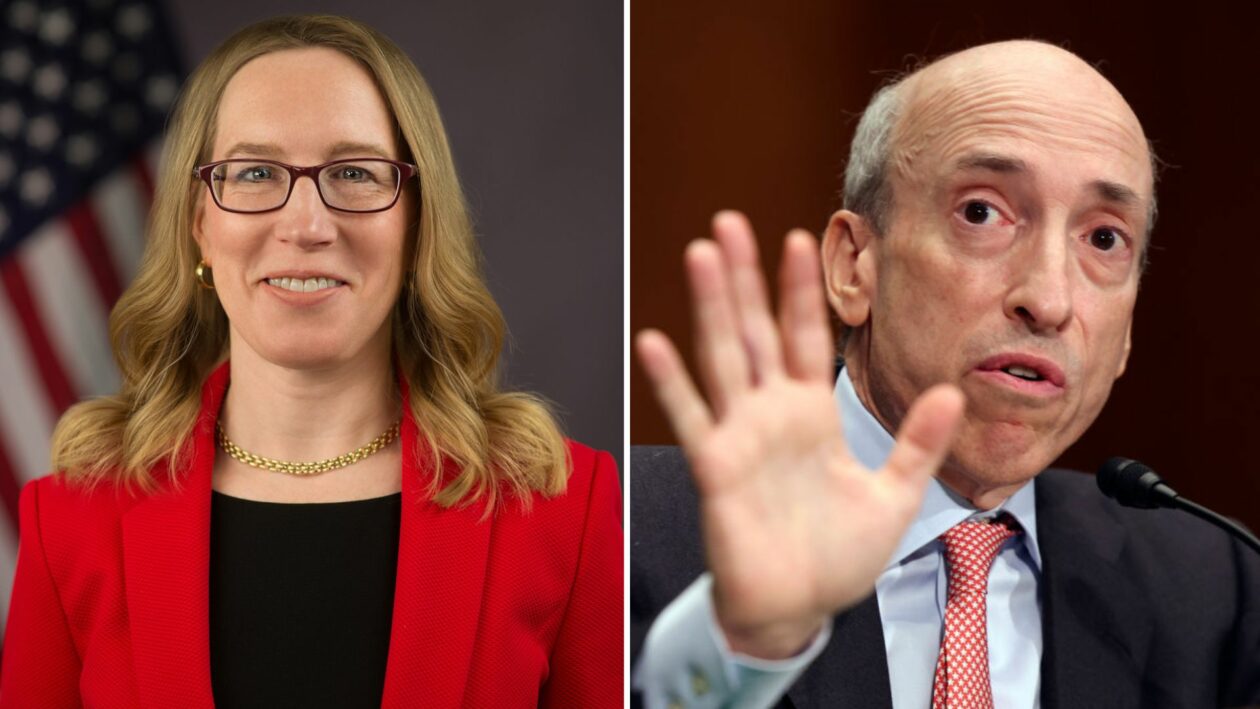

U.S. Securities and Exchange Commission (SEC) commissioner Hester Peirce has publicly criticized the agency’s fines against the Kraken cryptocurrency exchange for offering staking products to investors, calling the approach “paternalistic and lazy.”

Peirce said in a Thursday statement that she disagreed with her agency’s action this week to shut down Kraken’s staking program, a move the SEC counted as “a win for investors.” Peirce’s role as commissioner includes advising the SEC on applying rules to new developments in financial markets.

Peirce, a lawyer, made the statement after the SEC on Thursday said two Kraken subsidiaries failed to register the offer and sale of their staking products. Kraken agreed to pay US$30 million to settle the charges, according to the SEC.

As part of the settlement, Kraken said on Thursday that it had shut its on-chain staking services for U.S. users.

Staking refers to the process of crypto investors depositing tokens into certain blockchains to help secure the network and receive rewards in return – typically more tokens. The practice is widely used on various “proof-of-stake” blockchains including Ethereum, the second biggest.

SEC Chair Gary Gensler said in the statement that the agency’s action “should make clear to the marketplace that staking-as-a-service providers must register and provide full, fair, and truthful disclosure and investor protection.”

The SEC and the Commodity Futures Trading Commission (CFTC) are both positioning themselves to be the default regulator of the emerging digital asset industry and the role of cryptocurrencies.

Crackdown coming?

Peirce said that it is concerning that the SEC’s solution to a registration violation is to shut down a program that has “served people well.”

“A paternalistic and lazy regulator settles on a solution like the one in this settlement: do not initiate a public process to develop a workable registration process that provides valuable information to investors, just shut it down,” Peirce said.

“Using enforcement actions to tell people what the law is in an emerging industry is not an efficient or fair way of regulating.”

Peirce added that it might not have been possible for Kraken to register properly. “In the current climate, crypto-related offerings are not making it through the SEC’s registration pipeline.”

Brian Armstrong, chief executive officer of Coinbase Global Inc., the largest crypto exchange in the U.S., welcomed Peirce’s response.

“Well said. There was no way to register (a disingenuous offer),” Armstrong tweeted on Thursday, after saying a day earlier that the SEC may be considering a broad ban on crypto staking for U.S. retail users.

What’s at stake?

The SEC said that when investors provide tokens to staking-as-a-service providers, “they lose control of those tokens and take on risks associated with those platforms, with very little protection.”

Staking services providers generally are not providing proper disclosures, Gensler said Thursday in a Twitter video. “There’s currently no reliable way, as an investor, to know these important investment questions,” he said.

However, Peirce argued that while more transparency might well be a good thing, “whether we need a uniform regulatory solution and if that regulatory solution is best provided by a regulator that is hostile to crypto, in the form of an enforcement action, is less clear.”

Bill Hughes, senior counsel and director of global regulatory matters at ConsenSys, the Ethereum software firm behind leading cryptocurrency wallet MetaMask, said that staking is an essential feature of today’s programmable blockchains, particularly Ethereum.

“Staking is never going away. Access to it will only grow, because that is what people all around the world will demand,” Hughes said in an emailed statement.

Hughes added: “Staking is in its relative infancy. There is a degree of experimentation in how one can stake, and what staking-related services are most useful to the broader ecosystem. This is not a process that is predetermined or top-down in orientation. It evolves organically.”