Last year, the People’s Bank of China (PBOC) took a hardline stance against cryptocurrency, declaring it would block access to all domestic and foreign exchanges and ICO sites. At the time, the financial regulator said it would “adopt monitoring measures such as interviews, inspections, and bans on the monitored entities involved in virtual currency activities to resolve related risks in a timely manner.” Many took the statement as a de facto ban on cryptocurrency and blockchain, but this approach has developed in ways that show China is embracing blockchain technology rather than opposing it.

Blockchain has become a national priority in both public and private sectors, and over the last few years, China-based blockchain projects have received increasing support from both local and provincial governmental bodies. Since the original announcement from the PBOC, they have been working on a fully backed digital currency, and China has invested heavily in blockchain applications and services.

China has a long history in the short lifespan of cryptocurrency and blockchain. National exploration of the technology and digital currencies began in 2014 when the PBOC formed a study group to research the practicality of issuing digital currencies and the related technological, operational and legal issues that would result. As early as 2016, Chinese banks began exploring the use of blockchain technology within various segments. Two years later, the Bay Area Trade Finance Blockchain Platform launched (initiated by PBOC), and has since seen 38 banks join the platform. Also started in 2018, the Shenzhen Municipal Tax Bureau introduced blockchain e-invoicing and has since issued more than 18 million blockchain e-invoices.

Flash forward to October 2019, when President Xi Jinping announced that blockchain is a core technology, bringing the cutting-edge concept to wider attention. Since then, a growing number of Chinese blockchain-based projects have received support from both local and provincial government bodies.

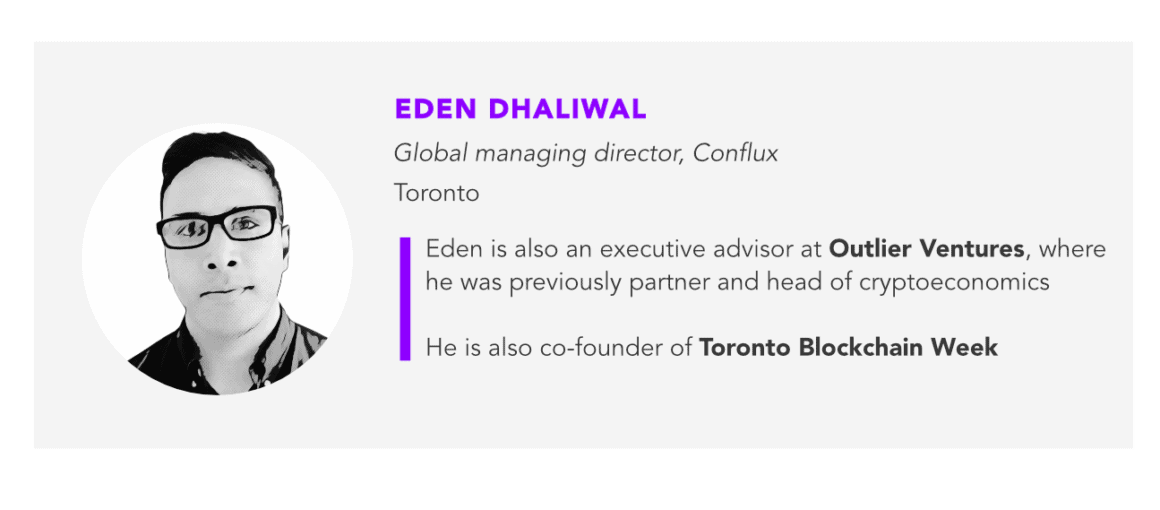

For example, my company, Conflux Network, is a blockchain company that has received endorsements from state governments in both Shanghai and Hunan. The Blockchain Service Network (BSN) was created to advance the blockchain ecosystem nationally in a careful, calculated manner. Launched in China in April, BSN was designed to boost the integration and adoption of blockchain. A global effort, BSN has integrated with six public chains including Ethereum, EOS, Nervos, Tezos, NEO and IRISnet.

Then, in July, the network split in two — BSN-China and BSN-International — to make the network regulatory compliant, more secure and economically stable, without losing the functionalities of public blockchain networks. The private infrastructure of BSN brings in more enterprise readiness in China, while the public infrastructure brings in global reach to new technological innovations. This two-tiered ecosystem ensures capital and asset flow across chains and countries without compromising on the trustworthiness of the network.

In an attempt to stay ahead of the game, PBOC has plans to launch its own digital currency, called Digital Currency Electronic Payment (DCEP), by the end of this year. This past April, PBOC launched the first trials of DCEP in four Chinese cities — Shenzhen, Suzhou, Chengdu, and the Xiong’an New Area near Beijing. This marks a milestone on the path towards the first electronic payment system derived by a major central bank. The creation of this native currency will attempt to stimulate daily banking activities like deposits, payments, and withdrawals all from within a digital wallet.

When it comes to an overall investment outlook for cryptocurrency, China is highly pragmatic and experimental in their approach. This runs counter to how many banks and governments view crypto as some sort of Wild West landscape of decentralization and lax regulation. However, this dose of pragmatism should be a good thing, as an objective-oriented philosophy is centered around what will deliver immediate, top notch results and in turn benefit the future of Chinese business.

See related article: DeFi with Chinese characteristics? How China may centralize crypto finance

China’s blockchain research and implementation over the past few years has made it clear that they’re not playing catch up with the Western world, but rather exploring thoughtful, measured ways to deploy a new sort of digital infrastructure for their economy. China’s main use-cases for blockchain technology will focus around its ability to encourage data sharing, making businesses more efficient and establishing better credit systems in various sectors — including internet of things (IoT), supply chain management and government services. Since the central government has deemed blockchain technology a top priority, we can expect this rapidly growing technology to drive ample growth opportunities in China’s market and beyond.

There’s no question that the Chinese government has identified blockchain technology as an issue of national importance and it considers blockchain to be a tool for disintermediation and improving efficiencies.