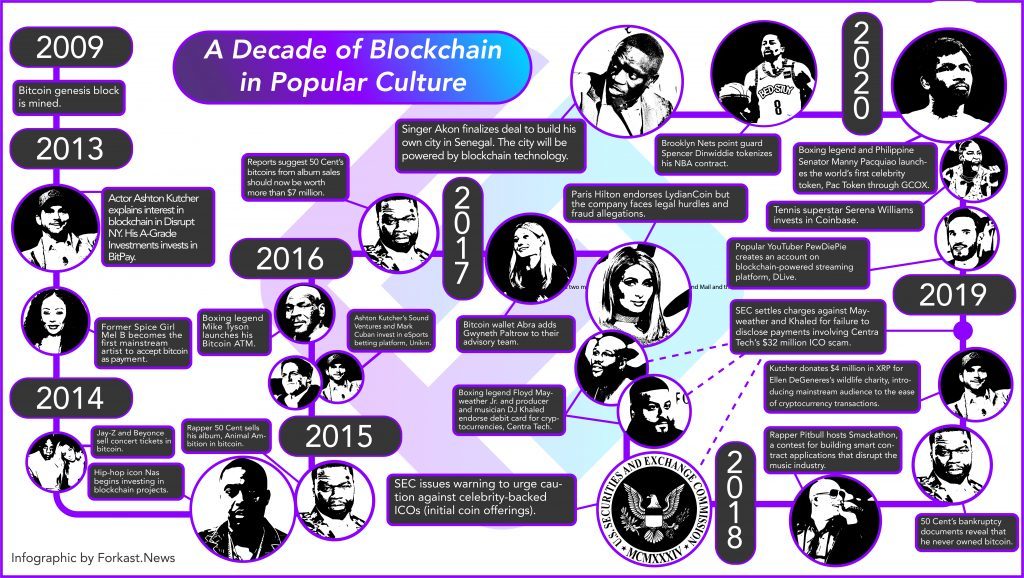

To celebrate the end of 2020, here is a Forkast.News editors’ pick from our archives, content that still rings fresh, true and — in a world now measured in nanoseconds — timeless.

As bold-faced names in the entertainment and sports industries like PewDiePie, Manny Pacquiao and Spencer Dinwiddie dabble in blockchain technology, their use of cryptocurrency could signal a growing shift toward grassroots financing.

“With the help of cryptocurrencies, funding and ticketing will be merged and work in a crowdfunded manner,” said Emil Chan, adjunct lecturer of blockchain in fintech for Hong Kong University SPACE. “The intellectual property of songs or even sports clubs will be owned by the fans instead of the producers or the middlemen”

Since 2019, celebrities and popular personalities have been trying out blockchain, enabled by cryptocurrencies or decentralized content platforms, to interact directly with their fans and supporters. Among them is YouTube breakout star Felix Kjellberg, better known as PewDiePie, who signed an exclusive live-streaming deal with decentralized platform DLive, which rewards content creators and viewers with tokens.

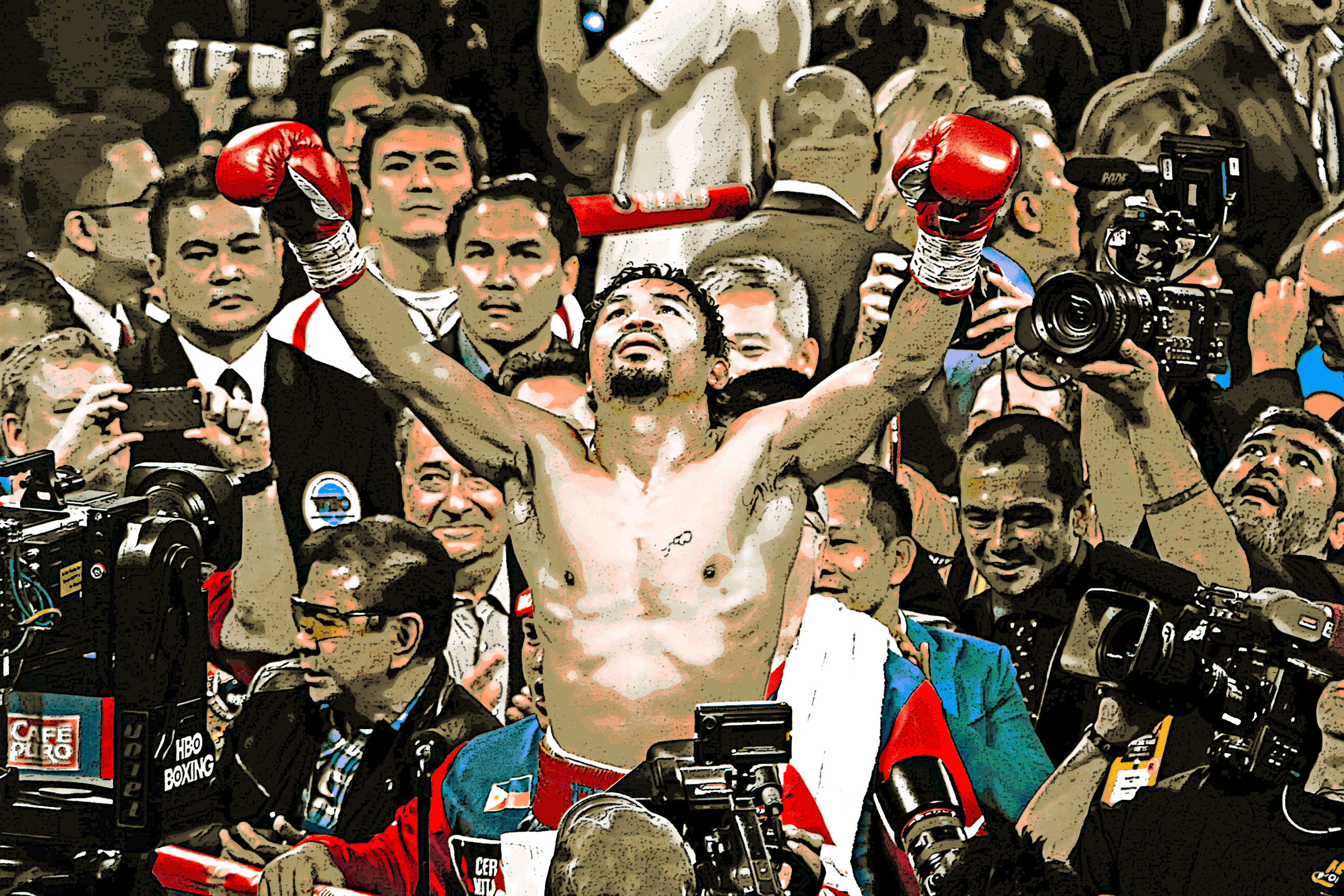

Philippine senator and boxing champion Manny Pacquiao, meanwhile, has released a PAC token to “facilitate the purchase of merchandise and social media interactions” with his fans and it is now available for purchase on Singapore’s Global Crypto Offering Exchange (GCOX).

Recently, National Basketball Association (NBA) star Spencer Dinwiddie also has tried jumping into the blockchain game by announcing plans to tokenize his own contract to become an investment vehicle. Although the offer would be available only to accredited investors, Dinwiddie promised in a tweet to make it available for all soon.

I can’t wait to have a Reg A offering as well. The hoops we have to jump through now Make the process cumbersome. NDAs, KYC/AML, Accredited investors, cross reference with other approved lists etc etc. but soon we will have it for ALL! I promise https://t.co/l4E1U36LdD

— Spencer Dinwiddie (@SDinwiddie_25) January 12, 2020

If PewDiePie, Pacquiao, Dinwiddie and other bold-face names are successful in using cryptocurrencies and blockchain, we might see more celebrities harnessing these technologies to bypass traditional financial management systems, Chan said. The value chain of traditional businesses served by the financial industry will be disrupted by decentralized finance networks that will “no longer require financial service companies to be their backbone.”

Senegalese-American singer Akon also recently put his hat into the cryptocurrency ring, announcing a partnership with dApp BitMinutes to provide prepaid mobile phone tokens to users.

Their application, launched through Akon’s cryptocurrency, named Akoin, allows users to make transactions on the Stellar blockchain. The idea is to make it easier for Africa’s unbanked to have access to mobile networks and financial services by swapping mobile minutes with fiat currencies through the use of the Akoin cryptocurrency.

“What we were basing our currency on in the beginning was all about cell phone prepaid minutes, and I thought that [BitMinutes] would be the first that we’d tap into being the fact that they cover so much of the continent, and also that they were the best and the leading in that field at that moment,” said Akon in a tweet.

@BitMinutes has been with @AkoinOfficial since the beginning. I’m excited to start changing the world together, one minute at a time pic.twitter.com/Kk6gg8UdNE

— AKON (@Akon) March 6, 2020

Scheduled for a public release in Q2 2020, BitMinutes is set up to offer Akoin users free money transfers to 1.2 billion accounts, micro-lending and cash in/out services as well as free mobile top-ups to four billion mobile phones in Africa.

Obstacles on the horizon

But before these all-star attempts at decentralizing finance become mainstream, the financial powers are already mounting resistance.

Dinwiddie has faced a variety of challenges from the NBA, including threats to terminate his contract.

Digital-cultural trend analyst Lauren deLisa Coleman said that Dinwiddie is getting pushback because he’s taking a decentralized approach inside an entity that is massively centralized.

“Anything that’s dealing with professional athletes, it’s almost like [they’re] indentured servants,” Coleman said. “They have all these different things they can and cannot do, and so you’re seeing this tug-of-war. I think we will continue to see this as time and culture moves because it’s not ever just about the adoption of the technology itself, it’s always about the mindsets and culture around it.”

Traditionally, big changes in financial services have come from regulators and the big market players. The celebrities’ adoption of blockchain not only disrupts that, it could represent a fundamental shift in power from the institutional power players to the grassroots and individuals.

“Like the internet, blockchain will bind many business processes which have to be carried out by many industries in the traditional ways,” Chan said. “The magnitude of cross-industry disruption caused by blockchain in the future will be much higher than those of the internet in the past.”

But as some celebrities are discovering, involvement with crypto can also be a legal minefield. Getting paid for endorsements and promotions may be a normal part of their world, but when it comes to tokens for initial coin offerings — which regulators regard as securities — a radically different set of laws apply.

Actor Steven Seagal found out the hard way. The U.S. Securities and Exchange Commission recently fined him $314,000 for allegedly promoting an ICO for crypto company Bitcoiin2Gen without divulging that he had been promised $1 million in cash and B2G tokens to do so.

“These investors were entitled to know about payments Seagal received or was promised to endorse this investment so they could decide whether he may be biased,” said Kristina Littman, chief of the SEC enforcement division’s cyber unit, in a Feb. 27 announcement of the agency’s settlement with Seagal. “Celebrities are not allowed to use their social media influence to tout securities without appropriately disclosing their compensation.”

The SEC also settled charges with professional boxer Floyd Mayweather and musician DJ Khaled for similar reasons in 2018.

Independence through crypto

The internet has already disrupted traditional media and distribution models. YouTube’s platform, for instance, provides content creators a stage, ease of access and business independence like never before. Kjellberg’s PewDiePie channel, for example, has amassed 103 million subscribers as of the date of this publication.

According to a report by Forbes, the 10 top-earning YouTubers collectively earned more than $162 million from June 2018 to June 2019, with Kjellberg raking in $13 million. The Forbes ranking tallied pretax income that the top 10 YouTube earners collected from advertisements as well as other sources such as sponsored content, merchandise sales and tours.

See related article: Blockchain is key to realizing the digital industrial revolution

“The more independent you are, maybe like PewDiePie, [the more] you’re able to enact some of this stuff easier and quicker than if you’re trying to act like something which is very independent or entrepreneurial inside of a larger entity,” Coleman said.

In a recent YouTube video, Kjellberg said: “One of the reasons I joined DLive is because their mission is to not take any of their streamers’ earnings, and that is how they support streamers in a huge way.” It should be noted, however, that Kjellberg has not been active on DLive for over a month as of the date of this publication, so his level of involvement remains to be seen.

Regardless of what Kjellberg ultimately does, blockchain industry watchers say the embrace of cryptocurrencies as an alternative to traditional money and finance, for megastars as well as smaller content providers alike, may be the wave of the future.

“Once you reach a certain level and you know you aren’t really comfortable with dealing with all those massive parameters and people continuously making money from your talent, all these things come along that seem like you might be able to be a bit freer, and this becomes more interesting to you if you [or your team] have that kind of mindset.”

Coleman adds: “We will see a lot more stabs, a lot of false starts, a lot of legal debates around it and things like that before it becomes something which is maybe more mainstream in its approach.”