In this issue

- Bitcoin prices rise on PayPal’s cryptocurrency news

- US Fed not yet sold on digital dollar

- USDC stablecoin adds Solana blockchain to rely even less on Ethereum

- In China: new DCEP digital currency law; digital yuan to be used by 80,000 rural banks

- Funding spotlight: Bangalore-based Signzy raises US$5.4 million

From the Editor’s Desk

Dear Reader,

286 million customers.

The digital assets / cryptocurrency space just got a little more crowded. That’s how many active users PayPal currently serves… and now in the cryptocurrency space. With billions of transactions per year, PayPal now also wants to add cryptocurrency into the mix, allowing users to buy and sell via its new digital wallet. As one of the biggest and best-known online payments brands in the world, PayPal has now created an on-ramp to cryptocurrencies for mainstream customers. And if you have any doubt as to what this means in terms of liquidity, you need not look further at bitcoin prices on the heels of the announcement. Bitcoin prices climbed 5% as PayPal announced it is launching its own cryptocurrency service last week.

It’s a natural progression if you think about it. As cryptocurrencies and alternative digital assets become more mainstream, so too are mainstream firms engaging and exploring how they want to participate. Question is, are everyday retail customers ready to explore the sometimes murky world of cryptocurrency trading, price volatility and yield farming in DeFi? Baby steps first.

This week’s Current Forkast notes that necessity is the mother of invention. We are seeing this play out in real time as global markets react to Covid-19 slowdowns, political instability and trade tensions. As the appetite for alternative assets grows, the desire to diversify and hedge intensifies. Trusted brands, from businesses to sovereign nations, are all getting in on the act.

Until the next time,

Angie Lau,

Founder and Editor-in-Chief

1. Bitcoin prices rise on PayPal’s cryptocurrency news

By the numbers: PayPal — over 5,000% increase in Google search volume.

Global online payments system PayPal unveiled a new service to buy, hold and sell Bitcoin, Ethereum, Bitcoin Cash and Litecoin directly within users’ PayPal digital wallet. The service will be made available to U.S. users in the coming weeks and will expand to international markets in the first half of next year.

- Following the announcement, bitcoin’s prices topped US$13,000 for the first time since July 2019 and is currently trading at $13,763 at the time of publication, according to CoinMarketCap data. PayPal also hit its all-time high on Nasdaq (PYPL).

- PayPal may not be finished here. On Friday, Bloomberg cited “people familiar with the matter” to report that PayPal may be looking into acquiring multisignature bitcoin custodian BitGo.

Forkast.Insights | What does it mean?

PayPal supporting cryptocurrency should be groundbreaking news. On any over-the-counter exchange, like LocalBitcoins and Paxful, people have been buying and selling crypto for years — albeit against the payment processor’s terms and conditions. According to publicly available data, LocalBitcoins has between US$2 million and $7 million a day in volume and there are currently 215 traders that use PayPal. Its bigger brother, Paxful, does just over $1.6 billion in volume a year and has dozens of traders offering the same.

In short: this is a major market that operates in the gray area, as PayPal is known to lock and throw away the key accounts suspected of trafficking in cryptocurrency. So surely this is something the company would want to bring in from the cold with this announcement? No, not really. The company is quick to highlight that while you can buy and cash out cryptocurrency, you can’t transfer crypto outside of PayPal.

It’s safe to assume that PayPal is right now battling the leviathan of global financial regulations to prepare for its next move. While PayPal is an authorized money transmitter in dozens of countries around the world, regulators have a spectrum of opinion on cryptocurrency. Mass adoption of the Financial Action Task Force’s “Travel Rule” would be a necessary first step. The question of custody is also one regulators are considering but don’t have a universal answer for. In PayPal’s case, you don’t control the keys, thus PayPal retains custody of the coins.

So what’s the point of all of this? Exposure to an alternative asset class, but also preparing to create on-ramps to future digital assets like a galaxy of stablecoins or even CBDCs that are blockchain-based, like France’s effort.

This isn’t as exciting of an announcement as many had hoped, but for an organization as large and established as PayPal, anything like this would come in the form of baby steps.

2. US Fed won’t be hurried on CBDC

By the numbers: CBDC — 5,000% increase in Google search volume.

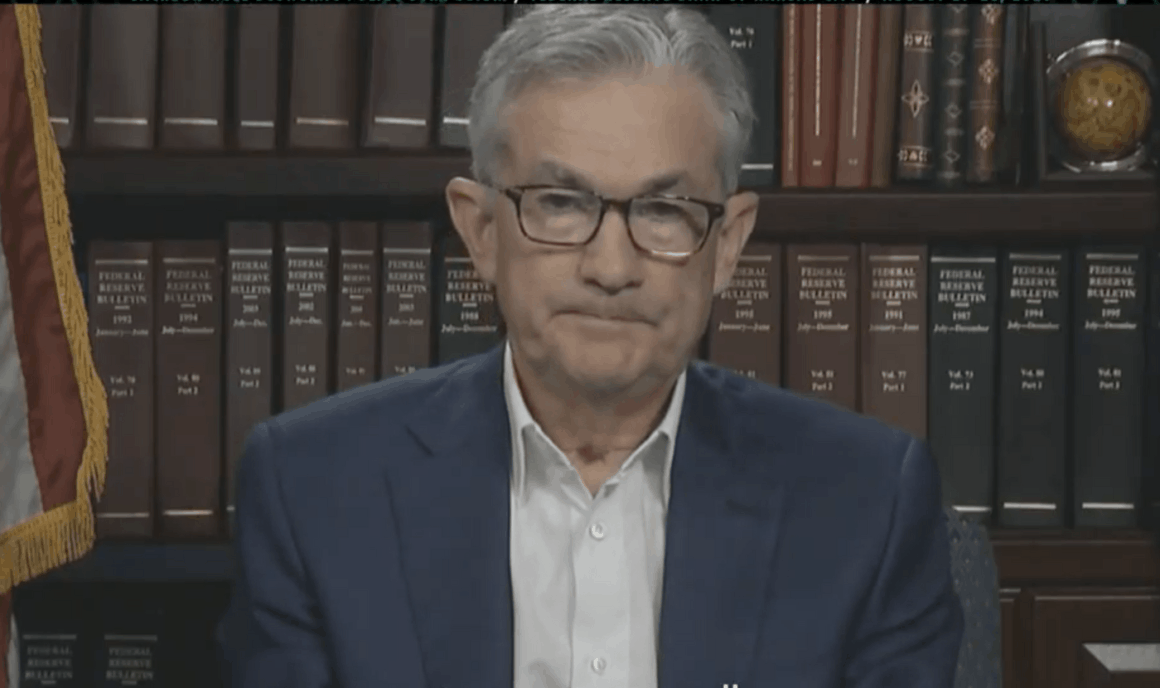

Jerome Powell, the Federal Reserve chair, has again reiterated that the U.S. is in no hurry to launch a central bank digital currency (CBDC), stating it is “more important to get it right than to be first.” Speaking at an International Monetary Fund virtual seminar on cross-border payments and digital currencies, Powell stressed the importance of private sector collaboration.

- Powell had previously distanced the Fed from the Digital Dollar Project in June, saying that “the private sector is not involved in creating the money supply.”

- Bahamas has launched its sovereign digital currency, the “sand dollar,” this past week. The Bahamian dollar is pegged to the U.S. dollar on a one-to-one basis.

Forkast.Insights | What does it mean?

Unlike China with its new DCEP digital currency, there may not be a pressing need to launch a U.S. CBDC immediately.

The U.S. doesn’t have the same need to build its currency’s liquidity. While China might force international firms that wish to trade with it to use DCEP, most businesses by default will likely still settle transactions in USD simply because it’s the most liquid currency out there. CBDCs are being seriously eyed by aspiring regional hegemons like Brazil to throw its weight around, but the U.S. doesn’t have that problem. The E.U. is said to be considering one, but there’s not the same driving force behind it, as the continent doesn’t have a quest for liquidity — it’s already there. Japan, known for its ultra-conservative central bank, has its eyes on CBDCs not because of its desire to innovate but rather as a defensive move to protect the yen as an international currency.

Where the U.S. does have a problem is the need to print more money to fuel its growing debt and deficit load thanks to Covid-19. In the usual understanding of economics, once the money supply hits a certain point, inflation rears its ugly head. And that’s why the Fed wants to take its time to get a U.S. CBDC right. If it can pull it off as a way to bypass the usual rules about money supply and inflation, it’ll be an incredible tool in its portfolio. But do it the wrong way, and it could have an opposite effect: an acceleration of inflation.

3. USDC coming to Solana blockchain

By the numbers: Solana — over 5,000% increase in Google search volume.

Within a week of USDC’s announcement that it would integrate with the Stellar blockchain, Coinbase and Circle’s stablecoin announced its migration into a fourth blockchain, Solana.

- USDC is the world’s second largest stablecoin by market capitalization. The world’s largest, Tether, also announced its integration with Solana last month.

- Total value locked in DeFi now exceeds $11.5 billion, according to DeFi Pulse.

Forkast.Insights | What does it mean?

For an industry vertical with the word “decentralized” in its title, it’d be awfully ironic if it remained clustered around Ethereum.

Although Ethereum is one of the biggest and most liquid of all the blockchains, its scale also works against it. It just can’t seem to keep up with new startups that seem to be able to build blockchains that are cheaper and faster. Case and point: Ethereum has a 15-transactions-per second cap while Solana can push out over 50,000.

There’s no point in any stablecoin remaining just on one blockchain. Just as “rising tides lift all ships,” the liquidity of adding an in-demand payment rail like a stablecoin to the platform will boost overall demand for it and make it break out from the rest of the pack of technically impressive but underused blockchains.

Exchanges are also stakeholders in this too. If Ethereum gets jammed up because of DeFi, it can have consequences downstream. FTX is smart to use this as a chance to launch ‘Wormhole,’ a decentralized exchange to swap Solana for stablecoins or other tokens without the use of Ethereum.

Ethereum-reliant DeFi had never been challenged by a lack of liquidity. But the ultra-high gas fees that latency-sensitive DeFi caused has hurt other projects on the network and created a demand for firms like Alchemy, which provides workarounds for the gas problem. One solution to the problem may be to lessen reliance on Ethereum, which is what USDC appears to be doing.

4. In China: new law for DCEP outlaws competitors; 80,000 rural banks agree to adopt digital yuan

China‘s central bank drafted a banking law, which provides a legal basis for DCEP — the Chinese central bank digital currency — and outlaws all other digital tokens.

- People’s Bank of China (PBOC) has issued a revised law on its website for public comments. Article 19 confirmed digital yuan as legal tender, stating: “the unit of renminbi is yuan, and the unit of RMB currency is jiao (1/10) and cent. RMB includes the physical form and the digital form.”

- Addressing initial coin offering(ICO) and other tokens trade, Article 22 clarifies that no group or individual may produce or sell tokens, coupons and digital tokens to replace renminbi or be used as renminbi substitutions circulating in the market. If the case is serious enough, offenders could be put in jail.

The Digital Currency Research Institute, a unit of People’s Bank of China (PBOC), signed a pact with Rural Credit Banks Funds Clearing Center (RCBFCC).

- In the contract, DCEP, as an economic infrastructure, will be widely used in China’s countryside.

- RCBFCC was established in 2006 to serve as a national clearing entity for China’s small and medium-sized rural financial institutions. It currently covers nearly 80,000 rural credit unions, rural commercial banks and rural cooperative banks around the nation.

Forkast.Insights | What does it mean?

The PBOC’s law about how DCEP is the only digital representation of the RMB that makes sense within the context of China’s tightly controlled economy where capital inflow and outflow is closely monitored. A liquid, successful DCEP used to settle international transactions that have a nexus to China would create a market for trading offshore DCEP and an RMB stablecoin — which in turn could be a way to bypass capital controls. An offshore stablecoin trading hub would also serve as a tool for true price discovery of the RMB, as there would be no pegs, something which authorities in Beijing relish.

More pressing, however, is how this would impact China’s major mobile payment platforms WeChat Pay and Alipay. The two of them have digitized a fair amount of the nation’s money supply. Would this law force them to relinquish their ability to digitize currency and force-adopt DCEP as a payment rail? The two platforms aren’t going to disappear, they will likely just be revised. It’s not a question of WeChat Pay, Alipay, or DCEP but rather how can DCEP be seamlessly integrated into both. Alipay has published a number of patents relating to DCEP and how the company could work as a secondary issuer of a digital currency as a third party agent. This recent law from the PBOC may be the next step in that direction.

5. Funding spotlight: venture capital in India

Signzy — venture round, India, US$5.4 million

Bangalore-based Signzy has raised a $5.4 million round led by Arkam Ventures and Mastercard. Signzy has an artificial intelligence-assisted ID verification platform that allows banks and financial institutions to weed out fraud and tighten up their know-your-customer (KYC) process. Of particular interest to Mastercard may be Signzy’s Video KYC solution, which offers an efficient onboarding process to verify someone’s identity and ensure that they are actually alive.

Forkast.Insights | What does it mean?

In emerging markets like India, the quality of identification documents and corresponding material to support someone’s claim are sometimes questionable. AI-assisted identification verification services are nothing new, but are reliant on access to high-quality supporting databases such as voting records, centralized property directories, or utility records. In markets where this data might be spotty, advanced AI algorithms could pick up the slack.

As challenger banks and financial institutions take off in India, we can expect more of this. The country, and other emerging markets, have KYC/AML laws that they would like to strengthen as they formalize the informal economy. As such, the requirement for these institutions to have a solid platform like this as part of their onboarding process will only strengthen and in turn drive demand for firms like Signzy.