Decentralized finance (DeFi) — one of blockchain technology’s most world-changing uses — has grown from US$0.5 billion at the beginning of January 2020 to today’s total value locked of over US$50 billion.

What can we expect from this emerging industry, and how will DeFi affect traditional, centralized finance, or CeFi?

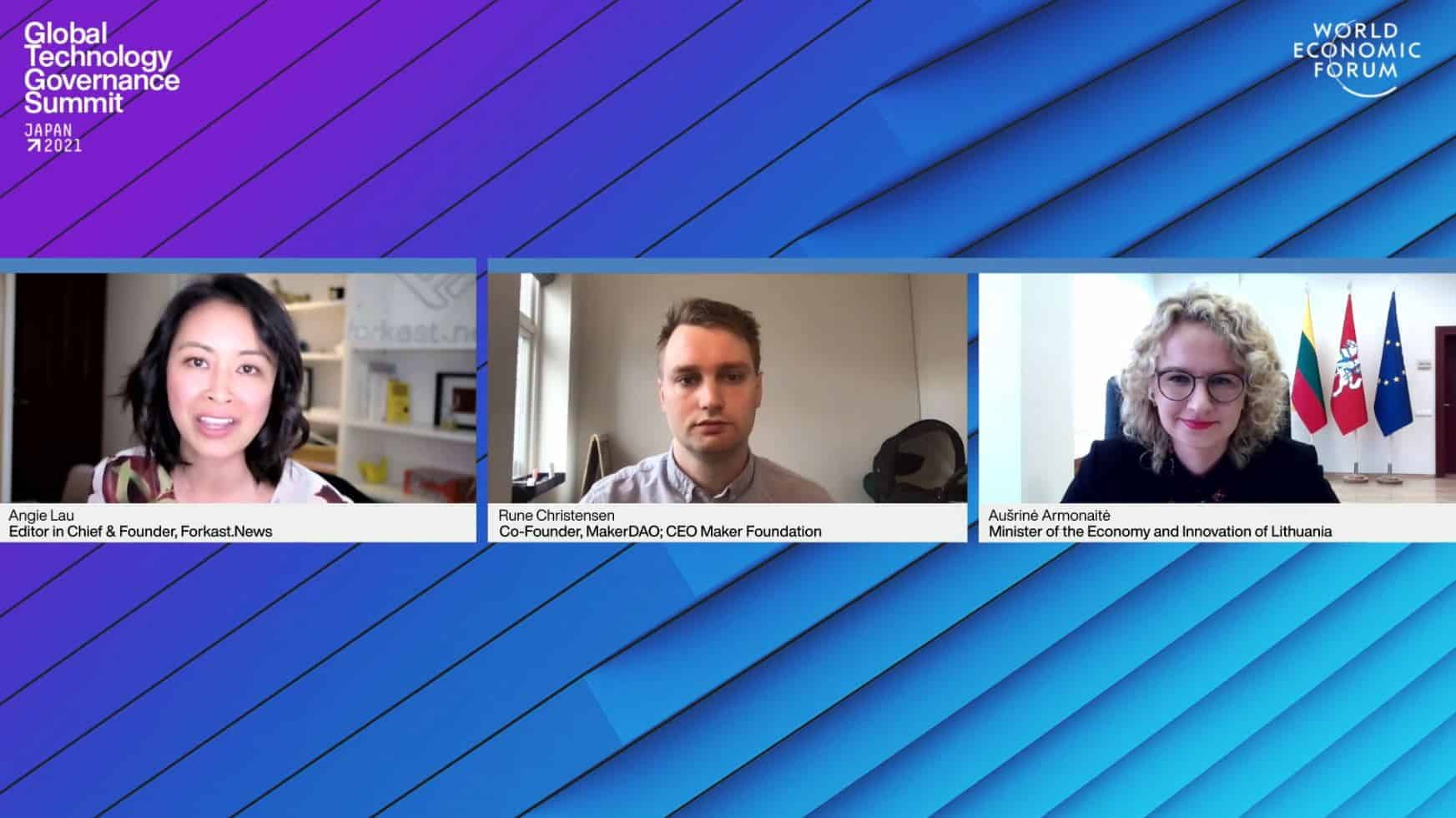

These are the main questions explored by a special panel at the World Economic Forum’s Global Technology Governance Summit, which continues through today. Panelists for “Behind the Decentralized Finance Hype” included Aušrinė Armonaitė, minister of the economy and innovation of Lithuania, and Rune Christensen, co-founder and CEO of MakerDAO. Angie Lau, founder and editor-in-chief of Forkast.News, served as the moderator.

“Fundamentally, DeFi is about providing universal access to financial services and tools,” Christensen said. “It’s a set of financial systems and protocols that you can access on the internet, and the crucial thing is that everyone gets to access it on the same terms.”

The superior accessibility of DeFi, regardless of who or where you are, is among the most valuable aspects of its ecosystem, Christensen added. “That is really the transformative power of DeFi. That there’s no longer any barrier for someone to participate in this single interconnected global financial system.”

Before blockchain technology enabled DeFi, financial services like borrowing and lending were largely available only through intermediary institutions like banks. But DeFi platforms like MakerDAO and others are now enabling, for anyone, easy and more direct access to financial services via smart contracts.

How does DeFi fit in the broader fintech space from a policy and regulations perspective?

“The bank of Lithuania and Lithuanian governmental institutions wanted to welcome more players in the [fintech] field … mainly electronic payment institutions that provide faster, more innovative and cheaper services to our customers,” said Armonaitė, whose nation is currently ranked the 4th best global fintech hub in the world — behind the U.S., the U.K., and Singapore, according to FinTech Magazine.

Lithuania has made significant strides in speeding up fintech company licensing, Armonaitė added. While business licensing can take up to a year in certain parts of the world, emerging fintech companies in Lithuania can become fully licensed in one month — which helps the growth of Lithuania’s private sector, Armonaitė said.

Lithuania has also been striving to promote DeFi on the regulatory front. “We need to be open-minded for DeFi as well, and this is a major thing also for the public sector and regulatory institutions,” Armonaitė said. “We do have to apply ‘teach more and punish less’ attitudes.”

As with any new and rapidly expanding industry, DeFi has had its share of bad actors, hackers and other problems.

“If you look at the past 5 years, it’s definitely true that there’s been a lot of bad apples in crypto, as is the case in any bubble of new emerging technology. But, I think the clear trend is that it has very much shifted away from the majority being essentially cash grabs,” Christensen said.

The founder of MakerDAO is optimistic about DeFi’s future. “Despite all of the momentum DeFi has today, it’s still in its very early phase,” Christensen said. “DeFi only exists in its own little bubble that hasn’t really interconnected or integrated much with the real world, but that’s what’s coming next.”

Numerous startups are now developing the technology enabling more real-world uses in the DeFi space. But, as nations adopt more regulations over DeFi, the technology’s growth is much slower than it was in the early days, Christensen said. But, he added, now is a monumental opportunity for regulators, politicians and countries as a whole.

“It’s all about whoever figures out how to make it easy essentially to do DeFi with real-world assets,” Christensen said.

“A lot of that capital will flow in the first place that starts integrating real-world finance at scale, and from there it’ll only keep growing,” Christensen said. “The advantages are just apparent. There’s efficiency, transparency, security, and the social scalability of having neutral common ground that you use for a fundamental financial infrastructure.”

Despite still being in the early days of DeFi, Lithuanian policymakers are already creating a regulatory framework for this technology, Armonaitė said. “We are at the final stages of the establishment of the anti-money laundering competence center here in Lithuania.”

The Lithuanian government is hoping to facilitate better public and private cooperation and information sharing, as well as coordinate technology adoption and implementation. “Hopefully that kind of framework where governmental and private institutions come together and work together towards a better regulation [that] would enhance change and appreciate the creative destruction we are facing, rather than defending ourselves from it,” Armonaitė said.

The aim of DeFi isn’t to completely reinvent the financial system, but to improve a specific segment that’s currently not working or not accessible for a large percentage of the global population, the panelist said. While the world’s existing financial system works fine for many, 1.7 billion people remain unbanked.

DeFi technology enables easy transactions like borrowing and lending, as smart contracts replace the need for a central financial institution, Christen said. “The fact that this can be done by anyone, that it’s completely open and available, is the central thing that an infrastructure like Maker tries to address.”