The limited availability of cryptocurrencies such as Bitcoin was supposed to protect against inflation brought on by the incessant printing of money by governments and central banks worldwide.

Or so people thought in so-called emerging economies.

The slump in Bitcoin prices this year just as inflation picked up pace has raised doubts about its role as an inflation hedge. But some citizens in emerging economies — well used to financial mismanagement, rampant inflation and currency devaluations — still regard cryptocurrencies as a means to protect their savings.

Argentina is one example.

Latin America’s third-largest economy has been suffering from repeated cycles of hyperinflation, mostly from the government’s financial mismanagement and having defaulted on its sovereign debt of US$81 billion in 2001. This year, inflation is expected at 72.6%, according to a poll by Argentina’s central bank.

That’s a far cry from the start of the 20th century when the country was one of the wealthiest countries in the world with per capita gross domestic product (GDP) exceeding that of European countries like France and Germany.

“In Argentina, we have a long history of not trusting institutions and losing money due to outright confiscation by government and banks or through inflation,” Pablo Sabbatella, the founder of Defy Education, a project dedicated to crypto education in Latin America, told Forkast. “This is why more and more people are discovering cryptocurrencies as a solution,” he added.

Argentina’s monetary authorities have imposed capital controls on the local currency, the peso, to prevent locals moving their savings into stronger currencies, especially the U.S. dollar. The government is now imposing regulations to impede access to crypto through financial institutions.

King Dollar

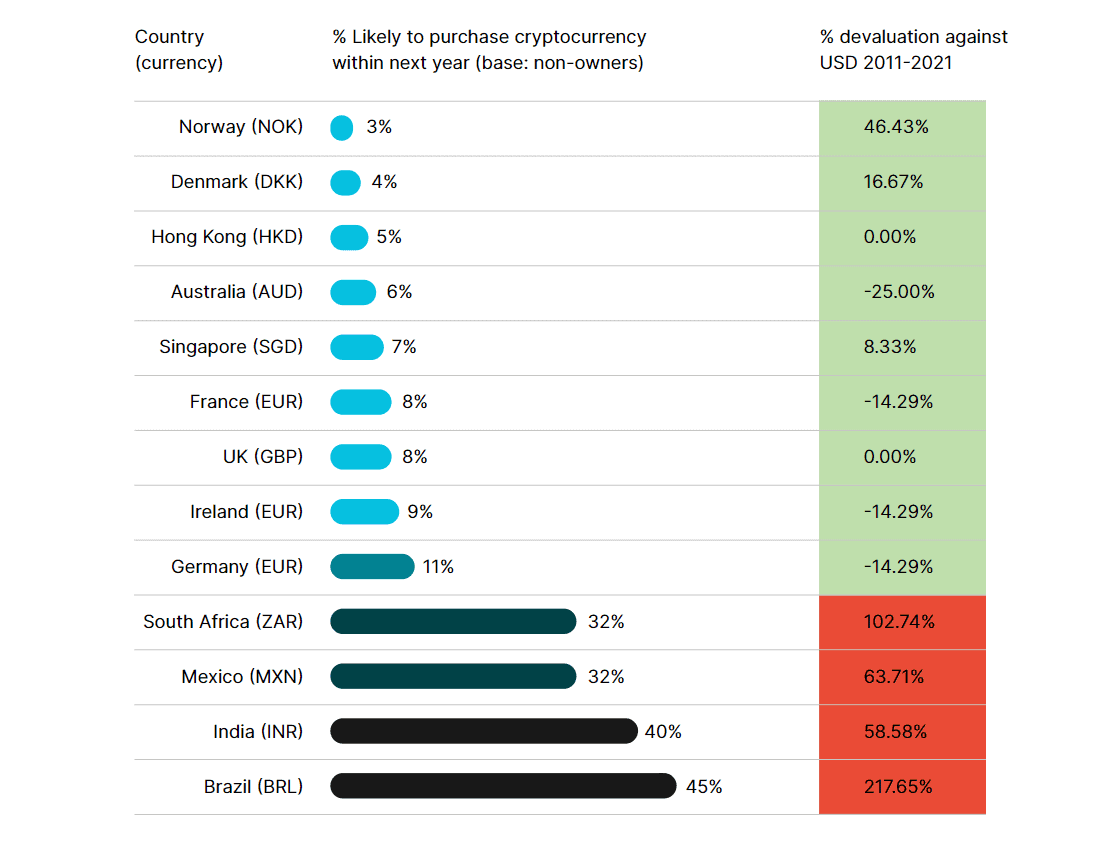

Inflation was a primary driver for crypto purchases in 2021, especially in countries where the currency sharply devalued against the U.S. dollar, a report by the Gemini crypto exchange said.

Some 41% of buyers polled in the report worldwide bought the asset for the first time last year. The online survey included 29,293 adults in 20 countries between Nov. 23, 2021, and Feb. 4.

Meanwhile, an increase in interest rates by the Federal Reserve to counter inflation has had ripple effects around the world, including in emerging economies loaded with dollar-denominated debt.

In the U.S., 12-month inflation hit 8.5% in March, the highest year-over-year increase since 1981, according to the U.S. Bureau of Labor Statistics. While inflation expectations over the next year have fallen to a median 6.3%, the Fed is likely to continue with planned interest-rate increases, according to a Reuters poll of 89 economists.

That along with the U.S. central bank choosing to reduce the size of its balance sheet is driving capital to the greenback while adding to the weight of their dollar-denominated debt.

The dollar has risen more than 18% against the Argentinian peso this year, according to data from the U.K.-based TP ICAP Group plc. (Tullett Prebon).

According to the Gemini report, respondents in countries whose currency fell 50% or more against the U.S. dollar were five times more likely to purchase crypto in the coming year than countries that experienced less than 50% currency depreciation, the Gemini report said.

Nearly half of respondents in Latin America and Africa believed certain cryptocurrencies were a “great way to protect against inflation,” according to the report. In Brazil, where the dollar has mostly appreciated against the real, 41% of respondents owned crypto.

Crypto investors in countries with local currencies that have held up better than Brazil, still see the digital currencies as an inflation hedge.

Almost two in three crypto investors in India and Indonesia believed crypto would act as a hedge against inflation. Even in Singapore with a stable currency, 42% of the Gemini respondents said they believed in crypto for its inflation-hedging properties.

In developed countries like the U.S., two in five crypto owners viewed investment in the asset class as an inflation buffer.

An uneasy bet

Sri Lanka is another emerging economy where the dollar has gained more than 77% against the rupee this year, according to Tullett Prebon data.

The country postponed paying back some US$7 billion in debt this year. An estimated US$5.6 billion is due through December 2022, according to data from the World Bank. With the country’s foreign reserve plummeting to a new low of US$1.8 billion, global investors doubt Sri Lanka’s ability to service its debt.

Although Sri Lankans have been buying more crypto assets since the end of 2020, adoption has intensified in the last few weeks as shortages of food and fuel led to street riots.

“They are escaping a currency that is most definitely to lose ever more of its value due to utter economic mismanagement,” according to Dilip Ishara, a blockchain community manager and “Binance Angel” based in Sri Lanka.

“About a year ago, the community had around 4,000 members,” he said, referring to locals affiliated to Binance, the world’s largest cryptocurrency exchange. “Today, we stand at more than 8,600,” he added.

Cryptocurrencies like Polkadot (DOT), Ocean Protocol (OCEAN), the Graph (GRT), or Helium (HNT) are in high demand as it is believed they will benefit from Web3 adoption, Ishara said, adding that stablecoins linked to the U.S. dollar are also of interest.

Stablecoin tango

Over in Argentina’s capital of Buenos Aires, stablecoins have helped Argentinians trade across borders, something that was not easy because of foreign-exchange restrictions, Sabbatella said.

Use of stablecoins is on the rise with local property sellers, said Manuel Ferrari, cofounder of Money On Chain, a protocol that allows the creation of stablecoins using Bitcoin as collateral.

“Bitcoin and stablecoin adoption in Argentina is mainly driven by the younger and more educated generations,” he said.

“Last weekend I went to the shopping mall in Moreno (some 50 kilometers from Buenos Aires) and some shops had stickers of USDT, DAI and other stablecoins,” said Ferrari, referring to US Tether or Dai stablecoin from MakerDAO. He expects usage to pick up in the next two years.

Our way or the highway

But governments down on their luck aren’t giving up their grip on the flow of money so easily.

Along with pushing for the adoption of their central bank digital currencies (CBDCs), authorities have resorted to taxation and regulation to wean people away from cryptocurrencies.

India taxed cryptocurrency transactions at a flat 30% from April while denying it legitimacy through legislation. A further 1% tax-deducted-at-source will be effective July 1 on transactions exceeding INR 10,000 (about US$129). Trade volumes on crypto exchanges fell as much as 70% as a result.

In Singapore, the de facto central bank tightened rules for cryptocurrency service providers based in the city state, even for firms exclusively catering to offshore clients.

These measures prompted a flight of crypto firms from Singapore and India to digital asset-friendly jurisdictions like Dubai.

In the Philippines, which faced a debt of 12.68 trillion pesos (US$242 billion) in March, or about 63% of GDP, the highest in 17 years, the finance authorities are proposing new taxes on cryptocurrency by 2024, among other measures.

In Sri Lanka, the central bank has said cryptocurrencies are not yet approved for transactions with and risks of any eventualities lie with investors.

In early May, Argentina’s central bank prohibited financial institutions from offering clients any operations involving unregulated digital assets, according to Bloomberg News. It also banned bank clients from purchasing crypto, including in assets whose returns are determined by the fluctuations of cryptocurrencies, the news agency said.

This is highly unlikely to deter Argentinians from investing in cryptocurrencies like Bitcoin, Ferrari said. “I have nearly zero doubt that the current context in Argentina is going to change anytime soon, which is why I expect explosive growth in the use of Bitcoin,” he said.