market conditions,” Igneus Terrenus, head of communications at Singapore-based crypto exchange Bybit, told Forkast in an interview.

The crypto market now has close to 300 spot exchanges with interchangeable features, Eqonex said. “Intense market competition and low margins, combined with the significant technological load required to ensure optimal performance has made running a profitable exchange increasingly challenging, especially in the current environment where crypto exchange volumes have fallen,” Eqonex said in its statement.

That bear trend is taking its toll across the industry. Last week, Singapore-based crypto lender Hodlnaut froze withdrawals as well as ended its token swapping feature, while exchanges like CoinFlex and Coinbase are reducing headcount. Singapore-based crypto lending and trading platform Vauld has reduced staff while seeking court protection from potential lawsuits, while crypto Hedge fund Three Arrows Capital has been ordered to liquidate.

Eqonex reported US$203,230 of revenue in its exchange business for the year that ended in March 2021, on an average daily volume of US$15.9 million, its latest annual report showed. About 70% of this daily volume in March was generated by institutional clients, Eqonex said.

Net loss for the overall business, including trading and capital market related businesses, asset management and custodial services businesses widened to US$125.3 million for the financial year that ended in March 31, 2021 from US$57.7 million a year earlier, Eqonex’s annual report showed.

Market turmoil would have a direct impact on a company with a business model that is “singular in its nature,” said Terrenus. But it is possible to navigate market uncertainty with a “well-hedged” business model, he added.

Collin Cheong, director for corporate development at Singapore’s Coinhako crypto exchange, said companies have to accept and understand the cyclical nature of markets and have “sufficient provision” in times of market uncertainty.

“It is important at this time for any company in the business to relook, to see whether their operational model is scalable, cost effective and able to withstand the test of time,” Cheong told Forkast in an interview.

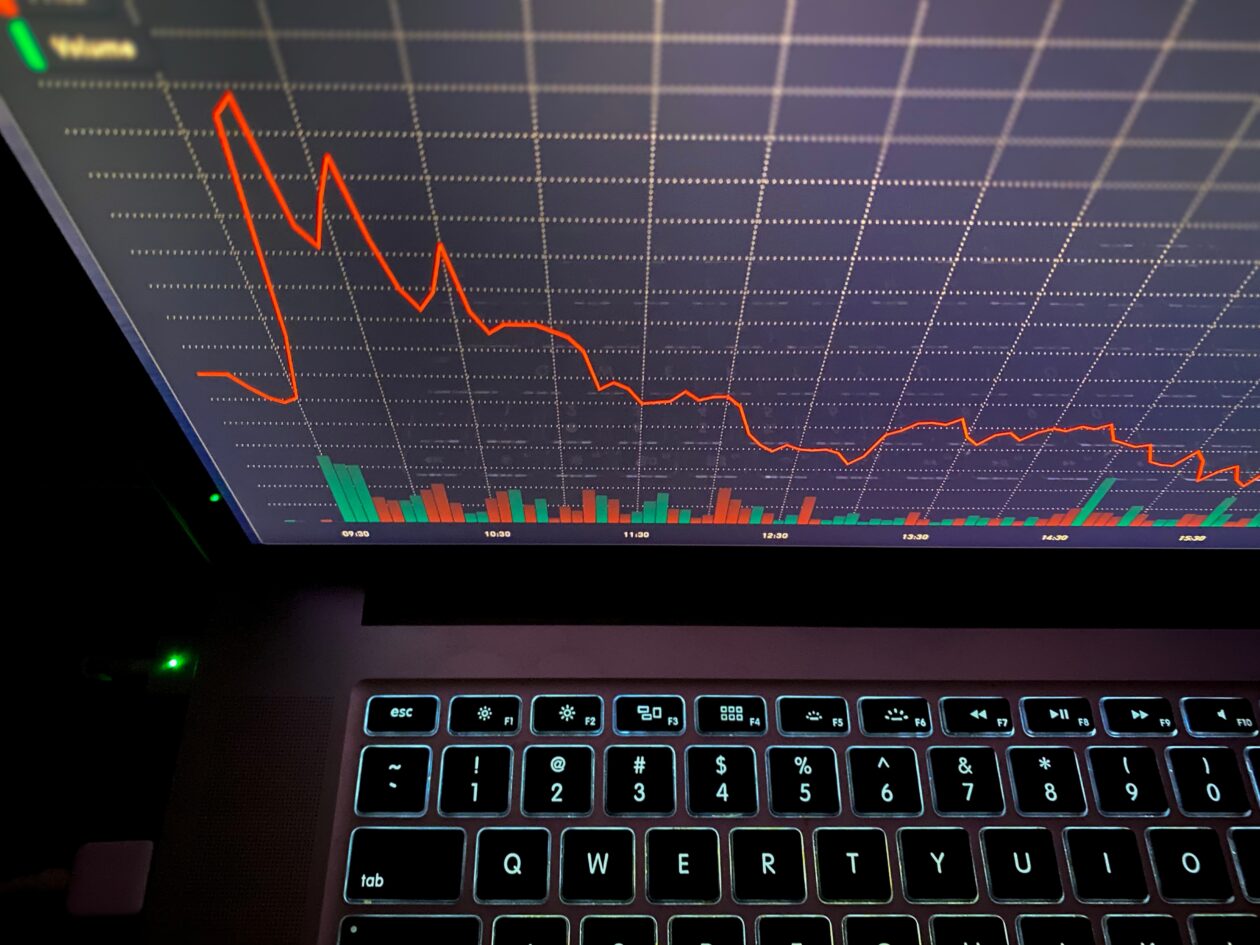

The current bearish sentiment in crypto is also reflected in equities markets, Cheong said, leading to lower trading volumes from a lack of investor confidence in the asset class.

Shares in Eqonex closed down 2.3% at 78 U.S. cents a share in Monday trading on Wall Street. The stock is down some 59% this year, according to MarketWatch data.