Bitcoin Punks, the Bitcoin-native spin-off of the popular CryptoPunks blue chip non-fungible token (NFT) collection, saw over 1,145 Ether worth of daily trading volume on Feb. 28, according to data from blockchain analytics firm Dune.

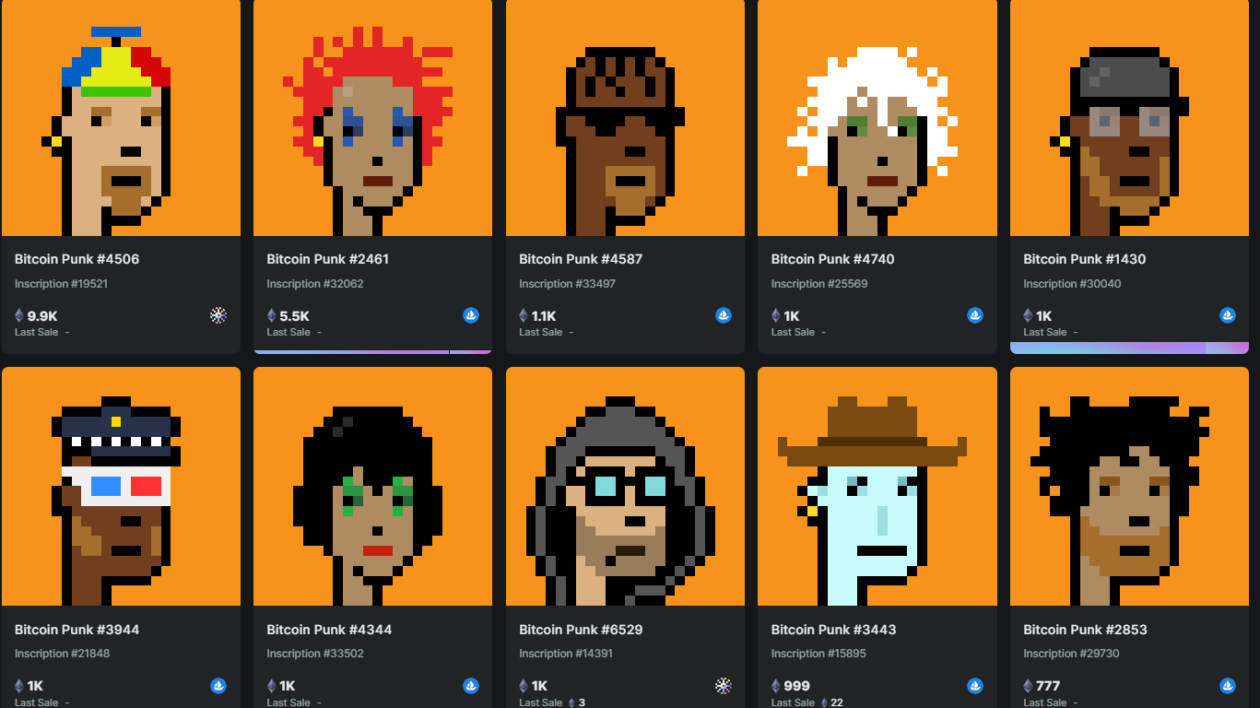

Bitcoin Punks is the first collection of 10,000 NFTs on Bitcoin, which were uploaded from the original Ethereum-native CryptoPunks collection via the Ordinals protocol. Bitcoin Punks are 10,000 of the first 34,400 Ordinal inscriptions on the network, which could make them more valuable for collectors.

The sales surge in Bitcoin Punks occurred on the same day that Yuga Labs, the U.S.-based company behind Bored Ape Yacht Club, announced plans to launch its first NFT collection on the Bitcoin network, TwelveFold.

Yuga’s announcement came a week after the Bitcoin network exceeded 154,000 inscriptions within a month of the launch of the Ordinals protocol. The network has over 228,000 inscriptions at the time of publication, according to Dune data.

“BTC now has an extra use case other than just being a currency. BTC is now a place where NFTs or ‘digital artifacts’ can be created and stored on every single node on the Bitcoin network. The added benefit of having a rock-solid use case of NFTs added to BTC will impact miner fees to go up as demand for network resources go up. IE: Sats/kb will go up, unless new ways to reduce the cost go down,” wrote Yohann Calpu, chief marketing officer at NFT data aggregator CryptoSlam, to Forkast.

Jonas Betz, a crypto analyst based in Germany, agreed that Ordinals can benefit the Bitcoin network.

“The usage of Ordinals comes with an increased transaction volume on Bitcoin, which increases the rewards for miners and can therefore help to make the network stronger and more decentralized. Secondly, Ordinals can also increase Bitcoin adoption by appealing to a wider audience that is interested in NFTs and the broader digital art market. This can help increase demand for Bitcoin and potentially drive up its price,” wrote Betz.

“But there is also a flipside, as Ordinals are dividing the Bitcoin community. Many Bitcoin proponents are not in favor of a divergence from Bitcoin’s original use case as a store of value and a medium of transfer. Ordinals could also consume more Bitcoin block space, making Bitcoin transactions more expensive,” he added.

Kasper Vandeloock, chief executive officer of quantitative trading firm Musca Capital, said that Ordinals will be limited in utility.

“There are a lot of Bitcoin believers that are not fans of Ordinals but I think it’s an amazing thing. The more utility it has the better, however, I am afraid that it will not have many use cases. Something interesting about NFTs is the DeFi part of it which is developing, like being able to use NFTs as collateral and getting loans,” wrote Vandeloock, adding that he is “not expecting it to be a big part of the Bitcoin network.”

Texas-based Bitcoin core developer Jimmy Song said that Ordinals have a “unique” way of storing digital art. “The unique thing about these is that the entire jpeg or image is stored in the transaction instead of there being a pointer to an image like in other chains.”

CryptoSlam’s Calpu agreed that Ordinals stand out from traditional NFTs.

“The big deal about Ordinals is that there are no other ‘coins’ created for NFTs to be generated on BTC, unlike $XCP (Counterparty) and $STX (Stacks) which Bitcoin maximalists called “shitcoins” and were never fully accepted,” he wrote.

“How it does this is by using the op_return field, and having data ‘inscribed’ within it (via Taproot upgrade) that allows for a single satoshi (smallest unit of BTC) to be utilized as the data carrying vessel,” Calpu added.

See related article: At least US$577 million of Blur-linked NFT sales are wash trades, CryptoSlam says