The Terra Classic (USTC) and Luna Classic (LUNC) debacle is helping embolden advocates for central bank digital currencies (CBDCs), arguing that their inherent stability supersedes any benefits so-called stablecoins, algorithmic or otherwise, could offer.

The project backed by Singapore-based Terraform Labs PTE Ltd. has been upended with the community approving a proposal to create a new blockchain on the Terra network without the algorithmic stablecoin.

But the new LUNA token was dead in the water, thanks to a 67% plunge to US$5.81 in the past 48 hours, according to CoinMarketCap data, making regaining the trust of the Terra community a tall order. The decline of the algorithmic stablecoin pioneer is likely to support the cause of critics.

Earlier this month, Treasury Secretary Janet Yellen reiterated a call for Congress to authorize the regulation of stablecoins.

“I think that simply illustrates that this is a rapidly growing product and that there are risks to financial stability,” Yellen told the Senate Banking Committee, referring to the collapse of USTC and LUNC. More than US$40 billion in investor wealth was wiped out, according to estimates by The Block. “We really need a consistent federal framework,” she said.

Last year, a Treasury-led panel of regulators recommended Congress regulate stablecoin issuers similarly to banks, according to The Wall Street Journal. Current legislation doesn’t provide comprehensive standards for the new assets, Yellen said, according to the newspaper.

A flawed idea

USTC differed from other major stablecoins, such as USD Coin, Binance USD and Tether as it relied on an incentive-based algorithm to maintain its peg to the greenback. Others claim their peg to the U.S. dollar is backed by hard assets though there has never been an independent audit of these.

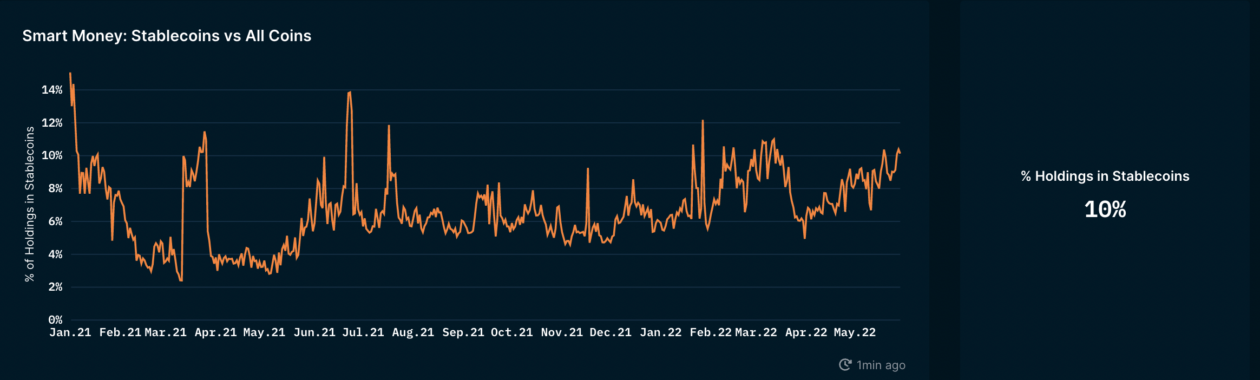

Stablecoins make up 10% of the tokens held in Smart Money wallets that track on Ethereum by Nansen Pte. Ltd., the Singapore-based blockchain analytics platform. This does not include stablecoins that are being staked in yield farms as they leave the wallet in such situations.

Critics of algorithmic stablecoins point out that bad actors could easily manipulate the incentives to undermine a stablecoin project’s peg. A report by Nansen pointed to seven wallets of so-called crypto whales being responsible for the USTC de-peg.

In “Demystifying TerraUSD De-Peg,” Nansen researchers studied on-chain data from Terra to Ethereum between May 7 and May 11. Examining the on-chain activities, “we found that a small number of wallets and a likely even smaller number of entities behind these wallets led to imbalances in the Curve liquidity protocols that were regulating the parity between UST and other stablecoins,” Nansen’s researchers said.

Seven “initiating” wallets swapped significant amounts of UST to other stablecoins on Curve as early as the night of May 7 (UTC), the researchers said. These wallets had withdrawn sizable amounts of UST from the Anchor protocol on May 7 and before (as early as April) and bridged UST to the Ethereum blockchain via Wormhole, they added. “Out of these seven wallets, six interacted with centralized exchanges to send more UST (supposedly for selling) or, for a subset of these, to send USDC that had been swapped from Curve’s liquidity pools,” Nansen researchers said.

Seizing the moment

The crisis encircling the Terra ecosystem prompted at least one supporter for the digital dollar to fill a possible gap in the need for stable cryptocurrencies.

“The recent turmoil in crypto financial markets makes clear that the actions we take now — whether on the regulatory framework or a digital dollar — should be robust to the future evolution of the financial system,” Federal Reserve Vice Chairwoman Lael Brainard told lawmakers.

A CBDC could coexist and complement stablecoins in the future by providing a widely available, government-backed means of payment, Brainard said. “It could provide a safe, central bank liability as the neutral settlement layer in the digital financial ecosystem,” she added. “It would actually facilitate and enable private sector innovation.”

A CBDC supported by the Federal Reserve would likely enjoy the same trust and privileges as U.S. paper dollar bills and coins as both are backed by the government, according to the Money and Payments: The U.S. Dollar in the Age of Digital Transformation consultation paper by the Fed to examine the pros and cons of a potential U.S. CBDC. It also helps governments ensure the relevance of their currencies as a means of transaction and store of value in a fast-digitizing world, the paper said.

In the case of the U.S. dollar, its role as the de-facto currency of the global financial system meant it has not lost most of its value in relation to other currencies, according to data from the Euronet Worldwide-run currency website xe.com.

Measured against the supplementary foreign exchange reserve assets defined and maintained by the International Monetary Fund (IMF) or Special Drawing Rights (SDRs), the U.S. dollar has risen 6.9% over the last 12 months through May 27, data compiled by Trading Economics showed.

This is despite the Federal Reserve’s balance sheet swelling to US$8.9 trillion or to 22% of the country’s nominal gross domestic product (GDP), according to latest data compiled by the Federal Reserve Bank of St. Louis showed.

It had previously risen to 35% of GDP at the height of the Covid-19 pandemic, a level not seen since World War II, data from the Board Of Governors of the Federal Reserve System showed.

The balance sheet is made up of the Fed’s assets and liabilities, such as government loans extended to regional banks and U.S. currency in circulation.

Critics of CBDCs point out that cryptocurrencies such as Bitcoin saw an increase in demand partly owing to the incessant money supply by central banks and governments around the world acting to mitigate the economic fallout of the Covid-19 pandemic.

“CBDCs are not the solution,” said Ben Caselin, head of research at crypto exchange AAX Ltd. “They add to the money supply and will basically exacerbate inflation or devaluation [of the currency].”

“Stablecoins are important, but it’s kind of missing the point, right?” Caselin said. “If you’re going to do that then you’re still USD minded — you’re still fiat minded.”

He expects the world’s leading cryptocurrency, Bitcoin, to naturally rise to meet the market’s need for a stable store of value once it reaches a greater adoption rate of around 60%, or when its supply limit of 21 million has been reached.

“If we can call anything stable and in that sense I would say it’s the ultimate stablecoin,” said Caselin.

Not my turf

Some governments have been happy with adopting cryptocurrency, partly to reduce the fees incurred on remittances and with trading in the U.S. dollar.

In 2021, El Salvador became the first country in the world to formally adopt Bitcoin as legal tender. At the time, President Nayib Bukele claimed the country could save on millions in fees on remittances — which make up 22% of GDP, as well as bring 70% of the country’s unbanked population into the fold of financial services.

At between 2%-3% of a transaction, remittance fees have mostly remained high, biting into the savings of people in emerging economies that rely on money sent by friends and family abroad.

The global transaction costs of cross-border payments amounted to US$120 billion a year, according to estimates by OliverWyman Inc. There are also hidden costs from the two- to three-day delay on average in receiving payment, the management consultant said.

But with Bitcoin having dropped some 35% since El Salvador adopted the cryptocurrency, the argument for CBDCs with relatively less volatility has picked up steam.

From a government’s perspective, a CBDC could help governments and central banks retain some of their financial utility lost to cryptocurrency by offering a digital dollar themselves.

Certainly when it comes to remittances, OliverWyman’s joint research report with J.P. Morgan showed a multi-currency central bank digital currency (mCBDC) could reduce cross-border transaction revenue by around 80% annually — or about US$100 billion, excluding foreign exchange revenues.

CBDCs would have the advantages of a digital currency, such as being faster and cheaper to operate, but would also bring many of the trappings of the traditional finance world, this time supercharged through its integration with blockchain.

“If we look at the core of the government in terms of its ability to effectively manage a nation of people, effectively manage the balance sheet and the taxes and how that applies, I think crypto is a threat to that,” Trent Barnes, Principal of ZeroCap (Australia) Pty Ltd, told Forkast.