In this issue

- Singapore: stablecoin rules in play

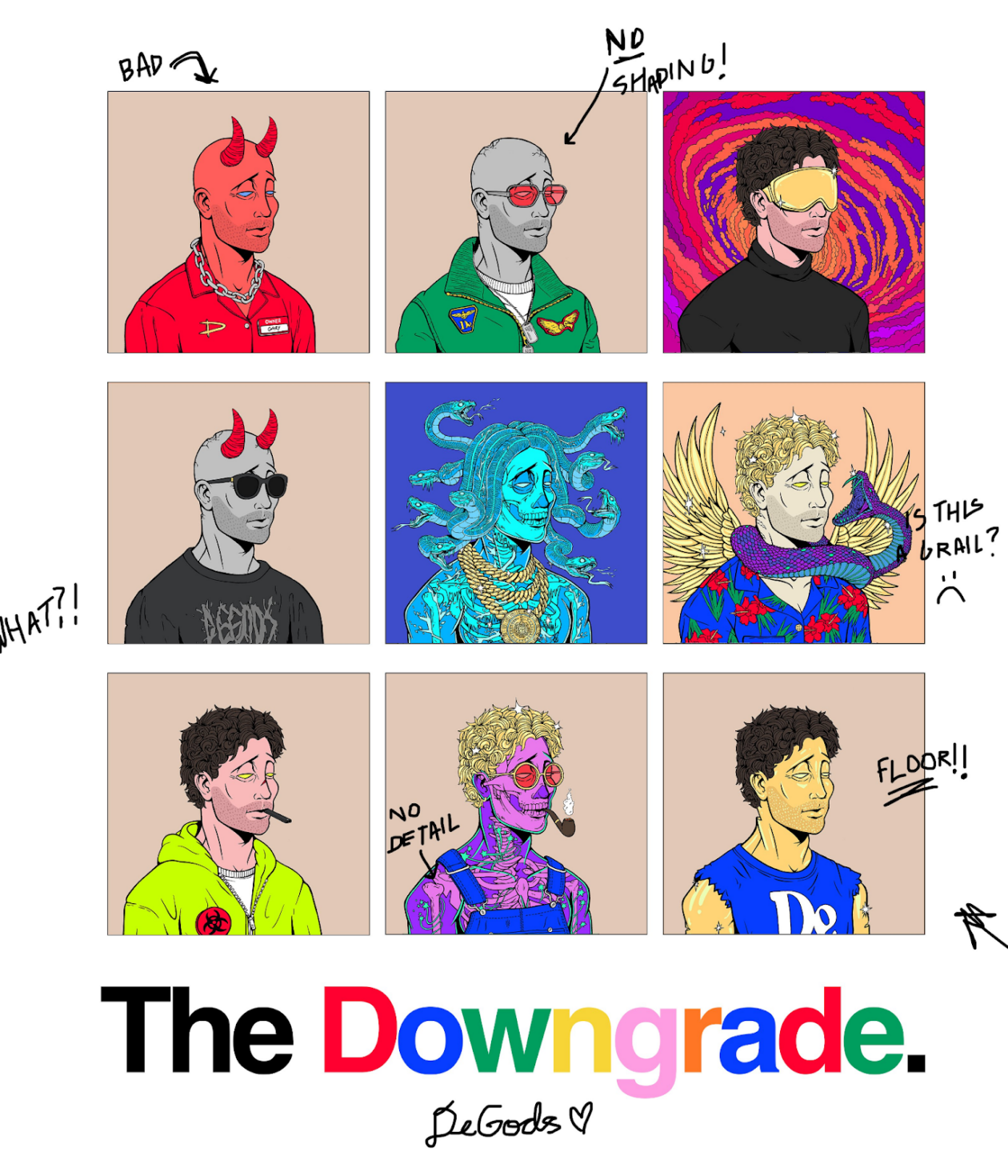

- DeGods downgrades

- HKVAX: lucky third

From the Editor’s Desk

Dear Reader,

At first glance, there’s something almost too perfect about a country like Singapore deciding to embrace stablecoins. Singapore, ahem, is nothing if not big on stability.

But it’s also big on innovation, too, albeit circumscribed by certain nanny-state imperatives.

And Singapore is serious about positioning itself at the forefront of the future of finance. So long, that is, as the architecture of the finance system remains fundamentally unchanged — an approach exemplified by its central bank’s aptly named Project Guardian, which ropes in some of the world’s biggest TradFi names.

But seriously, Singapore is good at this kind of thing. In rolling out its revised regulatory framework for stablecoins, it joins a small but growing club of nations that have devised rules for the assets or are in the process of doing so.

Given the importance of stablecoins to the digital asset ecosystem and a growing acknowledgment among finance sector regulators around the world that stablecoins are here to stay, we can expect that club to grow.

It’s refreshing to see authorities recognize the limits of their power and, rather than attempt to wrestle the Hydra of the digital asset phenomenon in a death-match struggle they can never decisively win, engage and enable it to do its stuff.

Paging United States policymakers and regulators. Pay attention, please.

Until the next time,

Angie Lau,

Founder and Editor-in-Chief

Forkast.News

1. Finding stability

The Monetary Authority of Singapore (MAS) unveiled a regulatory framework for stablecoins on Tuesday as the Southeast Asian city-state positions itself as an aspiring global nexus for the crypto sector.

- The framework delineates critical conditions for stablecoin issuers: ensuring value stability, maintaining a minimum base capital level, guaranteeing redemption at face value and assuring disclosure on matters like holder rights and audit findings of reserves.

- “When well-regulated to preserve such value stability, stablecoins can serve as a trusted medium of exchange to support innovation, including the ‘on-chain’ purchase and sale of digital assets,” MAS said in its release.

- MAS said that the new regulations would be applicable to Singapore-issued single-currency stablecoins pegged to the Singapore dollar or a selection of 10 major currencies, such as the U.S. dollar, the euro and the U.K. pound.

- Implementation of the regulation will begin once approval for amendments is received from the Singapore parliament.

- Singapore is not alone in its pursuit of stablecoin regulation. Earlier in June, Hong Kong initiated its own regulatory framework for crypto exchanges and is now in the process of devising a licensing structure for stablecoin issuers, which could be revealed within the year.

- Meanwhile, the U.S. Congress has been deliberating on a stablecoin bill introduced in April 2023. The bill mandates the U.S. Federal Reserve to draft stipulations for the issuance of stablecoins, while concurrently upholding the jurisdiction of state regulators.

Forkast.Insights | What does it mean?

Singapore’s regulatory framework for stablecoins comes a week after PayPal, the global payments behemoth boasting over 435 million active users, launched its own stablecoin.

The increasing interest of major financial institutions in these fiat-pegged cryptocurrencies, coupled with accelerating regulatory discussions, underscores the significance of these assets in the forthcoming digital economy. Asian entities are certainly not lagging behind this trend.

In June, Mitsubishi UFJ Financial Group, the biggest bank in Japan, introduced its Progmat Coin platform to facilitate the creation and trading of stablecoins supported by Japanese banks. In July, Shinhan Bank, South Korea’s second-largest bank, and SCB TechX, the tech wing of Thailand’s oldest bank, Siam Commercial Bank, successfully concluded their second stablecoin transaction trial on the Hedera network.

Stablecoins play a crucial role in the broader cryptocurrency realm and the decentralized finance sector of Web3. These coins offer investors liquidity and a haven from market volatility.

However, the importance placed on these assets is not without its hazards. A case in point is the devastating Terra-Luna crash in May 2022. This incident is reminiscent of the occasional anxiety investors feel when the value of the world’s largest stablecoin USDT, issued by Tether, deviates even slightly from its peg to the dollar.

In fact, Tether’s daily trading volume is the highest in the entire industry, surpassing even that of Bitcoin. With a market capitalization exceeding US$83 billion, it makes up 7% of the entire cryptocurrency market. The potential impact of a hypothetical collapse of USDT similar to Terra’s would be cataclysmic, leading many to believe that it could cripple the whole industry.

This potential vulnerability underscores the importance of evolving regulatory dialogues and the proliferation of stablecoin alternatives. By diluting the dominance of a single stablecoin, these measures could prevent a singular point of failure in the industry.

2. DeGods Decline

One of the top non-fungible tokens collections, DeGods, kicked off their Season III event, delivering new art and fancy rewards to their NFT holders. But the execution was close to a disaster, with delays, bland art, and the omission of one major component — female avatars. Poorly received by collectors, the DeGods collection’s floor price nosedived with the sour sentiment of the broader NFT market seeping into the DeGods community.

- The daily average sales price of DeGods NFTs has fallen from as high as US$24,000 in July to now just above US$9,000.

- Sales have climbed 303% in the past week from old collectors exiting the collection and new ones entering, with trades on secondary markets exceeding US$7.8 million.

- Wash trading increased by over 1,782% with farmers taking advantage of the collection’s extra trading volume, and washing over US$21 million in NFTs.

- While most of the NFT market finds sellers on the losing end of trades, the DeGods collection has found sellers in profit by over US$661,000 in the past seven days.

- DeGods holders need to pay 333 $DUST (US$333) to upgrade their NFT to Season III art, and $DUST lost half of its value since Season III

- DeGods companion project, the y00ts, will be moving from Polygon to Ethereum to join DeGods on the same chain. Y00ts experienced similar negative sentiment and declines in prices.

- Holders have been told to expect bugs in the art as last-minute changes can impact the final product.

Forkast.Insights | What does it mean?

Traders still don’t know how to value NFTs, so when a project makes mistakes or missteps, traders punish them by dumping their assets. Time and again we see this play out in the NFT market, the last noteworthy example being Azuki’s disastrous late June mint that saw their collection’s floor price fall over 60%.

Compounding the negativity in DeGods Season III, the team also announced that their companion project, the y00ts, would be moving from Polygon to Ethereum to join DeGods under one roof. While this may seem benign at first, consider that both collections just moved to their current locations from Solana earlier this year. Perhaps holders are now questioning the team’s judgment and their ability to properly plan for the future.

There are few “blue chip” NFT projects left that have had flawless executions. But make no mistake, when (not if) they deliver something that doesn’t resonate with collectors, their collection’s floor price will suffer. Maybe it’s time for traders to rethink what exactly they value in NFTs, and how much they’re willing to spend on NFTs that offer just a jpeg.

Collections like Milady and Sproto Gremlins promise nothing, and collectors eat them up. They buy these NFTs to join communities, have a good time, and to share trading tips with each other. If that sounds exactly like what other NFTs (like DeGods and y00ts) offer, you’re not wrong. Milady NFTs floor price now threatens to leapfrog DeGods, making them the 3rd highest priced PFP NFT.

The issue with most NFT collections is that they sell the idea that they’re offering the next Bored Ape, or that they’re at the cutting edge of technology. At least, that’s what collectors hear in their heads. Projects should get honest with NFT communities about what their NFTs are so that collectors can properly value these assets. Currently, they’re not much more than a new iteration of fan clubs mixed with rewards platforms, and if projects were more up-front about that, we’d see much less volatility in NFTs.

3. Hong Kong nears third licensed exchange

Hong Kong Virtual Asset Exchange (HKVAX) last Friday received an in-principle approval from the Hong Kong Securities and Futures Commission (SFC) to provide virtual asset trading services, making it the third licensed crypto exchange in the city.

- This preliminary approval permits HKVAX to operate “Type 1” and “Type 7” regulated activities in Hong Kong. Those activities include securities management and offering automated trading services to retail investors, as per a press release from the exchange.

- Upon receiving final SFC clearances, HKVAX plans to introduce an over-the-counter brokerage, facilitating trades between fiat currencies and virtual assets. Additionally, they will launch an institutional-grade trading platform and provide a fully-insured custody solution. The timeline for these subsequent approvals remains undisclosed.

- “Hopefully the full license would come out by the end of the year or hopefully early Q1,” HKVAX Chief Strategy Officer Matthew Cheung told Forkast.

- The development is a significant milestone in Hong Kong’s revamped cryptocurrency exchange licensing regime initiated this June. This framework permits approved “virtual asset trading platforms” to offer cryptocurrency trading services to retail investors.

- Notably, on August 4, HashKey Exchange and OSL, the first SFC-licensed cryptocurrency, were granted enhanced licenses, positioning them as the pioneering platforms authorized to cater to retail clientele.

- Meanwhile, the SFC has cautioned against certain crypto exchanges that have misleadingly insinuated their submissions of license applications. The regulator said that any such deceit will be factored into their assessment if and when these platforms formally apply for licenses.

Forkast.Insights | What does it mean?

Good things come in threes, so news that Hong Kong’s securities regulator has given the nod to a third digital asset exchange is welcome.

Hong Kong’s progress in its journey to emerge (or, perhaps more correctly, re-emerge) as a crypto and digital asset hub has been somewhat stop-start, not helped by the skittish behavior of some banks that authorities rely on to provide services to the rehabilitated local industry, among other things.

The fact that just three exchanges are open — fewer than half the number in putative rival digital asset hub Singapore — testifies to those difficulties.

The emphasis of Hong Kong’s new digital asset regulatory framework is very much on consumer protection, which is understandable, given the various upside-down-Portapotty-on-top-of-a-Dumpster-fire-inside-a-train-wreck events the crypto industry has thrown at investors in recent times.

That focus is heavily underscored by the Securities and Futures Commission’s rather dark warning to crypto exchanges that any attempt to mislead potential customers with false claims of filed license applications will find their conduct counting against them when any real applications are made.

Yet it’s difficult to say with complete conviction that the regulator has struck the right balance in its risk calculation. It seems clear that there may still be some room for improvement when it comes to giving digital asset businesses the latitude they would like when it comes to parts of the regulatory framework.

As they stand, Hong Kong’s crypto rules mandate a 12-month cooling-off period between the launch of a token and its listing on an exchange. They don’t permit crypto derivatives, staking or airdrops. And for now, stablecoins remain banned. That leaves any exchanges that retail investors might use largely limited to spot market activity.

In a city that’s as sophisticated a finance hub as Hong Kong, it seems odd that such significant parts of the future of finance have been put off limits.

Protecting the public is, quite rightly, a priority. But that responsibility shouldn’t necessarily come at a disproportionate cost simply because the right regulation is still missing.