Asian stablecoins Binance USD (BUSD) and Huobi’s HUSD beat out stablecoin giants Tether (USDT) and Circle (USDC) in average transaction size for Q1, according to a recent report from CoinDesk Research.

Binance BUSD and Huobi’s HUSD ranked first and fourth respectively, outshining their seniors and leaving some onlookers scratching their heads. Is demand for alternatives to legacy finance on the rise in Asia?

Asian stablecoin transactions on the rise

Stablecoins “allow for borderless transfers of tokens representing fiat currencies and are behind much of the liquidity in crypto markets,” according to the CoinDesk report published this month. This is thanks to their ability to circumvent cumbersome traditional transfer processes and the need for fiat on-ramps in exchange trading.

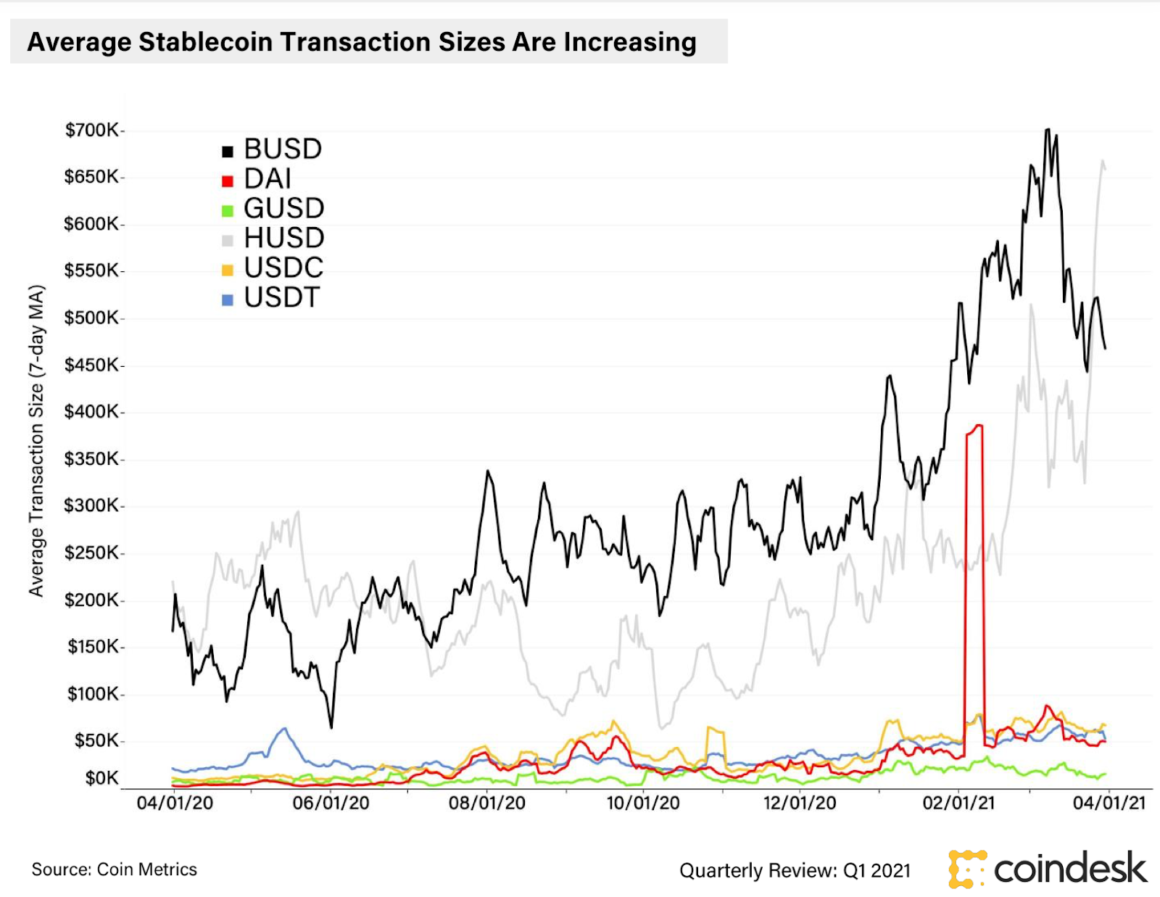

Data compiled from blockchain research group Coin Metrics showed the top six stablecoins by average transaction size to be Binance USD (BUSD), Multi Collateral DAI (DAI), Gemini Dollar (GUSD), Huobi (HUSD), Circle (USDC), and Tether (USDT).

“Although Tether (USDT) is the longest-standing stablecoin, it does not command the highest average transaction size,” the report said. “This goes to the stablecoins of crypto exchanges Binance (BUSD) and Huobi (HUSD), both of whose transaction sizes grew notably over Q4.”

Both Binance and Huobi’s stablecoins have deep roots in Asian and are younger than veteran Tether, which launched in 2014.

Originally founded in China before departing for less regulator-constrained shores, , the Binance cryptocurrency exchange — now the largest in the world by trade volume — launched its USD-backed stablecoin in September 2019. Binance exchange sits on the largest daily volume of any major exchange, with a daily volume of almost US$37 billion at press time.

Like Binance, Huobi’s cryptocurrency exchange was also founded in China and moved operations to escape a government ban on crypto trading. The company, which now has offices throughout Asia and in the U.S, launched its stablecoin HUSD in July 2019. Huobi’s exchange ranks fourth by 24-hour volume at time of publication. Coinbase Pro and Kraken are 2nd and 3rd, respectively.

But feelings are mixed

Despite the enormous appetite for stablecoins in Asia, the governments are not equally enthused.

Recently, a newly launched Terra (THT) that was Thai baht-backed rocked the boat in Thailand a bit too much, and Thailand’s central bank declared the stablecoin to be illegal.

“Those wishing to provide services involving Baht-backed stablecoins are required to consult with the [Bank of Thailand] for consideration before beginning any operations,” Bank of Thailand stated in a March 19 press release. Some crypto advocates viewed this move as an attempt to stifle economic freedom.

“They always fear you before they join you. @terra_money now putting central banks on guard,” tweeted CEO at Terraform Labs, Do Kwon. “$THT will be adopted whether BOT likes it or not.”

As Forkast.News reported, there are currently no approved baht-backed coins in the country.

Indonesian stablecoins could serve rural banking needs

Further southeast, Indonesian markets are focusing on Binance Launchpad’s recently announced support for Tokocrypto, a project seeking to build an NFT marketplace for the country and bridge centralized and decentralized finance. According to Tokocrypto CEO Pang Sue Ka, “TKO is Indonesian People’s Token.”

Such egalitarian ideals are nothing new for the world of blockchain, but buzz phrases like “banking the unbanked” and “financial inclusion” don’t easily translate to ground-level action when it comes to massive, centralized institutions.

Pandu Sastrowardoyo, the vice president of consulting for Blocksphere in Jakarta, told Forkast.News that the real people to be helped by stablecoins in Indonesia are not the big banks and city centers but the myriad smaller communities in this nation of 17,508 islands — about 6,000 of which are inhabited.

“Indonesia is huge,” Sastrowardoyo said. “The cross border-remittances and cross-regional remittances — within one province to another — now a lot of the banks have actually already taken care of, when we’re talking about the top banks. But the smaller banks, rural banks do not have access to that kind of structure and capability.”

Indonesia currently has an approval system for accepting Indonesian rupiah-based stablecoin projects such as IDRT and IDK, whose institutional usage is rising. But Sastrowardoyo is careful to note none of this translates to being able to transact outside government purview.

“Unlike a lot of the other countries that are perhaps starting to use stablecoins towards transacting in country, replacing roles of banks, like money transfers, etc … Indonesia cannot, from that perspective, do it in a way that replaces the role of banks within the country.”

Still, her remarks imply the surge in Asian stablecoin success revealed by the new study is no mystery.

“In terms of actual traders using the coins and the popularity, of course bridging to Binance is key for a lot of the liquidity,” Sastrowardoyo said. “The ecosystem itself is quite strongly using stablecoins.”